Policy Note | Scaling Clean Energy through Climate Finance Innovation

· 34 min read

Steven W. Pearce

Adaptation · Mitigation

illuminem briefings

Climate Change · Environmental Sustainability

illuminem briefings

Climate Change · AI

France24

Public Governance · Climate Change

Euronews

Mitigation · Climate Change

Mongabay

Climate Change · Effects

Transitioning to a low-carbon energy future consistent with the goals of the Paris Agreement requires trillions of dollars of additional investment in the Global South. Most of this investment will need to be in domestic-oriented projects, generating local currencies and creating domestic development opportunities. However, local capital alone will not be enough, and significant amounts of foreign investments in the form of debt or equity will play a critical role. Exchange rate risk—the possibility that a local currency (LC) loses value relative to the foreign currency (FC) in which a loan is denominated—is a major impediment to large foreign capital flows for clean energy projects, increasing the cost of capital and at times hindering investments altogether while creating financial exposure issues for domestic sponsors. While currency hedging and other options exist, they can be expensive and are lacking for many developing country currencies, particularly at the long tenors, low cost, and large scale required to support the needed clean energy investments.

Addressing exchange rate risk should therefore be a priority for climate- and development-focused policy makers, financial executives, clean energy investors, and civil society advocates. While this issue is important regardless of economic cycles, it is vital in times of rising interest rates and cost of capital—particularly in many emerging and developing markets, which are often seen as riskier by investors in times of global economic uncertainty.

This policy note sets out a possible structure that could alleviate exchange rate risk for clean energy projects. It outlines a facility, supported by a combination of domestic and international resources (including carbon credits, official development assistance, and international private capital), that could issue currency exchange risk protection to international lenders to catalyze financing for clean energy projects in developing countries.

Critical features of the facility would include the following:

The facility, as conceived by the authors, would generate several benefits for project owners, host countries, and international investors, including by:

The facility outlined in this policy note reflects extensive analysis and consultations conducted by the authors. While it is possible that this specific concept could become a reality, the primary objective of this piece is to catalyze intensified discussion on potential solutions that can increase the flow of climate finance to developing countries by addressing the constraint of currency exchange rate risk.

Efforts to address the climate crisis face a range of challenges—political, geopolitical, economic, technological, financial, and more. One of the most persistent challenges is the difficulty of mobilizing sufficient capital to enable developing countries[2] to continue developing while simultaneously accelerating their clean energy transition.

To deliver clean energy consistent with the terms of the Paris Agreement, it is estimated that finance for clean energy infrastructure in developing countries, even without including China, needs to grow massively. Analysis produced by the International Energy Agency in cooperation with the World Economic Forum estimates that, depending on whether one aims to limit global warming to “well below” 2.0o Celsius or to 1.5o Celsius, such investments must grow from roughly $150 billion per year currently to either $600 billion or over $1 trillion in 2030.[3] Advanced economies pledged to mobilize $100 billion annually for clean energy investment in developing countries but have fallen short, only meeting 80 percent of that.[4]

A key to achieving these goals is addressing the currency exchange risk that occurs between foreign-denominated financing and the local currency (LC) revenues of clean energy projects in emerging economies and other developing countries. This policy note sets out a possible structure to address this constraint and is organized as follows:

This policy note is the result of a collaboration among scholars at Columbia University’s Center on Global Energy Policy, working with the World Economic Forum’s “Mobilizing Investment for Clean Energy in Emerging Economies” initiative[5] and the World Bank Group’s Climate Change program “Invest for Climate.”[6] The piece reflects the authors’ analysis and research, including information gathered through discussions with investment and commercial bankers, private investors, multilateral bank executives, development finance authorities, development advocates, clean energy project developers, foreign exchange experts, and policy stakeholders.

In order to achieve the global climate goals set out in the Paris Agreement while also meeting rising demand for energy to fuel economic growth, developing countries need much more clean energy investment. Numerous analyses estimate the scale of need. As noted earlier, the International Energy Agency (IEA) has published seminal analysis that projects a need for fourfold to sevenfold increases in investments.[7] That analysis also estimates that 30 percent of the needed funding could come in the form of foreign capital.[8] This is due to the comparatively small scale of gross domestic product, less developed capital markets, and competing priorities for domestic funds (such as education and health services). Moreover, a portion of the required equipment will need to be sourced from abroad in foreign currencies (FCs). Foreign capital will need to play a significant role.[9]

Adding complexity, capital for clean energy finance tends to be available in advanced economies rather than in developing economies.[10] Investment in developing countries grew at only 2 percent per year for most of the period since 2015, the year when the Paris Climate Agreement was achieved.[11] Developing countries comprise two-thirds of the global population but have attracted only one-fifth of clean energy investment since 2016.[12] Available finance is a key missing link to accelerate clean energy deployment in developing economies.

Clean energy technologies often require large up-front capital expenditure. Their overall lifetime costs (initial capital expenditures plus operations, maintenance, and financing costs) may be lower than those of legacy energy systems, but the capital intensity of clean energy poses its own burdens, especially in capital-constrained developing countries. This means that building clean energy in developing countries requires effective management of a range of different risks—the creditworthiness of purchasers, possible regulatory and political uncertainties, unfamiliar technologies, and where foreign debt is involved, currency exchange rate risk.

Two additional important dynamics are relevant in financing clean energy projects to meet climate goals. First, greenhouse gas (GHG) emissions are projected to rise in emerging economies and other developing countries as a result of demographic, development, and energy demand reasons. Over the coming decade, countries currently classified as low and middle income by the World Bank[13] will grow to constitute roughly two-thirds of total global energy demand, a stark shift from the beginning of the century when the majority of global energy demand was in advanced economies.[14] Similarly, energy emissions in developing countries are currently projected to grow by 5 Gt by 2040, while over the same period they plateau in China and shrink by 2 Gt in advanced economies.[15] These projections highlight the importance of reversing emissions trends in these developing countries, which must simultaneously continue to develop their energy systems to raise inadequate standards of living. This emissions-reduction outcome requires a massive increase in clean energy investment in developing countries.

