· 7 min read

This article is part of Carbon Academy, a new illuminem series exploring the essential concepts within the world of carbon.

1. Introduction

As already examined in one of our previous articles, the carbon removal space can largely be divided into two main categories: technology-driven solutions and nature-focused solutions. In this article, we dive deeper into one of the main technology-based methods, biochar, examining the following aspects:

- What biochar is

- How long it can store captured CO2

- Cost and market size

- Benefits and risks

- Notable companies

- The factors that might influence its success, and the financial resources needed for its effective implementation

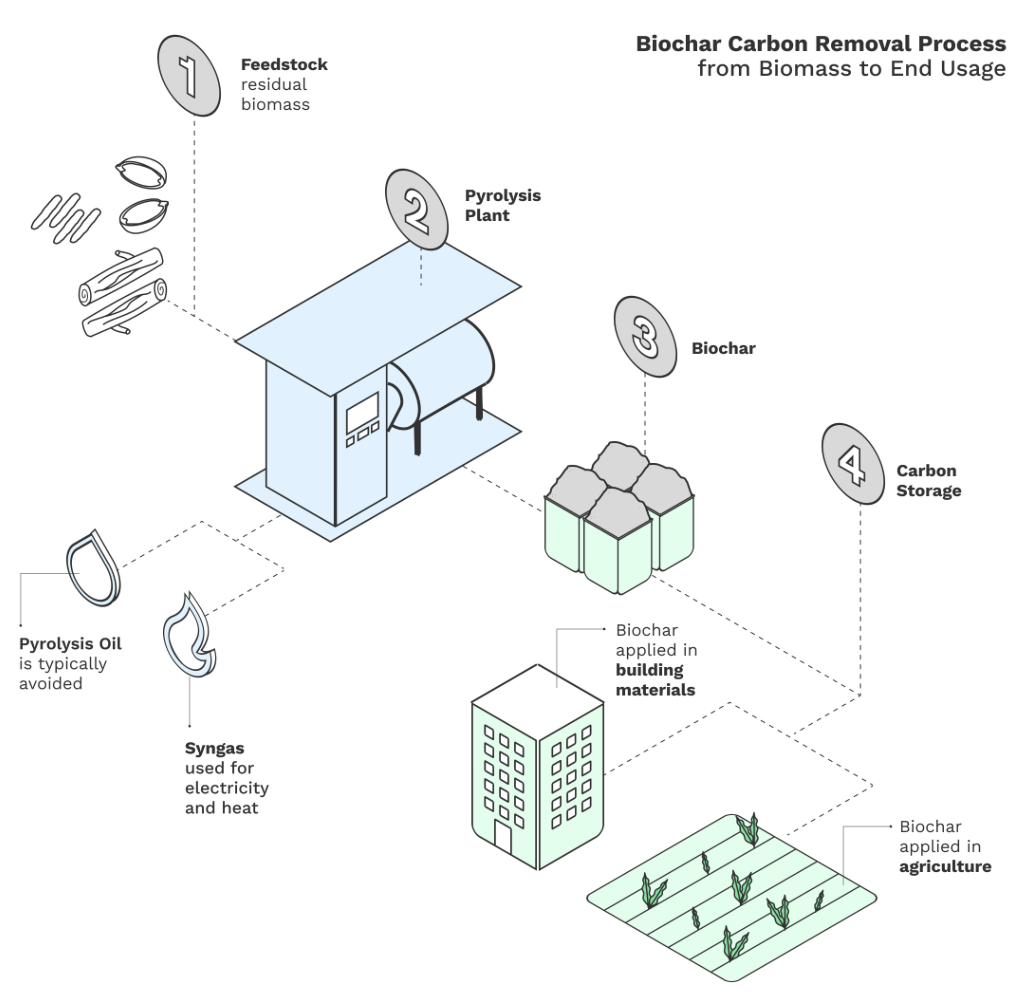

2. How it is produced

Biochar is a carbon-rich, stable soil amendment produced as a by-product of pyrolysis, a process that extracts energy from biomass without the presence of oxygen. Typically made from organic materials like wood chips, crop residues, or agricultural waste, biochar is created by heating these materials in an oxygen-free environment, preventing combustion. As the organic matter heats up, it undergoes chemical reactions that break down its complex molecular structure, releasing volatile gases and leaving behind a solid residue: biochar. This residue, once cooled and collected, becomes a highly porous material with a large surface area, making it ideal for soil amendment and carbon sequestration. By retaining the majority of carbon, biochar offers a sustainable solution for improving soil health and mitigating climate change.

3. Storage timescale & mitigation potential

Biochar decays 10 to 100 times more slowly than the original biomass, and scientific consensus holds that a substantial fraction of biochar stored in both controlled and open environments can remain stable for hundreds of years.

Considering its mitigation potential, biochar offers a vast capacity to sequester carbon dioxide annually. Studies indicate that biochar can sequester between 0.3 to 6.6 gigatons of carbon dioxide each year (GtCO2/yr).

4. Cost & market size

🔹 The average biochar price for 2023 was $131 per tonne

🔹 Biochar receives only about 12% of CDR funding but in 2023 it represented over 90% of delivered carbon credits.

