The potential for public-private partnerships in India’s nuclear electricity program

· 6 min read

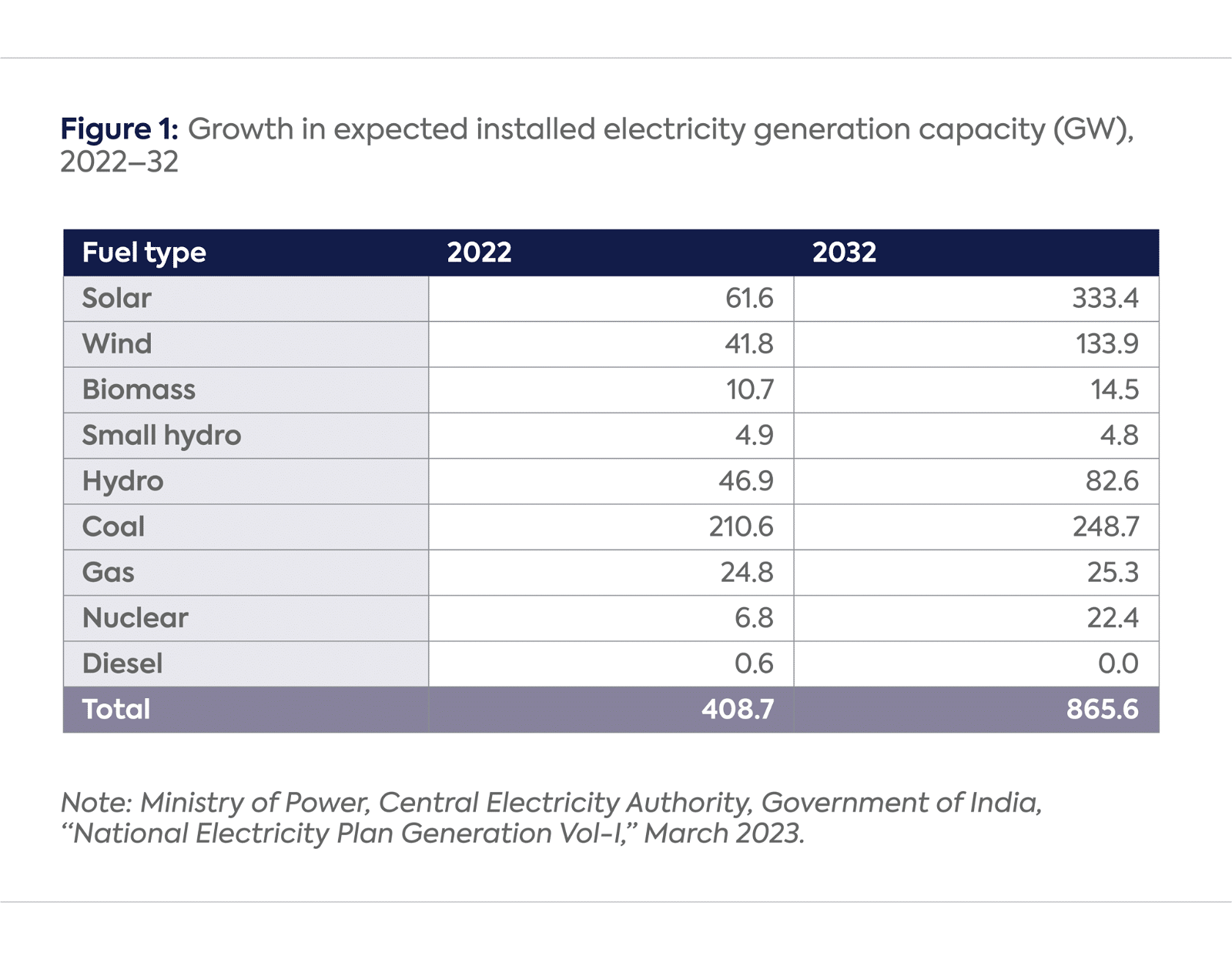

Reuters recently reported that, for the first time, the Government of India will invite private companies to invest in nuclear electricity projects to ramp up growth in this important non-fossil electricity source.[1] This change comes as India pursues ambitious targets for the decarbonization of its electricity sector. India’s target of 500 gigawatts (GW)[2] of non-fossil electricity generation capacity by 2030—announced at the 2021 Conference of Parties to the United Nations Framework Convention on Climate Change (COP26)—is well above the current capacity of about 190 GW.[3] Such an ambitious target will need a significant contribution from nuclear power, which at 7.5 GW accounts for only 2 percent of India’s total installed electricity capacity.

This move by the government is a groundbreaking first step toward expanding the investment pool that India’s nuclear electricity sector can tap. It signals an increasing role for the private sector in India’s nuclear capacity expansion, even as the operation of nuclear power plants remains with state entities. The companies reportedly in play—Tata Power (one of the largest power generation companies in the country), Reliance Industries, Adani Power, and Vedanta Limited—may each invest around $5.3 billion and earn revenues through electricity sales. As the authors discuss, such a partnership between public and private parties holds promise for the growth of the Indian nuclear power sector.