Second, as described in more detail in the next section, the majority of these clean energy investments need to be made in power and other infrastructure projects designed to meet local demand; they therefore generate local currency revenues. In addition, they tend to earn modest returns that require long return periods. They thereby contrast to the high-return foreign currency generating export projects that have, to date, attracted much of the international capital to energy investments in developing countries.[16]

Most clean energy projects—such as solar or wind power plants, investments in public transit systems, building efficiency retrofits, and electric vehicle charging stations—generate revenues in local currency. Traditionally, local borrowers are required to repay any foreign debt finance on agreed terms in the foreign currency, such as US dollars, euros, or yens. If the local currency loses value relative to the foreign currency during the life of the loan, a common circumstance with many developing country currencies, the project’s investors are exposed to a material risk.

Often, this risk is borne by host-country participants through, for example, host-government guarantees or by denominating the loan and other returns to foreign investors in dollars or other foreign currencies. As a result, as one expert analysis states, “When local currencies depreciate, the consequences [for host developing countries] range from bad to disastrous; including insolvency, job losses, recession, increases in non-performing loans, decreases in investment flows and economic crisis.”[17] In addition, foreign investors are often unwilling to invest without access to coverage beyond what the host government provides, thereby limiting the supply of capital for clean energy investments.

Two other factors compound the currency exchange rate risks for clean energy investment in developing countries. First, as noted above, most such projects are not major cash generators; they provide utility-scale returns. Second, the debt service terms may extend for 15 years or more, during which currency depreciation can be large while slim margins make it more difficult to absorb.[18]

Importantly, developing countries can be on the losing end of exchange rate fluctuations for a variety of reasons—some having nothing to do with their own policies or practices. For example, in early 2022, global investors worried about the macroeconomic impacts of Russia’s war in Ukraine, and many investors shifted to traditional “safe” stores of value. They wanted to hold wealth in US dollars or gold, for example.[19] Many other currencies—especially those in the developing world—suffered losses as a result.[20] Other factors also adversely affected them, such as the sharp increase in energy import prices and the impact on their currency reserves.

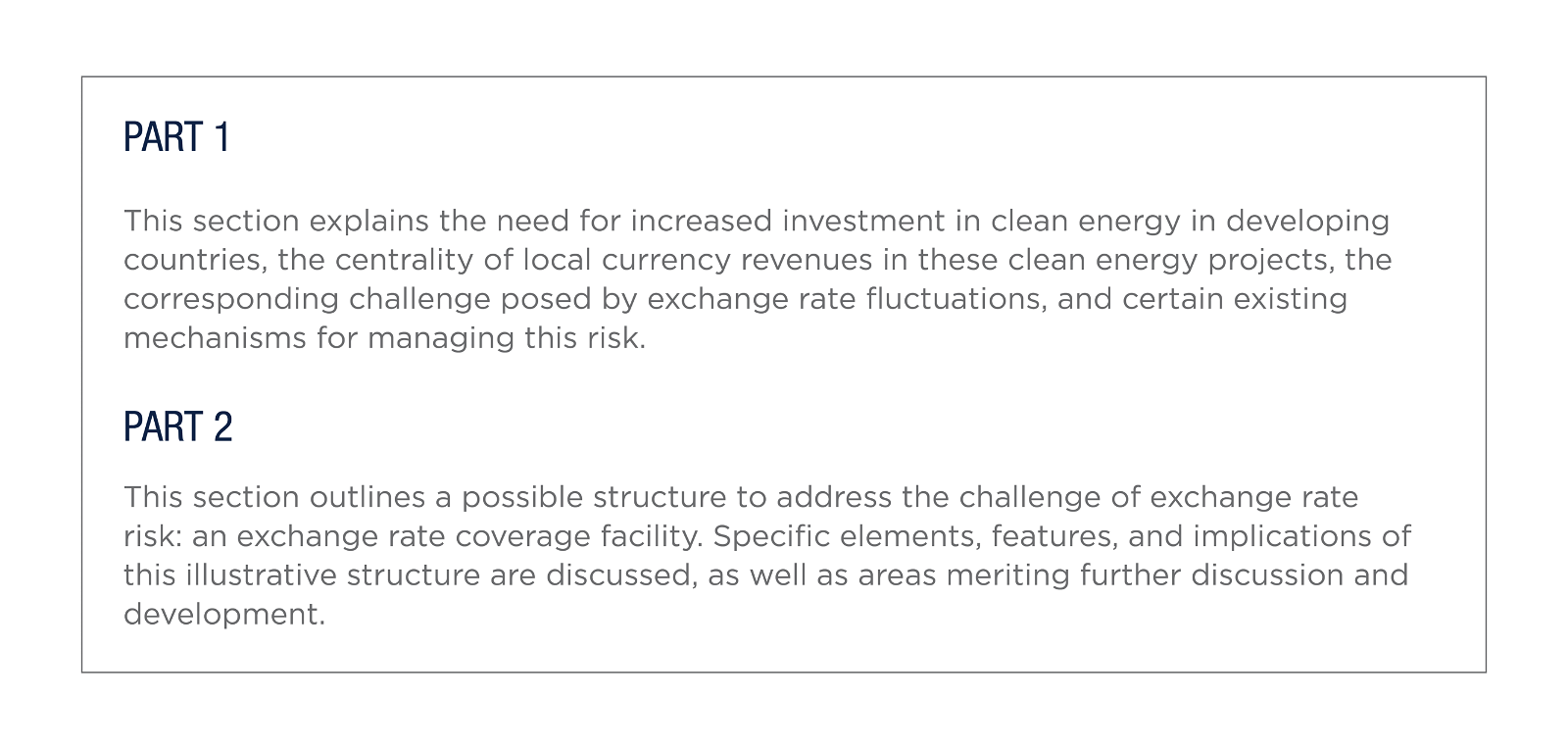

Problematic domestic policies can also drive down the value of local currencies. At times it is difficult to identify the exchange rate impact of individual factors, especially over the short term, but as a general proposition the local currencies of many emerging economies have depreciated significantly relative to the dollar over the last 20 years. The LC values for Indonesia, India, Egypt, and South Africa relative to the US dollar are shown in Figure 1.[21]

Certain existing tools and mechanisms can help manage exchange rate risk, but they have specific implications for costs, tenor, and scale. One such mechanism, host-government guarantees, covers the gap between the value of the local currency revenues and the debt service (and potentially equity payments) owed to foreign investors. Such guarantees require that the host government has fiscal space and can often create macroeconomic and budgetary stresses—a particularly salient issue given the trying macroeconomic environment of the past two years.

