· 5 min read

Before a Carbon Credit is generated a strong methodology must be in place. This methodology defines the minimum parameters required to successfully implement a carbon removal project and generate an associated number of carbon credits. These parameters must ensure that the reductions are real, measurable and additional to what would have occurred otherwise.

Such methodologies are not exclusive to carbon markets. There are other environmental markets, such as Biodiversity Credits, which create a fungible market value for environmental conservation. Biodiversity offset schemes provide a transparent, consistent and scientific approach to assessing biodiversity values and offsetting the impacts of development on biodiversity.

Methodologies underpin market transactions by providing a standard unit of measurement as well as protocols that allow investors, and buyers to trust the product they are trading. To finance a carbon removal or reduction project, an investor needs assurance that the units generated will be marketable. A standard unit of measurement allows traders to provide liquidity to a market by ensuring that they can transact with other market participants. A rigorous methodology reassures buyers that the unit they are buying will genuinely create the impact it says it will.

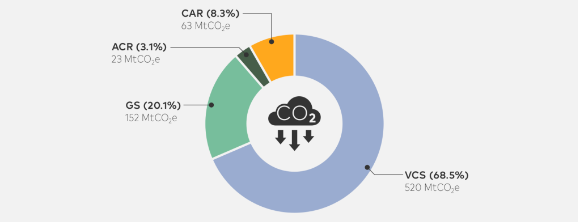

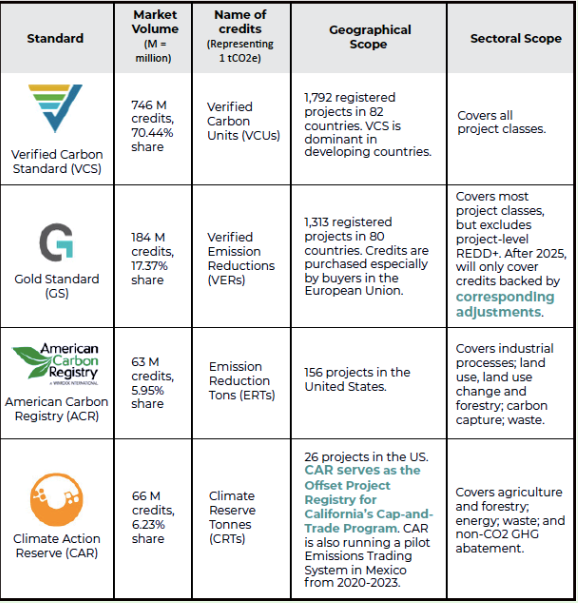

Today, there are hundreds of these methodologies administered by a multitude of organisations. Yet, there are only a handful who act as gatekeepers to environmental market participation. In the voluntary carbon market (VCM)this is particularly concentrated with one organisation, Verra, holding around 70% market share.

The organisations also cover a significant variety of projects. The 4 main types of carbon credit projects are:

- Forestry and conservation

- Renewable energy

- Community

- Waste to energy

Amongst these, there are a variety of sub-project types that cover everything from blue carbon (marine and mangrove) to cooking, energy efficiency and industrial processes. A good source to refer to if you are looking for more info regarding methodologies is the standards and registries themselves.

Verra alone has 6 different standards covering a range of different impact areas. The most well-known is the Voluntary Carbon Standard (VCS). Under the VCS Verra has developed almost 50 approved methodologies ranging from forestry standards such as

- VM0015 Methodology for Avoided Unplanned Deforestation, v1.1

Through industrial standards such as

- VM0040 Methodology for Greenhouse Gas Capture and Utilization in Plastic Materials, v1.0

There are also smaller standards that issue carbon credits in the VCM. Plan Vivo is a standard that sets requirements specific to smallholder and community projects in developing countries. In Australia, there are almost 40 methodologies that have been developed under the government’s Emissions Reduction Fund.

Such a large number of methodologies creates complexity, requiring significant expertise to support implementation and verification. This leads to a large number of intermediaries which adds cost to implementation. These methodologies were also built without considering the ability of technology to help them scale.

The methodologies outline the requirements for Measurement, Reporting and Verification (MRV). Today, MRV is often carried out in an old-fashioned, analogue, manual way, requiring physical measurements of physical assets — literally someone walking into a forest and measuring the girth of a random tree.

