· 14 min read

To keep global attention on nature as the United Nations Climate Conference (COP30) closes its doors against the backdrop of Brazil’s Amazon forest, illuminem is proud to publish a special report and first-ever ranking of companies based on their nature impact: The NATURE100™.

In a world where the degradation of nature threatens everything—from supply chains to financial systems—this is not just a report. It is a call to action and a compelling snapshot of the latest developments in this field.

The uniqueness of this report lies in the use of an unprecedented dataset of more than 100,000 nature-related data points, covering thousands of companies worldwide. Only recently, driven by the rising global attention on nature, has large-scale nature data begun to emerge and be used as an essential tool for businesses to mitigate risk and unlock opportunities. All of this data will soon be available on the illuminem Data Hub™ (request immediate access to our full nature dataset). This dataset offers unparalleled insight into nature’s role in corporate strategy, empowering companies to understand, manage, and scale nature-positive action.

We extend our heartfelt gratitude to our partners at GIST Impact for their invaluable work—alongside the illuminem team—in gathering, cleaning, and building this nature dataset. We also thank our community of experts (proudly the world’s largest in sustainability), who helped us define the methodology, assess the results, and bring forward core findings.

The NATURE100™ celebrates companies leading the way in integrating nature-positive strategies, charting the path for the next generation of corporate sustainability. We recognize that no company is flawless when it comes to nature or environmental performance. Yet, we believe it is necessary to spotlight credible progress along the path, both to inspire and to accelerate action. At illuminem, we are therefore committed to moving beyond a “culture of green-bashing” that targets those trying while overlooking all others, making no effort at all. We are confident that our community will value this approach, united in praising and accelerating efforts to protect and restore our most essential asset: Nature.

All eyes on Nature

Amid the cyclical shift of attention from climate topics (to AI and geopolitical crises), Nature has become the most discussed environmental issue in boardrooms and corporate sustainability agendas. Cutting carbon is no longer enough in a world facing resource depletion, accelerating biodiversity loss, and widespread ecosystem damage. Last year alone, millions of hectares of tropical forest disappeared, one-third of the world’s rivers suffered irreversible harm, and one million species were pushed toward extinction. A recent study¹ even warned that unchecked nature degradation could wipe out up to 26.8% of global equity value. Nature is not only the foundation of life itself, it underpins the entire global economy.

“The ROI of Nature”

When ecosystems degrade, companies bear the cost: rising input prices, disrupted supply chains, higher insurance premiums, unpredictable productivity and demand shifts, and tightening regulations. Nature restoration can reduce both capital expenditures (capex) and operational expenditures (opex). By mitigating physical risks, nature-based solutions reduce maintenance costs and extend asset lifespans.

For instance, in the construction sector, Integrated Constructed Wetlands — natural wastewater-treatment systems composed of shallow ponds and vegetated marshes — have been shown to cut development costs by 35% and reduce operating expenses by 40% compared with conventional “gray” infrastructure².

In the consumer-goods sector, water investments are gaining momentum. Unilever, the Anglo-Dutch giant, has reportedly committed €10 million to a dedicated Water Efficiency Fund³. The company says the initiative has already helped it avoid €60 million in costs by reducing water use across its global network of factories, while saving more than 1.1 million cubic meters of water each year⁴.

In agriculture, the World Business Council for Sustainable Development — working with PepsiCo and other companies — found that the return on investment for adopting six widely used regenerative farming practices turns positive after just three to five years, outperforming conventional methods⁵.

Across industries, the conclusion is becoming harder to ignore: nature doesn’t merely sustain life — it sustains cash flows and even delivers financial dividends.

What we learnt from 100,000 nature data points

The NATURE100™, the world’s first ranking of the 100 best companies for their nature impact, offers a revealing snapshot of how the global industry is responding to the planet’s ecological pressures.

