Responsible Investing and Hedge Funds: The Intersection of Sustainability and Alpha

· 8 min read

At first glance, it may seem inconsistent to think of hedge funds as socially responsible investors, given the reputation that hedge funds have had for being the more aggressive, sophisticated investors. However, ESG investing is not only for the long-only friendly investor. There often is a misconception around what truly defines an ESG – integrated strategy and it is oftentimes mislabeled as being an impact strategy, where returns are sacrificed for impact.

ESG is the integration of environmental, social and governance factors into decision-making for both corporations and institutional investors. It is first and foremost a risk management tool, whereby hedge funds can utilize to improve their risk-adjusted returns and manage volatility. For years, investors have turned to hedge funds in pursuit of alpha and strong risk management; neither goal can be achieved without consideration of sustainability for any given business model. A long / short approach can actually help better allocate capital to those companies driving positive improvements and raise the cost of capital for other firms who are not taking the appropriate action and / or will be negatively impacted by sustainability trends. Therefore, with their razor focus on risk management and volatility, hedge funds are optimally suited for ESG integration across their portfolios.

Hedge funds are the investment vehicles best positioned to be at the intersection of sustainability and alpha.

There are a number of approaches by which hedge funds can drive alpha by incorporating ESG principles across their investment processes, which make the industry a prime candidate for ESG integration.

Thematic investing. As there are a number of industries that are ripe for disruption due to the shift towards sustainability, as we have seen with the focus on energy transition, driven by global regulation and surging market demand by millennials and broadly for values-based investing, hedge funds can take long positions in high quality businesses, benefiting from secular tailwinds from these thematic assessments, not currently priced into markets.

ESG integration into due diligence at the security / issuer level. As the SEC crackdown on greenwashing continues to unfold following the footsteps of Europe, managers are increasingly become more cognizant of being aligned on marketing, compliance and investment processes, which is also forcing their hands to take a closer look at ESG integration across their funds.

The hedge fund managers that will outperform are those that have fully integrated ESG into their investment processes and see this as another tool to refine risk management and drive alpha. They will be accounting for exposure to ESG risk factors during preliminary idea generation and screening and conducting more deep-dive due diligence around relevant environmental and social factors that may be a risk but also those that may prove to be a value creation opportunity (i.e., the undiscovered ESG transformation stories), particularly as they continue to engage with Management teams.

The onus is also on the hedge fund manager to navigate through the plethora of ESG data in the marketplace today and leverage technology platforms and other alternative data tools to further refine their analysis, that extends well beyond the cursory look at ESG ratings.

Short-selling. Short-selling is a way to express that an asset is mispriced and not adequately incorporating ESG factors or systemic risks into its business activities, governance structures or future scenarios. Shorting can also be used to hedge a portfolio’s overall exposure to material ESG-related risks. Short selling can be viewed to some degree as a tool of stewardship that could lead to market-level changes; it could incentivize a company to think about transition risk more seriously across its business to become less carbon-intensive. Short-selling goes beyond shorting oil and gas and other carbon intensive industries, but also finding companies where their carbon intensity may be under-stated. These are potential opportunities for alpha for active managers who look for market dislocations. However, this is only a true tool for active stewardship if the focus is on stock-specific analysis vs buying carbon offsets at the portfolio level to neutralize carbon exposure, which is increasingly being discussed across the industry.

The activist approach. Shorting companies that are “greenwashing” their net zero goals or fall short on diversity targets is a source of alpha, as is taking a more activist approach. Take the Engine No. 1 public campaign around Exxon, where a $250mm investment fund approached an iconic brand name in the oil and gas industry with its transformative work and managed to elect 3 board members to drive change on its clean energy strategy and approach to capital allocation.

ESG integration at the portfolio construction level. As many hedge funds have more flexibility around their investment mandates and are not necessarily tied to benchmark indices (i.e., +/- 200 bps relative to the bench) as tightly as mutual funds, they also have the ability to integrate ESG and drive alpha at the security level, but all the while manage sector risk. For example, we have seen broad underperformance across both passive ESG ETFs and actively managed ESG-integrated funds YTD, which can largely be attributed to sector exposure (higher exposure versus the respective benchmark to technology and underweight energy.) Hedge funds are more uniquely positioned to leverage their approach to navigate through market volatility, use this flexibility to invest in the best-in-class names, without being as restricted to benchmark criteria as ESG-focused mutual funds, and be able to better hedge ESG risk at the portfolio level.

