Could Germany's nuclear power stations help kickstart the domestic clean hydrogen economy? A thought experiment

· 7 min read

After Putins's attack on Ukraine citizens across Europe have come to realize how strongly their economies depend on natural gas from Russia, so strongly in fact that a moratorium on gas imports seems off the table as a viable sanction against the regime in Moscow.

While this dilemma can hardly be resolved in the short term, governments and companies seem committed to pivot their strategies through A) reducing the amount of natural gas required across domains, e.g., by accelerating the transition towards electric heating via heat pumps, B) diversifying supplier relationships, and C) replacing natural gas and other fossil fuels by derivatives like hydrogen.

This article focuses on option C) and picks up the current debate in Germany, other European countries (France, UK, Sweden, Poland, Hungary, Romania, Bulgaria), and the EU (taxonomy) about the future of nuclear power in general, and its potential use as a primary energy source in an emerging hydrogen economy (sometimes called "pink hydrogen"). To this end, we conduct a back-of-the-envelope techno-economic assessment to answer the following question:

Our preliminary findings indicate that under conservative assumptions approximately 7 million tons (Mt) of clean hydrogen could be produced at a levelized cost of hydrogen (LCOH) of

This illustrates that domestic clean H2 from Germany's remaining nuclear fleet would most likely be cheaper than any domestic green H2 project coming online in the near future (see Exhibit 1 in Hydrogen Council 2021). This is mainly due to the fact that the nuclear plants can nearly be operated around the clock, which means that the capital expenditures (CAPEX) can be spread over a signficant amount of clean electricity or clean H2 respectively.

Implementing a nuclear H2 production in Germany would require a total capacity of approximately 4 gigawatt (GW) of electrolysers to be installed near the nuclear power plants Emsland in Lower Saxony, Neckarwestheim 2 in Baden-Wuerttemberg, and Isar 2 in Bavaria (~1.3 GW each) at a cost of about EUR 4.5bn. Out of the three plants, Emsland appears almost ideally suited for such a project due to its proximity to the gas transmission infrastructure, and the activities of the GetH2 initiave.

In terms of its energy content, an annual production of 0.68Mt of clean H2 produced (~22TWh) could displace ~1.93Mt of natural gas, which corresponds to ~3% of Germany's gas imports from Russia in 2021, and 1.6% of Germany's total gas imports in 2021 (BAFA 2022). If this figure may appear small on first sight, one should be aware that Germany stronlgy relies on natural gas to meet its primary energy demand (~27% in 2021, only beat by oil ~32%, BDEW 2022). In its recent energy security progress report published on March 25, the Federal Ministry for Economic Affairs and Climate Action (BMWK) has stated its goal to buy 700 million m³ of LNG (~6TWh) via terminals in the North Sea at the going market rate, which may replace ~1% of the natural gas imports from Russia. The domestic nuclear H2 option could have a 3 times larger effect at fixed levelized cost, and a number of positive externalities that are stated below.

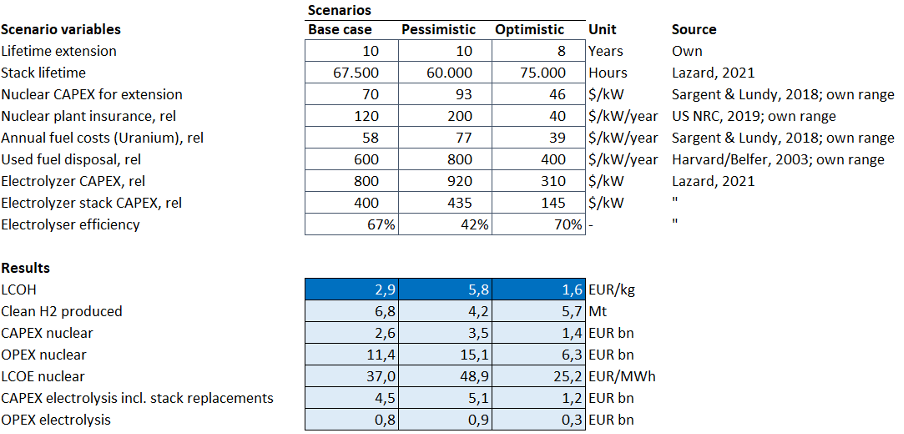

Assessing the sensitivity of LCOH to 9 key input parameters, we find that the cost may be significantly lower (1.60 EUR/kg in an optimistic scenario) or higher (5.80 EUR/kg in a pessimistic scenario). An overview of the key assumptions and results for each of the three scenarios is provided below:

We find that it is particularly important to select the duration of the lifetime extension of the three nuclear power plants such that it maximizes the use of a given electrolyzer stack. In other words, it doesn't make sense to go for a "nice" number such as 10 years, but rather 1 stack (~8 years) or 2 stacks (~16 years).

Since such a mega project may spur technological lock-ins, policy makers should do two things. On the one hand they should restrict the lifetime extension of the nuclear power plants to their techno-economic optimum as outlined above. On the other hand they should provide testbeds to build and learn from the operation phase of multiple different electrolyzer designs (AWE, PEM, AEM, SOEC) from different OEMs.

While nuclear safety and clarity on used fuel disposal are paramount to receive a social license to operate, it is clear that excessive cost for achieving them could render the approach economically non-viable. We have tried to reflect this by assuming a spectrum for one-off CAPEX associated to the lifetime extension, annual plant insurance cost (ranging between 1-5% of overnight construction cost for a new plant), as well as waste disposal cost, which amounts to a total of EUR 11.4bn in the base case scenario.

In light of our findings and in the context of limited options to address climate change and national security concerns, we believe it is well justified to explore this idea in-depth before starting to decommission the remaining nuclear plants from 2023 onward. The four key arguments are:

1. Germany could gradually ramp up its domestic clean H2 production to 700.000 tons per year at a price level, which makes its use attractive across a number of applications (see Exhibit 10 in Hydrogen Council 2020). Under optimal conditions it could even start to compete against unabated grey hydrogen used in refineries, especially when natural gas prices remain high.

2. Germany could create instant demand for 4GW electrolyzers, 10% of the 2030 target proposed by the EU hydrogen strategy, which could be a powerful commitment to the block's intended leadership role in this emerging industrial domain and help accelerate investments in regional production capacity.

3. Instead of being co-optimized for electrolysis, the renewable capacity coming online could be fully geared towards decarbonizing the power grid. To do so, ~500GW of solar+wind need to be installed every year until 2050 according to IRENA 2020: the world is currently adding less than half of what's needed.

4. Since they already have a grid connection, the nuclear plants could help stabilize the grid in extreme cases. A corresponding mechanism like the grid reserve, capacity reserve or security stand-by should be put in place to avoid that these written-off assets compete with newly installed flexibility equipment, with LCOE ranging between 25-49€/MWh (2.5-4.9ct/kWh).

In our view, the next steps should look as follows:

Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

Olaoluwa John Adeleke

Power Grid · Power & Utilities

Alex Hong

Energy Transition · Energy

illuminem briefings

Hydrogen · Energy

Financial Times

LNG · Oil & Gas

Oil Price

Renewables · Energy

Forbes

Energy Transition · Energy Management & Efficiency