Maritime EU ETS: Obligations and options for action for maritime transport (Part 1)

Unsplash

Unsplash Unsplash

Unsplash· 7 min read

Since 2005, the EU Emissions Trading System (EU ETS) has been the European Union's (EU) central market-based climate instrument. Since 2018, the maritime transport sector has been required to measure, report and verify emissions in accordance with EU ETS rules (monitoring, reporting, verification – MRV), and emissions pricing began on 1 January 2024. In this first part of a series on the EU ETS for maritime transport, the basics of the obligations for affected companies are explained.

This extension of the EU ETS to maritime transport was part of the ‘Fit for 55’ package and covers all ships with a gross tonnage (GT) of 5,000 or more that call at ports in the EU or the European Economic Area (EEA), regardless of their flag. Shipping companies were therefore assigned to national administrative authorities on 30 January 2024 (source: EU). This assignment list is not exhaustive, as companies may still be subject to regulation after the deadline and are obliged to comply despite not being listed. The shipping sector already contributed around 6% of EU ETS emissions in its introductory year 2024 (source: EEA) and caused around 13% of all transport-related greenhouse gases in the EU in 2021 (source: EMSA).

The first evaluation of the integration of shipping into the EU ETS by the EU Commission in March 2025 shows that over 5,000 shipping companies are registered on the European MRV platform THETIS-MRV and that verified monitoring plans for more than 15,000 ships are available (source: EU Commission). Figure 1 illustrates the geographical scope of the EU ETS for maritime transport: 100% of emissions for intra-EU/EEA voyages are covered, while 50% of emissions are subject to taxation for voyages to/from third countries. This regulation aims to prevent carbon leakage and minimise avoidance behaviour.

Figure 1: Example illustration of the scope of the EU ETS maritime with the 100/50% rule (source: carboneer)

The EU ETS operates on a cap-and-trade principle with an annually decreasing emissions cap. Shipping companies must purchase corresponding emission allowances (European Union Allowances (EUA)) for each tonne of CO₂ equivalent emitted and surrender them in the Union Registry each year. Companies with low CO₂ abatement costs can sell their EUAs to companies with high abatement costs. This means that CO₂ is avoided where it is most efficient and cost-effective.

