· 7 min read

The Voluntary Carbon Market (VCM) has undergone significant changes over the years, and understanding these shifts not only explains the challenges we've faced but also highlights the immense opportunities that lie ahead - Lars Kroijer, CEO AlliedOffsets

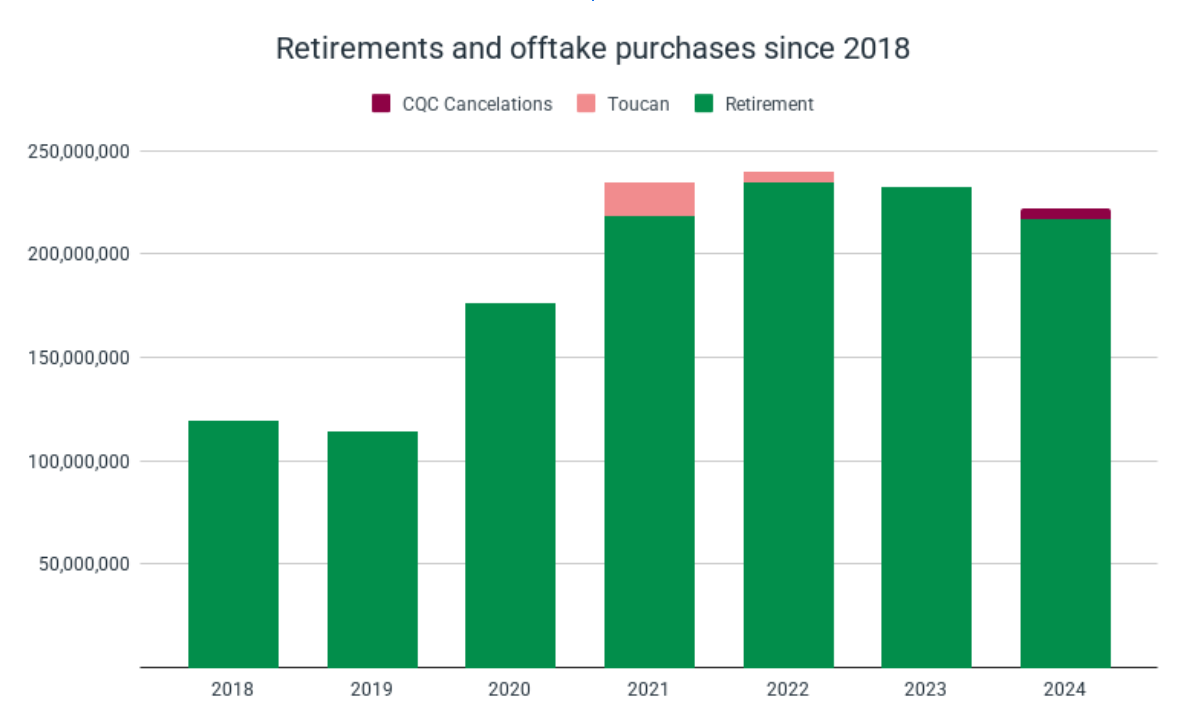

2024 was another bumpy year for the VCM, with retirements and prices not seeing growth. Quality was a top concern for buyers, and there were several positive developments on that front: ICVCM issued the first CCP approvals to standards and methodologies, while compliance markets made headway on integrating VCM credits for a portion of the compliance allowance. The latter is important because the compliance markets serve as de facto quality standards in the market.

Removal activity continued to grow in 2024, fueled by buyer preference for what they perceive to be higher-quality credits. There was an increase in both NBS and engineered removal purchases, though many marketplaces and buyers who had prioritized engineered solutions in the past have started to move into NBS, as well. That suggests buyers were unwilling to pay for pricier ($100/ton+) credits, and opted for more economical NBS removals.