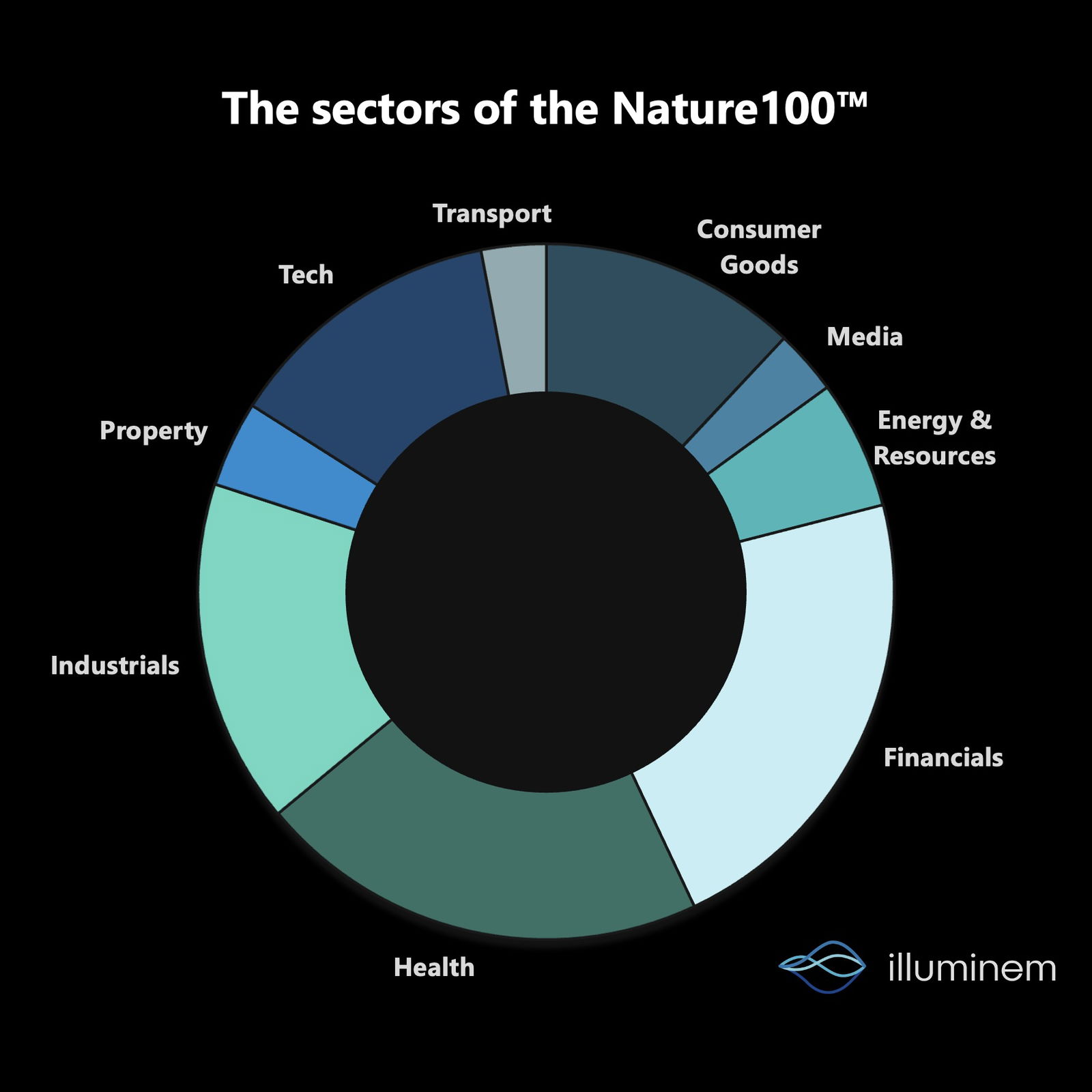

Financial firms and health companies emerge as the strongest performers, with 22 and 21 companies on the list, respectively, reflecting their earlier moves to embed nature-positive strategies into operations and risk management.

In a result that may surprise some observers, industrial companies come next with 16 firms represented — despite the sector’s inherently larger environmental footprint. The consumer-goods sector follows with 12 companies, including several that have begun openly advocating for nature in their public communications. By contrast, the technology sector — often celebrated for its high-profile sustainability commitments — ranks below the typically overlooked industrial category.

