More is More: Potential boost to Asian renewable energy from the Indo-Pacific Economic Framework

· 4 min read

The Indo-Pacific Economic Framework (IPEF) may take another 12-18 months of negotiations to deliver details. IPEF member countries can choose to sign up to any or all of its four Pillars: Fair trade, Supply-chain resilience, Decarbonization, and Anti-corruption. If the IPEF becomes a binding agreement that delivers on its ambitions, many Asia Pacific economies could receive a boost to their clean energy needs.

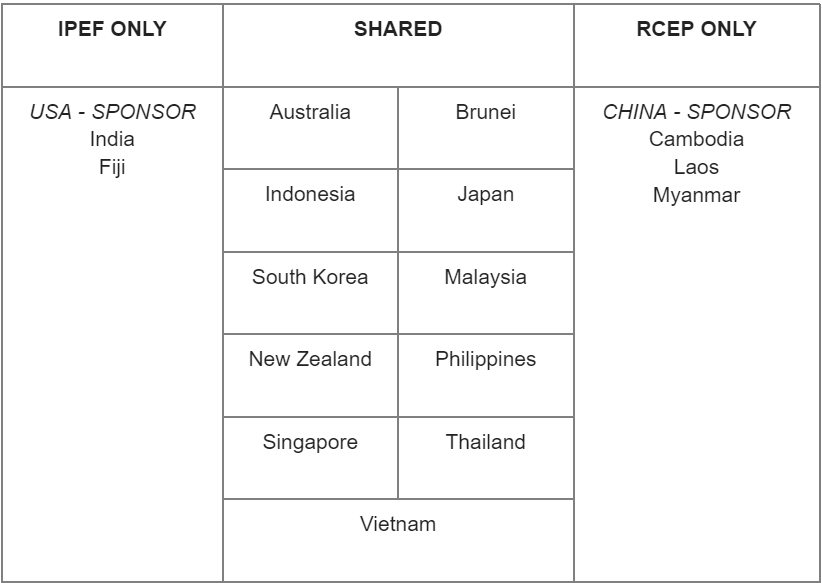

The IPEF is not a free trade agreement like China’s Regional Comprehensive Economic Partnership (RCEP). Nonetheless, there are 11 IPEF signatory countries which are also part of the RCEP: Australia, New Zealand, Brunei, Philippines, Indonesia, Singapore, Japan, Thailand, South Korea, Vietnam, and Malaysia. For those countries signed on to both, the US-led IPEF can complement the China-led Regional Comprehensive Economic Partnership (RCEP).

The Decarbonization Pillar that promotes renewable energy could be consequential. The initial White House statement on May 23, 2022 explained the Decarbonization Pillar was designed to “accelerate the development and deployment of clean energy technologies” by “deepening cooperation,” “providing technical assistance,” and “mobilizing finance, including concessional finance”. While all countries in IPEF which sign on to the Decarbonization Pillar could gain those advantages, the 11 countries shared with RCEP would reap the added benefit of competition and, potentially, cooperation between the US and China.

Global consultancy McKinsey estimates the cost of an orderly path to Net Zero 2050 at 1.5 degree warming would be around USD9.2 Trillion (T) every year. One of the largest components of that cost is on cleaning up power generation, estimated at USD1.97T/annum. This spending would be diverse until around 2030, but then becomes dominated by wind and solar thereafter. As a result, just under half of that annual spend is forecast to be on transmission and storage infrastructure necessary for greater renewables penetration.

Based on McKinsey’s analysis, IEEFA estimates that the US IPEF and Chinese RCEP agreements would cover countries which need a combined annual spend of about USD1.27T to stay within the orderly Net Zero 2050 scenario of the Network for Greening the Financial System (NGFS). Most of the spending among those 11 shared countries comes in ASEAN, where the ability to self-finance that level of investment would be a challenge. If the IPEF’s Decarbonization Pillar survives and succeeds, it could benefit the effort to decarbonize power generation in those countries by adding competition between with the RCEP to provide clean energy development assistance.

China’s Development Bank and its Export-Import Bank are two of the largest development finance institutions (DFI) in the world, lending almost as much as the World Bank between 2008-2019. These two banks have provided more public sector finance for power projects than the combined effort of the eleven largest multilateral development banks (e.g. World Bank, International Finance Corporation, Asian Development Bank) between 2006-2015.

China has also pledged to end financing thermal coal power projects abroad, which made up 42% of the country’s offshore power investments (in GW) since 2000, according to Boston University's database. This frees up an enormous amount of capital at a time when China’s two DFIs are being encouraged to participate in the greening of China’s Belt & Road initiative. This combination of ample dry powder with China’s thriving solar, storage, wind, and transmission industries may prove difficult for IPEF to match.

However, a successful IPEF can still improve the environment for clean energy development. While IPEF can’t easily compete against Chinese renewable suppliers, there is no reason an IPEF-financed renewable energy project couldn’t source Chinese equipment imported at RCEP tariffs, if that is the optimal solution.

IPEF is likely small next to China’s massive DFIs, but think tank Brookings suggests the US could harness the Development Finance Corporation’s USD60 Billion wallet as a strategic alternative. IPEF concessional finance would also compete against the often onerous terms of Chinese international financing, so risk assessments and structures may provide opportunities.

The combined support from IPEF and RCEP accelerates learning curves of renewable energy construction as well as critical transmission and storage infrastructure. As more gets done, each subsequent project inherits a lower risk profile. IPEF competition on technical assistance would pit the US private sector and the Department of Energy’s sprawling system of national laboratories against China’s state-owned enterprise think tanks, private sector innovation efforts, as well as its academic and public sector research efforts.

Finally, the IPEF offers a US alternative to Chinese regional influence on market design, regulatory structure, as well as clean energy standards and monitoring. With IPEF’s success, a more engaged US advisory can provide a more diverse selection of options to suit the various development goals of Asian economies.

Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Hydrogen · Energy

illuminem briefings

Energy Transition · Energy Management & Efficiency

Vincent Ruinet

Power Grid · Power & Utilities

World Economic Forum

Renewables · Energy

Financial Times

Energy Sources · Energy Management & Efficiency

Hydrogen Council

Hydrogen · Corporate Governance