🔹Valued at USD $600 million in 2023, the global biochar market is projected to grow to nearly $3.5 billion by 2025. Corporate buyers like Microsoft and JP Morgan Chase are significantly increasing their investments, indicating growing confidence in the biochar carbon credit market. Notably, in the first quarter of 2024, Microsoft has committed to purchasing 95,000 tons of carbon dioxide removal credits from a biochar plant in Mexico.

5. Benefits & Risks

5.1. Benefits

- Carbon sequestration: Biochar has the potential to capture carbon from the atmosphere and store it in soils for hundreds to thousands of years, mitigating climate change.

- Soil improvement: It enhances soil fertility by improving nutrient retention, water retention, and soil structure, leading to increased crop yields and resilience to drought and erosion.

- Waste management: Biochar provides a sustainable solution for managing organic waste materials, such as agricultural residues, forestry byproducts, and organic urban waste, reducing greenhouse gas emissions from decomposition.

- Reduced dependency on chemical fertilizers: By enhancing soil fertility and nutrient availability, biochar can decrease the need for synthetic fertilizers, thus reducing environmental pollution and the associated costs.

5.2. Risks

While biochar holds promise, it's crucial to acknowledge the challenges it brings. Here are some of the main ones, each ranked by risk level (source: RMI report):

a. Energy requirements (Medium risk)

While the energy requirements for collection and transportation are relatively small, pyrolysis consumes the most energy.

b. Water requirements (High risk)

Biowaste does not require additional water, but producing biochar at a gigaton scale is likely to necessitate dedicated forestry or crops that consume significant amounts of water. Such dedicated forestry should not be grown in locations at risk of water stress.

c. Fertilizer requirements (Low risk)

Biowaste does not require fertilizer, and there are currently dedicated crops available that require minimal fertilizer

d. Land use requirements (High risk)

Biowaste will not provide sufficient feedstock at a gigaton scale, necessitating the use of cultivated crops that require significant land. The increasing demand for biomass could lead to unsustainable harvesting practices.

e. Environmental impacts (Low risk)

Biochar presents minimal, manageable risks while concurrently promising advantageous outcomes for pollution mitigation and environmental remediation.

f. Carbon conversion efficiency (High risk)

Pyrolysis processes face potential competition from alternative biogenic pathways boasting superior sequestration rates. Despite this, contemporary commercial pyrolysis reactor technology typically retains 5% to 50% of the organic carbon in the resultant biochar, whereas wood burial retains over 90% of the carbon from the original feedstock

6. Notable companies

Below is a geographically arranged list of some of the major biochar industries:

United States

- Pacific Biochar: Based in California, this company converts retired biomass power plants into biochar production facilities, using organic material from forests to reduce wildfire risks. Pacific Biochar supplies biochar to agricultural suppliers and compost yards.

- Standard Biocarbon: Located in Maine, USA, Standard Biocarbon has raised $5 million from Nexus Development Capital to develop and scale their biochar production facility. They produce biochar from sawmill residuals and aim to capture 3,000 tons of carbon annually at their new facility.

- CharGrow LLC: Specializing in high-efficiency, low-emission biochar production technologies, it provides custom solutions for various feedstocks and applications.

Australia

-

Rainbow Bee Eater: An Australian company known for its Echo2 technology, which creates synthetic gas from biomass and biochar. They utilize low-value organic materials, such as forestry residues and crop leftovers, to produce biochar used as fertilizer and animal feed.

Sweden & Finland

- Carbofex: Operating in Finland, Carbofex produces biochar and high-quality pyrolysis oil from spruce wood chips. They have been active in the carbon removal sector, selling credits to companies like Shopify and Microsoft.

- Ecoera: A Swedish company and the country's first large-scale biochar producer. They create synthetic gas for heating and are involved in projects to develop climate-positive agricultural systems. Shopify has purchased credits from Ecoera.

Germany

- Carbon Cycle: Based in Germany, this company produces biochar from woodchips, which is sold to the farming sector across Europe. They also engage in the carbon credits market, selling credits to Microsoft among others.

- Novocarbo: Based in Hamburg, Novocarbo has secured €25 million in growth funding from SWEN Capital Partners. The company builds and operates Carbon Removal Parks that combine CO2 removal with the generation of regenerative energy and biochar production. They aim to expand their network across Europe to reach up to 200 Carbon Removal Parks by 2033.

- Carbo Culture: This company raised $6.2 million in seed funding in 2021. They use a patented "carbolysis" process to create biochar, aiming to remove significant amounts of CO2 from the atmosphere. Carbo Culture has also pre-sold carbon removal credits.

7. Path to success

Achieving enhanced carbon efficiency in production and ensuring a sustainable supply of biomass feedstock are indispensable prerequisites for success. The cost associated with the feedstock acquisition and transportation, and transportation of biochar to application sites are the main factor impacting the economic feasibility of biochar. Regarding the funding required for success, estimates range from $450 to $650 million over a period of 10 to 12 years.

8. Conclusion

In conclusion, biochar production and use remain highly variable, contingent on specific circumstances such as location, feedstock type, production scale, pyrolysis conditions, biochar pricing, and the type of cultivated crop. Despite these challenges, the biochar market is experiencing significant growth, with some experts referring to it as "black gold." The success and scalability of biochar will depend on continued investment and supportive policy measures, which will determine if it can maintain its growing trend.

Are you a sustainability professional? Please subscribe to our weekly CSO Newsletter and Carbon Newsletter