Voluntary carbon market could reach $40b by 2040

Unsplash

Unsplash Unsplash

Unsplash· 6 min read

The voluntary carbon market (VCM) is at a point of inflection. Headwinds in the market – an unfriendly political climate in key countries, tightening budgets for sustainability, and an oversupply of historic credits – could batter already low sentiment. But there are also glimpses of a rebound: improved credit quality means trust is slowly coming back to the market, consolidation among actors means increased efficiencies, and an Article 6 boost could very well mean the VCM is primed for a big year. In order to help the market make sense of these competing scenarios, AlliedOffsets is thrilled to launch our Forecast Model.

Below is a summary of the report, full report can be downloaded here.

AlliedOffsets is the leading data and analysis company for the VCM. We track more than 35,000 projects from dozens of registries (as well as unregistered removals projects), 16,000 buyers, billions of credit issuances, prices across the market, and much more. This data allows us to create industry-leading insights into the VCM; to date, these have informed current trends in the market.

• Supply inputs: The model analyses 14 sectors and 200 countries/territories, incorporating nearly 150,000 unique variables to forecast credit issuance. These inputs are adjustable to adapt to evolving market conditions.

• Demand insights: Drawing from emissions data, reduction targets, sector-specific trends, and voluntary-compliance market dynamics, the model generates precise demand projections at both company and aggregate levels.

• Pricing Projections: By overlaying demand scenarios with supply-side data, the model calculates sector-specific prices, enabling detailed forecasts across geographies and timelines.

The model forecasts three scenarios: low growth, base case, and high growth, illustrating the market's potential trajectories:

• Low growth: The market stagnates over the next 15 years, with low prices and limited project development.

