The trillion-dollar fantasy: linking ESG investing to planetary impact

· 21 min read

On April 8 2021, the National Oceanic and Atmospheric Administration observatory in Mauna Loa, Hawaii, reported that the carbon dioxide levels in the atmosphere had reached 419 parts per million, the highest levels recorded in more than 4 million years (this number peaked for 2022 at 421 parts per million in May). That same day, BlackRock, the world’s largest asset manager, announced another milestone: It had raised $1.25 billion for its U.S. Carbon Transition Readiness ETF, the largest exchange-traded fund in history. The fund is a visceral embodiment of BlackRock CEO Larry Fink’s assertion to clients that the firm “doesn’t see itself as a passive observer” when it comes to combating climate change.

Seeing the world’s largest asset manager act as a social and environmental steward should be a cause for optimism. Instead, it represents the peak of a long-developing feint, one with damaging consequences — a sort of Kabuki play in five acts:

We find ourselves today at the intermission after Act III. Unfortunately, as we move to Act IV, it will become clear that the exaggeration of the win-win of the so-called “investor revolution” is distracting from the work needed to reset our economic system. As ESG investing has been accelerating, the planet has experienced the warmest two decades on record, Antarctica has been melting, U.S. income inequality has been gapping, and species have been disappearing at rates unseen for millennia. And the Dow Jones Industrial Average is hitting new highs and asset managers are collecting attractive fees to oversee a popular new investment category.

Here’s what’s wrong. Investors are finally taking ESG investment seriously. But as currently practiced, most ESG investing delivers little to no social or environmental impact.

BlackRock’s haul was the high point of a process set in motion two decades earlier. At that time, several companies expanded their scope of responsibility to include social and environmental stewardship. One, Timberland — a then-billion-dollar footwear and apparel company where I served as chief operating officer — was at the vanguard of a cohort of companies committed to doing well and doing good. The company amplified one of the first corporate social responsibility (CSR) reports in 2002, paid employees for 40 hours of community service, and installed renewable energy at its distribution center and corporate headquarters. Timberland believed that companies had a role to play in addressing growing social and environmental challenges.

Notwithstanding Timberland’s nascent efforts, at the time the prevailing wisdom in business, in academia, and on Wall Street was that CSR was, at best, a distraction. Acclaimed economist Michael Jensen noted, “Because stakeholder theory leaves boards of directors and executives in firms with no principled criterion for decision-making, companies that try to follow the dictates of stakeholder theory will eventually fail.”

Undeterred, early practitioners of CSR received support from a growing cadre of NGOs and consultants eager to help companies define and report on their social and environmental impact. In 1997, the Global Reporting Initiative (GRI) was formed with the support of the United Nations Environment Programme to create the first comprehensive sustainability reporting framework. “There was a belief in the early 2000s that sustainability disclosure was the missing ingredient,” says Ralph Thurm, former COO of the GRI, the largest of the multi-stakeholder reporting standard setters. “Data would allow consumers and investors to pressure companies to become more sustainable, delivering for people and the planet.”

Over time, Wall Street’s view of the social and environmental progressed from enmity to indifference. One academic study that examined the relationship between high CSR scores and sell-side analysts’ ratings from 1993 to 2007 concluded that analysts and investors had moved from “interpret[ing] CSR as . . . destroying shareholder wealth” to being “less pessimistic.”

A seminal study in 2012 started to shift investor sentiment. This collaborative study between academics at the Harvard and London business schools examined 90 pairs of “twin” companies, each in the same industry (e.g., Walmart and Kmart Corp.), one classified as “high sustainability” and the other as “low sustainability.” The study’s authors made these determinations based on a review of each company’s CSR policies and practices.

During the first six years the academics studied, the high- and low-sustainability companies’ stock price movements were almost identical. However, when compared over an 18-year time frame, the authors found that the high-sustainability companies outperformed their low-sustainability twins by an average of 480 basis points.

