illuminem's Weekly Briefings

· 8 min read

Hello and welcome to our newly-minted top 5 sustainability stories! Each week, we handpick the most significant and attention-worthy news. Don't miss these essential headlines:

Driving the news: 30% of shareholders of major US banks, including Goldman Sachs, BoA and Wells Fargo, supported proposals put forward by environmental activists calling for a plan to phase out financing of fossil fuel projects by 2030.

Why it matters for the planet: The support for these resolutions (against the boards' recommendation) highlights the pressure on banks regarding their financing of carbon-intensive companies.

What’s next: The rejection of the proposals does not mean the end of the push towards sustainable investments.

One quote: "Pressure is only going to increase" (Danielle Fugere, President, As You Sow, one of the activist groups behind the proposal).

One stat: The six largest US banks financed $1.6+ trillion in fossil fuel projects since the Paris Agreement (2016). This represents a 10% increase the previous five-year period (source: RAN).

Click for more on sustainable finance

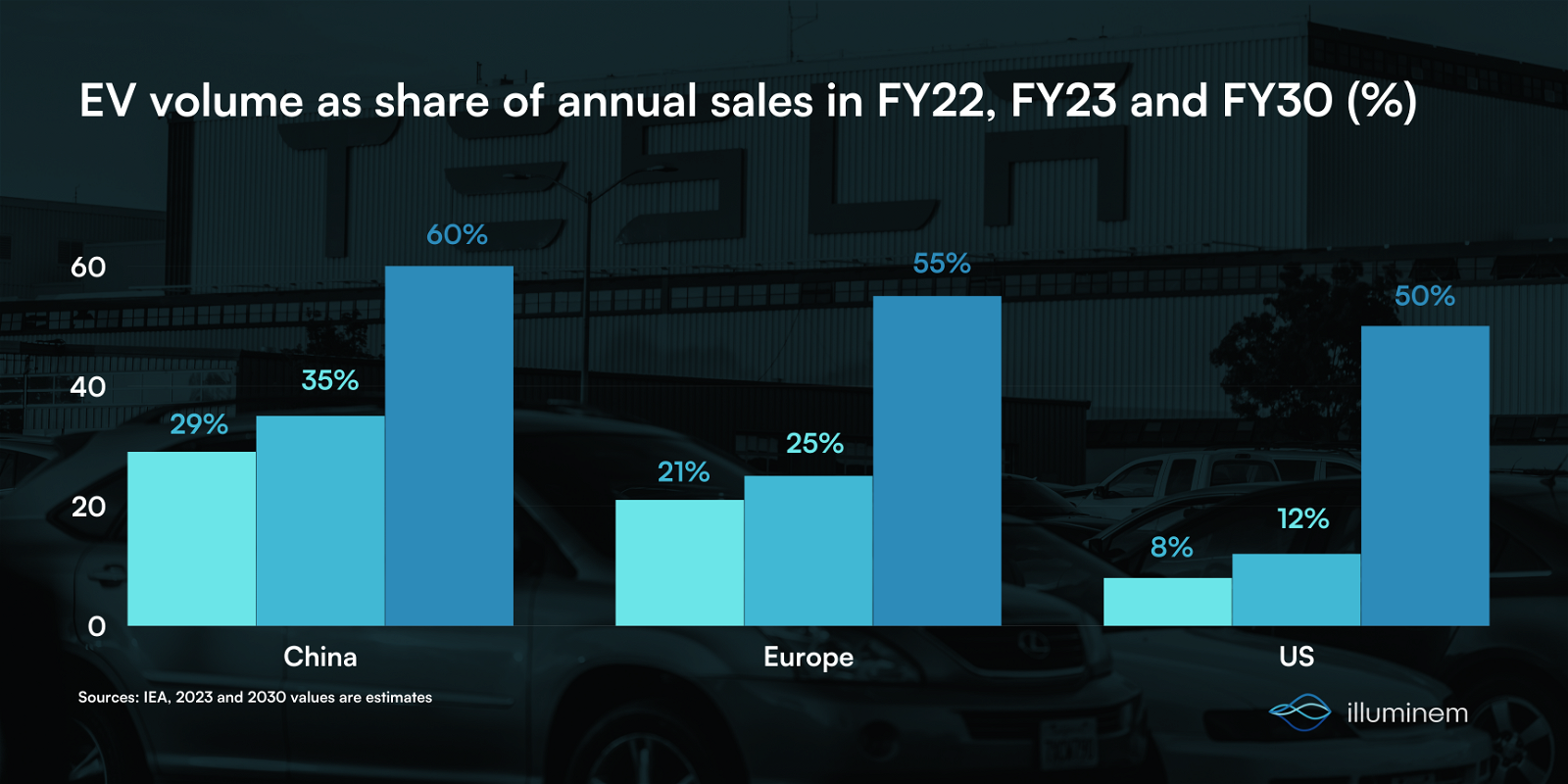

Driving the news: The International Energy Agency (IEA) forecasts that nearly one in five cars sold worldwide in 2023 will be electric vehicles (EVs).

Why it matters for the planet: The IEA report indicates that EVs are becoming increasingly competitive with traditional gas-powered cars, and that the charging infrastructure is expanding rapidly .

What’s next: The US and the EU are currently in talks to address their differences on EVs subsidies.

One quote: "EVs are no longer marginal or niche at all" (Timur Gül, Head of energy Technology Policy, IEA).

One stat: 35% of global car sales will be electric by 2030, up from a forecast of 25% just a year ago (source: IEA).