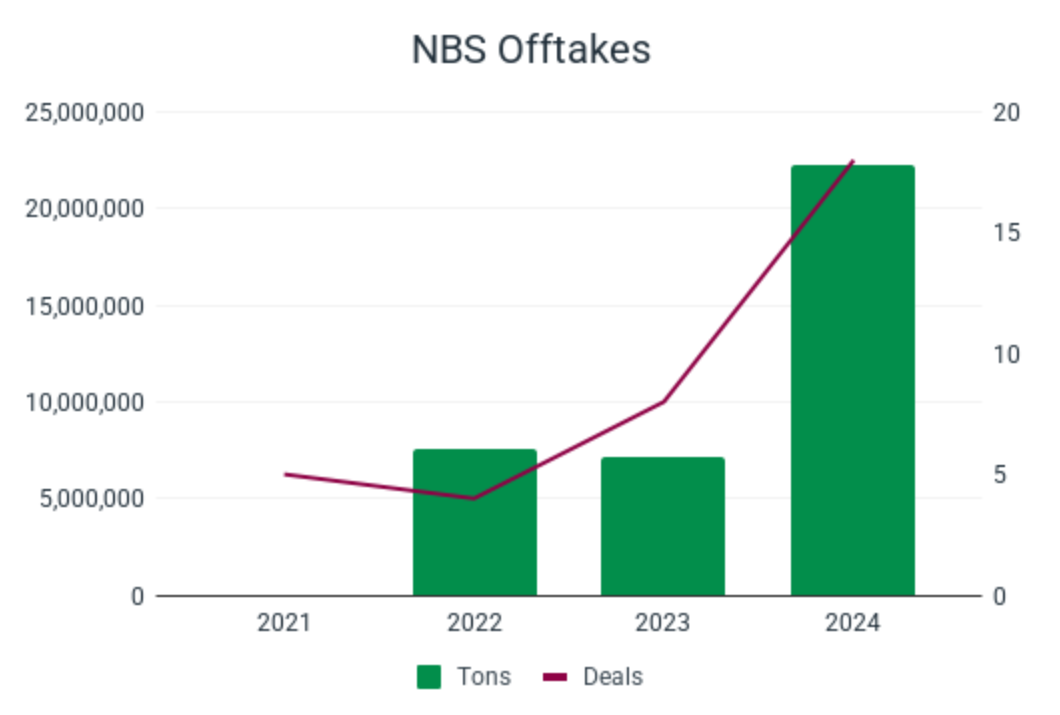

Over 20m of the NBS credits (~10% of market retirements) were purchased via off-take agreements that will see credits supplied well into the future. This signifies a larger shift of corporate behavior, from purchasing credits on the secondary market, to investing in early-stage projects to secure supply. That trend is likely to continue to grow in 2025.

Access the full report here, or read a summary of the report below!

VCM Headline Numbers from 2024

The VCM is slowly changing

Overall retirement activity in the VCM didnʼt see any growth, but that may be a win given the negative headlines and tepid buyer interest. 2024 was a year of focus on quality, and a year of change. Removals saw their largest share of activity, and the makeup of the underlying project sectors and registries is more varied than ever. We expect that to continue in 2025.

