Marine shipping will change radically, electrify and consume biofuels to decarbonize

· 12 min read

Global shipping, deep-water, short-sea and inland, is a major contributor to global warming emissions, roughly 750 millions tons of CO2e annually before COVID. Moving tens of thousands of tons of goods tens of thousands of kilometers takes a lot of fuel, currently it’s all fossil fuels, and frequently the filthiest of them.

Over the past two years, I’ve been finalizing my first pass of likely decarbonization pathways of all transportation through 2100. As I noted in a recent article where I articulated why biofuels were the primary replacement for any transportation mode that couldn’t be electrified, that we had enough carrying capacity and that food supplies wouldn’t be impacted, this has been a nine-year process. And to be clear, everything except a portion of marine shipping can be electrified directly by 2100 in my opinion.

All ground transportation will be electrified, either grid-tied for trains and potentially some heavy freight trucks, or with batteries or a hybrid of the two. As I noted in a separate article, China, Europe and India are electrifying all rail rapidly, with North America as the sole outlier. Aviation will depend on a mix of biofuels and batteries to decarbonize, with battery energy density by mass and other innovations allowing pan-Pacific flights by perhaps 2060 or 2070, and most airframes replaced by 2100 in my assessment.

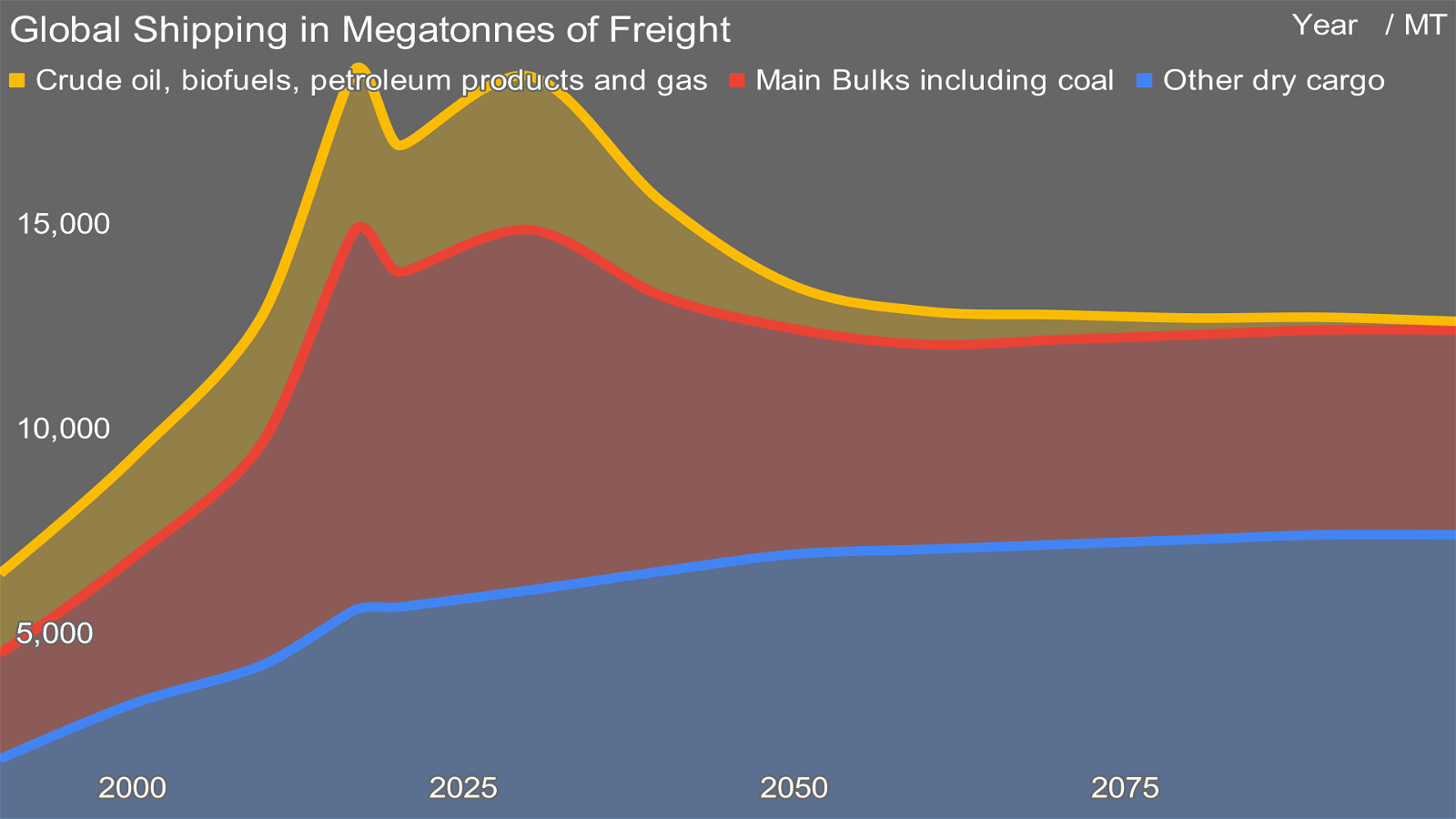

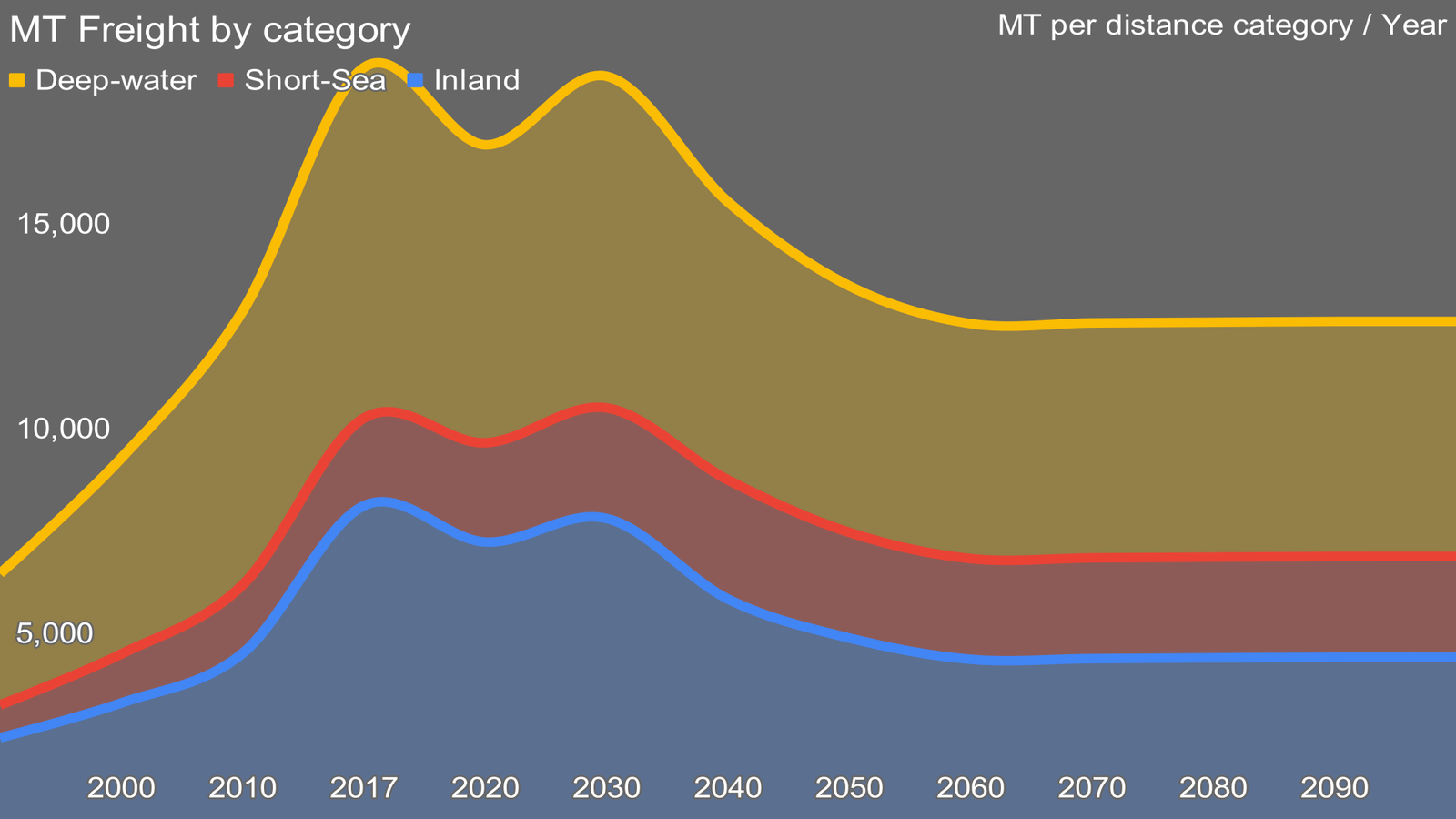

But until recently, I had not completed my assessment of the likely pathway for marine shipping decarbonization. I had already assessed the global freight megatons for inland, short sea and deep water shipping. I’ve updated my earlier projection through 2100 to reflect my learnings and feedback I’ve received since that initial publication. Note that I started in 1990 to provide context for the very rapid growth of shipping through 2017.