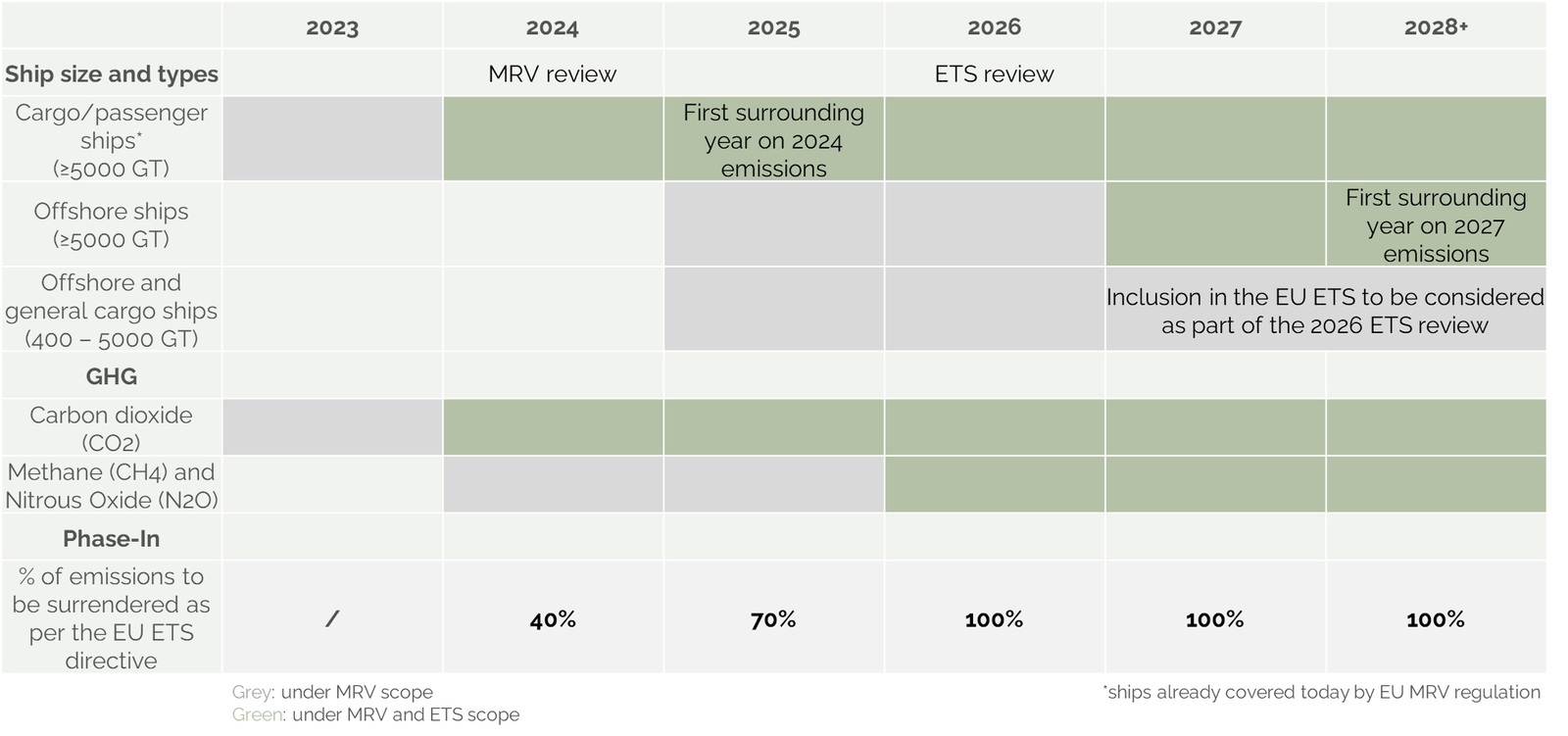

The inclusion of shipping in the EU ETS is taking place in stages. While only CO₂ emissions are subject to pricing for the time being, methane and nitrous oxide will also be priced from 2026. From 2027, the system will also cover offshore vessels with a GT of over 5000. While smaller ships between 400 and 5,000 GT have been part of the MRV since 2025, it is still unclear whether and when the emissions of these ships will also be priced. This is expected to be decided in 2026 as part of a major EU ETS review. In addition to the gradual introduction of several ship and emissions categories, pricing will also be phased in over a three-year period. From 2024, affected shipping companies will have to surrender EUAs for 40% of their verified emissions, 70% in 2025 and 100% from 2026 (Figure 2).

Figure 2 : EU ETS maritime implementation period (source: carboneer according to EU Commission)

The obligated ‘shipping company’ within the meaning of the EU ETS Directive is, by default, the registered shipowner. The shipowner may contractually delegate the EU ETS obligations to the company that is responsible for ship operations under the International Safety Management (ISM) Code. A prerequisite for delegation is that a proper and complete mandate agreement in accordance with the detailed requirements of Implementing Regulation (EU) 2023/2599 has been submitted to the competent authority (source: DEHSt). The mandate agreement must document the assumption of all EU ETS obligations and be submitted to both the administrative authority and the verification body. Bareboat charters can only act as shipping companies if they are also ISM companies. The company responsible for MRV of emissions and the obligations under the EU ETS must always be identical. In practice, this requirement poses considerable challenges, as many shipping companies operate their fleets through multiple ISM managers who use different management and emission measurement procedures.

The annual compliance cycle of the EU ETS for shipowners and ISM companies follows a clearly structured annual rhythm that begins even before the first port call. Before operations commence, an approved monitoring plan must be in place, which is reviewed by an accredited verifier and approved by the competent administrative authority (source: EU Commission). The verified plan must be submitted to the competent administrative authority via the THETIS MRV portal by 1 April 2024 at the latest or within three months of the first port call under EU jurisdiction. Throughout the reporting year, ships continuously record their greenhouse gas emissions using the methods defined in the monitoring plan. By 31 March of the following year at the latest (Figure 3), this data must be verified and include both a ship-level emissions report and a company-level emissions report, which are generated via the THETIS-MRV portal.