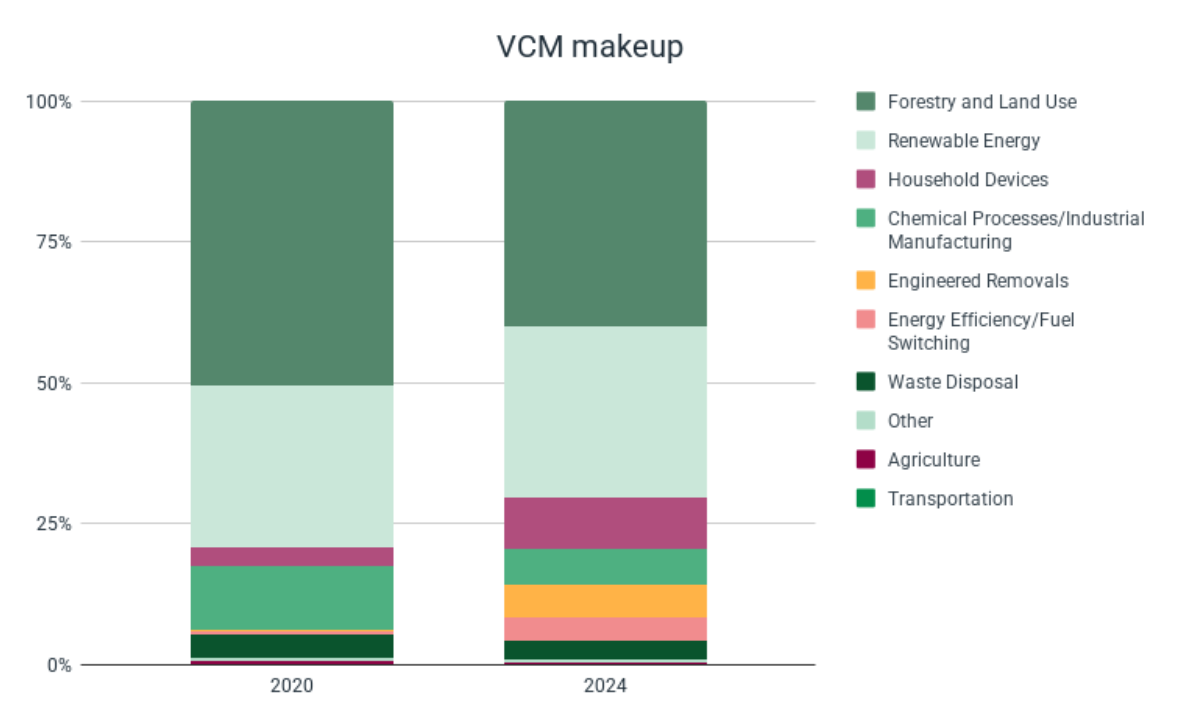

VCM is becoming (slightly) less homogenous

The share of renewable energy and forestry credit retirements has gone from 80% in 2020 to 70% in 2024.