Another approach is for the debt obligation to be denominated in the FC, which results in the project developer—often a state-owned enterprise—bearing the responsibility to cover a depreciation-related debt service shortfall and often then turning to the government owner for compensation.[22] Clean energy investment in developing countries will not be able to proceed at pace and scale if all projects must rely on host-government compensation or guarantees—not only because these governments lack the financial capacity to do so, but also because doing so may not be wise from a macroeconomic management perspective.

Another tool used for certain projects—price indexation—has different implications. In this case, the project developer would raise the price it charges for the clean energy if the local currency loses value over time.[23] Such an arrangement can present major political and social problems if it results in significant tariff increases for consumers. As a result, this may translate into an accommodation in which the government once again steps in to pay the required amounts without passing the costs onto consumers.

Domestic private companies developing clean energy projects often do not have the option to turn to the state for compensation or have the financial muscle to cover potential large losses due to currency fluctuations. Even international companies investing in many markets with greater financial solidity and ability to diversify risks across different markets and currencies are exposed to LC depreciation risks over time, which can make investments that would otherwise be financially viable riskier and, hence, less attractive or even impracticable.

Importantly, the market can also provide protection—at a price and under certain conditions and limitations. Exchange rate swaps and hedges can be purchased in the commercial market to protect against currency risks, but hedges and swaps are only available for certain currencies, and they are not generally available for the long-tenor obligations that characterize the financing for clean energy investments. They can also be costly.[24]

Recognizing the limitations of currency hedging products for many developing country currencies, various donors, together with multilateral financial institutions, established The Currency Exchange Fund (widely known as TCX). TCX aims to facilitate sustainable development in emerging and frontier markets by providing currency hedging services for project developers and borrowers in these markets.[25] In the 15 years since its inception, TCX has de-risked $1.4 billion in loans to developing countries, including $53 million in energy projects.[26] While an important addition, there remains significant room for more financial innovation.

Risk-adjusted returns matter for domestic and foreign investors, and the FC risk is an important element in that determination. The financial products currently available to catalyze clean energy investments by addressing currency exchange rate risk are insufficient to deliver the needed volume of foreign investment, particularly on terms that are affordable and consistent with other development needs. Consequently, there is not only room but need to do more in this area. The following section sets out a possible new facility to help fill this gap.

One possible approach to manage exchange rate risk is through the creation of a Clean Energy Exchange Rate Coverage Facility (ERCF). The structure and design presented here by the authors are not the only form that such a facility could take. Rather, this proposal provides an indicative structure with certain features that can be debated, amended, and improved. In order to facilitate the basic design task, certain parameters of the proposed facility have been simplified.

The Clean Energy Exchange Rate Coverage Facility is intended to increase funding for clean energy investments in developing countries[27] by protecting FC lenders (including those supplying commercial loans and buying bonds) against depreciation of LC payments, while also helping to protect domestic sponsors against this exposure. The facility would do so by absorbing this risk, which is distributed among its various funders (as described below). The facility would provide foreign lenders for clean energy projects with an offshore, creditworthy financial guarantee against foreign currency exchange risk and also help project sponsors access FC loans at lower rates than would otherwise apply.

In general, the following guiding principles have informed the development of this illustrative structure to respond to potential concerns of investors, local stakeholders, and international financiers, including multilateral development organizations:

The proposal blends the attributes of

with

with

The ERCF would cover the entire FC loan repayment against any shortfall resulting from depreciation of the LC relative to a contractually defined exchange rate, referred to herein as the “Reference Exchange Rate.” This coverage would include minor depreciations (e.g., the LC is worth 99.9 percent of its original value), as well as extreme depreciation (e.g., the LC is worth a tiny fraction of its original value), and all levels in between.