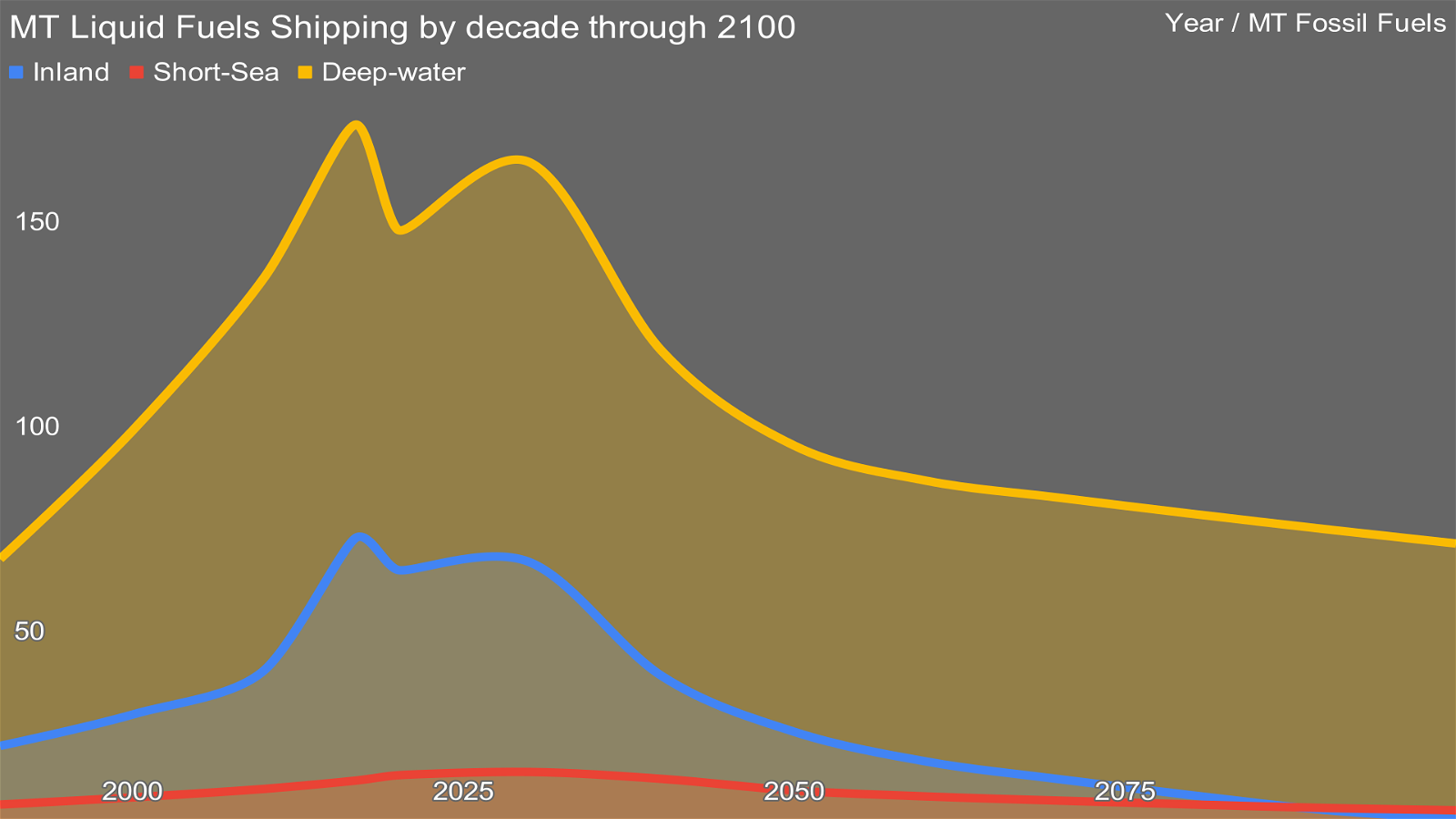

COVID, of course, changed shipping substantially, although not nearly as much as in the case of aviation. But there was still a dip. The return of shipping, however, is temporary. A decline is coming. Why? 40% of deepwater shipping is bulk coal, gas and oil. Most of that is going away. By 2100, perhaps 5% of oil will still be being extracted, processed and refined, but it will be almost entirely for high-value industrial feedstocks, not for burning as fuel. And as my assessments of transportation make clear, replacement liquid and gaseous fuels will not be replacing the sheer mass of fossil fuels we move across the seas today.

Coal demand peaked in 2013, with a brief return to those levels during the energy crisis of late 2022. But it’s dropping again. Among other things, the rise of renewables in China has been massive, with the 13 years from 2010 to 2022 adding about 1,400 TWh of renewable electricity to the grid every year and a further 240 TWh of nuclear energy. And China isn’t slowing down on deploying low carbon electricity, although the analysis makes it clear that they are doing much better at adding renewables than nuclear, unsurprisingly. India too has been aggressively transforming.

Most major analysts are now projecting a good likelihood, especially with the European energy crisis, that peak oil demand will occur between 2025 and 2030. That means the start of a massive market shift for oil away from the heaviest, sourest and furthest from water sources like Alberta’s, but it also means that reduction in bulk oil shipping likely will occur in the next decade and then accelerate in the coming decades.

And my assessment of the silver linings of Europe’s energy crisis is that it will accelerate peak natural gas demand as well, which I project is likely by 2035. All three bulk fossil fuels will see tumbling shipping megatonnage in the coming decades, which is a good news story as all of the fuel required to push them through the ocean goes away as well.

Another 15% of bulk shipping is raw iron ore. That too will be diminishing, for three reasons. The first is that much more of the world’s steel will be coming from existing steel that is scrapped and fed through electric steel minimills to make new steel. With the coming reductions in fossil fuels, all of the massive amounts of steel in fossil fuel infrastructure and distribution will become available as scrap. The USA alone has over 5 million kilometers of pipelines, as one example. Those pipelines, pumping rigs, processing facilities, refineries, marine tankers, rail freight cars, road freight vehicles and the like are all becoming obsolete, easily mined sources of valuable steel. The fossil fuel industry is likely the single biggest demand center for steel, that’s all going away and it’s a resource that’s already processed.

The second is that the price of fuel for shipping will be increasing. There is no alternative that is cheaper than the left overs from refineries that are burned today when we allow the atmosphere to be used as an open sewer. The age of free negative externalities is ending, and the replacements are all more expensive. More expensive shipping means more local processing, on balance.