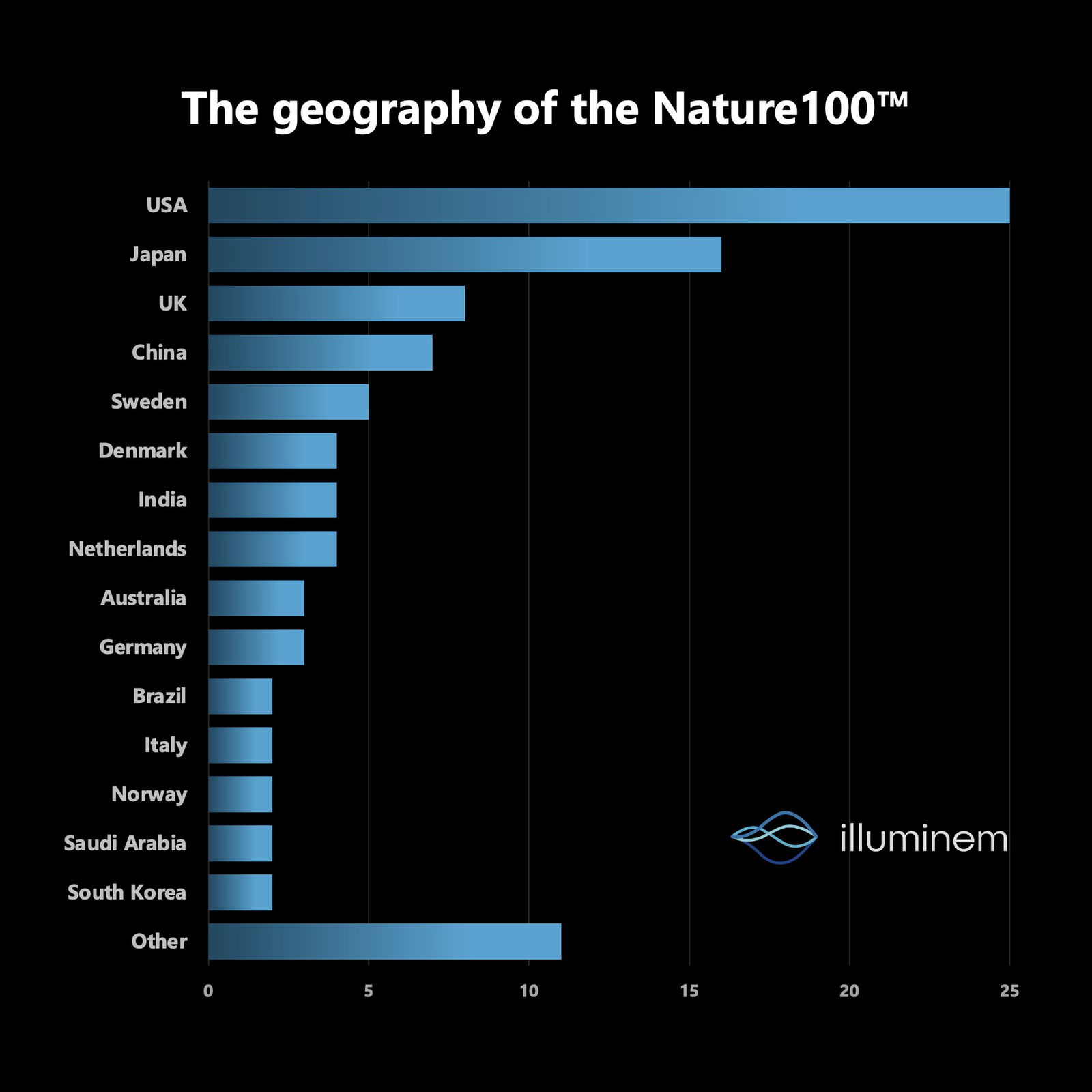

Geographically, the ranking is dominated by companies from the United States, Europe, and Japan, regions where regulatory pressure and investor scrutiny have long driven sustainability efforts. Yet the presence of many firms from China, India, Brazil, and Saudi Arabia signals a widening global recognition of nature as a core strategic and economic priority.

Company size also plays a role. Nearly all NATURE100™ firms are medium to large enterprises (with average revenues around $5B) rather than the biggest incumbents, suggesting that nature-positive strategies are becoming a competitive lever — a way for ambitious “second” players to set themselves apart from industry giants that have been slower to evolve.

Finally, a striking 88 of the NATURE100™ companies are publicly listed — a pattern consistent across regions — suggesting that transparency requirements and access to capital markets may accelerate corporate action on nature.

Contact us to learn how to advance toward leadership in the Nature100™ and access detailed data on more than 1,000 companies (soon exclusively available on Data Hub™)

Contact us to learn how to advance toward leadership in the Nature100™ and access detailed data on more than 1,000 companies (soon exclusively available on Data Hub™)

The business leaders in Nature

Among the companies featured in the NATURE100™, the Brazilian cosmetics group Natura stands out as one of three Latin American firms on the list. True to its name, the company has become a global reference in embedding nature throughout its value chain. Natura popularized the concept of the “standing forest”, an ingredient-sourcing model that meets customer demand, commands a price premium and helps preserve the Amazon. By employing local forest communities to harvest seeds from species such as ucuúba for its cosmetic lines, the company provides stable income in regions where work is often tied to deforestation.

Patagonia, the clothing company long held up as a model for environmental stewardship, is another prominent honoree. Nature sits at the core of its mission and is embedded in everything from operational KPIs to brand value. Patagonia was credited as one of the first multi-million-dollar companies to replace conventional cotton with organic cotton back in the 1990s, eliminating harmful chemicals in the process. The shift for Patagonia and the players who followed the example yielded striking results: up to 46 percent lower global-warming potential, 70 percent less acidification, 91 percent less water consumption and a 62 percent reduction in primary energy use⁶. More recently, Patagonia’s radical ownership restructuring — which channels nearly all profits into environmental causes — has directed more than $100 million to nature protection in just three years.