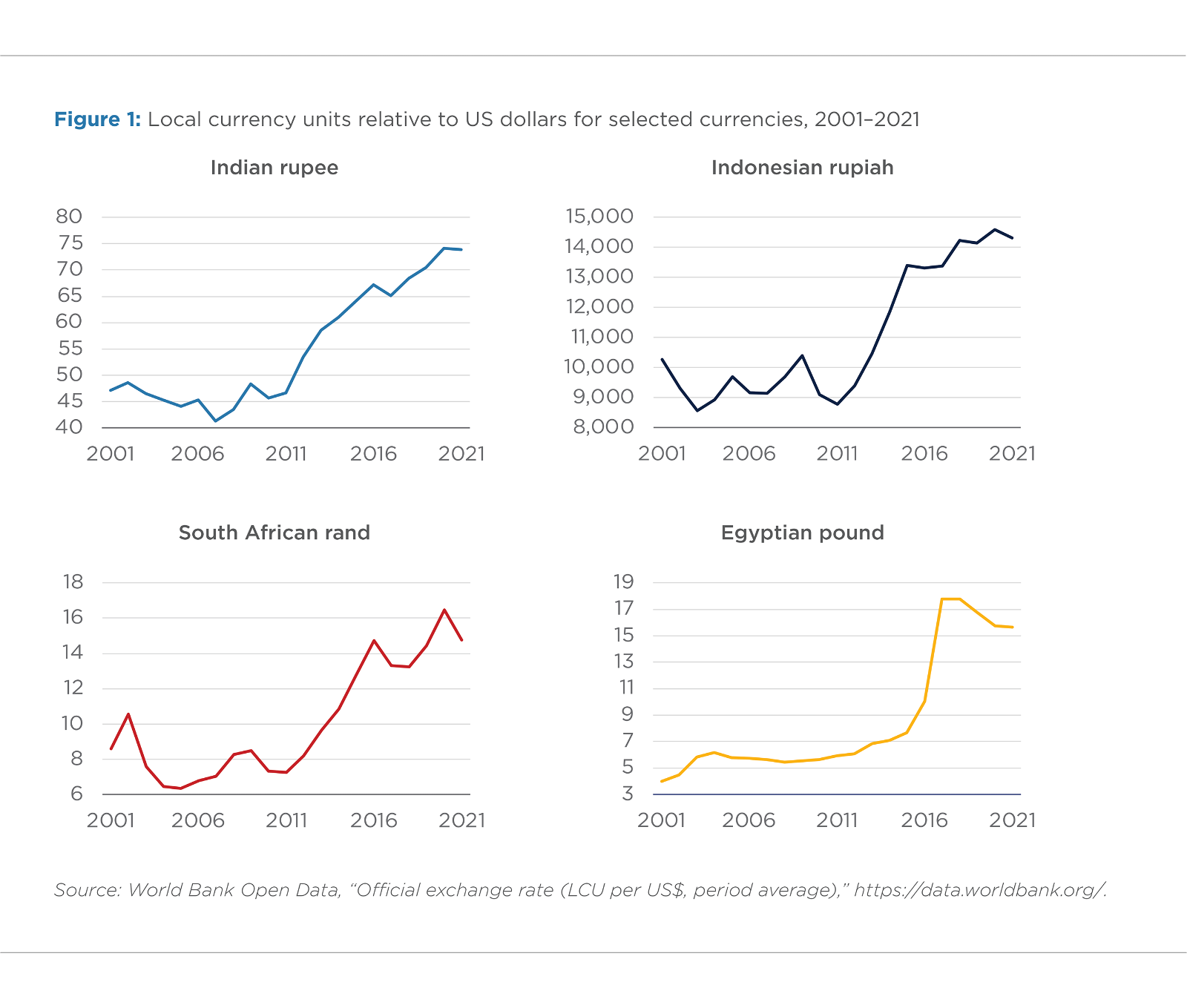

The ERCF’s coverage would be issued to support the debt service payments due to the FC lender of a project. The facility would be established and operate “offshore”—that is, outside the project host country—and would make its shortfall payments in FC directly to the FC lender (as depicted in Figure 2). The FC loan would be issued by the foreign lender to the project borrower; the coverage would be issued by the facility to the foreign lender. When there is a shortfall in the LC contracted amount relative to the FC debt service payment,[29] the ERCF would pay the dollar amount of that shortfall directly to the foreign lender.