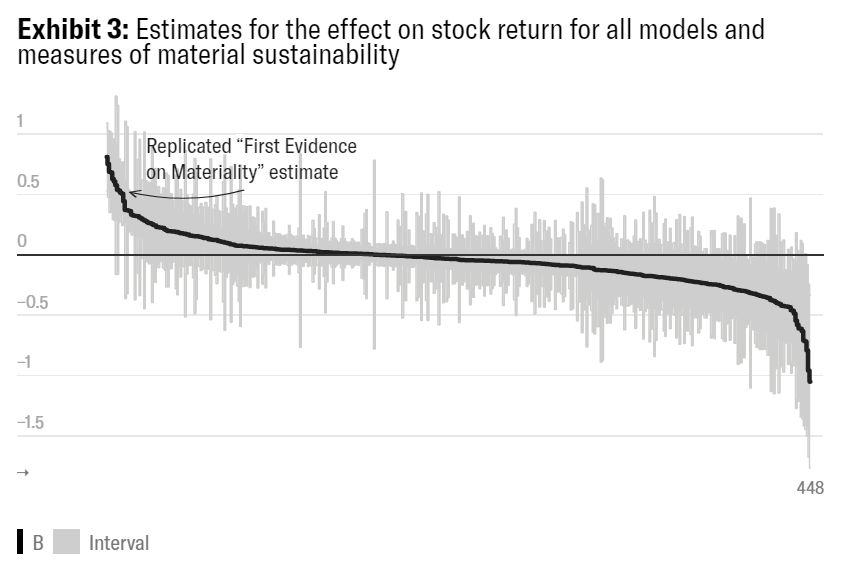

This work was published in one of the most widely cited academic reviews of sustainability and financial performance. For this study, entitled “Corporate Sustainability: First Evidence on Materiality,” the authors used data from the Sustainability Accounting Standards Board to determine how companies’ focus on material versus immaterial sustainability factors impacted financial performance. They concluded that “firms with good performance on material sustainability issues significantly outperform firms with poor performance on these issues, suggesting that investments in sustainability issues are shareholder-value enhancing.”

Armed with these studies, Wall Street’s selling engine clicked into gear. Goldman Sachs and BlackRock made acquisitions and new hires to support the launch of new ESG investment products, and research from Morgan Stanley and other firms “helped dispel concerns that investors have to sacrifice returns to do good,” as The Wall Street Journal wrote in 2016. Investment firms collectively pirouetted from disavowing sustainability to becoming fierce advocates for it.

The industry had good timing. Just as millennials were entering their prime investing years and women were assuming ever more responsibility for their own investments, asset managers pitched them on a revelation: Companies committed to addressing mounting ESG issues were, in fact, higher-returning assets. No sacrifice required. Instead, at long last, a proven win-win.

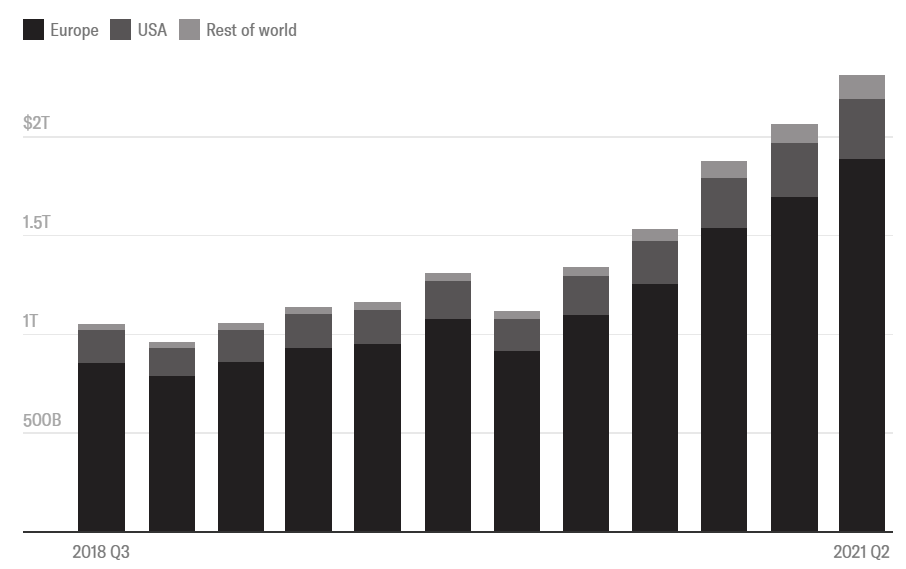

It is hard to overstate the change in fund flows that this win-win narrative delivered. Just five years ago, the term ESG investing was still fairly new. Now, according to the Global Sustainable Investment Alliance (GSIA), one in three dollars invested globally is invested in ESG assets. Over the past two years, inflows to ESG funds have been almost double those of the rest of the stock universe, with inflows now averaging billions each day.

