Biodiversity credits: an introduction

· 10 min read

According to the World Economic Forum’s New Nature Economy report, approximately $44 trillion of economic value generation depends on nature. Given its impact on the global economy and businesses, safeguarding the planet's rich biodiversity through substantial investment is essential. According to The Nature Conservancy, the biodiversity financing gap is estimated to fall between $598-$824 billion per year.

Given this landscape, the need for innovative financing mechanisms has never been more urgent. One promising funding source is provided by biodiversity credits. In this article, we will explore biodiversity credits as a key financing mechanism, focusing on the following aspects: definition, differences between biodiversity offsets and credits, how they work, benefits and challenges, the biodiversity market, and a comparison between carbon credits and biodiversity credits.

Biodiversity credits are an economic instrument that can be used to finance projects and activities that produce positive and measurable goals for biodiversity (e.g., reintroduction of endangered species, ecosystem restoration and habitat protection, etc.). The primary goal is to encourage the conservation of biodiversity by providing a financial incentive for protecting or restoring natural habitats and ecosystems. Biodiversity credits can be sold or traded to entities seeking to offset their environmental impacts or to support conservation efforts.

There are two main types of biodiversity credits: biodiversity credits proper and biodiversity offsets.

Biodiversity offsets represent costs imposed on companies (typically associated with activities like construction, mining, and other environmentally impactful industries) to mitigate negative impacts on local ecosystems. They are often legally mandated by state agencies as a prerequisite for obtaining permits.

Conversely, biodiversity credits offer companies the opportunity for voluntary investment in projects focused on biodiversity conservation and restoration.Unlike offsets, biodiversity credits aim to generate meaningful positive impacts on biodiversity through targeted conservation actions. Thus, while biodiversity offsets serve to compensate for environmental damage, biodiversity credits are intended as investments in conservation and restoration efforts.

Biodiversity credits commonly originate from conservation initiatives encompassing activities such as reforestation, habitat restoration, species protection, and the establishment of protected areas.

Let us look at the process that leads to their creation:

Verification, certification and monitoring

a) The company or a third party then conducts a biological survey to determine the baseline condition of the habitat. This process assesses factors such as species diversity, ecological health, and water quality.

b) Upon successful implementation of conservation activities, accredited organizations or governmental bodies usually certify these credits to ensure they meet specific conservation standards. Ongoing monitoring ensures that conservation is actually maintained, and regular reporting provides transparency and accountability

Trading

a) Companies, governments, and individuals can buy biodiversity credits to offset their negative impacts on biodiversity, fulfill regulatory requirements, or demonstrate corporate social responsibility.

Conservation incentives

Biodiversity credits create financial incentives for landowners and businesses to conserve natural habitats. By monetizing conservation efforts, these credits encourage sustainable land use and biodiversity preservation.

Economic value of ecosystems

They help quantify the economic value of ecosystems and biodiversity, making it easier to integrate environmental considerations into economic decision-making.

Corporate responsibility

For companies, investing in biodiversity credits can enhance their corporate social responsibility (CSR) profiles. This helps them meet environmental sustainability goals and improve their public image.

Market-based solutions

Biodiversity credits represent a market-based approach to conservation, promoting efficiency and potentially attracting significant private sector investment. This approach leverages market mechanisms to drive conservation funding, creating a scalable solution that can adapt to the needs and demands of different regions and sectors.

Conservation incentives

Biodiversity credits create financial incentives for landowners and businesses to conserve natural habitats. By monetizing conservation efforts, these credits encourage sustainable land use and biodiversity preservation. This not only helps protect endangered species and ecosystems but also promotes long-term ecological health.

Economic value of ecosystems

Biodiversity credits help quantify the economic value of ecosystems and biodiversity, making it easier to integrate environmental considerations into economic decision-making. By assigning monetary value to the benefits provided by ecosystems, such as clean water, air, and pollination, biodiversity credits make the case for conservation in economic terms.

Standardization issues

There is a lack of universally accepted standards for measuring and verifying biodiversity credits, which can lead to inconsistencies and challenges in ensuring the credibility and effectiveness of these credits.

Market development

The market for biodiversity credits is still nascent and underdeveloped. Building a robust market requires increased awareness, trust, and participation from various stakeholders, including governments, businesses, and conservation groups.

Regulatory frameworks

The absence of robust regulatory frameworks and policies in many regions makes it difficult to implement and enforce biodiversity credit schemes effectively. Strong regulatory support is essential to ensure compliance, transparency, and accountability in biodiversity credit markets.