Figure 3: Compliance cycle in the EU ETS (source: carboneer)

A Document of Compliance can then be created via THETIS-MRV, which must be carried on all affected ships of the relevant company. In order to have sufficient buffer for any corrections, verification should begin promptly after the start of the year. Once the shipping company has assigned the verifier to the Union Registry, the verifier can confirm the verified emissions directly in the Maritime Operator Holding Account (MOHA) in the Union Registry.

At the same time, affected companies use the MOHA to purchase, trade and submit EUAs. The central compliance deadline for the year is 30 September. By this date, sufficient EUAs must be submitted via the MOHA in the Union Registry to cover the verified company emissions. To ensure that the reporting, verification and submission processes run smoothly, a tight internal schedule is recommended: continuous monitoring, early data validation by verification bodies, timely entries in THETIS-MRV and the Union Registry, and timely procurement and provision of the required EUAs.

In the EU ETS, violations of the obligation to surrender EUAs by 30 September of each year are subject to a fine. The penalty payment is €100 per tonne of CO₂ equivalent for emissions caused in the previous year for which no EUA was submitted. Since 2012, the value has been increasing annually in line with inflation, meaning that violations in 2024 will incur a penalty of €132.06 per tonne of CO₂ equivalent (source: DEHSt). Regardless of the penalty payment, the obligation to retroactively purchase and submit the missing EUAs remains. Similarly, if EUAs are not submitted, the names of the defaulting shipping companies are for exampled published in the Federal Gazette of Germany once the decision has become final; at EU level, the Commission also maintains an annual list of non-compliant operators.

This ‘naming and shaming’ increases the reputational risk, and in the event of repeated violations in two or more reporting periods, the flag or port state authorities may, as the most severe measure, deny access to EU ports or also detain ships in the home port of an EU state. Since liability applies company-wide, a single ship violation can affect the operator's entire fleet (source: DEHSt). Consistent measurement of emissions, timely verification and timely procurement and submission of EUAs therefore remain essential to avoid financial penalties and operational restrictions.

In the second part of our series, we will look at price and market developments in the EU ETS, the cost implications for shipping companies and the complementary rules under the FuelEU Maritime Regulation.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Sustainability needs facts, not just promises. illuminem’s Data Hub™ gives you transparent emissions data, corporate climate targets, and performance benchmarks for thousands of companies worldwide.

1. DEHSt, 2025, EU Emissions Trading 1 for Maritime Transport, URL: https://www.dehst.de/EN/Topics/EU-ETS-1/Maritime-Transport/EU-ETS-1-Maritime-Transport/eu-ets-1-maritime-transport_node.html

2. DEHST, 2025, EU ETS 1 Sanctioning, URL: https://www.dehst.de/EN/Topics/EU-ETS-1/EU-ETS-1-Information/Sanctioning/sanctioning_node.html

3. DEHSt, 2025, Maritime Transport-FAQ, URL: https://www.dehst.de/SharedDocs/FAQ/EN/maritime-transport/FAQList-SV.html#faq-id-299956

4. EEA, 2025, EU Emissions Trading System data viewer, URL: https://www.eea.europa.eu/en/analysis/maps-and-charts/emissions-trading-viewer-1-dashboards

5. EMSA, 2025, Facts and Figures, URL: https://emsa.europa.eu/publications/item/4515-emter-facts-and-figures.html

6. EU, 2024, Kommission Implementing Decision EU) 2024/411, URL: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=OJ:L_202400411

7. EU Kommission, 2025, FAQ – Maritime transport in EU Emissions Trading System (ETS), URL: https://climate.ec.europa.eu/eu-action/transport-decarbonisation/reducing-emissions-shipping-sector/faq-maritime-transport-eu-emissions-trading-system-ets_en

8. EU Kommission, 2025, Report from the Commission: Review of Regulation (EU) 2015/757 on the monitoring, reporting and verification of greenhouse gas emissions from maritime transport in relation to the potential inclusion of ships below 5 000 gross tonnage but not below 400 gross tonnage , URL: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52025DC0109

9. EU Kommission, 2025, Monitoring, reporting and verification URL: https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets/monitoring-reporting-and-verification_en

illuminem briefings

Shared Mobility · Tourism

illuminem briefings

Nature · Maritime

illuminem briefings

Maritime · Public Governance

Carbon Herald

Carbon Capture & Storage · Maritime

The Guardian

Maritime · Pollution

Offshore Energy

Carbon Regulations · Public Governance