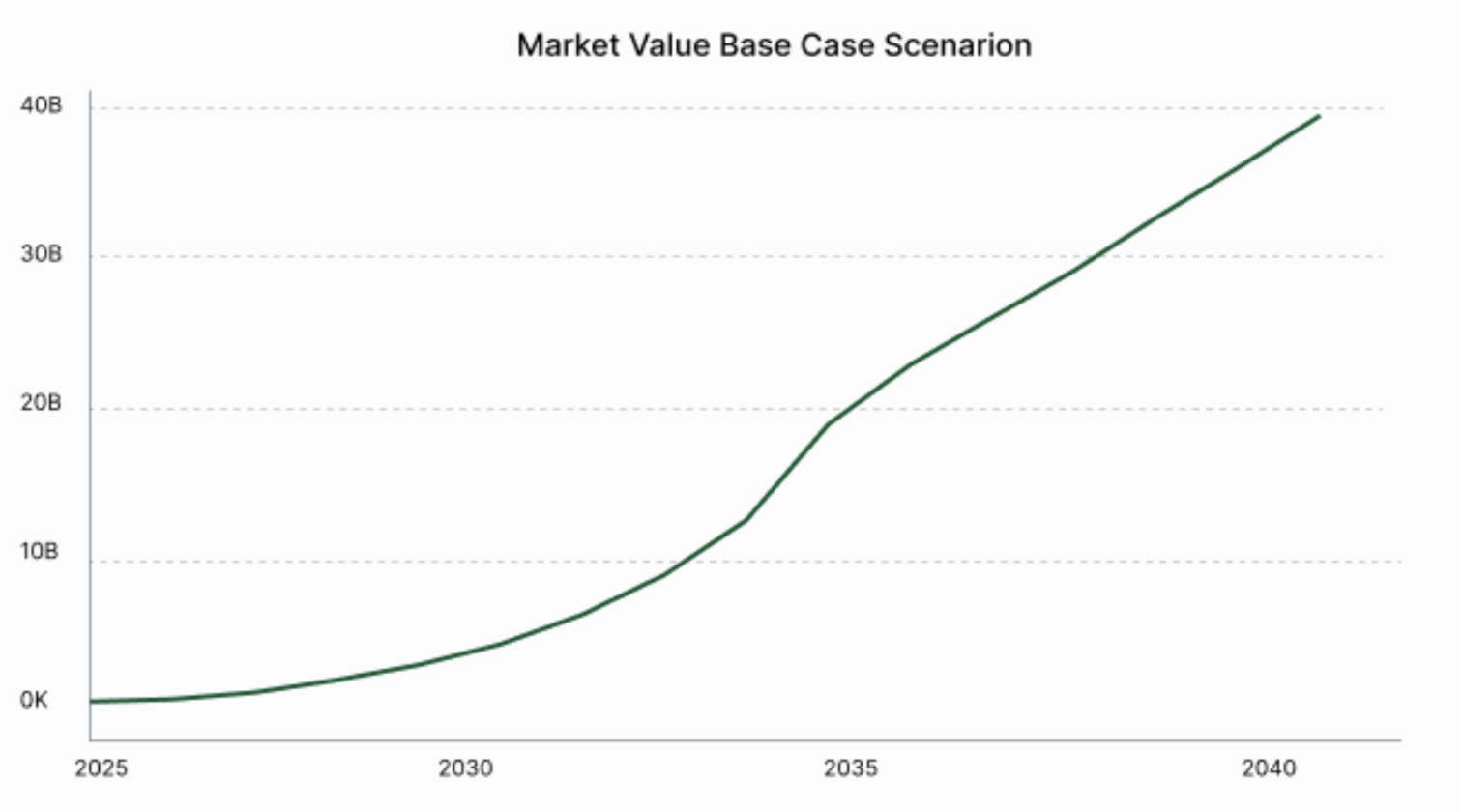

• Base case: Slow growth persists until 2032, followed by rapid expansion. Prices rise to $30/ton by 2035, with market value reaching ~$40 billion by 2040.

• High growth: Prices exceed $50/ton by 2037, with accelerated project development in high-cost sectors like engineered removals.

• The base case below projects a growth scenario that sees companies offsetting a portion of their missed targets. Here we expect the market to grow slowly until 2032, as oversupply of credits means that there is enough supply to satisfy demand until that year.

• The primary market value stays in the single digits until 2033, at which point it quickly increases, reaching ~$40b by 2040 (in nominal terms).