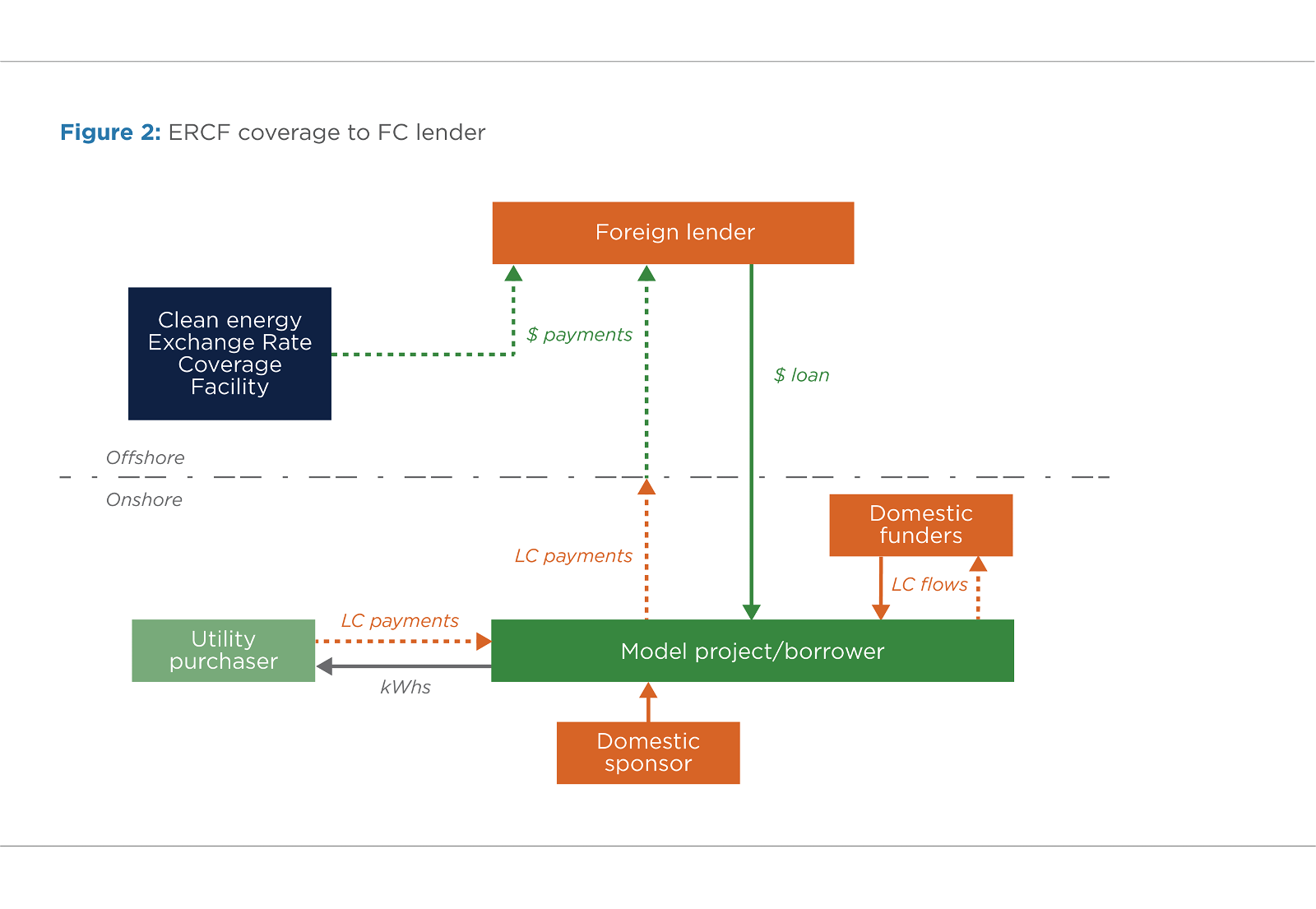

This coverage is illustrated in Table 1, which depicts how the shortfall would have applied to a 10-year,[30] dollar-denominated loan using the historical exchange rate for the Indonesian rupiah/US dollar from 2012 to 2021. The exchange rate average for 2011 of 1:8,770 is used as the Reference Exchange Rate. The ERCF coverage would, as reflected in Table 1, have paid the FC lenders $0.7 million in 2012, rising to $4.0 million in 2020, and a total of $30.9 million over the 10-year term.

The ERCF is not designed to cover traditional credit, operational, technological, or other risks, which fall within the usual due diligence remit of project investors. However, consistent with its climate and development orientation, the product would conceptually be structured such that the facility’s shortfall currency protection is triggered if the project produces the clean energy (which in turn produces the carbon credits) and the borrower makes the contracted LC payment.

The facility’s product could potentially be used to mobilize additional funding from foreign lenders to domestic banks to increase the capacity of these banks to provide local currency loans for these projects. The facility could also explore potential specialized product windows, for example aggregating smaller projects from small island developing states. In addition, consideration could be given to providing some complementary protection for equity investors. Finally, the facility could be structured to receive any “surplus” in the event of an appreciation of the LC relative to the Reference Exchange Rate.

This section describes the sources of funding for the facility, the facility’s potential exposure, the proposed funding structure to meet that exposure, and other possible financial management and operational considerations.

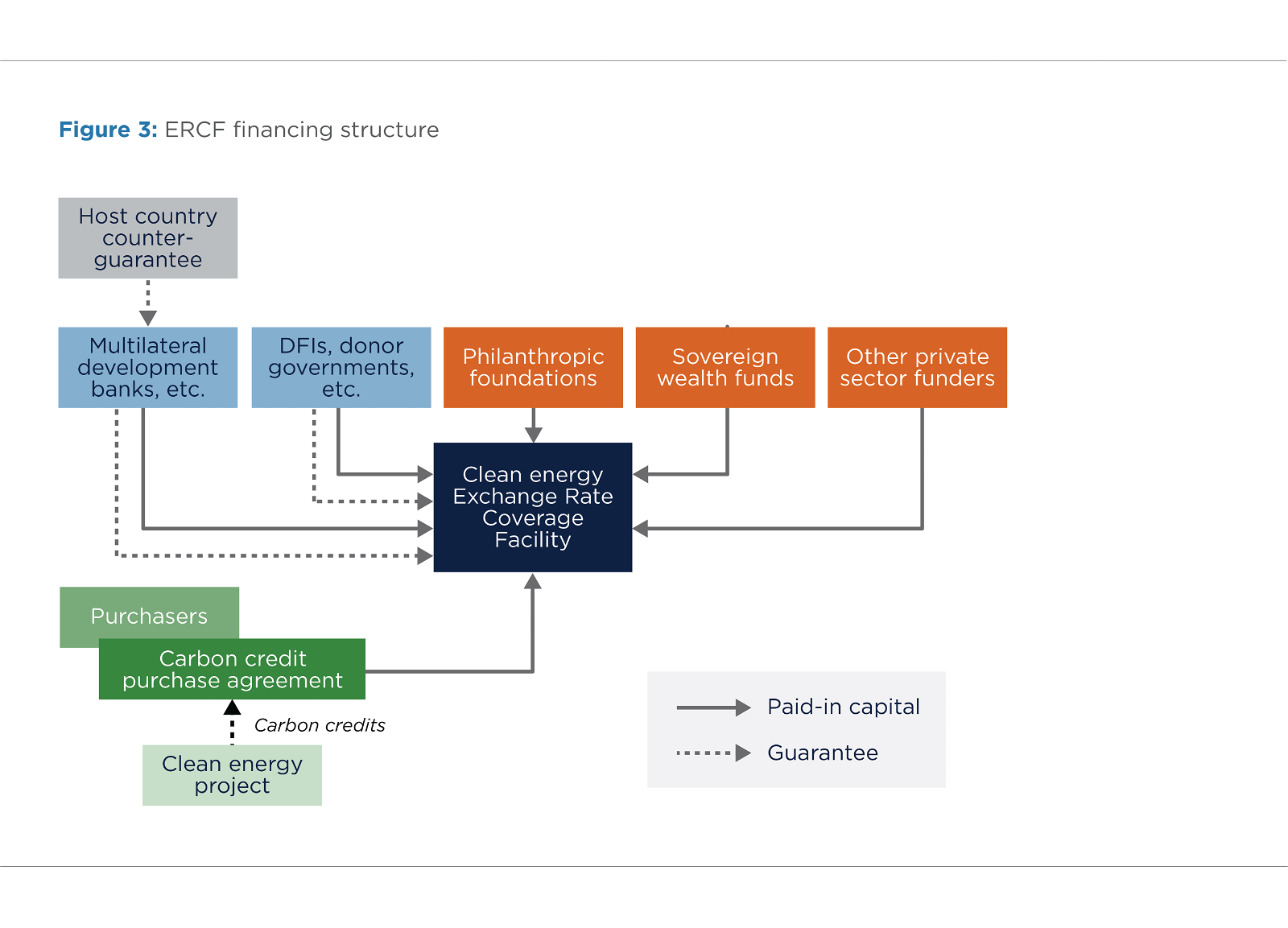

The ERCF would draw on funding from three types of sources: (i) carbon credits; (ii) multilateral development banks (MDBs), development finance institutions (DFIs), and others in the international development/climate community; and (iii) other sources of international capital. The result is a “blended finance” facility:

These various funding sources are depicted in Figure 3.

