Sustainable investing: finding climate friendly investments

· 12 min read

We’ve spent hours pouring through the holdings of various ESG ETFs and mutual funds focused on sustainable investing. Time and again we came across the same set of problems. We ended our search ultimately unsatisfied, particularly with the leading ethical filter, ESG. But before we talk about why, let’s ground in some definitions.

Over the past 15 years, ESG has emerged as the leading ethical filter for evaluating investments on the public markets (replacing Socially Responsible Investing, SRI).

ESG stands for Environmental, Social, and Governance. These are the three factors that companies are graded upon.

Independent ratings agencies, such as MSCI, grade a public company across all three of these factors. For each factor, companies are given a 1-10 score. These scores gets averaged to generate a final ESG score for the company.

That’s the nice part about ESG. It is theoretically quite thorough, balancing out the various factors that a company can take to improve its corporate governance while decreasing its negative environmental and social impacts.

For the individual investor, having someone else do the work to crunch these numbers can alleviate some of the ethical burden. You can feel more confident your investments are more broadly aligned with your values by basically checking a box and paying a little extra.

Unfortunately for us, as investors focused on climate change, we consistently run into three issues when evaluating ESG funds:

The companies that create ESG funds (think Vanguard, BlackRock, etc.) pay large amounts of money to get access to the latest ESG databases that analysis companies like MSCI build. This gives the fund managers that build ESG funds a high degree of transparency for each company. They can see the full breakdown of each subcategory.

That’s great for the fund manager. It does not mean that you, the share owner of that ESG fund, get that same level of insight. This means you basically have to trust the fund managers and their screening criteria.

They might advertise that a given fund has a certain ESG threshold. No companies below, say 5.0 are included. Great, but as an individual investor you have no context. How different is a company that scores a 5.0 vs. a 6.0 on an ESG scale? Will a 6.0 pass your personal threshold? What about a 6.1?

Things get even more complicated when you fold in specific ethical focus areas, which in our case, is climate change. Blackrock’s ESG fund (SUSA) certainly has fewer fossil fuel holdings than a standard index fund (which is a great start), but they still include investments in Conoco Phillips and Hess. Are these just better fossil fuel companies than ExxonMobil and Chevron? Do they treat their employees better? Why were these companies included?

So whether your issue is climate change, gun control, or gender diversity, ESG funds can help. But be prepared to ultimately only feel less bad about your investments, certainly not good.

