illuminem market insights: Top 100 U.S. companies | Are they zeroing in or zoning out?

Unsplash

Unsplash Unsplash

Unsplash· 4 min read

illuminem is proud to publish this analysis for different industries based on data from our Data Hub™, first open sustainability platform offering comparability and visibility on the sustainability performance of all companies, public and private, and first sales tool for sustainability players.

As climate concerns rise along with regulation pressures, corporate ESG strategies have become a key tool for showing a company's commitment to long-term sustainability. While some firms act as flagships on decarbonisation and sustainability in business operations, many trail behind, exposing themselves to financial and reputational vulnerabilities.

Using illuminem's Data Hub™, we have been looking at the top 100 U.S. companies by revenue, as they represent a broad section of the energy, finance, technology, and consumer goods sectors, thus giving a good picture of global sustainability trends.

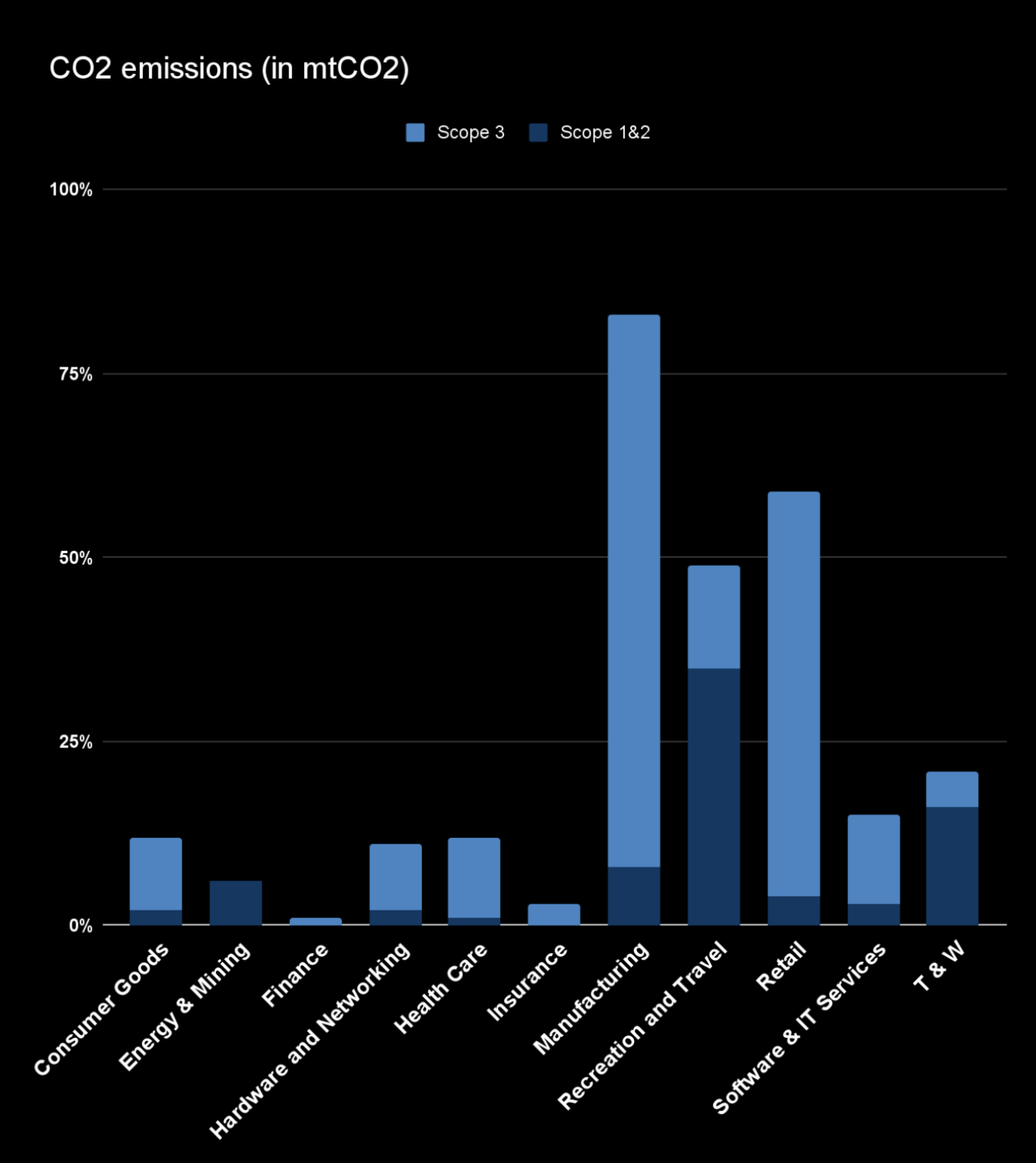

Carbon emissions remain a challenge across industrial sectors that are structurally dependent on fossil fuels. The graph below sums up the carbon emissions in mtCO2 by industry type:

*T&W: Transportation & Warehousing

As expected, the Energy and Heavy manufacturing sectors are the most representative in terms of reported Scope 1&2 emissions, as the nature of their operations relies on extractive processes and high-energy operations.

Companies within the Technology and Financial services industries report substantially lower emissions from their service-oriented business models. However, Scope 3 emissions, which are caused by supply chains and consumer use, remain an important concern even for these low-emission industries.