In order to illustrate how a clean energy project, its FC loan, the ERCF coverage, and the illustrative facility funding structure interact, the authors have developed a model clean energy project and related FC loan. They assume the following:

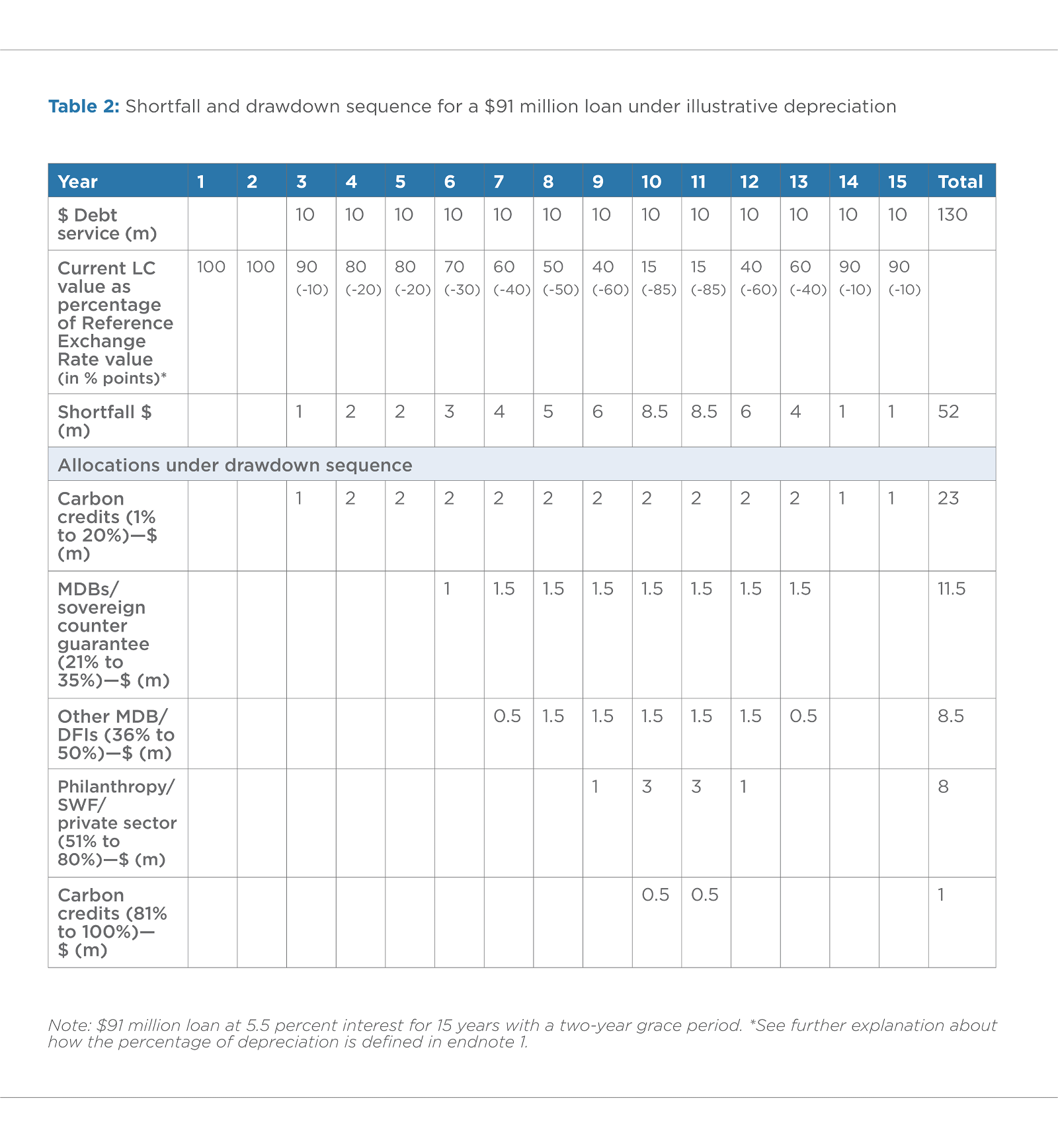

The resulting total FC loan amount, including IDC, is $91 million. The debt is repayable in 13 annual equal installments of $10 million, for total repayment over the life of the loan of $130 million. As a consequence, each 10 percent LC depreciation relative to the Reference Exchange Rate in any given year generates a shortfall of $1 million for that year and, if repeated for the entire life of the loan, a total shortfall of $13 million.

The maximum exposure of the facility (i.e., assuming a complete collapse of the local currency through the term of the loan) would equal $130 million payable over the 15-year loan period. The facility would need to be funded to pay any and all shortfalls, up to the maximum of $130 million—an extremely unlikely scenario but nonetheless a scenario for which lenders would seek comfort. To meet this contingent obligation, the facility would draw on the following contributions:

Table 2 depicts, with respect to the model $91 million FC loan presented above, the drawdown sequence on facility resources to fund the shortfall payments for depreciation of the LC that varies over the life of the loan, from a low of 10 percent in year 3 to a high of 85 percent in years 10 and 11.

Note that under the illustrative structure, any and all potential shortfall payments (up to the total annual debt service payment, set at $10 million under the illustrative loan) to be made by the facility must be fully funded by the different funding sources. Accordingly, the funding to the facility by each and every contributor needs to be structured to be sufficiently robust to enable the facility—and by extension the coverage it issues—to provide lenders with strong investment grade protection against the risk of exchange rate depreciation. These funding arrangements would need to be reviewed and evaluated by an appropriate rating agency and will likely differ depending on the class of funder. For example, a guarantee from the World Bank covering the 15-year shortfall period may be sufficient, but a similar contingent obligation for some other funders may not be adequate. In addition, while the facility is structured to cover a massive depreciation, that is unlikely to occur for all currencies covered by the ERCF.