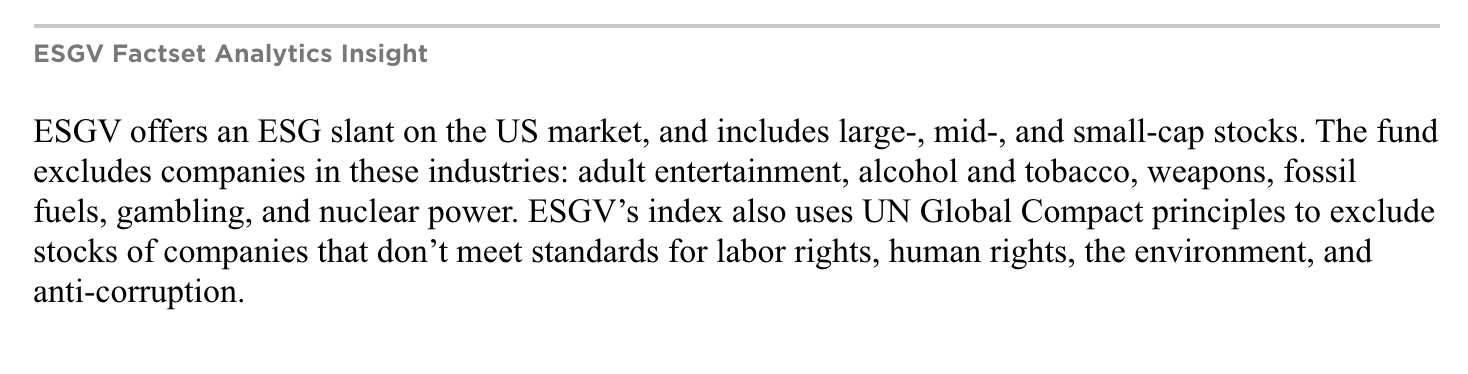

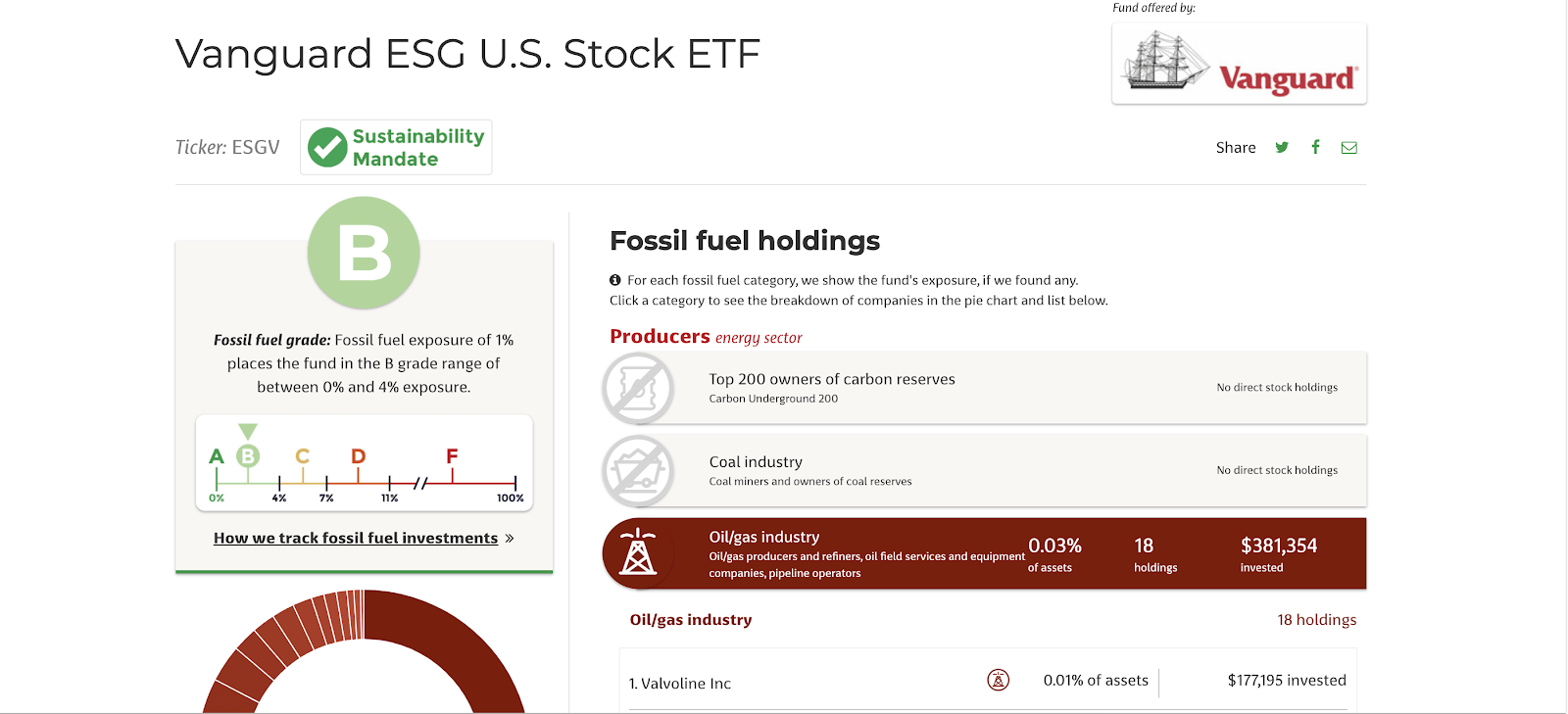

This is very frustrating. If you say you screen out a certain set of companies, then screen them out. Both Vanguard’s US and International ESG funds claim to screen fossil fuels. You can see it there right after weapons (which they also don’t fully screen out).