India’s nuclear electricity program has remained with state-owned and -controlled entities since its commencement; the Atomic Energy Act, 1962, limits all activities associated with atomic energy to the central government and companies or corporations established by it.[4] This also made the Department of Atomic Energy (DAE) and its primary nuclear power operator, Nuclear Power Corporation of India Limited (NPCIL), dependent on the central government for all capacity expansions. NPCIL currently follows the 30:70 equity debt ratio, where 30 percent of the capital comes in the form of equity participation by the central government or internal reserves of NPCIL, while the remainder comes through loans and bond issuances and, in the case of the Kundakulam Nuclear Power Plant, Russian credit.[5][6]

An amendment in 2015 expanded the definition of a “government company” to include other state-owned companies that are outside the ambit of the DAE.[7] This redefinition allowed companies in which the central government owned a majority or controlling stake to partner with NPCIL in developing nuclear power projects. Most notably, following the amendment, NPCIL was able to enter into a joint venture with NTPC (formerly National Thermal Power Corporation)—a positive development given NTPC’s deep pockets and dominance as the country’s largest electricity company. The joint venture, called ASHVINI (Anushakti Vidhyut Nigam Limited), is developing the Chutka (2×700 MW) and Mahi Banswara (4×700 MW) projects to build Pressurized Heavy Water Reactors (PHWRs).[8]

Following this significant move, NPCIL has been looking for alternative strategies and collaborations to generate capital for nuclear power projects at a time when the Indian private sector has also shown interest in owning and operating nuclear power plants in the country. However, the DAE has been reluctant to hastily open the doors to the private sector, as nuclear power generation requires significant transfer of sensitive knowledge and technology. More importantly, the operation of nuclear power plants also requires strict adherence to high standards of safety, security, and safeguards as well as navigation of India’s unique nuclear liability regime.[9]

Taken together, this means that enhanced private engagement in nuclear electricity will have to be a step-by-step process—and making critical investments is a logical first step for the private sector to get acquainted with important aspects of India’s nuclear power sector.

While private companies already play a role in supplying major components, equipment manufacturing, and related services, the 2015 amendment and this latest step toward further liberalization will help the Indian nuclear electricity program attract additional capital in new areas through joint ventures and private equity. Reuters reports that private investment would be allowed in nuclear plants, land and water resources, and construction activities in areas outside the reactor complexes of the plants. NPCIL will continue to build and operate the power plants and manage the fuel feedstock, likely allaying some of the DAE’s concerns related to partnering with private entities.

NPCIL currently operates 24 nuclear power reactors, including the fourth unit of the Kakrapar Atomic Power Project (KAPP-4) with 700 MW capacity, which was connected to the grid on February 20, 2023. In addition, eight more reactors of 6,800 MW are under various stages of construction and ten reactors of 7,000 MW in fleet mode are in pre-project activities, such as land acquisition, environmental clearance, procurement activities, site infrastructure development, public outreach, tending for main plant civil works, etc.[10] The total projected capacity by 2031–32 is 22,480 MW (Table 1). With potential investment from the private sector, the DAE hopes for an additional 11,000 MW by 2040.[11] Once the new agreement around private sector investments is realized, it’s likely that the companies will be involved in some of the pre-project activities for future projects.

The private sector is rich with capital, while the public sector, specifically NPCIL, are masters of technology development and operation, especially the indigenous PHWRs. However, leveraging the strengths of both partners to facilitate further privatization in the nuclear electricity sector would eventually require an amendment to Section 3 of the Atomic Energy Act, 1962, which limits ownership and operation of nuclear power plants to the government. For now, private sector investments are a significant step toward enhancing private sector participation in nuclear electricity, which is critical to realizing India’s clean energy goals.

This article is also published on Columbia's Centre on Global Energy Policy's website. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

[1] Sarita Changanti Singh, “Exclusive: India Seeks $26 Billion of Private Nuclear Power Investments,” Reuters, February 21, 2024, https://www.reuters.com/business/energy/india-seeks-26-bln-private-nuclear-power-investments-sources-say-2024-02-20/.

[2] “National Statement by Prime Minister Shri Narendra Modi at COP26 Summit in Glasgow,” November 02, 2021, https://www.mea.gov.in/Speeches-Statements.htm?dtl/34466/National+Statement+by+Prime+Minister+Shri+Narendra+Modi+at+COP26+Summit+in+Glasgow.

[3] Ministry of Power, Government of India, “Power Sector at a Glance ‘ALL INDIA,’” November, 30, 2023, https://powermin.gov.in/sites/default/files/uploads/power_sector_at_glance_Nov_2023.pdf.

[4] Section 3(a), Atomic Energy Act, 1962, https://www.aerb.gov.in/images/PDF/Atomic-Energy-Act-1962.pdf.

[5] For Kundankulam Units 3&4 and 5&6, the Russian government is the project creditor and allows for 40 annual repayments, which would start one year after the commercial operation.

[6] Indian Nuclear Business Platform “Indian Nuclear Industry Report,” 37, June 2023.

[7] Section 2, Atomic Energy (Amendment) Act, 2015, https://www.barc.gov.in/about/ae_amend_2015_0116.pdf.

[8] Ministry of Power, Government of India, “NTPC and NPCIL Sign Agreement for Joint Development of Nuclear Power Plants,” May 2023.

[9] R.B. Grover, “The Civil Liability for Nuclear Damage Act of India: An Engineering Perspective regarding Supplier’s Liability,” Progress in Nuclear Energy 101, Part A, 2017, https://doi.org/10.1016/j.pnucene.2017.04.012.

[10] NPCIL, “Overview,” March 3, 2024, https://www.npcil.nic.in/content/925_1_Overview.aspx.

[11] Ibid., note 1.

illuminem briefings

Oil & Gas · Ethical Governance

Jonathan Lishawa

AI · Energy Transition

Olaoluwa John Adeleke

Power Grid · Power & Utilities

The Wall Street Journal

Natural Gas · Oil & Gas

Financial Times

Oil & Gas · Upstream

Forbes

Nuclear · Power & Utilities