We are not out of the woods yet: putting nature at the center of climate action and beyond

· 11 min read

There were five key issues discussed at COP27 this year, one of them being nature.

The other four — food, water, industry decarbonisation and climate adaptation — are intrinsically linked to nature. Food production depends on biodiversity and ecosystem services (BES), such as the availability of pollinators and a stable climate, to name a few. Water availability relies on the capacity of the soil and forest to retain water and make it available when needed. Industry decarbonisation requires looking into materials, how these are being obtained (e.g. mined and the impact on habitat destruction), produced (e.g., by-products that affect nature such as acid rain) and used (e.g., chemical-intense agricultural system). At the same time, the availability of nature is key to improving resilience (e.g., reduced erosion in coastal areas) and adaptation (e.g., passive cooling).

In climate action agendas, as has been the case with the annual Conference of Parties, nature is often mentioned in relation to carbon. But as we expand our understanding of climate change and the ways to address it, it is time we recognise that nature goes well beyond carbon and has equally, if not more, essential contributions than decarbonising our economic system. The provision of its myriad of ecosystem services plays a key role not only for the climate (e.g., stabilisation of the water cycle) but for life itself, including ours.

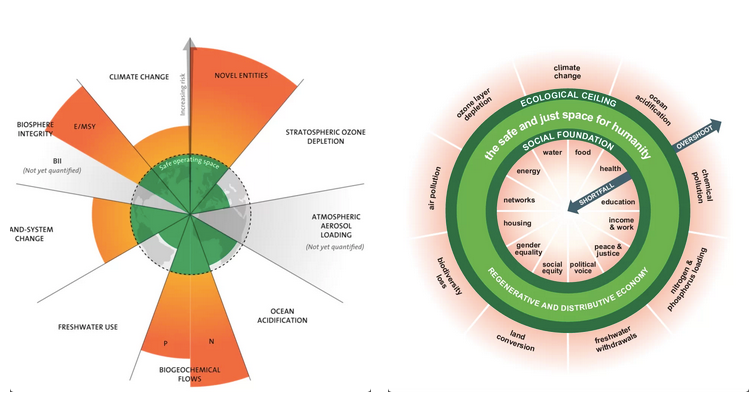

The stability and resilience of our planet require the proper functioning of Earth’s biodiversity and life-supporting systems, such as fertile soils and a stable climate. For this, we need to stay within the nine identified planetary boundaries to reduce the risk of irreversible environmental changes and the consequent decline in prosperity.

But is it too late? The ecological boundaries consolidate rigorous qualitative and quantitative information on the functioning of human-environmental systems. Taking a step beyond these thresholds is tantamount to disrupting the environment’s sustainability limit, within which humanity develops and thrives. Scientists estimate that as of 2022, we have already exceeded five: climate change, land system change, pollution by novel entities, biochemical flows of phosphorus and nitrogen, and biodiversity (see Figure 1). The last two are directly related to our agri-food production systems and represent the boundaries we have most exceeded, even more than the climate change boundary. These same boundaries continue to undermine each other. For instance, land use change (including agriculture) alone is responsible for 23 percent of global GHG emissions, adding pressure to the climate change boundary. A thriving human species also requires that nobody falls short on life essentials, such as food and housing, as adequately depicted by the doughnut of social and planetary boundaries (see Figure 2). Acknowledging and valuing the know-how on more traditional ways of living and managing natural resources practised by indigenous communities living closer to nature has an immense potential to help us stay within the green zone of the doughnut (see Figure 2). It remains to be seen whether climate and international development conferences to come will give more visibility to indigenous voices and hand back the power of leading climate action to local stakeholders..

People are becoming increasingly aware of, and thus concerned about, the health of our home, planet Earth. Biodiversity loss is being perceived among the top three critical long-term threats that will damage our species and the planet as a whole. But it is not merely about perceptions—nature matters for business and the economy. According to the World Economic Forum’s estimates, over 50 percent of the world’s GDP is moderately or highly dependent on nature and the services it provides. This number is very high, but could it still be an underestimate? We humans and our economic system are deeply intertwined with nature; we are a subset of the natural system. Thus, the collapse of nature, our foundation, means our destruction and that of our economic system (see Figure 3).