To assess the value and planetary impact of ESG investing, we first need to size and define the market. Then we need to validate the claims that ESG delivers win No. 1, alpha — or outsize financial returns — and win No. 2, positive environmental and social impact.

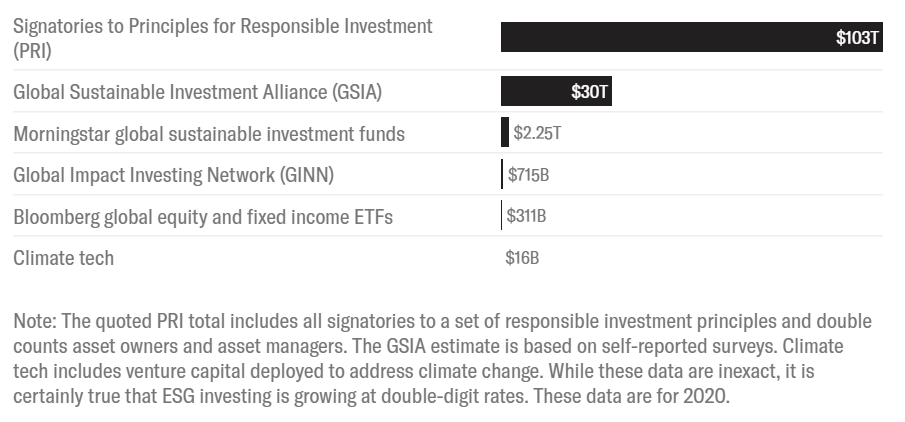

First, what is the size of the ESG market? Unfortunately, that can’t be determined with certainty. Quoted estimates of the size of the ESG market differ by a function of more than 100.

There is also no common definition or legal framework for ESG assets. “ESG is in many ways a bank’s marketing dream, precisely because it is so loosely defined,” according to the Financial Times. Bozena Jankowska, former global co-head of ESG at Allianz Global Investors, adds, “The size of our team relative to the large size and diversity of our mainstream equity investments meant that aiming to evaluate ESG factors across the board for all investments was a perpetual challenge.” Jankowska left AllianzGI in May 2016.

Without guardrails, asset managers can construct portfolios branded as ESG in any way they like. For example, if an asset manager chooses to invest in the top decile across all ESG-rated companies, the ESG fund might end up holding stocks of fossil fuel and firearms companies. Alternatively, a fund that invests in fossil fuels and mining but avoids tobacco stocks can classify itself as a negative-screen ESG fund.

It’s not surprising then that the BlackRock U.S. Carbon Transition Readiness ETF has very little to do with carbon, climate change, or ESG. While the goal of the fund is to deliver long-term capital appreciation by investing in mid- and large-cap stocks and to deliver a portfolio that is considerably lower in carbon intensity than its benchmark, its largest sector investments are in information technology (28 percent of the fund) and health care (13 percent of the fund). In addition, the fund holds positions in Apple (over 5 percent of the fund and the largest holding), Berkshire Hathaway, Coca-Cola Co., Walt Disney Co., Exxon Mobil Corp., Chevron Corp., JPMorgan Chase & Co. (the largest bank financier of fossil fuels), and Dover Corp., an industrial conglomerate that manufactures gasoline pumps.

Other ESG managers also hold technology and fossil fuel stocks in their funds. For example, as of the first quarter of this year, the Northern Trust World Custom ESG Equity index fund held more than 50 investments in oil and gas groups totaling $213 million. Relatedly, a recent study by InfluenceMap revealed that 71 percent of ESG-branded funds hold portfolios that are not aligned with the goals of the Paris Climate Accords. The report concluded that even “the climate-themed equity funds analyzed in this report exhibit climate misalignment levels similar to those of market indices.”

Regulators — particularly in Europe, where ESG has a longer history — understand that this free-for-all cannot go on unchecked. In Brussels, the European Union is working toward a taxonomy governing what can be marketed as a sustainable or ESG asset. In the U.S., the Securities and Exchange Commission has created a climate and ESG task force and has signaled its intention to police this space going forward, and the CFA Institute is writing a new set of standards for asset managers. In the meantime, greenwashing in the asset management industry continues unabated.

