How many batteries are needed in Africa?

· 14 min read

Electricity access in Africa has improved markedly in the past 20 years, expanding from 25% to 47% of the population. The off-grid solar and mini-grid markets have played vital roles in this expansion. In recent years, sales of solar products have increased by 10% year-on-year, with more than 2,000 mini-grids in operation [1]. Despite this progress, access to clean and reliable electricity remains one of the greatest challenges to sustainable development in Africa, as over 600 million people still lack access to electricity, and an additional 150 million face an unreliable connection [1].

There are a number of reasons why access in rural sub-saharan Africa is limited. First of all, it is simply too costly for already struggling utilities to extend their services to these communities. Even where a community has a grid connection, it is often plagued with technical issues and an intermittent power supply. From too little generation to sub-standard operation and maintenance practices to theft and uneconomical tariffs, it is no surprise that utilities are struggling.

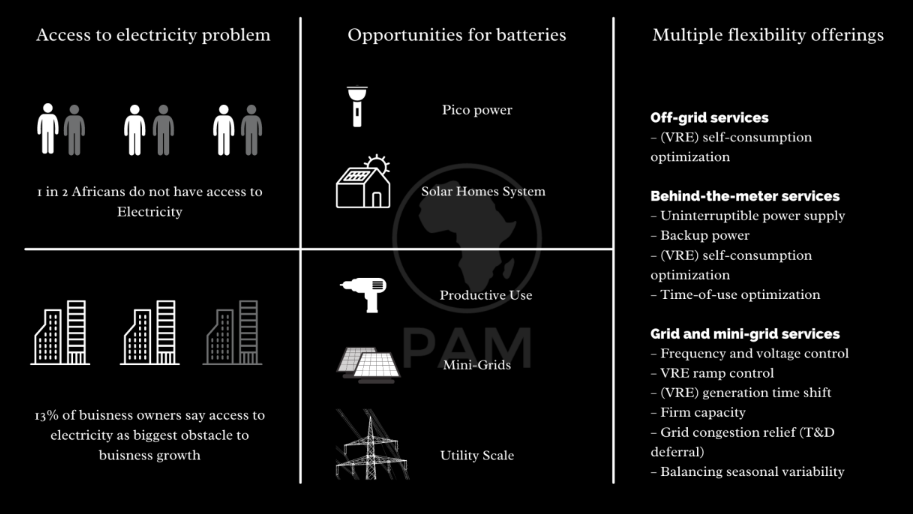

Renewable electricity generation in the form of solar home systems and mini-grids, particularly when coupled with batteries, is improving access, reliability, and the cost of energy. As such, over the next decade, batteries are expected to have a high uptake in Africa, especially with the declining costs.

Africa enjoys about 12 hours of daylight on average, which means that, where off-grid solar energy systems are deployed, batteries are crucial for providing stored energy for the remaining 12 hours. With suitable batteries deployed in a solar home system (SHS), mini-grid, or mesh-grid, more people can have access to an improved quality of life through access to better healthcare facilities, education, and higher productivity.

However, the high capital cost of batteries is still one of the primary barriers to the deployment of renewable energy systems in Africa. For example, in a typical solar project in Nigeria, battery costs account for over half of the project’s capital expenditure.