Complexity in valuation

Biodiversity is complex and multifaceted, making it challenging to accurately value and create credits that reflect the true ecological benefits. A comparison with the carbon market can illustrate this further (see also below):

To address these challenges, Colombia's Terrasos has developed a formula that considers several factors, including the rarity and degradation level of a habitat, its potential to enhance connectivity with other habitats, and its capacity for preservation or restoration. This data is processed through an algorithm that determines the number of credits a project can issue. Habitats facing greater threats generate more potential biodiversity credits, while less threatened habitats yield fewer.

Equity concerns

There is a risk that biodiversity credits may disproportionately benefit wealthier entities or regions, potentially marginalizing local communities and indigenous peoples who play crucial roles in conservation but may lack access to these markets. Ensuring that benefits are equitably distributed and that marginalized groups are included is critical for the success and fairness of biodiversity credit schemes.

Biodiversity conservation continues to face significant underfunding, as recent studies reveal a staggering gap of over $700 billion between the present annual funding and the amount required by 2030 to uphold ecosystem integrity. According to a recent World Economic Forum paper, estimates of the cost to halt the current global loss of biodiversity are as high as $1 trillion annually. Less than $150 billion is currently spent on such efforts each year.

To address this shortfall, 196 countries adopted the Kunming-Montreal Global Biodiversity Framework in 2022. They agreed to redirect $200 billion per year for conservation and restoration. In particular, targets 19(c) and (d) of the framework encourage innovative schemes such as payment for ecosystem services, green bonds, biodiversity offsets and credits with environmental and social safeguards