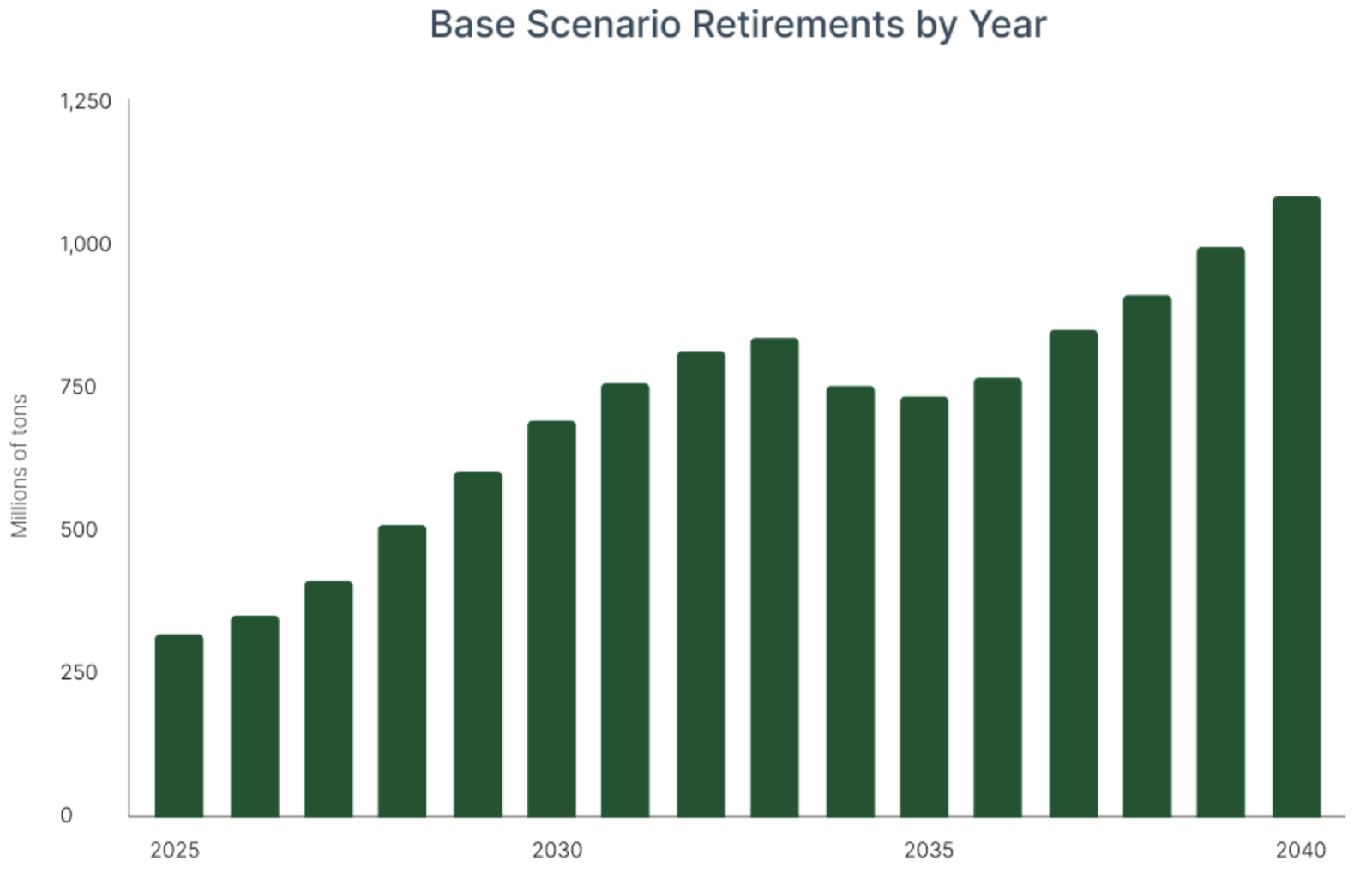

• The number of credit retirements reaches 1b in 2039, quadrupling the volume we’ve seen in the last several years. We foresee a spike in prices in the early 2030s dampening demand, as companies adjust to higher prices of credits.

• In the next 5 years, we forecast energy efficiency and waste disposal projects to become more popular as the VCM becomes increasingly used to fund the energy transition; waste sector projects benefit from countries’ desire to curtail methane emissions.

• By 2040, a focus on nature-based and engineered removals, as we near 2050 net zero targets, means these projects issue nearly 60% of the credits in the market, with ARR credits alone making for 20% of the market.

The timing of the model's release aligns with critical developments in the VCM. AlliedOffsets envisions its application across multiple stakeholders:

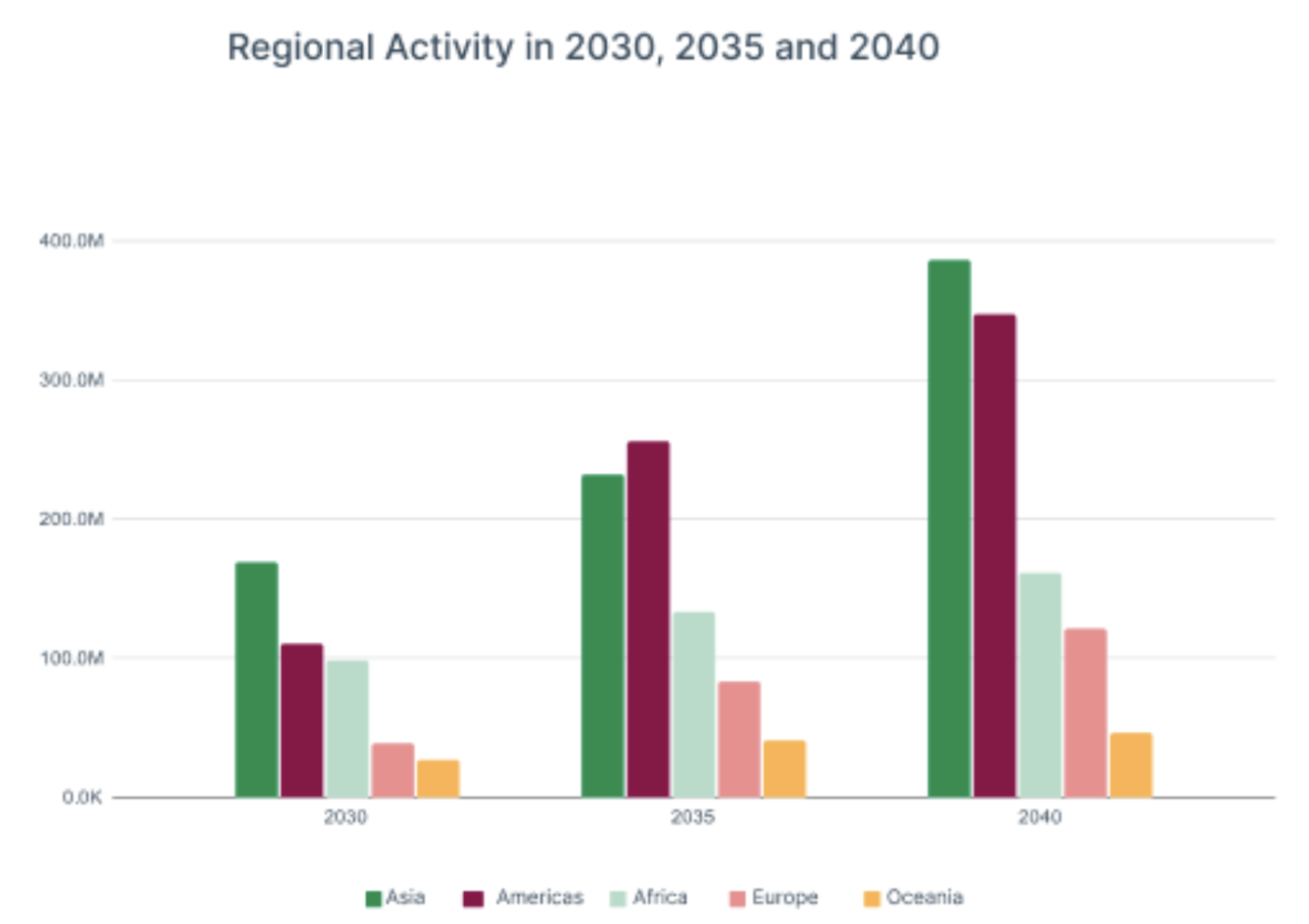

Asia is a leading region in the VCM, with China and India currently leading the way in terms of the number of projects that have been set up in those two countries, as well as the number of credits that have been issued since the market’s inception. We expect this dominance to continue into the future.

In our base case scenario, we anticipate that China and India will both stay in the top 5 countries by credit retirements as of 2040.

As the region with the most potential for nature based removals, we expect the Americas to overtake Asia briefly by 2035.

By 2040, however, Asia will regain its position as the VCM leader, driven by a high proportion of engineered removal projects launching in the region.

In addition to China and India, we forecast Indonesia, Bangladesh, and Turkiye to also significantly contribute to the issuance of credits in the market, with these five countries contributing more than a quarter of the credits issued in the market by 2040.

This report introduces the AlliedOffsets Forecast Model: how it works, potential use cases, and its results. We’re excited to share that the model is already being employed by multinational companies and governments in order to help them devise their approach to the voluntary carbon market.

Our base case scenario paints a picture of difficult years ahead in the short term, as prices fail to grow quickly enough to reach double digits until 2032. From then, however, the picture is much rosier.

What does that mean for those looking at the market today? Patience will be key over the next several years, as old credits are cycled out of the system and new projects (registering under increasingly conservative methodologies) begin to generate smaller vintages of credits. Nature-based removal projects seem likely to continue to appeal to buyers, even in the low growth scenario, as they can generate a large number of credits at relatively low cost.

But don’t count out avoidance credits – as those are cheaper credits to generate, any projects that can begin to issue credits now stand to benefit massively when (and if) prices increase in the future.

We’ll continue to update the model in the coming months and years: as new project types emerge, compliance markets come online, and companies enter the VCM, we’ll update our assumptions to reflect the market’s realities. We encourage everyone to follow along and provide feedback on the updates.

We hope this report will help readers understand where the market is heading at a high level. To learn more about the model or explore its applications, contact AlliedOffsets.

illuminem briefings

Net Zero · Carbon Market

Lukas May

Carbon Market · Carbon

illuminem briefings

Carbon Market · Carbon

Financial Times

Carbon Market · Public Governance

Carbon Herald

Carbon Market · Carbon Regulations

Politico

Carbon Market · Public Governance