Having the flexibility to use all levers of ESG analysis – from thematic investing to ESG integration and tactical short-selling, along with better engagement with Management teams, allows for higher alpha opportunities, all the while better managing risk across the portfolio. For example, a hedge fund could consider a long position in a company that has outlined a decarbonization pathway to be aligned with the ideal 1.5 degree scenario in accordance with the Paris Agreement and has been showcasing progress towards these goals (although valuation is not yet reflecting this transition), while shorting a position in a more carbon intensive company whose valuation does not reflect the implication an energy transition could have on their underlying business fundamentals and cash flow.

Best-in-class hedge funds will also be tracking their ESG exposure at the portfolio level (i.e., carbon intensity; diversity measures.)

The areas where there is likely to be the highest near-term adoption will be hedge funds that are equity related, long/short credit, and event-driven, where ESG data can be analyzed at the issuer level and dislocations and potential catalysts can be identified.

The best ESG-focused hedge funds will focus on the intersection of sustainability and alpha – finding a long-term secular theme that has material impact on asset pricing, while sifting through the ESG data noise to find winners and losers and using engagement with Management teams and tactical short-selling to drive outcomes.

Additionally, if hedge funds can provide some protection in times of market volatility as we are seeing today, they can help investors stay the course of a broader, sustainable investment objective within their portfolios.

The challenges, however, with ESG integration still remain, consistent with all other asset classes.

Lack of comparability and consistency. The biggest challenge the industry faces is the lack of comparability and inconsistency in data, even across major ratings providers and frameworks, which is further convoluted by a deluge of information from various AI technology platforms focused on ESG data collection and reporting using varying methodologies. Without consistency in reporting structure and format, comparability remains a challenge. Should the SEC climate risk disclosure move forward later this year and we continue to see progress towards collaboration across ESG frameworks, that will help address some of the comparability issues investors face today.

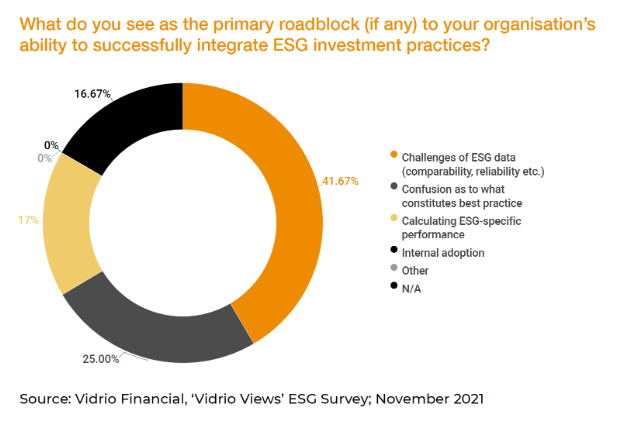

A recent ESG survey conducted by a technology and data platform Vidreo Financial summed it up well:

42% are still grappling w/ the challenge around data (i.e., comparability, lack of standardization) while others are still looking into what defines best practices and how is ESG-specific performance measured. These challenges that hedge fund managers face, however, are not specific to the industry, but rather broad-based, as the investment community continues to grapple with the ever-evolving market and regulatory landscape.

“Short-termism”. The second challenge the hedge fund industry faces is around catalysts given their generally shorter-term investment time horizons as opposed to long-only funds; however, although ESG factors take time to have an impact, most companies are moving quite quickly to build ESG programs and provide disclosure, given increasing pressure from stakeholders. This allows shorter-term investors to track progress against key performance indicators (KPIs) and take advantage of market dislocations as information quickly evolves.

The COVID pandemic was a wake-up call regarding the importance of factoring in tail risk into security analysis; although climate change may take time to unfold, if the intrinsic value of a security is a measure of its expected future cash flows, the potential “green swan” event also needs to be factored into the analysis.

As climate risk increasingly becomes factored into markets, particularly as US disclosures increase in FY 2023, the hedge fund industry will be best positioned to use all abovementioned levers (thematic investing, deep-dive ESG integration, tactical short-selling based on ESG factors and greater engagement with Management), to react quickly in an ever-evolving landscape to drive alpha within the lens of sustainability.

Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Biodiversity · Sustainable Lifestyle

Aaron Bruckbauer

Pollution · Greenwashing

Jesse Scott

Carbon Market · Carbon Regulations

The Guardian

Power Grid · Climate Change

NPR

Climate Change · Public Governance

BBC

Biodiversity · Climate Change