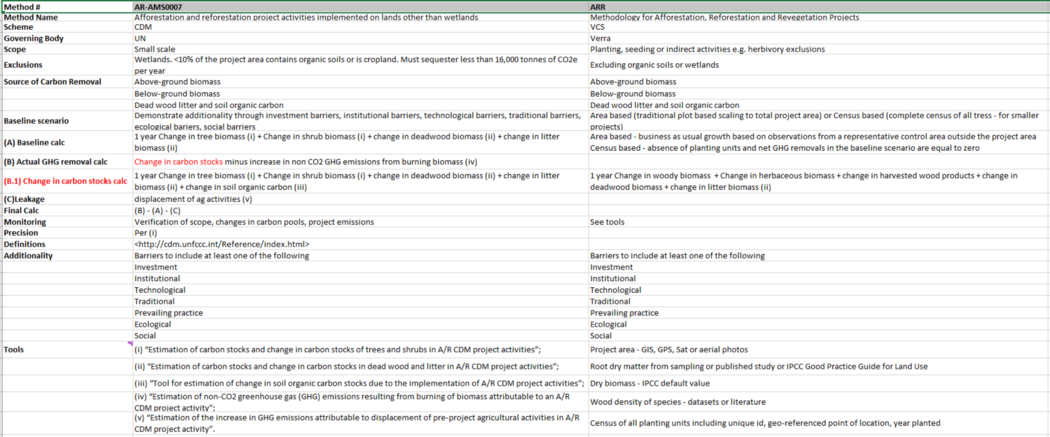

Let’s have a look at a methodology currently under development by Verra to see if anything is changing. The Methodology for Afforestation, Reforestation, and Revegetation (ARR) Projects is based on AR-AMS0007 Afforestation and reforestation project activities implemented on lands other than wetlands. It was originally developed under the UN’s Clean Development Mechanism (CDM)in 2012.

Verra’s methodology is built upon the CDM’s methodology. They both offer to generate credits for revegetation project activities that result in the removal of GHG from the atmosphere. There are certain exclusions, such as it cannot be done on wetlands, that apply across both methods. Both use various proxies to calculate impact, often taken from IPPC reports and guidelines or published literature.

Below you can find a summary of the similarities and some of the variances. Where the methods do differ are in the tools used to calculate impact. The CDM has developed internal tools that project developers can use to calculate impact. Note though that these tools are only used as estimations. They do require some field work to gather information such as “Ocular estimation of crown cover”. As such, it is necessary under this methodology to send an independent verifier into the forest to estimate how much the forest crown cover is growing or shrinking.

What all carbon projects generally share though is a standard unit of measure — a reduction or removal of Green House Gas (GHG) measured in carbon dioxide equivalent (CO2e). Having one credit equate to 1 Tonne of CO2e creates a fungible unit around which the market can trade. This standardisation ensures a level of liquidity but with so many different methodologies hardly two carbon credits can ever be alike.

This leads to an opaque market, where price discovery is difficult and value is hard to determine. Project developers cannot get financing for their carbon removal projects and must struggle to forward sell carbon credits in an illiquid market to advance their projects. Complex methodologies, requiring expert intermediaries make scaling carbon markets difficult.

So what do we need to scale? My view is that we need to balance the question of integrity, underpinned by market-accepted methodologies, with updated tools to automate measurement, reporting and verification. Specifically

- Digital MRV (dMRV) to replace labour-intensive, manual reconnaissance. Drones, remote sensing and satellite imagery

- Updated methodologies to emphasise dMRV

- Blockchain-based registries to ensure operational efficiency, full transparency and trust from provenance through to meta-registry

Getting the balance between integrity and scale is key. Environmental markets cannot afford claims of greenwashing whilst scaling these markets is crucial to meet the Paris goals and address the climate emergency. According to the Mark Carney-led Taskforce for Scaling the Voluntary Carbon Markets (TSVCM) voluntary action through the carbon markets will need to increase 15-fold by 2030 and 100-fold by 2050 from 2020 levels.

At Katalyst.Earth we are partnering with project developers and customers to create new incentive mechanisms that will scale carbon markets. By mixing digital MRV with blockchain technology we are creating a platform to make it easier for project developers to build and manage their projects whilst helping them to reach customers faster and more efficiently.

This article is also published on the author's blog. Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.