Notwithstanding the absence of regulation and quality control, ESG assets under management continue to grow. This is, in part, a function of increasing demand from individuals, family offices, pension funds, and endowments. Each of these actors, at least to some extent, wants to align their interests and values with their investing practice.

Demand is also fueled by reports of ESG alpha, or excess returns. A 2015 MSCI study looking at both tilt and momentum ESG investing strategies over an eight-year period found evidence of alpha. So too a Morgan Stanley review that confirmed that U.S. ESG equity funds outperformed peers in both 2019 and 2020. That said, reports of overperformance are suspect, especially in light of questions about what constitutes an ESG fund. Whether investors can generate alpha from ESG factors is also complicated by the following:

ESG may or may not be a source of outsize returns for investors, but asset managers are winning by managing these funds. According to data from FactSet, the fees for ETFs defined as socially responsible investments are 43 percent higher than the fees for standard ETFs. The Wall Street Journal wrote that this may be one reason “asset managers are among the biggest cheerleaders for sustainable investing.”

ESG investment promises better returns and improved social and environmental outcomes. But investors accept this almost on faith. While thousands of studies have been conducted to determine the relationship between ESG investing and alpha, only a handful of scholars have explored the question of whether ESG investing leads to better social and environmental outcomes.

Some types of ESG investments can more readily deliver on their promises. With a $715 billion global impact investing market, according to the Global Impact Investing Network, managers, by definition, are shaping the business of a private company. As are the $16 billion of venture capital investments in climate tech, including transport, agricultural technology, energy, and land use.

But impact and climate tech investments make up less than 1 percent of what some dub ESG.

For the remainder, it is again useful to distinguish between negative-screen investment and more engaged forms of ESG. Negative-screen investing likely does next to nothing to advance environmental and social goals. While there is certainly a point at which shunning and not insuring extractive industries will either increase their cost of capital or make their activities obsolete, it is more likely that we will stop using fossil fuels long before we exhaust their supply. It is also likely that the cost declines associated with renewable energy will crush fossil fuel viability prior to capital running out to support these industries.

What about the non-negative-screen ESG investments remaining? First, it is key to distinguish between investor impact and corporate impact. Impact is “change beyond what would have happened anyhow,” according to Florian Heeb, a researcher at the Center for Sustainable Finance and Private Wealth at the University of Zurich. Corporate impact is the change caused by the company’s activities, and investor impact is the change in company impact caused by investment activities. Given that investment impacts are “indirect and largely mediated by financial markets,” according to Heeb, they are very hard to prove.

In one of the few reviews of the impact of ESG investments, “Can Sustainable Investing Save the World?” the authors analyze three types of sustainable-investing impact mechanisms: capital allocation, indirect impacts, and shareholder engagement.

Capital allocation, or what some label ESG engagement, is shown to have limited impact, except for small companies in immature markets — the exact opposite of where most ESG dollars are invested. The evidence for indirect impacts — via stigmatization, endorsement, or benchmarking — is even less pronounced. Shareholder engagement is shown to be the most effective tool for investors that want their investments to have an impact on the issues they’ve identified as important.

Unfortunately, shareholder engagement represents a small subset of ESG investments, and even ESG funds from large asset managers do not always vote in favor of environmental and social proxy proposals. In fact, a recent study revealed that Vanguard’s FTSE Social Index Fund, the oldest and largest ESG index fund, either abstained or voted against environmental and social proxy proposals more than 95 percent of the time over the past 14 years.

As an operator and investor, these findings do not come as a surprise. Companies operate within a system and act in accordance with its rules and incentives. Notwithstanding headlines touting engaged asset owners and analysts, pressure for diversity, performance on water intensity, greenhouse gas emissions, and forced overtime are not the norm on quarterly calls. They are even less regularly part of conversations among investors and management teams at private companies. According to Merryn Somerset Webb, editor in chief of MoneyWeek, “an ESG fund will mostly have much the same effect on the world in which we live as a well-run non-ESG fund.”