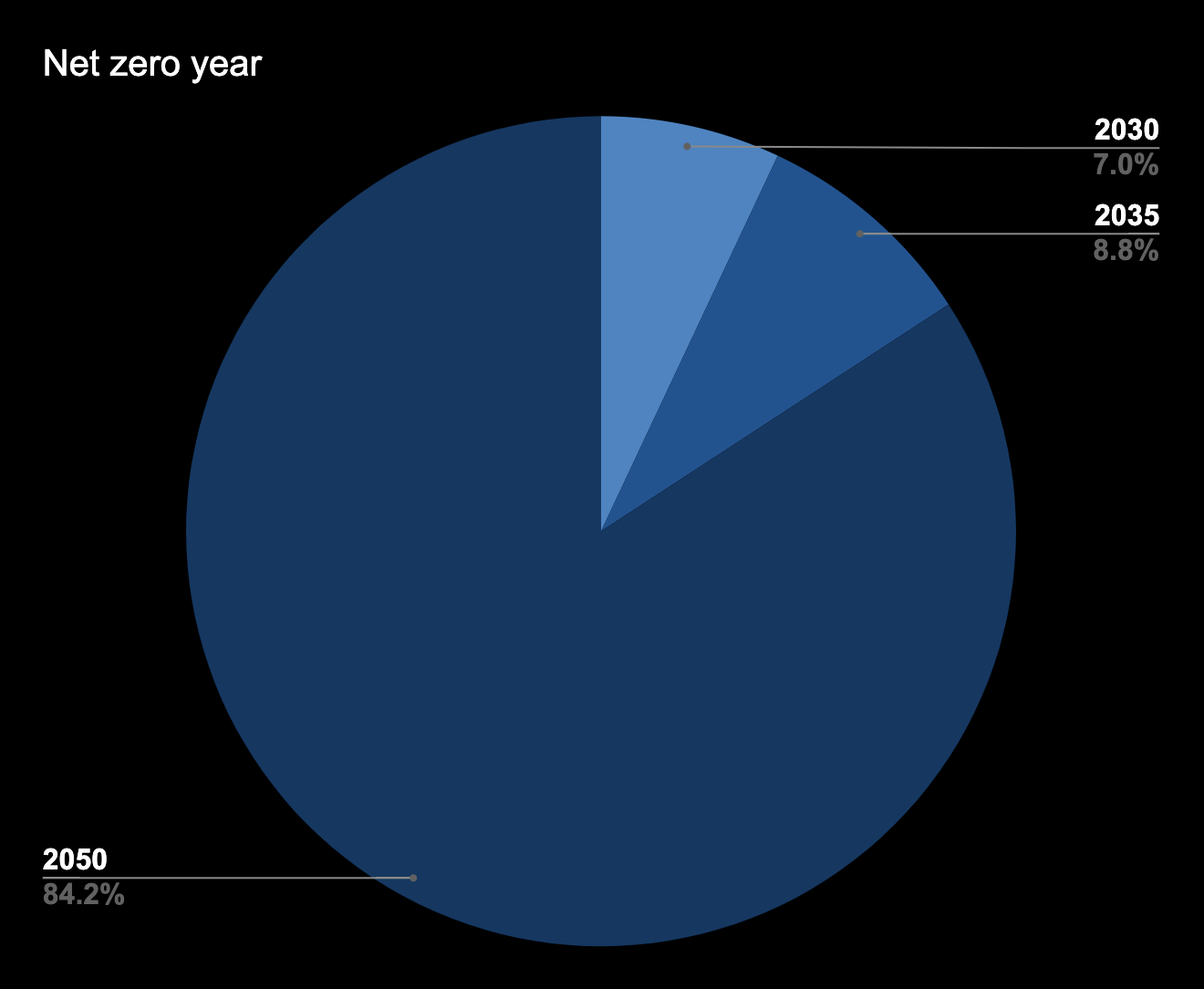

It is important to note that numerous companies long announced net-zero commitments, but for many of them, the strategy to achieve those targets remains relatively vague, with limited interim targets to ensure measurable progress. In addition, these targets are often set for 2050, where the UN Sustainable Development Agenda is 2030.