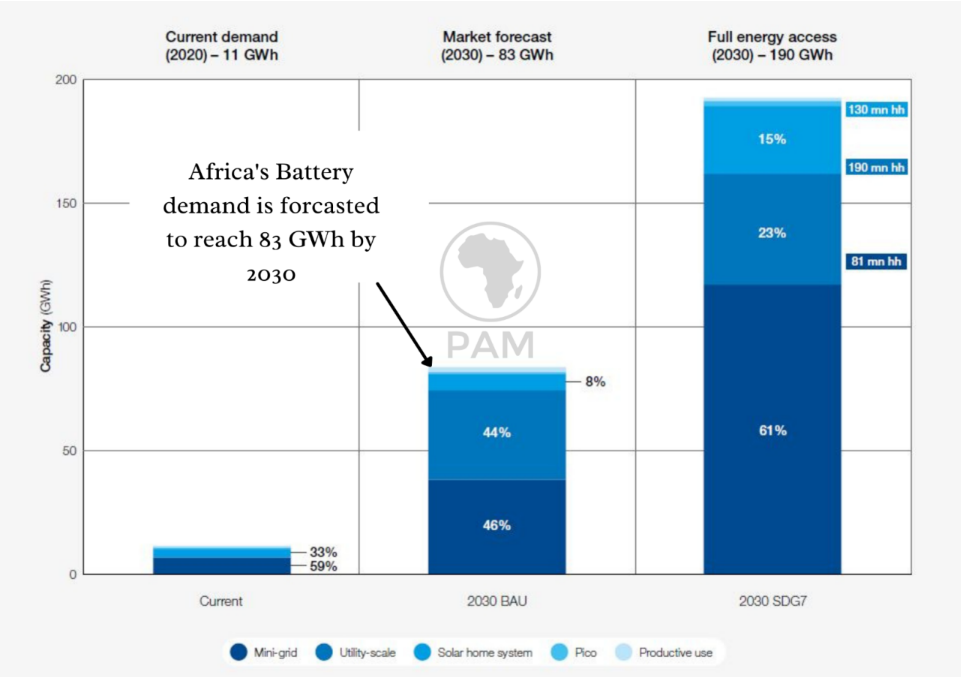

Despite this barrier, it is estimated that stationary battery capacity in Africa could grow by 22% annually through 2030 due to demand from energy access applications, and mini-grids alone could represent 40% of the 2030 market. Market forecasts by the World Economic Forum show that as more Africans gain access to energy over the coming years, the demand for batteries will grow to 83 GWh by 2030. [14]

Batteries are needed in Africa for various applications, such as mobile technologies, renewable energy systems, and grid solutions. In order to provide energy access in Africa, batteries will have to become much cheaper.

There are various ways of ensuring batteries are affordable and widely utilized. One option is manufacturing locally on the continent. To date, the manufacturing industry for batteries in Africa is still nascent, but some manufacturers are beginning to explore the possibility of establishing the first African gigafactory.

South Africa is currently taking the lead when it comes to battery manufacturing in Africa. Companies such as AutoX, Donaventa Holdings, Duracell South Africa, Energizer South Africa, Eveready, Metindustrial, Potensa, Probe Corporation, and Solguard have dominated this space for quite some time. However, they specialize in lead-acid batteries and may miss out on the energy transition to renewables and e-mobility. Innovation in these companies will be necessary to keep up with demand and ensure Africa’s independence in the battery space.

In Nigeria, very few companies have taken up battery development; the few that tried have faced major losses due to poor financials [2]. One such company was Union Autoparts Mfg. Co. Ltd., West Africa’s biggest battery recycling plant and located in a country believed to dispose of over 500,000 tons of used lead acid batteries every year. However, the plant could not source enough used batteries to supply its underutilized machines. It thus became impossible to be cost competitive with those exporting the batteries.