In addition, the absence of mandatory, comprehensive, or standardized impact reporting makes environmental and social impact hard to verify. Consider the following illustrations from companies perennially recognized as ESG leaders by ratings firms:

In a seminal Harvard Business Review article in 2011, Michael Porter and Mark Kramer cited Nestlé as a model for creating shared value (CSV). The authors pointed to Nestlé’s procurement practices with rural farmers in Africa and Latin America, which included bank loans, guaranteed supplies of pesticides and fertilizers, and providing farmers with expertise. This program yielded both security of supply for Nestlé and higher yields and prices for farmers. Nestlé has remained a CSV model for Porter and Kramer’s shared-value consulting firm and has engaged in many other CSV initiatives. The company has also been a perennial inclusion in the FTSE4Good Index, and ESG ratings firm MSCI ESG Research rates Nestlé as AA.

And yet, according to its own internal assessment, about 70 percent of Nestlé’s food products and 96 percent of its beverages (excluding pure coffee) failed to meet a “recognized definition of health.” While water is certainly healthy, Nestlé has been accused in California and Florida of depleting spring-fed aquifers and profiting off a public resource. Nestlé also is one of the top three plastic polluters and used only 2 percent recycled plastic in its 1.7 million metric tons of plastic produced last year. It has come under intense criticism from NGOs for its lack of transparency and progress on this front.

After becoming the poster child for outsourced labor abuses in the 1990s, Nike has worked to become an authentic sustainability leader. Among other things, Nike has a CSR committee on its board of directors, engages in political lobbying to address climate change, sponsors programs focused on women’s rights in its sourcing partner factories, and creates innovative product solutions aimed at becoming a circular company.

At the same time, Nike paid no U.S. federal income taxes in 2020. Nike is not an outlier. Salesforce, HP, and Consolidated Edison each took advantage of loopholes in the tax code to zero out their tax bill. And yet, Nike was rated A or above by ESG ratings firms.

The Coca-Cola Co. defines water usage as one of its most material sustainability factors. As water has become ever more precious, Coke has come under pressure from communities and activists to limit its usage. In 2007, protests in Kerala, India, and on campuses in the U.S. focused on Coke’s role in depleting the local water table. In response, that same year, Coke committed to “water neutrality” by 2020. Coke delivered on its goal five years early, declaring, “For every drop we use, we give one back.” To achieve this goal, Coke worked with hundreds of NGOs on projects ranging from conservation to reuse to sanitation. The company restores about 200 billion liters of water to nature each year. Sounds impressive.

However, an examination of Coke’s laudable progress reveals problems. First, Coke’s definition of water neutrality is not location specific. Said differently, Coke might deplete a watershed in one part of the world while adding to a healthy watershed elsewhere to deliver on its goal. In addition, Coke defines water neutrality to include only the water it uses in its operations. Unfortunately, according to the company, more than 90 percent of Coke’s water usage happens outside its bottling plants, mostly in sugarcane fields and in the plastic manufacturing process for bottles.

This illustration highlights the perils of lax standards, data insufficiency, and reliance on self-reporting. Even though we do not actually know if Coke’s overall water usage is going up or down, the company scores highly as an ESG investment.

These are but three illustrations of how ESG ratings and investing are not designed to advance environmental and social impact. Coke, Nestlé, and Nike abide by the law and are working to minimize their negative externalities. Nonetheless, these companies operate within a system that values growth over wellness, puts profit above the greater good, and reports less unsustainable as sustainable.

ESG ratings are broken. Imagine, as an analog, if another ratings system, Weight Watchers, were to allow users to ignore one category — say, candy — in their efforts to lose weight. Or if Weight Watchers’ clients did not set goals but instead received ribbons for relative performance. Success, then, could still leave a paying client obese, only less so. This is how ESG ratings systems work. They do not consider planetary thresholds; instead, they reward relative performance.

Finally, ESG funds are measured against benchmarks for financial returns; they are not measured on the impact they deliver. According to Tariq Fancy, former global chief investment officer for sustainable investing at BlackRock, “We invested wherever we could generate the best returns. That’s how we are paid, that's what we're legally obligated to do as a fiduciary, and that’s what our customers really want.” He continues, “Yes, ESG is on asset owners’ checklists, but they do not really check beyond getting the stamp of approval from someone like PRI [Principles for Responsible Investment] and asking a few questions around non-binding promises to consider ESG.” Funds remain unregulated. No mystery, then, why technology stocks represent the largest holdings in ESG fund portfolios and carbon emissions keep growing. Sustainability reporting did not deliver systemic challenges. ESG investing, as currently practiced, won’t either.