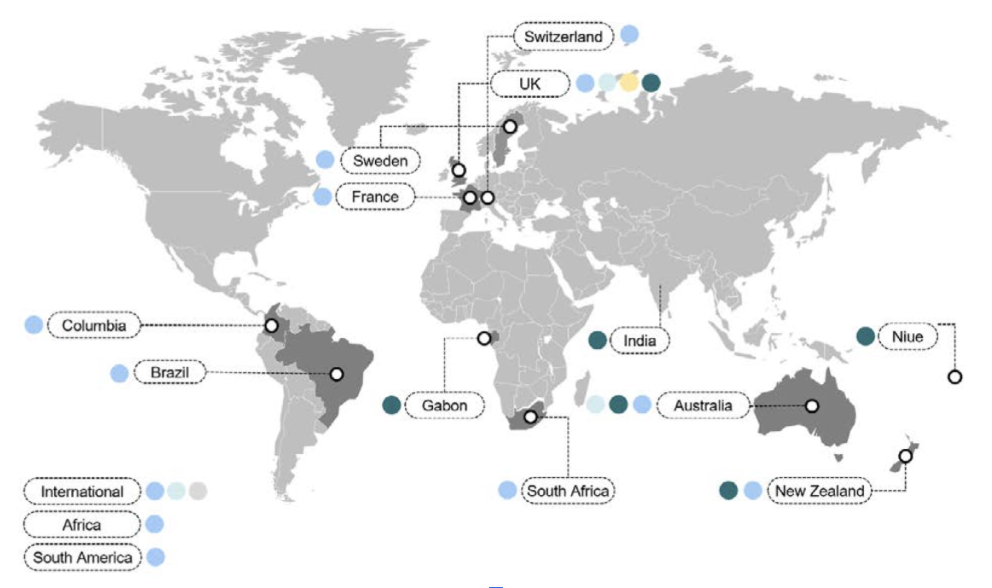

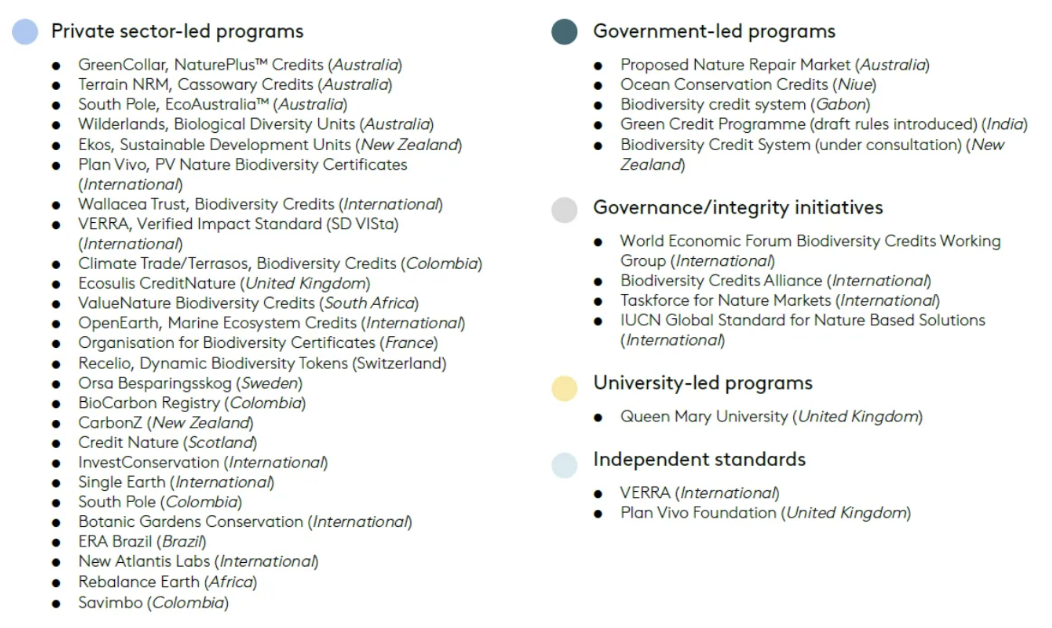

The biodiversity market is a purely voluntary, positive investment in nature by the private sector. Unlike the carbon market, the biodiversity credit market is still in its early stages of development. However, there are already approximately 26 private-sector biodiversity credit schemes in existence, each developing its own methodologies for calculating what constitutes a biodiversity credit.

The infographic below illustrates the geography of these 26 schemes:

source: Pollination

Below is a categorized list featuring the names of all crediting schemes, organized by private and public entities:

source: Pollination

The total market value of Biodiversity Offsets Scheme credit trades was $105.1 million in the 2022–23 financial year, up from $63.3 million in 2021–22.

As of May 2023, BloombergNEF reports that $8 million has been pledged to the eight most advanced crediting schemes.

The Voluntary Carbon Market, developed over more than two decades, is currently valued at approximately $2 billion. Thus, even if the biodiversity credit market were to grow to this magnitude, it would still fall short of addressing the $700 billion annual funding gap for nature.

In September 2023, The Wall Street Journal disclosed that not a single major company has declared its intention to acquire biodiversity credits.

The UK and France have announced a joint initiative to launch a biodiversity credits roadmap aimed at supporting companies' positive contributions to nature. Additionally, under the Environment Act 2021, the UK government is developing a statutory biodiversity credit scheme.

The Biodiversity Credit Alliance (BCA) exists to provide guidance for the establishment of a credible and scalable market that stands up to the scrutiny of multiple stakeholders. The coalition includes scientists, academics, conservation practitioners, policy and market experts, along with members of Indigenous and local communities. This diverse group of stakeholders is dedicated to ensuring that biodiversity credit markets incorporate strong mechanisms for free, prior, and informed consent, as well as equitable benefit sharing.

Carbon credits and biodiversity credits are both market-based instruments aimed at promoting environmental conservation, but they differ significantly in their objectives, scope, measurement, and implementation. Here are the key differences:

While both carbon credits and biodiversity credits aim to promote environmental sustainability, they target different aspects of the natural world, involve distinct measurement and verification challenges, and are at different stages of market development and regulatory support.

In conclusion, biodiversity credits hold significant promise for conservation and sustainable development, but several challenges must be addressed to unlock their full potential. Key areas needing attention include standardization, market development, regulatory support, accurate valuation, and equity. Tackling these issues is essential for biodiversity credits to effectively contribute to global biodiversity goals.

Biodiversity credits represent an innovative approach to financing and incentivizing biodiversity conservation. By creating a market for these credits, they offer a practical solution to combat biodiversity loss and promote sustainable environmental stewardship.

While the debate over the optimal use and effectiveness of biodiversity credits will continue, there is a consensus on the urgent need to scale up financing for nature and biodiversity.

Are you a sustainability professional? Please subscribe to our weekly CSO Newsletter and Carbon Newsletter

Aaron Bruckbauer

Pollution · Greenwashing

Jesse Scott

Carbon Market · Carbon Regulations

Glen Jordan

Sustainable Lifestyle · Sustainable Living

Inside Climate News

Pollution · Nature

The Jerusalem Post

Biodiversity · Climate Change

earth.com

Climate Change · Effects