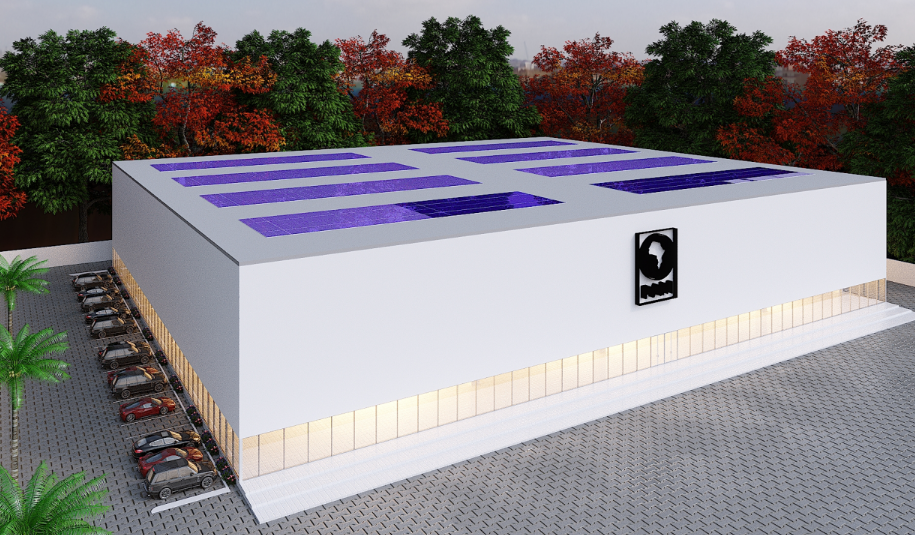

However, we are seeing some new hope for the continent. PAM Africa recently launched its plans to develop advanced batteries such as Li-ion and Na-ion batteries in Nigeria. The batteries will be used mainly for power applications such as backup supply for solar and grids. As we see the growth of solar projects in Africa, energy storage solutions such as Li-ion batteries will be fundamental in providing system flexibility. The current rate of innovation from utilities in Nigeria is slow as they are yet to adopt policies for a more flexible grid, such as net metering, individual export to the grid, and time-of-use tariffs. However, we believe that the uptake of battery storage solutions at home can create a use case for grid support services.

Megamillion has plans to be Africa’s first large-scale manufacturer of Li-ion cells and battery packs, in hopes of bringing down prices and thereby catalyzing mass adoption of energy storage systems. They are banking on economies of scale to reduce the price of the cells, with the goal of producing 38 GWh/yr by 2028. The chosen form factor is the cylindrical 2680 cell (a diameter of 26 mm and a length of 80 mm) a using nickel-manganese-cobalt (NMC) chemistry for the cathode. According to Megamillion, its cells have a capacity of 6200 mAh and an energy density of over 200 Wh/kg. Nickel, cobalt, manganese, graphite, and, of course, lithium can all be sourced in South Africa and several countries across Southern Africa.

The global transition towards green energy will create opportunities for Africa if seized correctly. As battery demand grows and Chinese, European, and American firms build battery gigafactories, African leaders must step up and include battery production as a continent-wide development priority. A strong regional battery supply chain, powered by the African Continental Free Trade Area (AfCFTA), will bolster Africa’s relevance in the international battery market.

While we see a significant opportunity to meet the growing battery demand at a lower cost through local manufacturing and assembly, other areas such as high-quality recycling and repurposing should also be explored. In the section below, we will be taking a deeper dive into what battery recycling means for Africa.

End-of-life management and battery recycling in Africa is still a major logistical and environmental challenge. The need for end-of-life battery management cannot be overemphasized. Policies on end-of-life management must be developed and implemented in order to prevent environmental problems in the future and to ensure the proper disposal of used batteries. The recycling process for Lead-acid and Lithium-ion batteries is quite different and must be examined separately.

Africa has a 1 billion dollar lead-acid battery market, of which the automobile industry accounts for 47%. This makes lead-acid batteries significantly more popular than any other battery type on the African continent. Other key application segments of the African Lead Acid Battery Market are the industrial, commercial, residential, and power sectors. The emergence of off-grid energy access will only see this figure rise in the coming years [9].

While lead-acid batteries are commonly collected and recycled, these practices are often associated with severe pollution.

Lead-acid battery recycling currently occurs across three main types of businesses. Commonly found recyclers in Africa include:

Take-back and recycling systems for lithium-ion batteries are still in their infancy due to the low volumes of end-of-life (EOL) lithium-ion batteries in most African countries. However, this is expected to change with the growing demand for stationary storage.