Beyond the ESG playact, some good news is at hand. Pressure from investors and citizens has led more than 1,000 companies to commit to science-based targets to deliver environmental outcomes to protect the planet. Both companies and countries have recently accelerated their commitments to net-zero carbon emissions goals. Microsoft Corp. has committed to become carbon negative by 2030 and to remove all the carbon it has emitted since its founding by 2050. Japan and the EU have committed to become net zero by 2050 and China by 2060. While targets should not be confused with progress, companies and countries are changing due to imminent natural disasters, NGOs organizing, civic engagement, and their own self-interest.

At the same time, dramatic reductions in the prices of renewable energy and batteries make it uneconomic to add new fossil fuel capacity in most parts of the world. Government support for technologies such as hydrogen energy, regenerative agriculture, and plastics recycling — and a more broadly shared urgency to address environmental disruption — is pushing capital to flow to climate tech solutions like batteries and clean cement and steel. This is yielding exciting and transformative solutions in fields including renewable energy, bio-based materials, and transportation.

Investors are also demonstrating that finance can be a source of positive social and environmental impact. Breakthrough Energy, a climate tech venture led by Bill Gates, assesses investments through two lenses: 1) Can the company deliver top-quartile returns, and 2) does the technology have the potential to sequester 500 million metric tons of carbon emissions (about 1 percent of current global annual emissions) each year? It is now investing its second billion-dollar fund. According to PwC, over $60 billion has flowed to climate tech over the past five years.

Shareholder engagement is also proving to be a compelling vehicle to deliver social and environmental impact. There is no better illustration of this trend than the agitation led by hedge fund Engine No. 1. Its work has led to Exxon replacing three of the 12 directors on its board. Engine No. 1’s campaign to push Exxon to invest more aggressively in renewable energy while working to decarbonize its legacy fossil fuel business was accomplished with the hedge fund owning only 0.02 percent of Exxon’s stock. BlackRock, Vanguard, and State Street Corp. all voted in support of three of the four Engine No. 1 board candidates.

In addition, there is a need for more rigorous benchmarking of ESG funds against appropriate benchmarks. To that end, a consortium of NGOs is working to extend the Science Based Targets measurement standard from companies to asset managers. If adopted, Science Based Finance Targets would be a great way for asset managers to verify their credentials while allocating capital to companies committed to addressing climate change.

Until these tools are broadly adopted, investors seeking ESG impact would be wise to ask asset managers three simple questions to determine the likelihood that a fund is designed to deliver positive environmental and social outcomes:

Responses to these questions will separate ESG-marketed funds from ESG-committed funds.

The private sector will have to be an increasingly active and authentic partner to address building social and environmental challenges. However, governments and policy must lead. In an article in Barron’s, Adam Seessel noted, “It’s not a corporation’s job to police the commons to prevent tragedies; that’s the commonwealth’s job.” Even BlackRock CEO Fink agrees. His most recent letter to shareholders noted that “government must play the leadership role in addressing this crisis.” So doing requires new rules, including prices on carbon and water that reflect social costs, clean electricity mandates, commitments to removing internal combustion engine vehicles from the roads, taxes on corporations and individuals that are fair and enforceable, disclosure for corporate lobbying, and incentives for new solutions for hard-to-decarbonize sectors. Funding from the EU’s Green New Deal that ties to each country’s environmental progress is a model to emulate, while the U.S.’s rejoining the global community by making aggressive commitments to electrify and decarbonize is welcome news.

So too is the increased investor preference for ESG assets and the long-past-due work to standardize sustainability reporting and regulate ESG investing. That said, do not expect these shifts to adequately address social and environmental problems. That work must also come from citizen action and more urgent and aggressive coordinated government policy to change mindsets and system rules.

This article is also published by the Institutional Investor. Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

Glen Jordan

Sustainable Lifestyle · Sustainable Living

illuminem briefings

Architecture · Carbon Capture & Storage

illuminem briefings

Labor Rights · Climate Change

Financial Times

Carbon Market · Public Governance

GB News

Carbon · Sustainable Mobility

The Independent

Effects · Climate Change