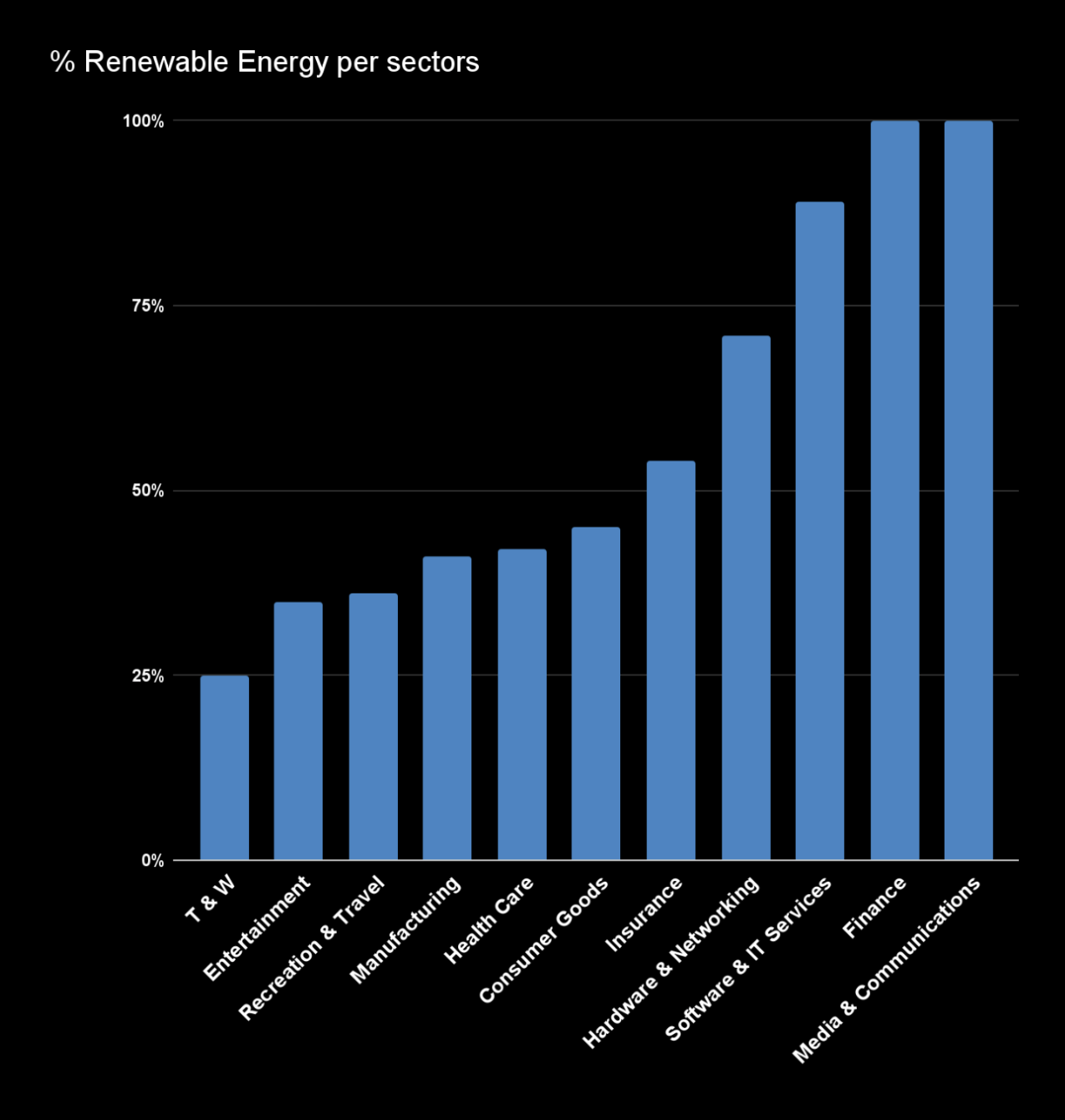

Technology companies lead in renewable energy procurement, often leveraging power purchase agreements to source clean electricity at scale. Many of these firms have already reached a high percentage of renewable energy use in their operations, with some exceeding 50% of total electricity consumption.

In sharp contrast, the road to renewables is challenging for industries with elaborate manufacturing processes, such as Consumer Goods and Automotive industries, in which high infrastructure costs and inconsistent policy incentives can lead to a slower transition process. Despite these hindrances, an increasing number of firms are investing in on-site solar installations and signing long-term agreements to procure clean energy, thus demonstrating an industry-wide move toward sustainability.