The third is that current new steel manufacturing requires coal, and much of the iron ore is steaming to the same ports as the bulk coal. However, in the future, the only requirement is electricity and perhaps water. Direct reduction of iron ore using green hydrogen or even electricity is being demonstrated today, and so running electrons to where the iron ore is extracted and processed to make sponge iron or steel for shipping becomes much more sensible in most cases. Much lower volumes and mass, most likely containerized instead of bulk.

The impacts will be felt differently by different modes of shipping. As I could find no available integrated data set for marine shipping that included deep water, short sea and inland shipping, I aggregated my own data set and calculated and projected tonnage in those categories through 2100. It was enlightening. I had not realized how large-scale inland shipping was, and shouldn’t have been but still was surprised that China had 50% of the world’s inland shipping. The full work up for how I did that is in the earlier publication and I encourage informed readers to go there to help me improve upon it.

Of course, there are also multiple efficiency measures that are completely viable, levers which will be pulled for shipping as fuel prices increase. Simply slowing ships down saves a great deal of fuel, and container ships will likely no longer be sprinting through the water quite as rapidly as they do today. Hull innovation continues, with the Ulstein X-Bow being top of mind, and suitable for container shipping as well. Container ship front aerodynamic additions are being used to smooth air flow around the stack of containers already. Advances in defouling including ultrasonic fouling prevention technology and defouling robots will keep hulls slipperier, reducing fuel demand. I’ve factored efficiencies into the projections as well.

All of this, of course, was in aid of understanding the CO2e concerns for marine shipping going forward. But as with other modes of transportation, the first question is what portions of marine shipping could be electrified with batteries. And the answer is quite a lot, in my opinion, especially given the significant reduction in deepwater shipping and the increasing shift to containerization, a trend documented in the recommended book by Marc Levinson, The Box: How the Shipping Container Made the World Smaller and the World Economy Bigger. Why does containerization matter? Because standard twenty-foot equivalent (TEU) containers are perfect for packing with batteries as is already happening for stationary grid and behind-the-meter storage. My assertion is that they will be used by both trains and ships, being winched on and off of both and stacked in transshipment ports for charging.

That’s going to take a while, as while battery energy density today is just fine for a multitude of marine uses, it needs to increase to enable larger ships and longer distances. And ships last a long time, as well.

And even with the reductions of deepwater bulk freight and electrification of significant portions of the segment, that still leaves roughly 70 million tons of fossil fuels worth of energy that has to be supplied in 2100. Obviously that’s not an acceptable carbon debt, and so will have to be mitigated as well with low-carbon fuels of some sort.

That’s where I left it last year. I knew that hydrogen wouldn’t be the fuel. Its energy density by volume and other characteristics made it deeply unsuitable as is. Biofuels were certainly an option as we’ve been making the stuff since Rudolph Diesel himself manufactured the first version of it in 1890. The chemistry and process is very well understood. But others are betting on other options.

One excellent conversation I’ve had recently was with Lynn Loo, currently the founding Chief Executive Officer at the Global Centre for Maritime Decarbonisation (GCMD), based in Singapore. Loo has a PhD in chemical engineering from Princeton, founded and was the initial Director of the Andlinger Center for Energy and the Environment at Princeton, and was a professor at Princeton for years as well. Setting up the GCMD, which has a similar budget but quite different goals than the Andlinger Center, fell into Loo’s lap while she was on sabbatical in the Little Red Dot and COVID struck.

Loo had reacted to my recent publication on biofuels, saying that while she was bullish on biofuels as well, in the opinion of the GCMD and the industry that they weren’t the only answer. And that’s a reasonable opinion. I spent nine years and a lot of brain cells coming to my conclusion, but the GCMD is running three multi-million dollar trials at present. One is biofuels, a second is ammonia bunkering and the third is on ship carbon capture. Maersk is betting on green methanol, and has purchased dual fuel ships and some green methanol supply. Others are on the ammonia bandwagon as I documented in my report on the EU’s hopes for green hydrogen from Africa filling their energy void. Others still haven’t got the memo on hydrogen, and think that there’s going to be a big business in shipping it in liquified form to replace LNG, and using the boil off to run the ships as LNG shipping often does today.