And yet ESGV has 18 holdings in straight up fossil fuel companies (at least as of July, 2020). VSGX has even more. Now it’s a much smaller portion of the total fund than a traditional index fund, but it’s not zero. What is frustrating is that such efforts undermine trust.

If we cannot trust Vanguard to successfully follow through on screening out fossil fuel companies and the metrics for ESG inclusion are opaque, what else are we missing?

And finally, ESG funds are generally about 3x more expensive than their non-ESG equivalents. This makes sense. ESG-fund managers have more variables to account for when constructing and managing a fund.

If you’re prioritising sustainable investment, you probably are happy to pay more for investments that better fit your values. But it’s hard to feel good about paying for the higher fees when the screening mechanisms are opaque and have obvious holes. Why pay extra for an eco fund that says it has no fossil fuel companies in it when it does, in fact, have fossil fuels in it?

All of that said, if climate change is your #1 issue, there are some other climate & sustainability funds that are worth looking at.

Change Finance has put together a collection of 100 large cap stocks from the S&P 500 that have no fossil fuel holdings in them (we double checked). You’ll recognise most of these companies. They do have a sustainable bend with Docusign (remote work) and Tesla being in the top holdings.

CHGX has two downsides. These generally come with the territory for small, newer investment companies. First, their expense ratio is quite high (0.49%). Second, their assets under management and liquidity is quite low (only $18.9m under management at the time of this writing). If you are going to be buying and selling frequently this could pose liquidity issues.

A newer addition to the ethical investing space, Engine No. 1’s VOTE ETF takes a different approach. They hold the 500 largest companies on US markets regardless of the ethical performance. Why? They want to ensure they have a “seat at the table” to put forward and vote on key ethical issues. They made headlines in 2021 after leading a successful campaign against management to add a number of more climate-focused people to Exxon’s board.

As far as affordable ethics-focused ETFs go, VOTE is incredibly cheap at 0.05% but it has a couple of downsides:

First, it leaves you fully exposed to fossil fuels. As of August, 2021 Berkshire Hathaway and JP Morgan Chase, two companies who are heavily invested in the continued use of fossil fuels are in their top 10 holdings. If you believe that fossil fuels are an industry in decline, then holding them may be risky from an investment perspective.

Second, so far we’re seeing little impact of Engine No. 1’s victory. As of August, 2021 ExxonMobil’s CEO doubled down on their commitment to fossil fuels and let investors know they “wouldn’t see huge shifts in the strategy.”

While we applaud Engine No. 1’s success thus far, we hold a different theory of change when it comes to voting. In a stock market that runs on quarterly results, it is very challenging to get a company like Exxon to kill its golden goose. We believe shareholder activism can be far more effective pressuring the companies who have a carbon footprint, but don’t depend on fossil fuels for their core business to switch to 100% renewable energy.

Etho Capital has taken a novel approach to building an eco ETF. They select large, mid, and small cap companies that rank in the upper percentiles for carbon efficiency in each market segment. Research at Stanford has shown that such a strategy, when combined with shorting carbon-inefficient companies, would have performed considerably better than the market.

(Before you get too excited, we actually spoke to the head researcher for this paper. She had not run the numbers for just buying carbon-efficiency companies. It’s unclear to what extent the shorting part of the strategy accounted for the gains.)

ETHO is a bit older than CHGX and therefore has more under management ($81.9m as of this writing). Similarly, it poses less but still relatively high liquidity risk, given its low trading volume. Like CHGX, ETHO has a high expense ration of 0.47%. ETHO is focused on US mid-cap companies (publicly traded stock valued between $2B – $10B), which can complement well with CHGX’s focus on large cap stocks.