Attracting buyers remains a challenge

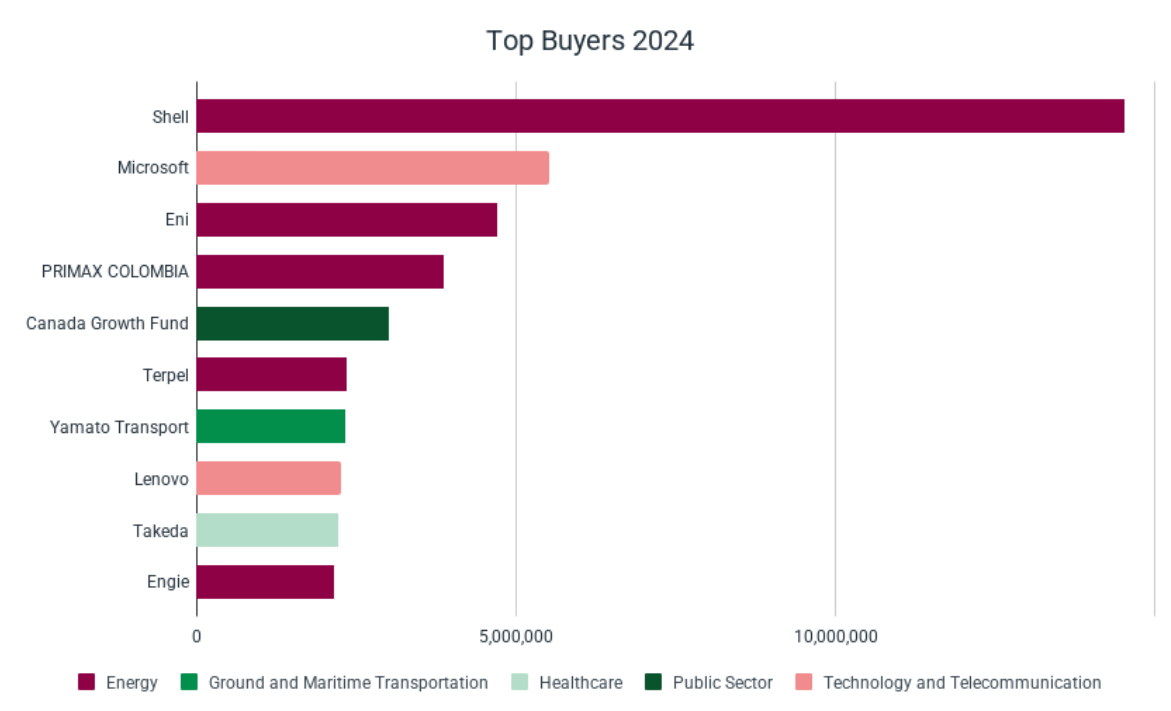

Energy firms (and Microsoft) drove the majority of retirement activity in the market once again; financial firms represented the largest cohort of buyers. While more companies than ever engaged with the VCM in 2024, the rate of growth of the entrants slowed.

Energy firms continue to dominate in 2024

The top buyer in the market for 2024, Shell, retired almost 3 times the number of credits of the next most prominent firm, Microsoft.

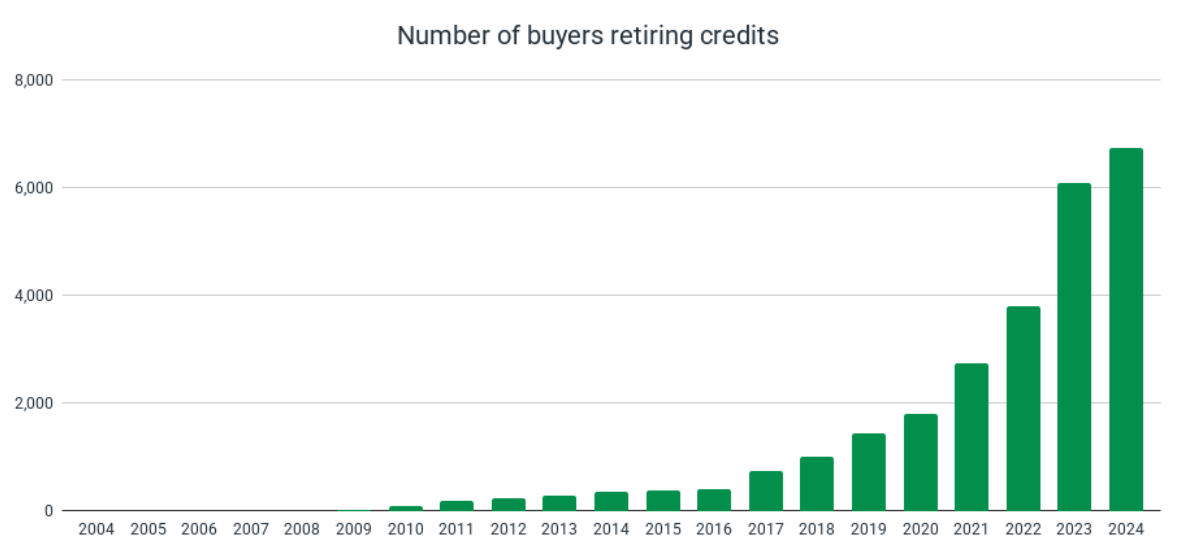

Number of buyers in the market continues to grow

The number of buyers active in the market has continued to increase in 2024, reaching over 6,500 firms for the first time this year, though the growth slowed relative to last year.

Carbon prices in 2024

Average prices and market sentiment reached lows not seen since pre-2021. One part of the market this didn’t apply to is NBS removals. With more offtake deals than ever in 2024, and prices consistently higher than in the secondary market, these transactions were a rare bright spot in the VCM.