I fully support the projects the GCMD is undertaking, and expect two of them to prove that ammonia and on ship carbon capture are dead ends. That’s a worthwhile undertaking, to run experiments that can concretely demonstrate that. It’s money well worth spending. And well worth doing as efficiently and quickly as possible, so that when port transformations start, they don’t waste time on the wrong things. Even in my projections ports are going to transform substantially, with much larger amounts of electricity flowing in, set aside for battery-filled TEUs, biofuel bunkering and a transformation away from bulk toward greater container shipping. That’s a very large number of very large infrastructure projects.

Thinking slow so that the port industry can act fast is what the GCMD is in the business of, which is why I introduced Loo to Bent Flyvbjerg, global megaprojects expert, Danish knight, inaugural Chair of Oxford’s Said School of Business’ BT Professor of Major Programme Management and author of the book, How Big Things Get Done, which I highly recommend, and would even if a bit of my material weren’t in it. Ports currently aren’t in Flyvbjerg’s data set and that’s a gap that funding would enable his team to overcome. And the port industry could really use Flyvbjerg’s insights to deliver transformation faster and with lower risk.

But having done the underlying chemistry, math and economics, I’m betting on batteries and biofuels. There’s vastly more than enough minerals necessary for batteries as they are highly reusable, and highly recyclable. Once we’ve mined the metals once, they’ll be good for potentially centuries, unlike the fossil fuels that they will displace.

And I’ve done the math for global transportation total fuel demand with longer haul aviation and marine shipping as the outliers that can’t electrify. And built the fuel demand curves aligned with long term strategic drivers including solving climate change, the end of population growth between 2070 and 2100, diminished demand due to higher prices of fuel, increased demand due to higher global affluence, and more. The megatons of biofuels required for the two areas where they have value is lower than the feedstock capacity of one of eight or so biofuel pathways, stalk cellulosic ethanol to biofuels, where corn, wheat and rice stalks are diverted to fuel while the ears remain calories for animals and humans.

I’m satisfied that biofuels are fit for purpose, we have enough of them, they won’t interfere with food for humans or animals, and that they’ll be cheaper than any alternatives. And that there are seven more biofuel pathways. They’ll also be lower carbon. The thing about all synthetic fuels is that they multiply the CO2e per MWh of electricity used to manufacture them. While energy will trend lower over time as industry and distribution electrifies, biofuels are much lower CO2 than fossil fuels right now and rapidly improving. With improvements in agriculture — precision agriculture, low-tillage agriculture, agrigenetics for nitrogen fixing and moving subsistence farmers off the land —, stalk cellulosic carbon debt will trend to zero. I don’t project, as some do, that it will trend negative, but to zero yes.