Several operational aspects would need to be addressed for this type of facility to move forward:

The facility set out in this policy note could generate several types of benefits, including:

The world has a clear and overwhelming interest in avoiding dangerous levels of climate change. To achieve that outcome requires substantial investments in clean energy projects across the developing world, which, in addition to avoiding GHG emissions, also contribute to economic opportunities and job creation in these countries. This, in turn, will require large levels of foreign investment. Given that these clean energy investments will mostly be in local currency-generating projects, both foreign investors and domestic economic actors will need protections against foreign currency risks, at levels that far exceed the financial or prudential capacity of host governments. The international community, both public and private, has a role to play in this regard.

The facility outlined in this policy note is a possible vehicle to translate climate engagement and financial resources into more plentiful flows of international capital to fund clean energy projects in developing countries. It does so largely by bringing together a variety of economic actors to cover any depreciation shortfall or, more precisely, to assume exposure regarding the risk of an eventual shortfall, including from massive depreciations. However, this also involves costs to the various prospective facility funders, both domestic and international, who must allocate some of their resources to this, rather than other uses. The attractiveness (from a cost/benefit analysis) of this potential investment in the facility would need to be assessed by each potential participant—including, notably, the owners of the carbon credits, which serve as a first loss.

Despite the illustrative details provided for the facility structure, a number of open issues remain and merit consideration, including access and certainty regarding carbon credits, relative appetite and participation of different funders, and treatment of the facility’s resources (including undisbursed funds), as well as institutional hosting. Most importantly, this policy note is designed to catalyze discussion on the important topic of how to advance climate and development finance in a way that meets the twin objectives of addressing climate change while reducing poverty and promoting growth in developing countries.

This article is also published by Centre of Global Energy Policy. Illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

[1] A terminological clarification: References in this paper to percentage of depreciation are expressed as the percentage of lost value with respect to the agreed Reference Exchange Rate that is formalized at the financial closing for a given clean energy project. If the text refers to a 90 percent loss of value of the relevant local currency, then an initial amount of LC that was worth $100 equivalent now only represents $10 equivalent. The LC is said to retain only 10 percent of its initial value (as determined by the Reference Exchange Rate). A 50 percent loss means that the LC is worth half (i.e., 50 percent) of its original value.

[2] While there is debate in various circles as to whether China should continue to be classified as a “developing country,” for purposes of this discussion China is not included. For more discussion of China’s proper status, see: Philippe Benoit and Kevin Tu, “Is China a Developing Country, and Why It Matters for Energy and Climate,” Columbia University Center on Global Energy Policy, July 2020, https://www.energypolicy.columbia.edu/sites/default/files/file-uploads/ChinaDevelopingCountry_CGEP-Report_072220.pdf.

[3] See: Organization for Economic Cooperation and Development (OECD)/IEA, “Financing Clean Energy Transitions in Emerging and Developing Economies,” June 2021, https://www.iea.org/reports/financing-clean-energy-transitions-in-emerging-and-developing-economies/executive-summary.

[4] In 2009, at COP-15 in Copenhagen, developed countries pledged to mobilize $100 billion per year by 2020. Just before COP-26 in Glasgow, the OECD found that clean energy investment capital mobilized for developing countries amounted to roughly $20 billion less than this goal. See: OECD, “Statement by the OECD Secretary-General on Future Levels of Climate Finance,” October 25, 2021, https://www.oecd.org/newsroom/statement-by-the-oecd-secretary-general-on-future-levels-of-climate-finance.htm.

[5] https://initiatives.weforum.org/micee.

[6] https://www.worldbank.org/en/topic/climatechange/brief/mobilizing-finance-for-climate-action-through-the-invest4climate-platform.

[7] Other analyses reach broadly similar conclusions. See, for example: IPCC AR6 (2022) WGIII report, “Climate Change 2022, Mitigation of Climate Change,” and notably discussion in chapter 15 (https://report.ipcc.ch/ar6wg3/pdf/IPCC_AR6_WGIII_FinalDraft_FullReport.pdf). There are also country and sector level reports. For example, Sustainable Energy for All (SE4ALL) and the Climate Policy Initiative concluded that Indonesia’s clean electricity investment needed to increase by more than a factor of four to $13.4 billion per year to comply with Indonesia’s net-zero target for 2060 (SE4ALL, “Paris Alignment of Power Sector Finance Flows in Indonesia: Challenges, Opportunities, and Innovative Policy,” March 2022, https://www.seforall.org/publications/paris-alignment-of-power-sector-finance-flows-in-indonesia-challenges-opportunities). Similarly, a study by BloombergNEF indicated that India’s investments in renewables would need to average $27.9 billion annually till the end of the decade to meet the government’s own renewable energy installation commitment (Shantanu Jaiswal and Rohit Gadre, “Financing India’s 2030 Renewables Ambition,” BloombergNEF, June 22, 2022).

[8] OECD/IEA, “Financing Clean Energy Transitions in Emerging and Developing Economies,” Figure 2.1.

[9] See Figure 2.1 in “Financing Clean Energy Transitions in Emerging and Developing Economies,” and Robin Baker and Philippe Benoit, “How Project Finance Can Advance the Clean Energy Transition in Developing Countries,” Oxford Institute for Energy Studies, September 7, 2022, https://a9w7k6q9.stackpathcdn.com/wpcms/wp-content/uploads/2022/09/How-Project-Finance-Can-Advance-the-Clean-Energy-Transition-in-Developing-Countries-ET17.pdf.

[10] IPCC, “Climate Change 2022: Mitigation of Climate Change,” Sixth Assessment Report, 15-4, April 2022, https://www.ipcc.ch/report/ar6/wg3/.

[11] Investment levels rose in 2021, although they still fall well short of the needed scale. IEA, “World Energy Investment 2022,” OECD/IEA, June 2022, https://www.iea.org/reports/world-energy-investment-2022.

[12] OECD/IEA, “Financing Clean Energy Transitions in Emerging and Developing Economies.”