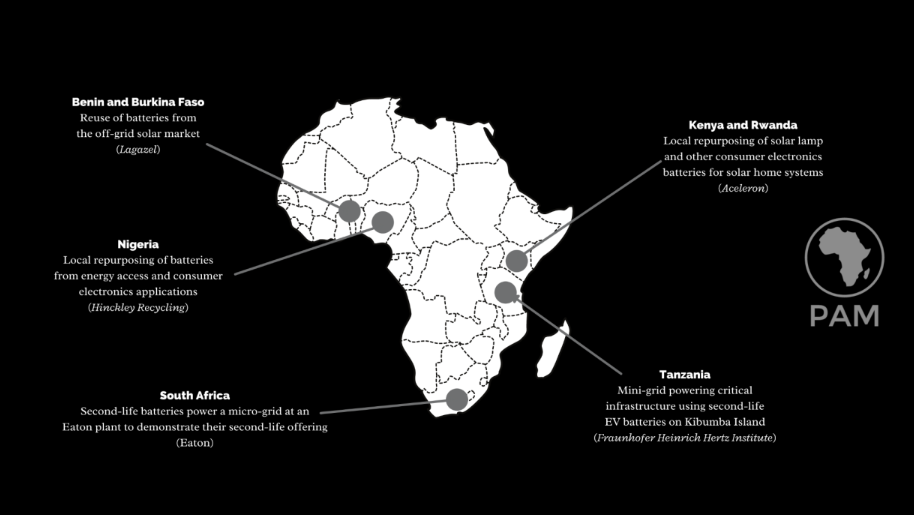

At present, the high cost of recycling implies that incentives to collect lithium-ion batteries are few, and where lithium-ion batteries are collected, there are stronger financial incentives to repurpose rather than recycle. Companies are beginning to repurpose batteries from local electronic waste, driven by the cost of alternative EOL management options. However, repurposing only delays the inevitable need for recycling, and is not a long term solution.

These are some of the challenges for the recycling of lithium-ion batteries in Africa:

Due to these barriers and costs, the collection and recycling of lithium-ion batteries is currently not an attractive business proposition. The bulk of waste generated from lithium-ion batteries is not currently collected and is most likely disposed of alongside general municipal solid waste.

A prominent example is Kenya, where seven of the biggest solar off-grid providers launched the Kenya Solar Waste Collective, aimed at pooling their resources and logistics to collect waste from off-grid installations and direct it to environmentally sound recyclers. The impetus came from the fact that many solar companies have a high awareness of environmental issues and grant opportunities often tie financial support to proper battery EOL management. For example, in Nigeria, for solar developers to qualify for the performance based grant (PBG) with the Rural Electrification Agency (REA), they would need to have a detailed plan for battery EOL management.

Companies in Kenya, Nigeria, and Rwanda are testing the remanufacture of EOL batteries from Off-Grid Solar (OGS) and consumer electronic applications. Projects are benefiting from partial grant-funding while looking to scale into commercial opportunities in the near term. Over 10 years ago, the Rwandan government started addressing e-waste and battery waste issues, when it passed voluntary regulations requiring producers and

importers to finance recycling; this regulation became mandatory in 2021. While the recycling of lithium-ion batteries in Africa remains almost absent, the Nigerian recycler Hinckley and the Dutch company Closing the Loop organized the collection, packaging and shipment of 5 metric tons of lithium-ion batteries from Nigeria to Belgium for recycling in 2020, less than 0.005% of the total used batteries in circulation. Although recycling in Africa is challenging at present, some stakeholders are leading the way.

While there is a growing demand for batteries in Africa, at present there is very little capacity on the continent to produce or recycle batteries at end-of-life. This appears to be an immense opportunity for the continent to take its destiny in its hands by investing in building these capabilities and reducing the reliance on foreign imports. This has the added benefit of creating jobs locally and boosting the economic productivity of the continent.