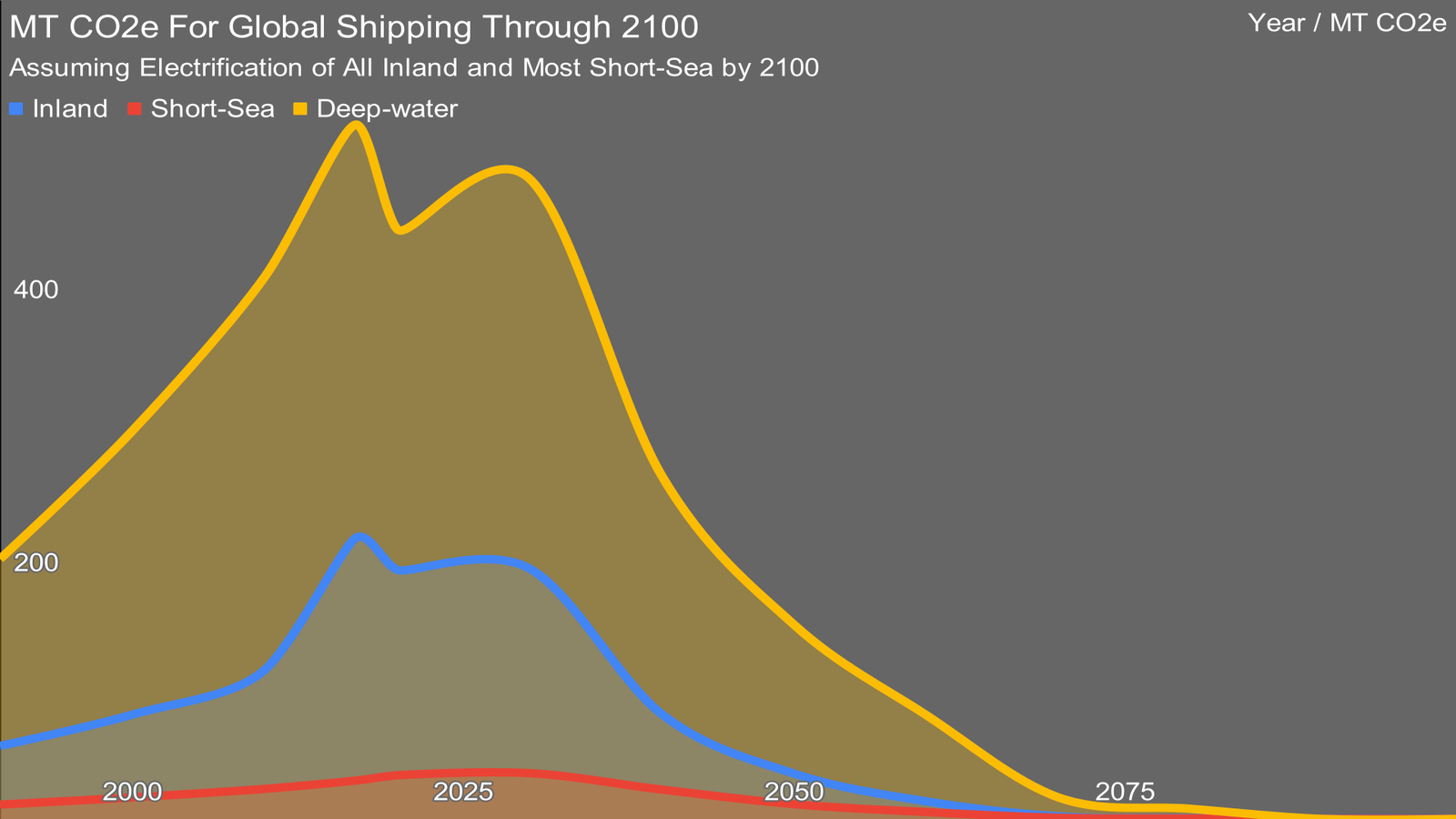

And so, the chart I couldn’t complete in 2022. A projection of global CO2e from marine shipping through 2100 that is aligned with a reasonable projection of what all freight shipping will look like decade by decade, all the levers that will be pulled, global freight demand changes, electrification and biofuel decarbonization.

Is this what will happen? No, of course not. Obviously the error bars are large. Obviously the global marine shipping industry is not going to do this voluntarily. Obviously governments have to force pricing of the negative externalities of CO2e emissions or regulate bunkering, most likely both. Obviously there are going to be fits and starts as green hydrogen and synthetic fuels from it run their course and fail (and as a reminder, there are numerous people who think they won’t). Obviously there will be local variances within the big world we live in. Obviously the fossil fuel industry will be working to delay transition, and to make blue hydrogen the solution despite its massive downsides and costs. Obviously it will be faster or slower in different components at different times.

But I think that this scenario is closer to correct than most. And it’s a good news story. This represents very significant decarbonization of this segment by 2050. As a reminder, with 11% of global energy flows going to extract, process, refine and distribute fossil fuels, and with the much higher efficiency of electrification, we are a lot closer to a decarbonized future than most people realize, and the transition will be faster.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Shared Mobility · Tourism

illuminem briefings

Nature · Maritime

illuminem briefings

Maritime · Public Governance

The Guardian

Maritime · Pollution

Offshore Energy

Carbon Regulations · Public Governance

The Guardian

Maritime · Mobility Tech