[13]That is with a gross national income per capita level of less than about $12,500. This currently includes China, which, as noted above, is not included in the term “developing country” as used in this paper.

[14] Philippe Benoit, “Energy and Development in a Changing World: A Framework for the 21st Century,” Columbia University Center on Global Energy Policy, March 2019, https://www.energypolicy.columbia.edu/research/energy-and-development-changing-world-framework-21st-century.

[15] OECD/IEA, “Financing Clean Energy Transitions in Emerging and Developing Economies,” 13.

[16] See: Baker and Benoit, “How Project Finance Can Advance the Clean Energy Transition in Developing Countries,” https://a9w7k6q9.stackpathcdn.com/wpcms/wp-content/uploads/2022/09/How-Project-Finance-Can-Advance-the-Clean-Energy-Transition-in-Developing-Countries-ET17.pdf.

[17] European Commission, Organization for Economic Cooperation and Development, European Development Finance Institutions, Convergence Finance, and The Currency Exchange Fund, “The Need to Reduce FX Risk in Development [sic] Countries by Scaling Blended Finance Solutions,” February 2017, https://www.convergence.finance/resource/7ursD0kKrKmoAeoy4MG6ug/view.

[18] For a general discussion of the foreign exchange exposure of renewable energy projects, see “The Need to Reduce FX Risk…” Separately, a white paper from BloombergNEF on renewable energy investments in India finds foreign exchange risk to be the second-most important financial risk to projects, after rising interest rates. See: Shantanu Jaiswal and Rohit Gadre, “Financing India’s 2030 Renewables Ambition,” BloombergNEF, June 22, 2022.

[19] Chris Flood, “Flight to ‘Safe Haven’ Funds Runs Its Own Risks,” Financial Times, March 7, 2022, https://www.ft.com/content/fea79934-139b-44f2-93bb-d9841a148d31.

[20] See: John Authers, “When Austerity Is a Bigger Problem Than Inflation,” Bloomberg News, July 18, 2022, https://www.bloomberg.com/opinion/articles/2022-07-18/mexico-s-enjoys-low-inflation-but-amlo-s-austerity-is-starving-the-economy?sref=Bo5bEQTo. Also see: Jeff Stein, “Poorer Nations Could Suffer from U.S. Efforts to Slow Inflation,” Washington Post, July 25, 2022, https://www.washingtonpost.com/us-policy/2022/07/25/federal-reserve-interest-developing-markets/.

[21] These represent the changes in nominal terms, not in constant dollars or real terms. Loan agreements are similarly denominated in nominal terms, whether they use variable or fixed interest rates.

[22] For example, Mexico´s state-owned utility, CFE, in the last couple of years (2020–2021) had to cover an additional 2.6 billion USD in its foreign denominated debt due to a 9.2 percent depreciation of the LC in relation to 2019, which represented 16.6 percent and 39.4 percent, respectively, of the net loss of the company in 2021 and 2020. See Operation´s Results section in “CFE´s 2021 Annual Report,” https://www.cfe.mx/finanzas/reportes-financieros/Reportes%20Anuales%20Documentos/Reporte%20anual%202021.pdf.

[23] See Baker and Benoit, “How Project Finance Can Advance the Clean Energy Transition in Developing Countries,” referencing, inter alia, Project Development for Power and Water, a Middle Eastern Case Study 1999–2019, P Conway EMEA Energy Consulting Ltd.

[24] Comments on the challenges of using hedging and swaps were made by investment bankers and project developers whom the authors interviewed on a confidential basis for this project. See also: Joaquim Levy, “Foreign Exchange Risk: How a Liquidity Facility Could Help,” World Bank blog post, July 18, 2017, https://blogs.worldbank.org/voices/foreign-exchange-risk-how-liquidity-facility-could-help.

[25] Created in 2007 by a number of European development finance institutions and other government agencies, TCX works in partnership with the International Finance Corporation, the European Bank for Reconstruction and Development, and other MDBs to offer hedging and swap products. For background on TCX Fund, see: https://www.tcxfund.com/concept-structure/.

[26] TCX Fund, “TCX Impact Report 2021,” May 31, 2022, 2, https://www.tcxfund.com/wp-content/uploads/2022/05/TCX-Impact-Report-2021.pdf.

[27] See discussion in endnote 1 on references in this commentary to “developing countries,” which grouping as used in this paper does not include China.

[28] See, for example, the Currency Inconvertibility and Transfer Restriction product offered by the Multilateral Investment Guarantee Agency (https://www.miga.org/product/currency-inconvertibility-and-transfer-restriction).

[29] Note that, as concerns of the contracted LC payments due from the borrower, they could either be set as payable in LC or, alternatively, in FC at their FC equivalent based on the Reference Exchange Rate. While this would not affect the shortfall coverage provided by the ERCF, it would affect which party (the borrower or the FC lender) bears the convertibility risk with respect to the contracted LC amount. See later discussion regarding Currency Inconvertibility and Transfer Restriction coverage.

[30] Most loans would be expected to have longer tenors, more in the range of 15 years, as described in Table 1.

[31] See, for example, the Carbon Initiative for Development, the Transformative Carbon Asset Facility, the upcoming Climate Emissions Reduction Facility of the World Bank, or the Future Carbon Fund or the Climate Action Catalyst Fund of the Asian Development Bank.

[32] This would be $2.6 million per year in carbon credits. This figure assumes a 10-year carbon crediting period for years 3–12. Each year would require $2 million in revenues to cover a 20 percent depreciation of the $10 million debt service payment. In addition, the ERCF would need to build up a reserve of $6 million from this project to cover years 13–15 when carbon credits would no longer be available (i.e., $0.6 per year of crediting). A project operating in a power system with a 0.75 emissions grid factor (i.e., tCO2e/MWh), with an $800 cost per installed kWh and a 23 percent capacity factor, would generate sufficient carbon credits.

[33] See description at https://www.miga.org/product/currency-inconvertibility-and-transfer-restriction.