We propose the following steps to boost the adoption of batteries in energy access applications:

1. Access to electricity – SDG7: Data and Projections – Analysis - IEA. (n.d.). International Energy Agency. Retrieved May 16, 2022, from https://www.iea.org/reports/sdg7-data-and-projections/access-to-electricity

2. Anyaogu, I. (2018, March 12). Why West Africa's biggest battery manufacturing plant lies idle. Businessday.ng. Retrieved May 16, 2022, from https://businessday.ng/investigations/article/west-africas-biggest-battery-manufacturing-plant-lies-idle/

3. Carbon Tracker & Grantham Institute, Imperial College, London. (2017, February 1). Expect the Unexpected: The Disruptive Power of Low-carbon Technology. Carbon Tracker Initiative. Retrieved May 16, 2022, from https://carbontracker.org/reports/expect-the-unexpected-the-disruptive-power-of-low-carbon-technology/

4. ESMAP & World Bank Group. (n.d.). Global Electrification Platform. Global Electrification Platform. Retrieved April 20, 2021, from https://electrifynow.energydata.info/

5. Faraday Institution & Imperial College London. (2018, October). Rapid Market Assessment of Energy Storage in Weak and Off-Grid Contexts of Developing Countries. Vivid Economics, 9-15. https://faraday.ac.uk/wp-content/uploads/2019/10/191025_Rapid_market_assessment_of_storage_in_developing_countries.pdf

6. International Energy Agency & Pavarini, C. (2019, February 7). Battery storage is (almost) ready to play the flexibility game – Analysis. IEA. Retrieved May 16, 2022, from https://www.iea.org/commentaries/battery-storage-is-almost-ready-to-play-the-flexibility-game

7. International Finance Corporation, ESMAP, & Dalberg Advisors. (2019). The Market Opportunity for Productive Use Leveraging Solar Energy (PULSE) in Sub-Saharan Africa [Report]. https://www.lightingglobal.org. https://www.lightingglobal.org/wp-content/uploads/2019/09/PULSE-Report.pdf

8. International Renewable Energy Agency, Nagpal, D., Parajuli, B., Hawila, D., Abou Ali, A., & Franceschini, B. (2018, January). Off-Grid Renewable Energy Solutions to Improve Livelihoods. IRENA Publication, 1 - 8. https://irena.org/-/media/Files/IRENA/Agency/Publication/2018/Jan/IRENA_Off-grid_Improving_Livelihoods_2018.pdf?la=en&hash=59C9F62113324CAB2C0D990246C5673FB805595E

9. Lead Acid Battery Market - Africa Industry Analysis 2021. (n.d.). Transparency Market Research. Retrieved May 27, 2022, from https://www.transparencymarketresearch.com/africa-lead-acid-battery-market.html

10.Lee, M., Soto, D. R., & Modi, V. (2014, September). Cost versus reliability sizing strategy for isolated photovoltaic micro-grids in the developing world. Renewable Energy, 69, 16 - 24. https://doi.org/10.1016/j.renene.2014.03.019

11.Lighting Global, World Bank, ESMAP, & GOGLA. (2020, February). Off-Grid Solar Market Trends Report 2020. Lighting Global, 6(February, 2020), 7-9. https://www.gogla.org/resources/2020-off-grid-solar-market-trends-report

12.Lilley, S. (2021, May). Sodium-ion Batteries: Inexpensive and Sustainable Energy Storage. Faraday Insights, (11), 1-6. https://www.faraday.ac.uk/wp-content/uploads/2021/06/Faraday_Insights_11_FINAL.pdf

13.Wang, X., Brown, R., Prudent‐Richard, G., & O'Mara, K. (2017, January 9). Energy Storage Trends and Opportunities in Emerging Markets. Energy Sector Management Assistance Programme, 2017, 5-6. https://www.esmap.org/node/57868

14.World Economic Forum, Global Battery Alliance, & Energy Storage Partnership. (2021, May). Closing the Loop on Energy Access in Africa. World Economic Forum - White Paper. https://www.weforum.org/whitepapers/closing-the-loop-on-energy-access-in-africa

Yury Erofeev

Battery Tech · Mobility Tech

illuminem briefings

Energy Transition · Energy Storage

illuminem briefings

Green Tech · Carbon

Vox

Energy Sources · Lithium

The Wall Street Journal

Li-ion Battery · Battery Tech

CBS News

Li-ion Battery · Energy Storage