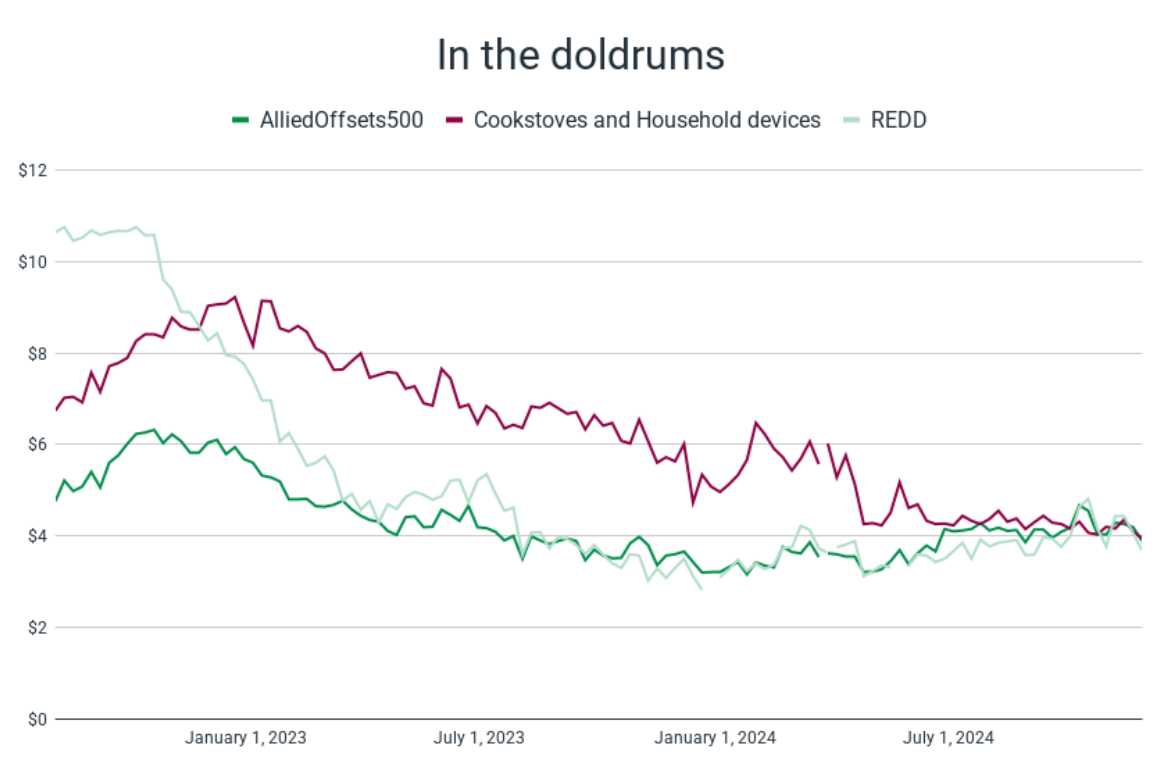

Prices continued downward slide

Prices in the market have generally gone sideways this year, ending a slump since 2023.

Notably, cookstove credits continued to fall in price following quality concerns. That trend followed for most of the year, though we saw another price slump in Q4, despite a healthy number of retirements in the market.

Carbon Dioxide Removal (CDR) in 2024

After a fruitful 2023, it’s hard to see 2024 as anything but a down year for CDR activity. 2025 promises to be a pivotal year for the market. Can prices fall enough to become palatable to a wider group of buyers? As more facilities come online, who will buy their credits? What will happen with the IRA? These questions will define the market next year and beyond.

NBS offtakes see increased activity

We saw the number of offtake agreements for NBS projects more than double, to 18 deals representing over 20m tons in 2024. The average price for credits is over $20/ton, higher than credits on the secondary market.

Quality in the market 2024

Integrity and quality have been the key topics of the VCM in the last two years. The market now has more ways than ever to tell potential buyers whether the credits they’re buying are actually a ton of carbon. Will this be enough to convince buyers they won’t wind up in the front pages of a newspaper, accused of greenwashing?

