Article 6: the key concepts

· 8 min read

This article is part of illuminem's Carbon Academy, the ultimate free and comprehensive guide on key carbon concepts

Drafted in 2015 and approved at COP26 in Glasgow, Article 6 of the Paris Agreement allows countries to cooperate to meet emissions targets. Article 6 allows countries to buy voluntary carbon credits to meet their Nationally Determined Contributions (NDCs), namely non-binding GHG reduction targets. Beyond NDCs, these credits can be used for other purposes, including CORSIA phase 1.

In this article, we go through the main components of Article 6:

Articles 6 has two different mechanisms that enable the generation of carbon credits: Article 6.2 and 6.4. Let us take a closer look at both.

Article 6.2 allows countries to trade emission reductions and removals with one another through bilateral or multilateral agreements. These traded carbon credits are called Internationally Transferred Mitigation Outcomes (ITMOs) and are generated from emission reduction projects in one country that can be transferred to another country to help meet its mitigation goals.

Source: The Nature Conservancy

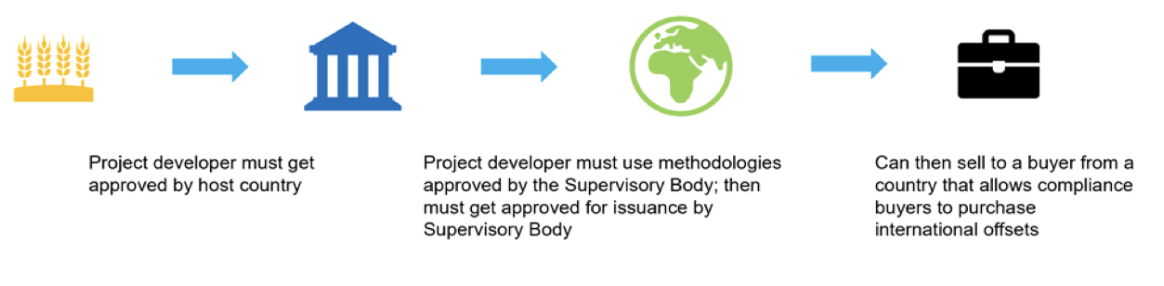

Article 6.4 is intended as a replacement of the Clean Development Mechanism (CDM) of the Kyoto Protocol. It aims to establish a mechanism for trading GHG emission reductions between countries, overseen by a United Nations entity, referred to as the Article 6.4 Supervisory Body (6.4SB). This entity will be responsible for the validation, verification and issuance of high-quality carbon credits, called 6.4 Emissions Reductions (A6.4 ERs).

The infographic below summarizes how Article 6.4 will work:

Source: The Nature Conservancy

As the picture shows, the issuance and trading of 6.4ERs credits are contingent on approval from both the country where it is implemented and the Supervisory Body.

Let’s recap the differences between the two main components of Article 6.

Article 6.2

Article 6.4

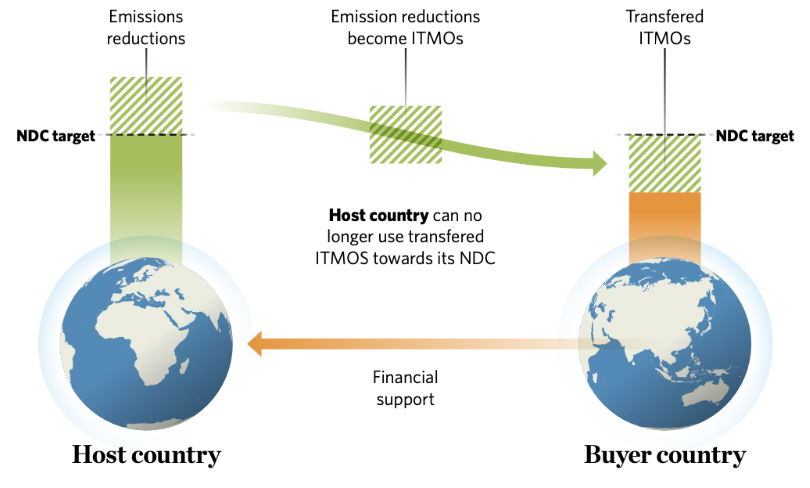

To mitigate the risk of double counting across National registries, a carbon accounting correction called "corresponding adjustment" will be implemented.