Recent research reaffirms the impact of our inaction to protect nature. For example, The World Bank’s The Economic Case for Nature estimates how changes in selected ecosystem services (fisheries, tropical timber and wild pollination) impact the economy. It concludes that a collapse in selected BES becomes a development issue as the impact suffered by low-income economies is higher than the global one (more than a 10 percent drop in 2030 GDP of low-income and lower-middle-income countries).

Building on the previous study, the Finance for Biodiversity initiative, including authors from Cambridge University, explored the impact of nature loss from a different angle. Their research looked at changes in sovereign creditworthiness and, thus, the cost of borrowing. The study concluded that under an ecosystem collapse scenario (the same ecosystems analysed in The World Bank study above), the cost of debt would increase disproportionately for emerging and developing economies. The ratings of more than half of the 26 countries analysed (58 percent) would face downgrades, triggering between USD 28 to 53 billion in additional costs of annual interest payments borne by these downgraded governments, and it would most directly impact the creditworthiness of lower-rated countries in emerging and developing countries. Thus, they argue that credit rating agencies should incorporate biodiversity and nature-related risks into rating methodologies and financial decision-making.

Action to protect nature would not only avoid the impacts mentioned above but would also accrue many benefits. For example, the same World Bank study concluded that nature-smart policies create a ‘win-win’ scenario for biodiversity and economic outcomes. Policies to reduce the conversion of natural land considered would result in a general increase in real global GDP in 2030, estimated to be around USD 50 billion to USD 150 billion. According to The Future of Nature Business 2020 report, transitioning towards a nature-positive economic model in key sectors could generate almost 400 million jobs and more than USD 10 trillion in annual business value by 2030 — a trend already being seen across several businesses.

Businesses are also increasingly taking cognisance of nature’s material risks. These lessons are rooted in enterprises depending directly or indirectly on natural resources through supply chains, changes in consumer behaviour or regulation due to environmental damages caused by businesses, or market disruptions resulting from nature loss. Furthermore, businesses are realising the opportunities of a nature-centred approach, evidenced by job listings to regenerate or preserve nature on the rise. As mentioned, the risks associated with nature loss are significant to the real economy. Economic and welfare losses arising from the deterioration of BES have an enormous impact on financial assets, one of the main reasons why nature started appearing on the radar of companies and the international development community. This awareness has materialised into well-known initiatives, initially subsumed under the umbrella of climate change, like Task Force on Climate-related Financial Disclosures (TCFD) and Glasgow Financial Alliance for Net Zero (GFANZ), and now directly discussed under the umbrella of nature-related risks and opportunities, such as the Taskforce on Nature-related Financial Disclosures (TNFD). Moreover, as assessing biodiversity risks is complex, companies are slowly designing tools for this purpose. For example, reinsurer SwissRe created the BES-Index, to support risk assessment, foster dialogue, and help decision-makers to take action.

In our current economic system ecosystem, services and asset values are not reflected in the price of goods or the cost of land use. We need a shift from an economic-oriented to a nature-oriented perspective to overcome this disconnection and manage BES-related risks. We need to promote nature protection, management as well as regeneration. But this clashes with financial institutions’ fiduciary duty, as some argue. Instead of treating fiduciary duty as their responsibility to implement a balanced and diversified investment strategy that considers climate change and BES-related risks, they focus on the greedy need to provide short-term gains.

Nature-positive solutions are not just about mitigating risks for nature, but also benefiting from its many untapped opportunities. Over the last 3.8 billion years, nature has shown us different ways to deal with humanity’s dilemmas and problems. Nature has tested and developed various business models and concepts to cope with scarce physical and energy sources. By analogy with a company’s assets, nature represents the lab that shows how to optimally use the resources to attain desired results. The real fiduciary duty of business leaders and the financial sector should be to drive investments in nature-inspired innovation and nature-based solutions by embedding nature’s life principles and stop ‘the lab’ from burning down. In other words, fiduciary duty is a good governance duty to take measures against the damage to biodiversity and ecosystem services to protect financial assets and generated values. Maximising financial returns only is the opposite of the core spirit and intention of ESG and sustainable investment.