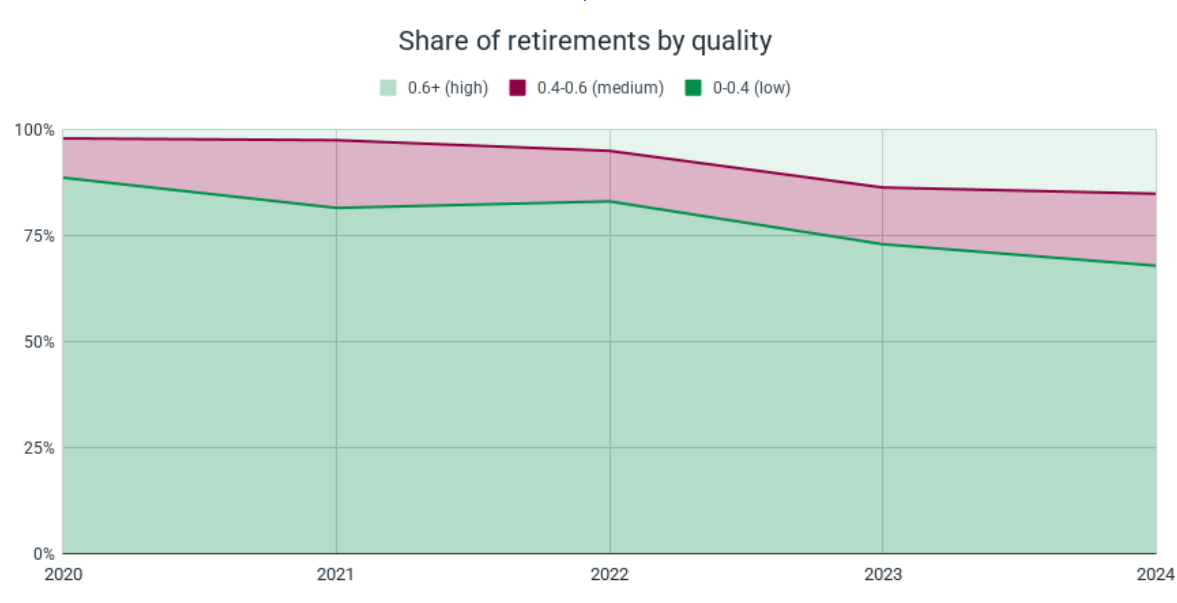

Quality of retirements continues to improve

In September, we launched a standardized quality score for 10,000 projects in our database. Based on the standardized rating of projects, we can see that the share of credits that are retired from low quality projects has dropped from ~88% in 2020 to 67% in 2024.

2025 and beyond

With the ICVCM driving a focus on quality, demand likely increasing from compliance markets (including Article 6) and data centers, and tightening of methodologies to limit the number of credits generated, there are reasons to be hopeful around the market heading into the new year. Headwinds remain, however. Trumpʼs election will mean fewer sticks or carrots for US companies to decarbonize. As international emissions trading markets begin to take off, we are likely to find some countries have over-promised the emissions reductions theyʼre able to export. And the over-supply of available credits in the market grew again in 2024. The growth of the over-supply of credits means our forecast for prices in the market remains bearish in the near term.

