BNP Paribas to halt funding for new gas projects

· 2 min read

To bring you all sustainability information in one place, we are testing a new type of short summary called “illuminem Briefings”. Please let us know your feedback!

🗞️ Driving the news: BNP Paribas, the eurozone’s largest bank, announced it will cease financing new gasfield projects. This decision further limits its funding for fossil fuels, following mounting legal action from campaigners against the bank's support of the sector

🌎 Why it matters for the planet: Activists are urging BNP Paribas to progressively restrict all of its financial services to companies that don't abandon new oil and gas projects

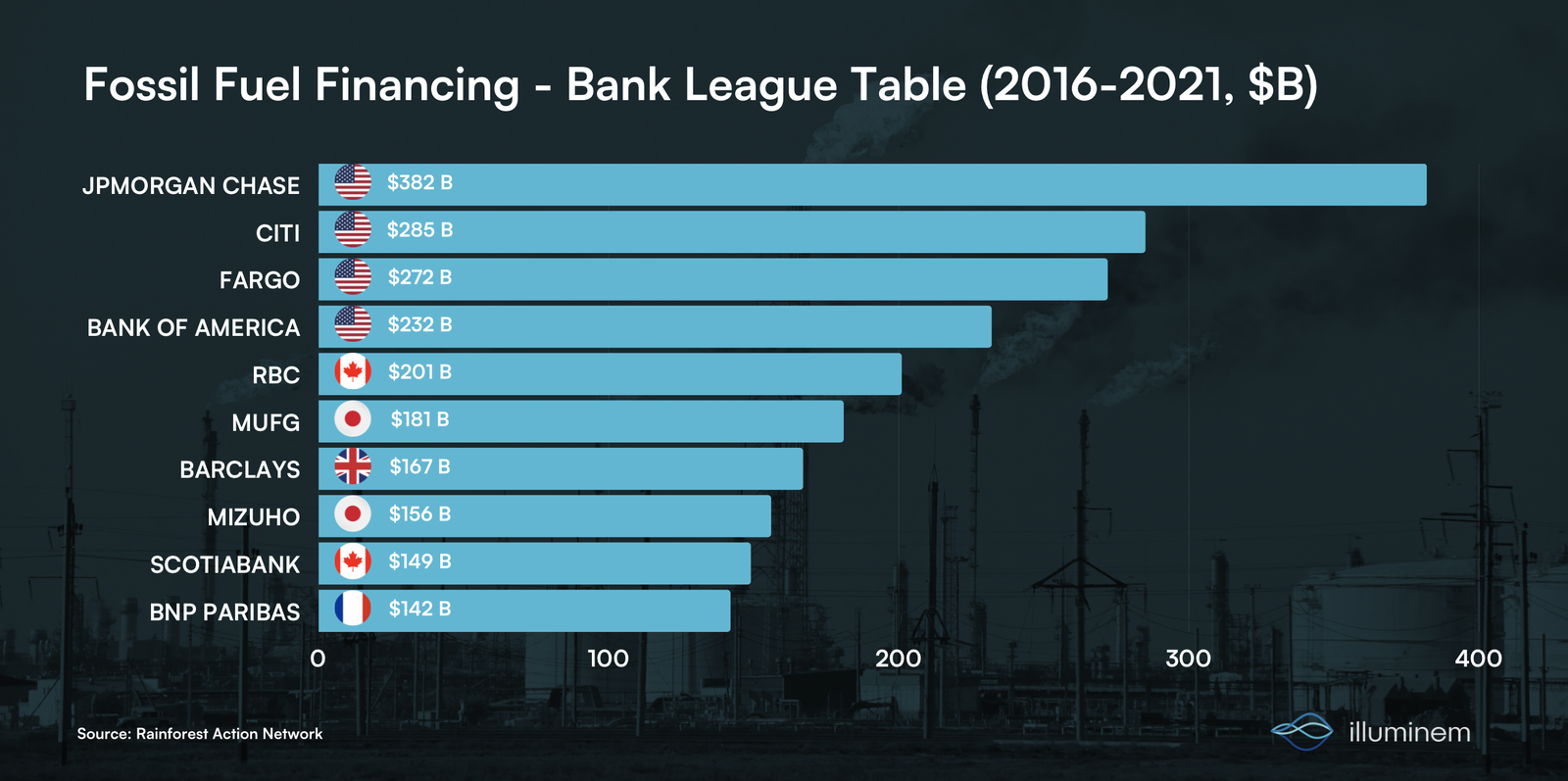

The Rainforest Action Network estimated that BNP had provided $20.8bn worth of financing to the oil and gas sector in 2022, more than any other European bank, and a total of $165bn since the Paris climate agreement in 2016

⏭️ What's next: This decision is indicative of the broader shift in the banking industry as it faces increasing pressure to divest from fossil fuels

Watch for upcoming shareholder meetings at JPMorgan Chase (May 17th) and Morgan Stanley (May 19th), where environmental activists put forward proposals calling for a plan to phase out financing of fossil fuel projects by 2030

📈 One stat: "This is a big step according to BNP, but a small step for humanity" (Alexandre Poidatz, Oxfam France’s head of advocacy)

⛏️ To dig deeper: Explore how & why radical climate activism is gaining traction

Charlene Norman

Sustainable Business · Sustainable Finance

illuminem

Climate Change · Environmental Sustainability

Responsible Investor

Sustainable Finance · ESG

Luxembourg Times

Sustainable Finance · Public Governance

ESG Today

Carbon Removal · Sustainable Finance

illuminem

Corporate Sustainability · Sustainable Business