Nature-based Solutions (NbS) are actions that help address societal challenges or increase the resilience of infrastructure and people, benefiting humans and helping restore nature simultaneously. Under the umbrella of climate change, the international community has primarily focused on Ecosystem-based Adaptation (EbA – focused on adaptation to climate change) and, in particular, on Nature Climate Solutions (NCA – focused on increasing carbon sinks). Well-known examples among the latter include forest conservation, restoration and management and regenerative agriculture. The regeneration of natural systems is one of the three principles of the circular economy. It is fully aligned with the climate change agenda as restoration not only returns forests or agricultural lands to a healthy state, but also increases the amount of carbon sequestered. Furthermore, it improves biodiversity, and quality of soil and water in the ecosystem, thus having a positive economic impact on people that depend on the forest or that make a living from agriculture. But NbS are not limited to climate change-related activities (e.g. green roofs or constructed wetlands to enhance storm runoff management). These are just more accessible and cost-effective entry points to mobilise the NbS agenda and the management of BES-related risks.

In order to achieve mass implementation of NbS, we need the mobilisation of capital, made possible by the involvement of the private sector and the massive scale of financial resources they bring. According to the recent State of Finance for Nature report, private financing accounts for only 14 percent of the USD 133 billion that currently flows into NbS annually, but the total figure needs to triple by 2030. The private sector will engage as long as they see the economic benefits of NbS monetised, translated into actual financial benefits or avoided losses for them.

A keyword for this to happen is ‘innovation’, of two types: business models and technology.

By business model, we mean the design and launch of enabling financial and non-financial mechanisms that will make all relevant stakeholders collaborate in a beneficial way to everyone involved (nature included, of course). Technology innovation refers to the use of data (lots of it publicly available), software and any technical equipment used to validate before and after the implementation of the NbS and to monitor its evolution. To understand this, let’s imagine the following:

There is a beautiful coastal tourist destination where many luxurious hotels are located. The destruction of mangroves in the area has made it more prone to storm surges, consequently affecting the hotel infrastructure. A mangrove reforestation project in this area would reduce the impact of such storm surges, providing direct financial benefits to the hotels (avoided infrastructure and tourism-related losses and lower insurance premiums) and insurance companies (reduced triggering of insurance policies).

What is preventing the investment in this NbS from happening?

There are many barriers that could explain this gap, such as misalignment of incentives (protecting mangroves versus developing the tourism industry), misalignment of expertise of relevant stakeholders (an insurance company would most likely not know how to plant and maintain mangroves), and perceived risks for the actual investment (mangroves could be cut again) to name a few. A business model to address this issue could be building collaboration between those with the knowledge to estimate the cost of inaction, those with the interest and know-how for protecting mangroves, and those with the resources that would benefit from such an NbS.

It would also include a solid MRV system that would rely on the use of satellite or aerial data translated into real-time observation capacity or tools currently available such as the NbS Evidence Platform, plus a de-risking mechanism for the investors that could include, for example, triggers to stop payments or engagement of third parties that would be willing to undertake the risk. Further, it could consist of a cost-effective mechanism for estimating carbon storage using advanced technologies (e.g. Machine Learning) and accruing GHG emission reduction, which, if sold, could provide additional benefits to those in the collaboration scheme.

Our imagination sets the limit to what business models can be developed. It is key to identifying the relevant stakeholders, the barriers and incentives they face for acting, and developing the necessary enablers to mitigate those barriers. And let’s not forget the enabling role of public and philanthropic resources. They could provide resources for the design and implementation of the mechanisms the business models entail, including resources for funding de-risking mechanisms (e.g. a first loss guarantee) to leverage private capital and the resources to finance the design and development of the technology needed.

This article is also published on Energy Base. Illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Barnabé Colin

Biodiversity · Nature

illuminem briefings

Biodiversity · Nature

Gokul Shekar

Effects · Climate Change

Inside Climate News

Pollution · Nature

The Guardian

Pollution · Nature

Inside Climate News

Carbon Market · Biodiversity