illuminem guide to the Voluntary Carbon Market (VCM)

· 10 min read

This article is part of illuminem's Carbon Academy, the ultimate free and comprehensive guide on key carbon concepts

Businesses are increasingly under pressure from society to address climate change, uphold corporate social responsibility, and commit to achieving net-zero emissions. One way they can do so is by buying carbon credits from projects that reduce or remove climate emissions.

In the realm of Carbon Markets, carbon credits are primarily traded within the Voluntary Carbon Market (henceforth VCM). In this article, we take a closer look at this market segment, breaking down our discussion into six sections:

To fully understand the Voluntary Carbon Market, it is necessary to see it in tandem with the other segment of the Carbon Market, namely the Compliance Carbon Market (CCM).

• In the CCM, companies adhere to government-mandated emissions limits

• In the VCM, companies take a proactive stance, voluntarily offsetting their emissions as part of broader sustainability initiatives. Participation is purely voluntary, allowing any company or individual to buy carbon offsets without being bound by legal obligations

• In contrast to the CCM, where governmental bodies oversee participants' compliance, the VCM operates through independent standards and registries such as Verra and Gold Standard. These entities have established their own frameworks for verifying and issuing carbon credits within the voluntary market sector

• While CCM’s trading system is mostly based on emission allowances, the units traded in the VCM are carbon credits

• CCMs are currently valued at over $800 billion, whereas the VCM is valued at around 2 billion

• Sell side/supply: the project developer setting up carbon offset projects that accelerate climate action, be it planting forest, energy efficiency, DACCS or agri projects

• Buy side/demand: companies that commit to buying offsets to accelerate their climate action. Among the biggest offset users are large oil-and-gas companies, airlines and car manufacturers, but also any individual, non profit, municipality, voluntarily reducing emissions

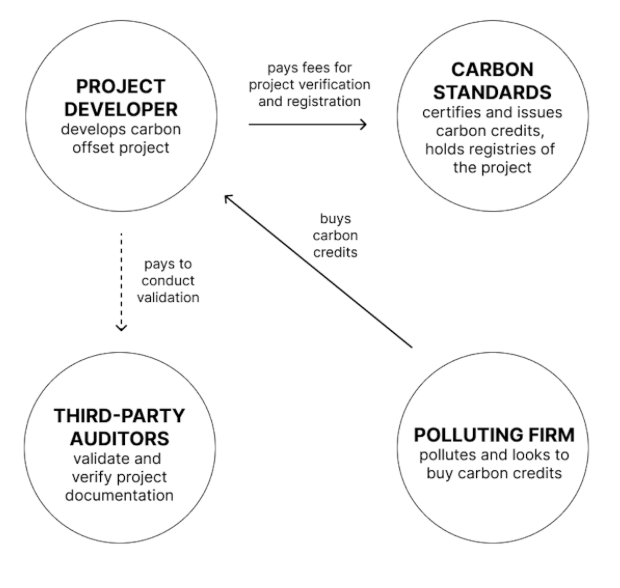

The infographic below outlines the steps involved in the production, certification and sale of offsets, with emphasis on the four main actors: the project developer, third-party auditors, certification standards, and corporate buyers:

Pricing mechanisms within the voluntary carbon market depend on 4 main factors:

• Carbon credit type: renewable energy, energy efficiency, forestry, planting trees. For example, long-term solutions, such as carbon removal credits (e.g. DACCS), usually come with a higher price tag

• Geography: where the carbon offset project takes place

• Co-benefits: the level of impact projects have on the welfare of the local communities they engage with

• Supply/demand dynamics: see further below

Currently, there is a lack of transparency regarding the pricing of carbon credits due to the majority of transactions being conducted over the counter, primarily between corporate buyers, developers, and intermediaries.

a) Issuances and retirement in comparison

While in the CCM supply and demand are regulated by government entities (see the cap-trade-system), in the VCM supply of carbon credits does not face any constraints.