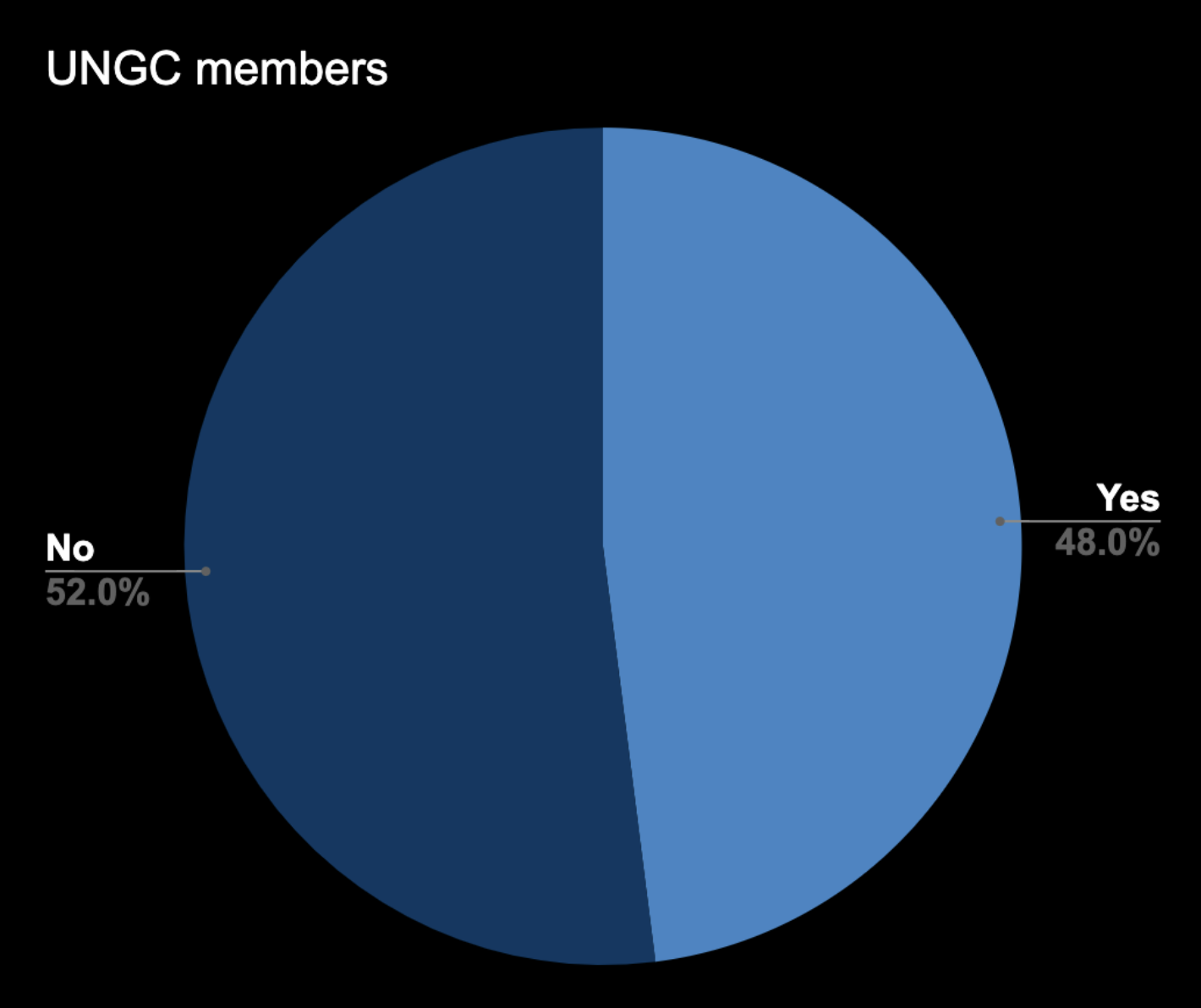

Strong governance structures ensure that sustainability concerns feature higher on the corporate agenda. Companies, whose boards have oversight over ESG, generally have more comprehensive climate strategies and are more transparent in their reporting. Data shows that some of the best performers in terms of ESG disclosure are also members of the UN Global Compact, which showcases their commitment to internationally accepted principles on sustainability. Yet, too many companies lack rigorous push to integrate ESG factors into long-term strategic decision-making.

While they are proactive or following, some industries are making great strides on ESG factors. Technology and Finance sectors keep their ambitions high, pressured by investor expectations and consumer demands to reach high sustainability targets. Their operations take advantage of renewable energy sources, increasing energy efficiency measures, and improving carbon reduction activities.

In contrast, Manufacturing, Transportation and Energy are sectors with structural hurdles to decarbonisation and are making their way much more slowly. Long-term net-zero commitments in these sectors have frequently been announced without clear, near-term action plans. The lack of explicit interim targets also raises doubts on their ability to achieve ambitious climate goals.