Click for more on electric vehicles

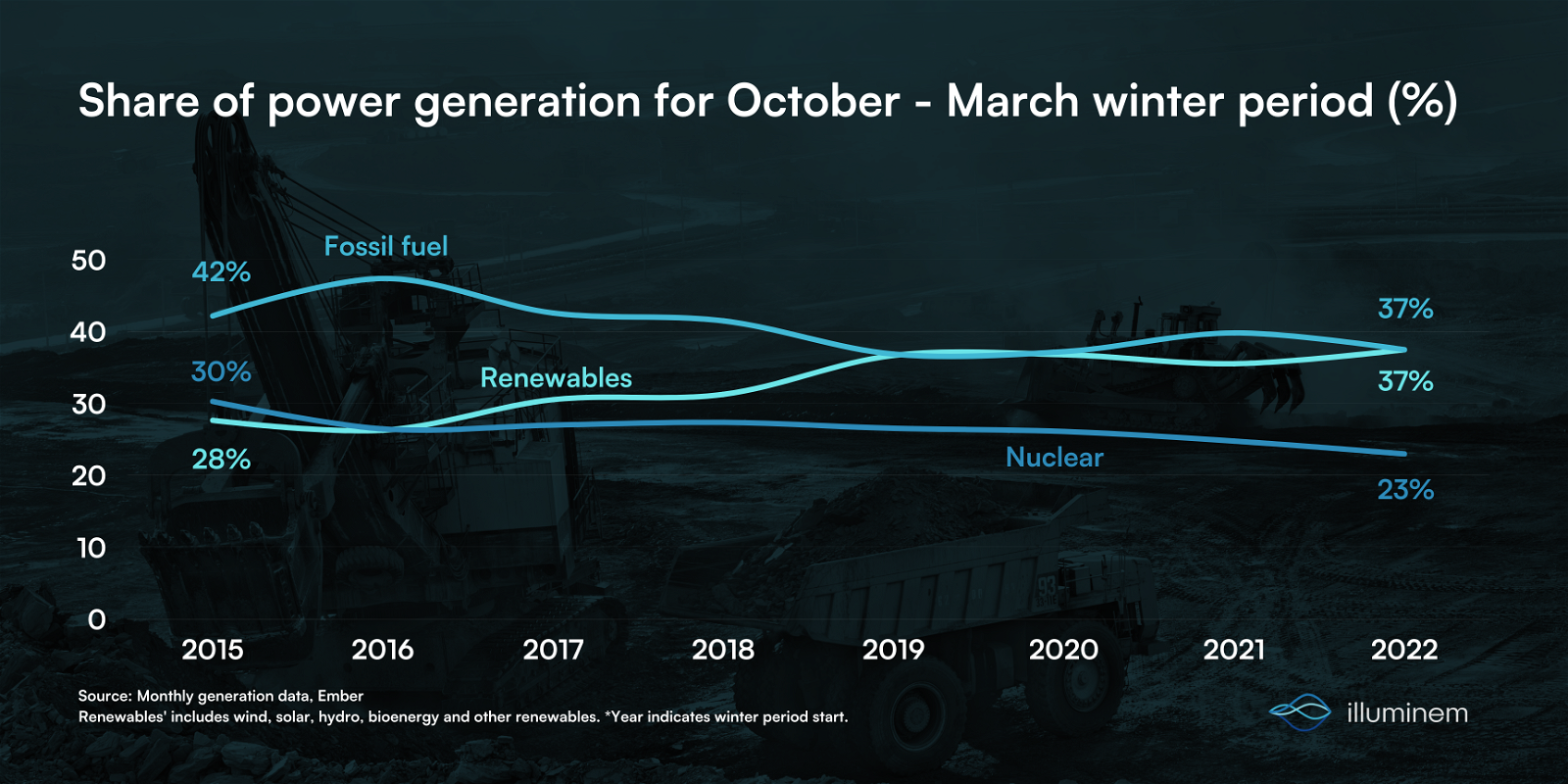

Driving the news: A report by think-tank Ember found that coal generation in Europe fell by 11% (-27 TWh) during the winter of 2022 (Oct. - Mar.), due to warmer weather and soaring energy prices.

Why it matters for the planet: Europe's power mix did not experience a steep rebound in coal usage, despite the continent's worst energy crisis in 40 years due to Russia's invasion of Ukraine.

What’s next: Europe must learn from the measures taken during this difficult winter and continue the transition away from fossil fuels. Sustainably maintaining demand reductions and focusing on demand flexibility will be crucial for the future of Europe's power system.

One stat: Total EU electricity demand was down 6% on the five-year average, saving €12 billion worth of electricity over winter (source: Ember)

Click for more on the energy transition

Driving the news: Ohmium International has raised $250 million in a Series C round led by TPG Rise Climate, with participation from Hanover Technology Investment Management and other existing investors.

Why it matters for the planet: Green hydrogen is considered by many as crucial for the rapid decarbonisation of hard-to-abate sectors, and this funding round is a vote of confidence in hydrogen's future.

What’s next: The market will be watching how green hydrogen companies accelerate their plans for large-scale production facilities.

One stat: The Series C round is five times larger than Ohmium's last fundraise of $45 million in a Series B round in April 2022 (source: Ohmium).

Click for an explainer of blue vs green hydrogen

Click for more on hydrogen news

Driving the news: In early April, the global ocean surface temperature reached a record-breaking 21.1°C (approximately 70°F), surpassing the previous record of 21.0°C set in 2016.

Why it matters for the planet: Warming ocean surface temperatures hurts food webs and marine ecosystems. Already, the global population of marine species has declined by an average of 50% since the 1970s (WWF).

What’s next: Record temperatures may signal the end of La Niña and the onset of El Niño, a climate pattern affecting global temperatures and weather.

One stat: The average surface temperature of the world's seas has increased by around 0.9C compared to preindustrial levels, with 0.6C coming in the last 40 years alone (source: IPCC).

Click for more on global warming

Alex Hong

Energy Transition · Energy

illuminem briefings

Hydrogen · Energy

illuminem briefings

Energy Transition · Energy Management & Efficiency

Financial Times

Power Grid · Power & Utilities

The Guardian

Natural Gas · Greenwashing

Politico

Solar · Public Governance