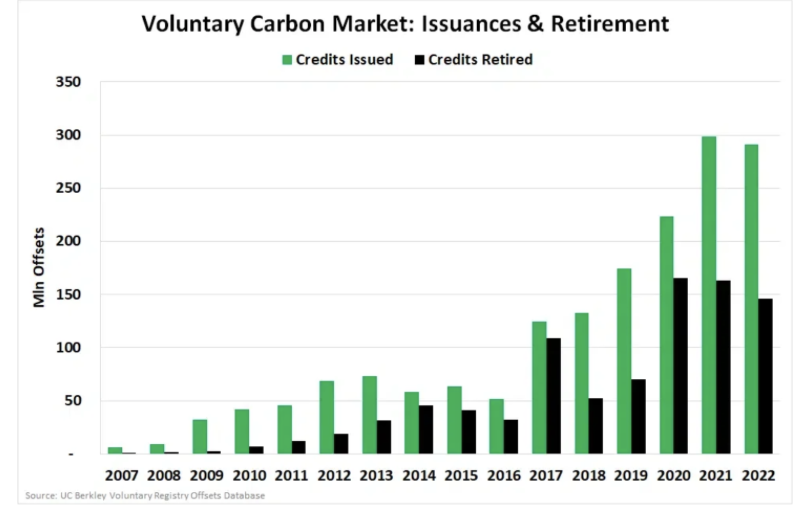

Supply and demand dynamics in the carbon credit market are closely tied to the issuance and retirement of credits (with retirement marking the moment when an entity wishes to count credits towards its voluntary goal or emission targets). Historically, prices have been low due to an excess in supply and due to the possibility for credits to be issued at very low costs. The abundance of low-cost avoidance credits has kept prices low, exacerbating the mismatch between supply and demand, an aspect that is clearly captured in the graph below:

Source: Carbon Credits with data gathered from the UC Berkeley Voluntary Registry Offsets Database

b) Qualitative considerations

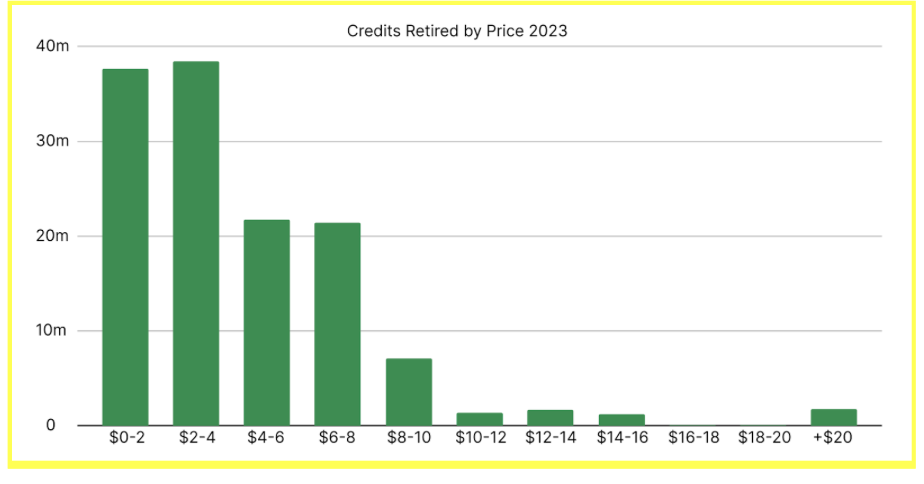

The challenge the voluntary market is currently facing is the supply of high-quality credits. While showing the quantity of credits issued, the above graph does not highlight the quality of each individual credit. Using price as a proxy for quality, the graph below illustrates how the VCM is still characterized by a preference for cheap credits, with the majority of 2023 retirements estimated at under 2 dollars.

Source: Allied Offsets

c) The need to increase prices

Forecasts indicate a probable growth in demand as the market matures, evolving towards more costly project types. With shifting demand patterns and increasingly ambitious policies, it is anticipated that prices will rise on average. Raising prices is important for two reasons:

• It increases the price companies face for ongoing emissions, providing a stronger incentive to expedite emission reductions

• It drives financing into a greater number of climate action projects which can become increasingly ambitious and innovative because there is a good rate of return

As we saw above, the demand continues to be largely driven by low-cost credits, with a notable emphasis on avoidance projects rather than removal initiatives. However, there are indications that buyers are gradually showing greater interest in investing in removal projects and are willing to pay a premium for high-quality credits, with a significant increase in the purchase of Carbon Dioxide Removal (CDR) credits over the last few years. This infographic illustrates these points in action:

Several challenges persist within the VCM, the main ones being:

• There is still skepticism around the reliability of carbon credits issued in the VCM. Carbon offsets from leading carbon standard providers have faced widespread criticism for potentially exaggerating the actual amount of carbon reduction achieved. Primary reasons behind these miscalculations are inaccurate baseline assessments, especially in the context of reforestation projects. These issues not only undermine consumer confidence but also complicate the distinction between high-quality and low-quality carbon credits

• Price transparency poses a significant challenge for both buyers and sellers, hampering effective price discovery in the market

• Different rules, criteria, and methodologies exist across different standard providers, and navigating through these standards, along with the multitude of registries and exchanges, is still challenging

As previously discussed, the VCM operates without a central regulator, resulting in a fragmented landscape where private entities evaluate the quality of traded credits according to their own rating systems.

However, there is a growing anticipation of increased scrutiny on the horizon. Entities such as the SBTI (Science Based Targets Initiative), the ICVCM (Integrity Council for the Voluntary Carbon Market) and the VCMI (Voluntary Carbon Markets Integrity Initiative) are playing crucial roles in bolstering parts of the certification process.

