· 2 min read

🗞️ Driving the news: 30% of shareholders of major US banks, including Goldman Sachs, BoA and Wells Fargo, supported proposals put forward by environmental activists calling for a plan to phase out financing of fossil fuel projects by 2030

🌎 Why it matters for the planet: The support for these resolutions (against the boards' recommendation) highlights the pressure on banks regarding their financing of carbon-intensive companies

- The largest sovereign wealth fund globally, Norway's oil fund, supported the transition plan resolutions proposed at BoA, Wells Fargo, and Goldman Sachs, along with Legal and General Investment Management

⏭️ What’s next: The rejection of the proposals does not mean the end of the push towards sustainable investments

- Watch for upcoming shareholder meetings at JPMorgan Chase (May 17th) and Morgan Stanley (May 19th), where similar resolutions will be tabled

💬 One quote: "Pressure is only going to increase" (Danielle Fugere, President, As You Sow, one of the activist groups behind the proposal)

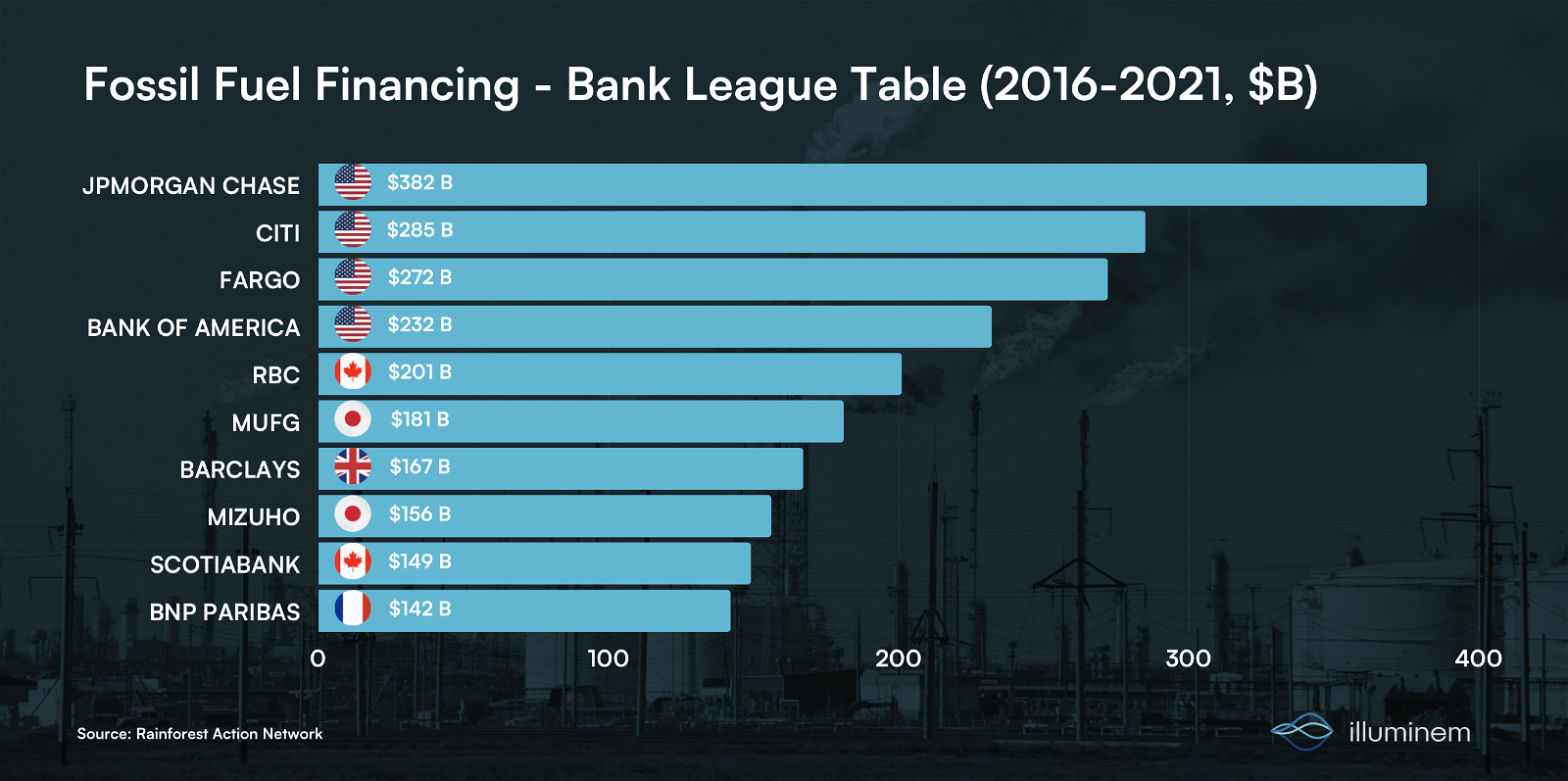

📈 One stat: The six largest US banks financed $1.6+ trillion in fossil fuel projects since the Paris Agreement (2016). This represents a 10% increase the previous five-year period (source: RAN)

Click for more on sustainable finance