Energy Vault is a poster child for why SPACs have become a destructive influence in cleantech investing

· 5 min read

Energy Vault has challenges in addition to its ineffective, expensive, carbon-debt laden, mechanical failure of an electricity storage solution. As such, it’s a poster child for cleantech special purpose acquisition companies (SPACs), where lack of required investment due diligence has been compounded by a lack of basic physics and engineering due diligence and an angel investor class one collaborator refers to as guilty old rich people trying to make their grandkids like them.

Recently a legal firm, Hittelman Strunk, filed a class action lawsuit on behalf of investors in Energy Vault due to an alleged stock price inflation scheme. Per the announcement, Energy Vault paid a million dollars to a firm called DG Fuels, and in return DG Fuels agreed to buy $520 million worth of Energy Vault products. The lawsuit asserts that DG Fuels has no revenue and has nothing in operation at present, and that this was not disclosed to investors. This would constitute a violation of securities laws in the US, per the announcement.

I had ignored Energy Vault for a couple of years, as a quick initial glance had it coated in so many obvious red flags to my eyes that it was clearly doomed to failure. However, due to my publications on low-carbon transformation, including end game challenges such as grid storage, aviation refueling, and marine refueling, people kept asking me about it. Then Energy Vault secured a reverse-takeover SPAC deal that saw it on the stock market at around $3 billion at peak, dropping to $0.88 billion at present.

The combination led me to analyze the technology in its initial incarnation — deeply absurd — and its purported later incarnation — imagine a massive 25-story heavy steel building hoisting multi-ton blocks up to the top couple of floors and not collapsing under the weight of its hubris. Like many bad technical ideas, attempting to engineer solutions to the glaring problems results in more and more glaring problems. Most organizations do not have tens or hundreds of millions thrown at them to perpetuate the bad idea however, as wise money does due diligence which includes getting a sensible third-party assessment done and paying attention to it.

Among other things, they claimed in various ways that they were able to manufacture 30 ton blocks with the same technical qualities as engineered concrete with close to no carbon debt and at least as cheaply as engineered concrete. If this were true, the world would be ecstatic, as it would solve one of the biggest and most glaring climate problems we have today, the vast emissions of the essential infrastructure material we use lavishly, concrete. We wouldn’t be wasting this magical substance on a silly elevator energy storage product, we’d be building bridges, dams, wind turbine foundations and high rises with it everywhere.

At that, it’s not the silliest gravity storage proposal going. Lift Energy proposes — proving that they don’t understand the basics of either physics or building elevator systems — to repurpose high rise elevators for energy storage when the buildings are empty. They received favorable press for this nonsense.

Pro tip: gravity storage is a proven, economical and viable technology called closed loop pumped hydro. Everything else is nonsense compared to pushing dirt cheap, zero carbon water a long way up hill with regenerating pumps.

That said, SPACs are the 2020s version of IPOs and ICOs. I also looked at the absurd market capitalization of electric vertical takeoff and landing air taxi firms, and their amazing loss of market capitalization, and saw the same pattern. Lilium, one of those firms, is also targeted with a class action lawsuit related to non-disclosure of critical information after Iceberg Research dropped a report on the deficiencies. This is common, with 85 legal actions underway against 34 of the SPAC firms.

The air taxi bubble and subsequent completely predictable — tiny market today, fantasy of massive market growth, three different technical and regulatory maturation processes required before even remotely viable — collapse has a seriously dampening effect on funding sensible aviation decarbonization ventures such as ELECTRON Aviation with its four-passenger, high-aspect ratio, streamlined regional air mobility on-demand solution and a stealth firm I’m affiliated with that has a electric propulsion system 20% more efficient than a standard electric motor plus propellers. Solutions in this space which will deliver high growth revenue this decade are finding it hard to find sufficient capital given the detrimental effects of SPACs.

In the cleantech space, the SPAC founders — money people who put investments into a company with no purpose except to do a reverse takeover of some willing startup with much less due diligence — were taking larger and larger bites of the money raised. As I pointed out, the publicly available information indicates Energy Vault was left with only a couple of hundred million of the raised money. Others will remember Nikola, another SPAC venture, and its $125 million securities fraud payout.

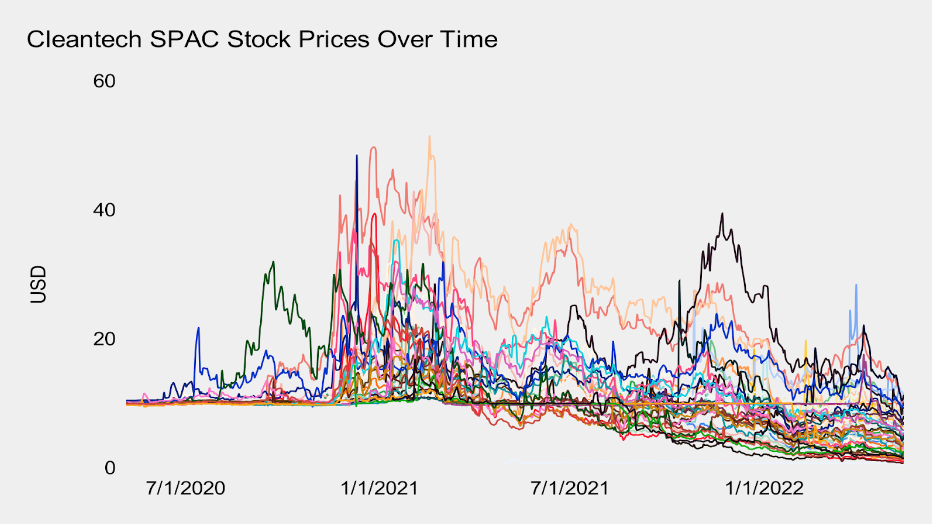

As the cleantech subset of SPAC investing shows across the 56 closed deals I was able to identify, the combination of lack of due diligence and lots of capital looking for cleantech led to massive pump and dump problems. The firms with decent solutions among the 56, and there are a few, are left with investors expecting revenue aligned with peak valuation, and typically with at best enough money to keep going, but not enough money to change the world.

Energy Vault’s claims as it went public through a reverse takeover SPAC did not withstand the slightest of technical or business scrutiny, yet it inflated to a market capitalization of $3 billion USD.

There’s a lot of excellent work going on in cleantech, and there are a lot of good investments. But there are also a lot of people attempting to cash in without moving the climate action needle forward. Caveat emptor.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

Glen Jordan

Sustainable Lifestyle · Sustainable Living

illuminem briefings

Architecture · Carbon Capture & Storage

illuminem briefings

Labor Rights · Climate Change

Financial Times

Carbon Market · Public Governance

GB News

Carbon · Sustainable Mobility

The Independent

Effects · Climate Change