Danish energy giant Ørsted has taken a different approach, committing that all new projects commissioned from 2030 onward will deliver a net-positive biodiversity impact. As part of its BioReef, ReCoral and broader ocean-health initiatives, the company and its partners have begun installing oyster-reef structures around offshore wind farms in the North Sea and transplanting 2,700 cm² of coral fragments onto turbine foundations in Taiwan to help jump-start marine recovery.

Spain’s Acciona has made similar strides. The engineering group recently achieved a 95 percent circularity rate in its water-treatment operations and now restores more than 1,000 hectares of habitat annually around its infrastructure assets.

Japan’s Bandai Namco, better known for its video-game franchises, has emerged as an unexpected leader in nature-related performance. The company cut plastic use in its packaging by 2,800 tonnes a year and shifted to 100 percent of paper packaging with FSC- or PEFC-certified sources — reducing both petrochemical consumption and waste risk.

Sweden’s banking group SEB has been pioneering nature within financial services. The bank launched one of the world’s first forest-backed financing instruments for landowners and has financed €4.3 billion in green projects with nature-linked outcomes.

Industrial-automation company Keyence, meanwhile, enables nature impact through its customers. Its sensing systems can reduce industrial water waste by as much as 70 percent in client facilities, a contribution that adds up to billions of litres saved each year across deployments.

Other companies less vocal about nature have also secured strong positions in the NATURE100™ thanks to rigorous metrics and steady progress. For instance, EXOR — the Italian holding company behind Ferrari, Stellantis, and The Economist — has begun pushing its portfolio companies to adopt nature-related indicators. And in India, the BSE (former Bombay Stock Exchange) took an early lead by launching the country’s first environmentally responsible index, the S&P BSE Greenex, more than a decade ago, to steer capital toward sustainable companies.

Key developments in the Nature-Business Agenda

The experience of the NATURE100™ companies reflects a market trend propelled by the recent standardization of nature-related metrics. Only three years ago, the Taskforce on Nature-related Financial Disclosures (TNFD) released a first universal framework for reporting nature-related risks, dependencies, impacts, and opportunities. Since 2025, Europe’s Corporate Sustainability Reporting Directive — even after its omnibus revision — requires 10,000 companies to integrate nature into core business strategy, turning disclosure from a voluntary gesture into a regulatory expectation.

Marco Lambertini, a top illuminem Voice and fmr. Director General of WWF for more than a decade, recently launched the Nature Positive Initiative, which has rallied an unprecedented number of companies behind a shared mission: halt and reverse nature loss by 2030 and pursue full recovery by 2050. He offered exclusive insights for this study: “From philanthropic commitments and compliance to reputational concerns and public engagement, nature is finally entering conversations in boardrooms and management meetings — about material risks as much as about opportunities for resilience and profitability,” he said. “Nature was economically valued only when it was dead: a tree standing in a forest or a fish swimming in the ocean was considered to be worth nothing. Yet biodiversity is central to the existential services nature provides to us and our economy. Until ‘living nature’ becomes part of fiduciary responsibility, risk management and profit-and-loss agendas, conservation and restoration will continue to be seen as obstacles rather than investments. To achieve a people-positive future, we must secure a nature-positive one.”

The view reflects both the industry’s growing focus on nature and its lingering frustration with years of inaction. Nature-risk assessments, once virtually nonexistent, is now standard practice for 14% among the 10,000 large companies surveyed by EcoVadis⁷.

Franziska Walde, co-founder of refiniq and an illuminem Thought Leader in nature risk, echoed the shift: “Nature risk is finally moving from ESG slide decks into decisions. Companies are starting to ask how nature will influence their capex plans, insurance costs and long-term profitability. It’s no longer just about their own operations — it’s about the resilience of the entire business, including supply chains.”

Her company, refiniq, is part of a small group of players integrating climate and biodiversity data at the asset and supplier level and translating it into dollar values and resilience actions.

One case Walde cites is Thyssenkrupp, the German industrial group. The company sought to understand how climate change and nature loss could affect production and asset health. It has since incorporated novel climate-risk indicators into the CEO’s quarterly dashboard — including heavy rainfall, surface flooding, heat, drought and water stress — along with biodiversity and ecosystem metrics such as proximity to high-value areas, land-cover composition and habitat condition. The analysis helped the company identify where water-related risks are most acute, where sensitive ecosystems and industrial sites intersect, and which facilities face the highest exposure to extreme events. Adaptation measures, maintenance plans and contingency procedures have been reprioritized accordingly.