The ICVM focuses on accelerating supply growth, while the VCMI concentrates on boosting participation and demand. These organizations, among others, are instrumental in fostering a market characterized by quality credits, depth, liquidity, and transparency.

The Voluntary Carbon Market has often relied on manual audits, which comes with several drawbacks including time consumption, limited coverage, high costs, and susceptibility to human biases and errors.

However, the introduction of digital Measurement, Reporting, and Verification (MRV) pilots holds promise for revolutionizing the market. These digital systems aim to streamline processes for project developers, while also offering benefits such as enhanced transparency and ongoing monitoring availability for buyers. Digital MRV provides benefits in 4 main areas:

• Data Collection: Digital MRV harnesses advanced technologies such as sensors, satellites, and remote sensing to gather and analyze data. This enables more precise, timely, and extensive data collection, facilitating insights on a broader scale, especially in the case of projects where measurements are more challenging, like forestry projects

• Automation: Digital MRV streamlines numerous data collection and analysis tasks, minimizing the necessity for human involvement and enhancing operational efficiency. Consequently, this leads to expedited reporting and decision-making processes

• Cost-Effectiveness: Digital MRV presents a more cost-effective alternative by reducing reliance on manual data collection and analysis

Carbon markets are becoming increasingly interlinked, especially as governments ramp up efforts to encourage participation in voluntary markets. This convergence of market structures holds the potential to enhance efficiency, credibility, and liquidity.

a) national entities buying voluntary credits

Sweden plans to use Gold Standard carbon credits to meet some of its NDCs. Similarly, countries like Chile, Colombia, Singapore, and South Africa have allowed mandated firms to offset their national carbon tax by using carbon credits from voluntary markets

b) voluntary purchase of allowances

The RGGI (Regional Greenhouse Gas Initiative), the main Compliance Carbon Market in the US, allows non-capped buyers to purchase and cancel RGGI allowances on a voluntary basis

c) carbon credits in compliance markets

Australia's government has also established a voluntary carbon market primarily focused on Australian government-issued credits

d) Article 6

Article 6 of the Paris Agreement is another element facilitating the interplay between compliance and voluntary markets, establishing a framework that bears the features of both CCM and VCM:

• CCM characteristics:

- Oversight by the UNFCCC

- participants are national entities

• VCM characteristics:

- the voluntary nature of government participation

- national entities can buy voluntary carbon credits to meet their nationally determined contributions (NDCs)

e) CORSIA

CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation) provides another example of a scheme combining compliance and voluntary carbon market traits. CORSIA was developed to reduce carbon emissions from international aviation and constitutes a unique case insofar as it encourages an entire sector to mitigate its carbon emissions by purchasing high-quality carbon credits from the Voluntary Carbon Market.

CORSIA is commonly regarded as synonymous with high-quality standards and rigorous certification. While the robustness of CORSIA standards positions it alongside the Compliance Carbon Market, the voluntary nature of participation aligns it with the Voluntary Carbon Market. Participation in CORSIA is phased, with a voluntary pilot phase (2021-2023) and a voluntary first phase (2024-2026). The decision to make it mandatory in subsequent phases will depend on the outcomes of reviews and decisions by participating countries.

f) implications

The convergence between the VCM and CCM holds the promise for positive outcomes:

• Higher-quality carbon credits: The integration of Compliance Carbon Market standards and requirements into the VCM has the potential of enhancing the quality of carbon credits issued in the VCM, thereby adding to transparency and instilling more confidence in buyers

• Increasing demand & competition: As noted by Eva Tamme, ‘as corporate buyers compete with governments for the same credits, there's a potential for demand to outstrip supply, with the effect of raising VCM prices’

Voluntary Carbon Markets continue to serve as a pivotal instrument for companies seeking to finance large-scale climate action during the transition to net zero. They foster a system that recognizes that emissions cannot be free, thereby incentivizing emission reduction efforts. Moreover, VCMs enable the expansion of innovative solutions, including carbon dioxide removal (CDR) technologies, offering one of the few at-scale alternatives in the near term.

The future of the voluntary market depends on its robust structure and governance, and we must work together to optimize its efficiency as much as possible. While choosing low-quality carbon credits may seem financially advantageous, the potential for reputational damage should always outweigh any immediate gains. Companies can mitigate market risks by not taking part in it. In a nutshell, whilst purchases can be voluntary, but transparency should be not.

Are you a sustainability professional? Please subscribe to our weekly CSO Newsletter and Carbon Newsletter

Glen Jordan

Sustainable Lifestyle · Sustainable Living

illuminem briefings

Architecture · Carbon Capture & Storage

illuminem briefings

Labor Rights · Climate Change

Financial Times

Carbon Market · Public Governance

GB News

Carbon · Sustainable Mobility

The Independent

Effects · Climate Change