Looking at the Top 100 U.S. companies, it is possible to highlight how fast some leaders are catching up with their sustainability targets, but also how most companies in certain sectors keep facing persistent challenges: while ambitions in corporate sustainability stand at an all-time high, execution speed across industries continues unevenly.

Flagship companies are those embedding robust mechanisms of governance, committing to science-based targets, and significantly investing in renewable energy on the road to transitioning to sustainability. In order to keep pace, latecoming sectors will need to increase investments that follow regulatory clarity, investor scrutiny, and consumer demand for sustainability.

As net-zero deadlines draw near, companies must translate commitments into tangible actions to maintain credibility and mitigate financial and reputational risks. This will require more knowledge sharing, coordination at the level of industries, policymakers, and investors in order to engineer systemic change.

How does your company compare with competitors in your field? Benchmark against peers and add your company to Data Hub™ to enhance visibility and transparency in sustainability performance.

This report has been created in collaboration with Filippo Cerno. illuminem Voices is a democratic space presenting the thoughts and opinions of leading sustainability and energy writers.

Alex Hong

Energy Transition · Energy

Steven W. Pearce

Adaptation · Mitigation

John Leo Algo

Ethical Governance · Environmental Sustainability

Responsible Investor

Sustainable Finance · ESG

Responsible Investor

ESG · Sustainable Finance

Responsible Investor

Sustainable Finance · ESG