Innovation is further accelerating the shift. The management and assessment of nature is undergoing a profound transformation with the arrival of AI-driven tools. Philipp Petry, a global expert and partner at Impact Strategies, told illuminem: “AI and nature intelligence are revolutionizing how we manage risk, turning what was once invisible into measurable and actionable. For the first time, companies can detect and respond to environmental challenges in real time, making nature risk an integral part of business strategy, not just compliance. The opportunity now is to use these capabilities not only to comply but to innovate, strengthen livelihoods and invest in landscapes that sustain supply chains.”

The wave of innovation is also opening the door to an entirely new market: nature credits. These are certified units of “nature-positive action”, such as restoring wetlands, expanding forests or improving ecosystem health, that could be financed much like today’s multibillion-dollar carbon-credit markets. Advances in technology are finally reducing the complexity that long hampered the measurement, verification and additionality assessment of biodiversity projects.

In July 2025, the European Commission published its landmark “Roadmap Towards Nature Credits”, signaling that nature outcomes may soon become investable and tradable — shifting nature from a perceived cost center to a potential revenue-generating asset.

Patricio Lombardi, the first climate minister ever appointed in the Americas and one of the most respected voices on biodiversity, welcomed the development as an “opportunity to bring transparency and real value to living systems.” But, as with carbon markets, the sustainability community is split on whether this will ultimately help protect nature. Friends of the Earth issued a critical response, calling the roadmap “a roadmap to greenwashing” and warning that nature credits cannot substitute for legal obligations to protect ecosystems.

Whatever the outcome, there is broad agreement on the point Lombardi underscored to illuminem: “The key development is finally understanding that nature underpins every part of the economy. A real transition must confront the tension between decarbonization and territorial impact while ensuring biodiversity protection, community trust, and social legitimacy.”

The NATURE100™ Methodology

Read the detailed the NATURE100™ methodology and request access to the whole dataset (soon on Data Hub™)

The Nature100™ study evaluated 100,000 nature-related data points across thousands of companies.

As an industry first, the ranking comes with expected limitations, especially regarding data availability for smaller companies. It will expand and sharpen as more companies report on nature and as additional KPIs become measurable. Even so, it marks a meaningful milestone for the field — one that reveals powerful insights and offers long-overdue recognition to the companies leading the way.

Companies were assessed using eight widely recognized key performance indicators (KPIs) that capture their impact on nature. For each firm, we examined the share of global species loss attributable to its operations through: (i) Ecological Land Use Changes, (ii) Greenhouse Gas Emissions, (iii) Nitrogen Releases, (iv) Nitrogen Oxide, (v) Phosphorus Releases, (vi) Sulfur Emissions, (vii) Water Usage, and (viii) Waste Generation.

To ensure fair comparisons between sectors with inherently different footprints — for example, land use is naturally far lower in tech than in agrifood — sector-median adjustments were applied to surface true relative performance.

Companies were also screened for environmental controversies using illuminem’s proprietary archive of 100,000 media articles. Firms facing pending scandals related to nature were excluded from the ranking. Missing data, affecting 13 percent of companies in the NATURE100™, was reviewed and validated by illuminem experts before inclusion.

All underlying data and insights will be available through illuminem DataHub™, with early access offered upon request to equip organizations with the intelligence needed to take informed, nature-positive action.

Closing remarks

The inaugural NATURE100™ offers a first global benchmark of corporate nature impact, valid across all geographies. It marks a turning point in which nature is no longer a side issue but a core driver of business strategy.

As more data becomes available, we hope this ranking will serve both as a reference and an invitation — encouraging companies to measure their nature impact, learn from emerging leaders, and accelerate the transition toward an economy that works with nature rather than against it.

With the closing of the “COP in the Amazon”, top illuminem Voice and fmr. Secretary-General of the Convention on International Trade in Endangered Species (CITES), John Scalon, captures the spirit of our findings: “It’s time to rethink the path we are on to protect our biodiversity, climate, and land, and our planet’s overall health.”

Important note to our readers: The full study was conducted by the illuminem media and expert team, with the support of illuminem and GIST Impact's proprietary data. The whole dataset used for this study is available upon request, and soon online on Data Hub™ (please contact us to receive it). The individuals quoted in the article bear no responsibility for the selection of the companies. No company in the NATURE100™ has any commercial relationship with illuminem. As always at illuminem, we warmly welcome your comments and contributions on our mission to empower the sustainable transition with the most insightful information and data.