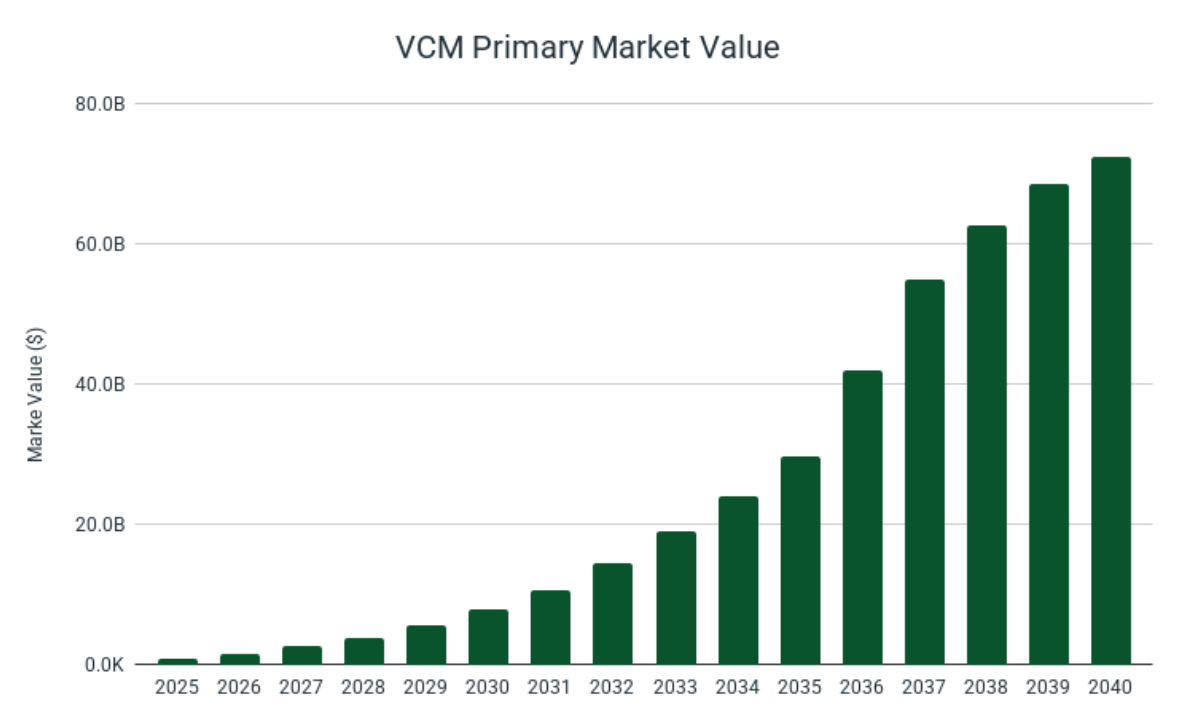

Based on the outputs of our forecast model, the primary market value of the VCM has immense potential for growth, driven by predicted future prices and credits projected for retirement.

Yet, as climate tipping points are reached, governments and companies need to determine how much, truly, they care about pricing emissions – without that clear direction, the VCM cannot grow in a meaningful way. The efforts that the industry has gone through over the past 18 months mean the VCM is better positioned than ever to help channel funds to climate-friendly projects. Whether or not buyers of credits will put trust in the revamped VCM after two years of controversy will be the main test for the market in 2025.

In the report we share some more insights and data outputs from our forecasting model on how we expect to happen in 2025 and beyond. Access the full report here.

Conclusion

The VCM, rightly, has focused on quality since early 2023: numerous initiatives, registries, and companies have launched to guide buyers to sound credits. These efforts are slowly starting to change the shape of the market. It’s focusing more on removals (which are easier to verify than avoidance credits), and retirements are coming from a more diverse group of credits.

Yet the previous failings of the market continue to haunt it: credits that have been issued to projects that wouldn’t make the grade today are still available to buyers. In the meantime, economic and political headwinds will not make it easier for projects to sell their credits.

This all combines to form an uncertain year ahead for the carbon market. While developers, standards, and VCM evangelists point to new projects and sectors to lead the market into the future, questions continue to arise about the quality of old credits that make up the vast majority of the market.

Still, projects in the VCM are, in some cases, uniquely positioned to channel large amounts of capital to parts of the world that would otherwise not see much investment activity. And even with fiscal belt-tightening across much of the rich world, there remains appetite to fund projects that both alleviate poverty, and help to decarbonize the planet. The long-awaited passage of Article 6 will stimulate more financial flows to emerging markets.

In short, there’s a lot to like about how the market is positioned coming into 2025; and yet, there are persistent and bothersome hurdles that it must overcome. Whether the cup is half full or half empty is in the eye of the beholder.

Read the full recap on AlliedOffsets. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.