There are dozens of renewable energy ETFs to choose from. They are great because they grant you global exposure to the top renewable energy companies.

We have two issues with these types of funds: first, they are too narrowly focused. Solving climate change will require more than just the transition to renewable energy (you can check out our full list of companies building climate change solutions). Diversification is important in a balanced investment portfolio. Given that these renewable energy ETFs only cover a small slice of the overall stock market, we would only feel comfortable allocating a small part of an overall portfolio to them.

Second, they, like ETHO and CHGX, are expensive. The cheapest has an expense ratio of 0.46%.

There are many green mutual funds. From Calvert to Parnassus to Brown Advisory, these funds tend to have stricter screeners than traditional ESG ETFs. Better yet, many undertake shareholder activism, pushing the boards of companies to end harmful practices in their supply chain like deforestation.

What’s not to like?

Well, some still have fossil fuel companies in them. Also mutual funds are more cumbersome and expensive than ETFs. In many mutual funds, when you sell, it can take up to a week to get your money out.

On top of that, they tend to cost far more in fees than even the most expensive eco ETFs. Calvert’s market equity fund (their standard eco investment fund) has a minimum investment of $1,000 and a net expense ratio of 1.74%. Yikes!

Fidelity also came out with a “Climate Action Fund” recently but there is little information about it aside from its very high gross expense ratio of 2.03%.

In our search, we couldn’t find any sustainable investment funds that met both our ethical and financial goals. So, what about advisors you can work with that can construct climate-friendly portfolios for you?

A few exist, but like the funds, you need to be prepared to pay.

There are two main investment advisors we’ve seen in our searches. They have differences between them, but they are both more expensive than traditional investment platforms.

Right now, one of the best options for many climate-focused investors is to work with a financial planner who can manage what is known as a “Separately Managed Account” or SMA for them. Unlike a mutual or exchange-traded fund (ETF), SMAs are collections of stocks that a financial/investment advisor manually puts together.

SMAs are relatively new as the software to make the management of so many stocks practical has only come out recently.

The problem with SMAs is that they are put together, often by hand, by individual financial planners. Such planners generally are small shops that have strict requirements for taking you on as a customer. You often need to have a lot of wealth for them to manage (the average minimum investment is $500k) and be comfortable with much higher management fees than online investment management platforms (the average is 1.00% of assets under management per year).

So this makes SMAs out of reach for most investors.

DIY funds: If you are set on building your own climate-focused portfolio using existing funds, here’s what we would suggest:

This would get you the highest exposure to the US stock market with zero fossil fuel companies and support for a group of renewable energy companies building climate solutions. Making investment decisions involves weighing priorities.

For us, while such a portfolio would meet our ethical standards around climate friendly investment while getting you a fairly diversified portfolio through funds that someone else is managing (so you don’t have to), the fees would still be far higher than we would like to pay.

DIY stocks: If you want to invest in the stock of companies that are building climate solutions through your own broker, checkout our total index of companies building climate solutions.

Our two cents: We started Carbon Collective because when it came to climate-friendly investing, we wanted to have our cake and eat it too. We think we hit our goal.

Our diverse portfolios directly track 80% of the US stock market and directly support 112 companies building solutions to climate change all with a carbon footprint that is 85% lower than a traditional index fund.

We combine stock market sector-based index ETFs, bond ETFs, and SMA-like collections of stocks to keep fund management fees low (0.08% – 0.10%) and our own management fees (0.20% + $25/year) are comparable to what you would pay for a traditional online investment advisor like Betterment or Wealthfront.

Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Carbon · Environmental Sustainability

illuminem briefings

Carbon Regulations · Public Governance

illuminem briefings

Climate Change · Environmental Sustainability

Politico

Climate Change · Agriculture

UN News

Effects · Climate Change

Financial Times

Carbon Market · Public Governance