For credits to be ‘correspondingly adjusted’, host countries, namely countries where the emission reduction/removal project takes place, must agree to transfer some of those credits or all of them to another country. In other words, the host country must remove the mitigation outcome from its own greenhouse gas inventory and not count it towards its own climate objectives, but must allow it to be transferred to the buyer who may use it towards their own NDCs.

To allow this transfer, the selling country (host) needs to take the emission GHG reduction out of its inventory, so the buyer can correspondingly adjust and bring the emission reduction into its own GHG inventory. A selling (host) country that authorizes the transfer of mitigation must increase its reported emissions by the amount transferred.

To further clarify the process, the selling country engages in the trade because its current emissions fall below its Nationally Determined Contributions (NDCs). As part of the Corresponding Adjustment mechanism, the selling country's emissions may increase, but they remain within the bounds of its NDC commitments. As for the buyer, the buyer country seeks to receive Internationally Transferred Mitigation Outcomes (ITMOs) because its own emissions exceed the limits specified in its NDCs. Through the trade, the buying country's emissions are effectively reduced, aiding in its efforts to meet and comply with its NDC targets.

The infographic provides a visual representation to all these steps:

Source: The Nature Conservancy

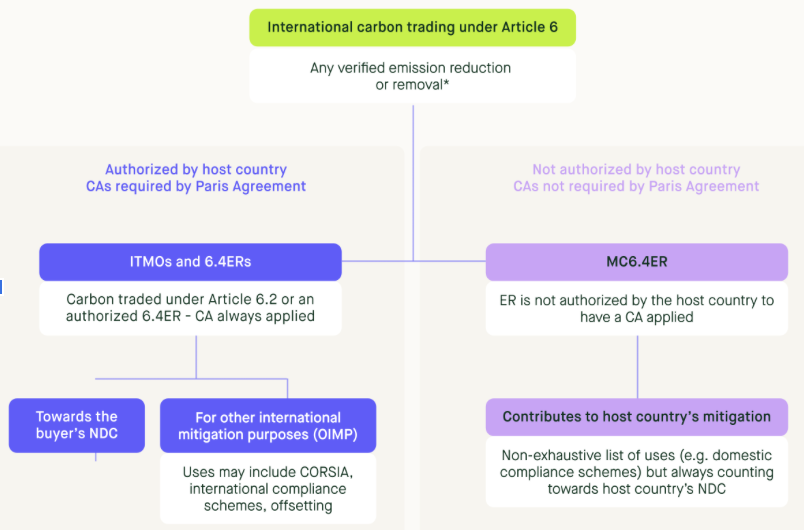

During the COP27 climate summit in Egypt in 2022, it was also agreed to establish a distinct credit category under Article 6.4, known as a "mitigation contribution" unit. Unlike ITMOs and 6.4ERs, this type of credits will not have a corresponding adjustment and therefore cannot be utilized for offsetting purposes. Rather, the nation where the reductions occur will incorporate these credits toward its own target. This innovative credit mechanism is an actual form of climate finance insofar as it enables countries hosting carbon-offsetting projects (and not the companies responsible for funding the project) to claim emissions reductions achieved toward their climate objectives.

The infographic below summarizes the difference between non-correspondingly adjusted and correspondingly adjusted credits:

Source: Sylvera’s report

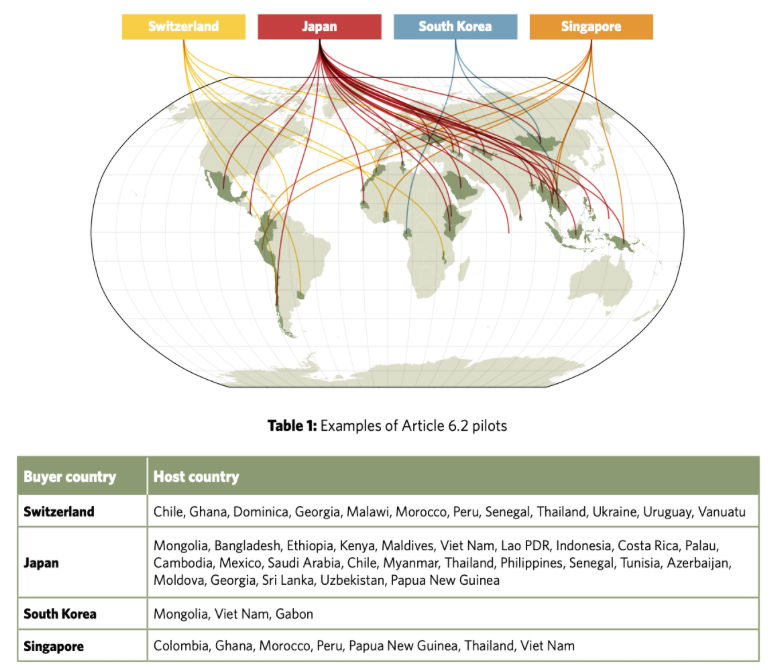

Certain nations are already engaging in bilateral agreements under Article 6.2. Notably, Japan and Switzerland have established robust mechanisms for procuring ITMOs. Switzerland has presented its inaugural "initial report" to the UN platform, emphasizing its partnerships with countries like Ghana, Thailand, and Vanuatu.

Source: The Nature Conservancy

It is unlikely that any credits will be issued or exchanged in the short term, except for potential instances where projects transitioning from the Clean Development Mechanism to Article 6.4. The trading of A6.4ERs depends on the establishment of a centralized registry, which is still under development. Several aspects still require clarification, ranging from the assessment criteria for project registration to methodologies for measuring emission reductions.

Article 6 mandates countries to transition from the Clean Development Mechanism (CDM), an international carbon finance initiative established under the Kyoto Protocol. The transition from the CDM to Article 6.4 is required to be finalized by the end of 2025. Transitioned projects will be subject to corresponding adjustments and supervision will be exerted by host countries. Subject to approval from the host country, projects projects can continue to employ CDM methodology until December 2025.

Article 6 is not exempt from challenges. Below, we highlight three prominent ones:

Article 6 establishes a structured framework enabling both nations and private entities to participate in emissions trading and cooperative endeavors aimed at fulfilling their mitigation objectives. While the A6.4 mechanism was always seen as a venue for private entities that want to buy or sell carbon credits, guidance for A6.2 developed at COP26 clarified that private entities can also engage in Article 6.2 transactions.

Article 6 facilitates the merging of compliance and voluntary markets, establishing a framework that incorporates characteristics from both CCM and VCM. CCM characteristics include supervision by the UNFCCC and the participation primarily of national entities. Conversely, VCM features include the voluntary engagement of governments, the involvement of private actors, and the ability for national entities to procure voluntary carbon credits.

Article 6 provides a good alternative to VCM, but also holds promise for bolstering confidence in the carbon market ecosystem as a whole. This is the case especially with Article 6.4 which, if implemented successfully, will establish a global carbon market under the supervision of a UN entity. This could significantly contribute to streamlining carbon trading on a worldwide scale and promoting greater transparency and accountability within the market.

Article 6 is used not only to reduce emissions in addition, but also accelerate climate progress through cooperation between developed and developing countries, thereby moving beyond a one-to-one offsetting approach where CO2 emissions released in one place are offset by emissions reduced or removed elsewhere. This is done through two additional mechanisms: Share of Proceeds (SoP) and Overall Mitigation of Global Emissions (OMGE). Both SOP and OMGE are required for all Article 6.4 credits but are only encouraged for Article 6.2 trades.

Article 6 is far from being a perfect mechanism. Debates persist, especially regarding the way to obtain letters of authorization, meet reporting obligations and acknowledge the transfer of mitigation outcomes between registries.

However, Article 6 carbon markets offer countries an opportunity to rectify the shortcomings of previous mechanisms like the CDM. By establishing a synchronized global framework aligned with governmental policies, Article 6 facilitates broader participation, offering a promising avenue for enhancing voluntary markets. In conclusion, Article 6 rulebook marks a significant milestone in the evolution of carbon markets, laying the foundation for a UN-administered global trading system and further bolstering international efforts to combat climate change.

Are you a sustainability professional? Please subscribe to our weekly CSO Newsletter and Carbon Newsletter

illuminem briefings

Biodiversity · Nature

illuminem briefings

Carbon Market · Public Governance

Steven W. Pearce

Adaptation · Mitigation

The Washington Post

Biodiversity · Nature

Yale Climate Connections

Effects · Climate Change

Euractiv

Carbon Market · Public Governance