· 13 min read

I’ve been spending a lot of time pushing back on what appears to be a pervasive culture of doom fueled by an abundance of misinformed climate clickbait. Many on the outside of the recent COP27 summit in Egypt may have heard that it’s too late to achieve the target of limiting global average temperature rise to 1.5°C, which was enshrined in the Paris Climate Agreement in 2015. But on the floor of the convention, 1.5°C was very much alive with many diplomatic blocs, especially vulnerable nations and island states, joined by the U.S. and hundreds of civil society organizations calling for 1.5°C aligned government pledges (NDCs) by 2025.

On the heels of COP27, here are my 6 top reasons why I believe we can be cautiously optimistic about solving the climate crisis, getting the world on track to achieve the 1.5°C target.

1. Renewables have reached a turning point, and emissions will peak before 2025

After 200 years of fossil fuel expansion, we are at a turning point in the global energy system. Fossil fuels are getting less attractive and more costly everyday (even without carbon taxes), as investment opportunities in renewables and energy efficiency become more and more appealing. The International Energy Agency (IEA) in their recent World Energy Outlook has done an about-face and is now predicting that fossil fuel emissions will peak by 2025. Putin’s war in Ukraine and OPEC’s recent price hike has exposed the fragility of an energy system dependent upon fossil fuel supply chains. While there has been a temporary bump in production of oil and gas to respond to the emergency, the golden age of natural gas is over and will be replaced by cheaper, cleaner, and more reliable energy sources.

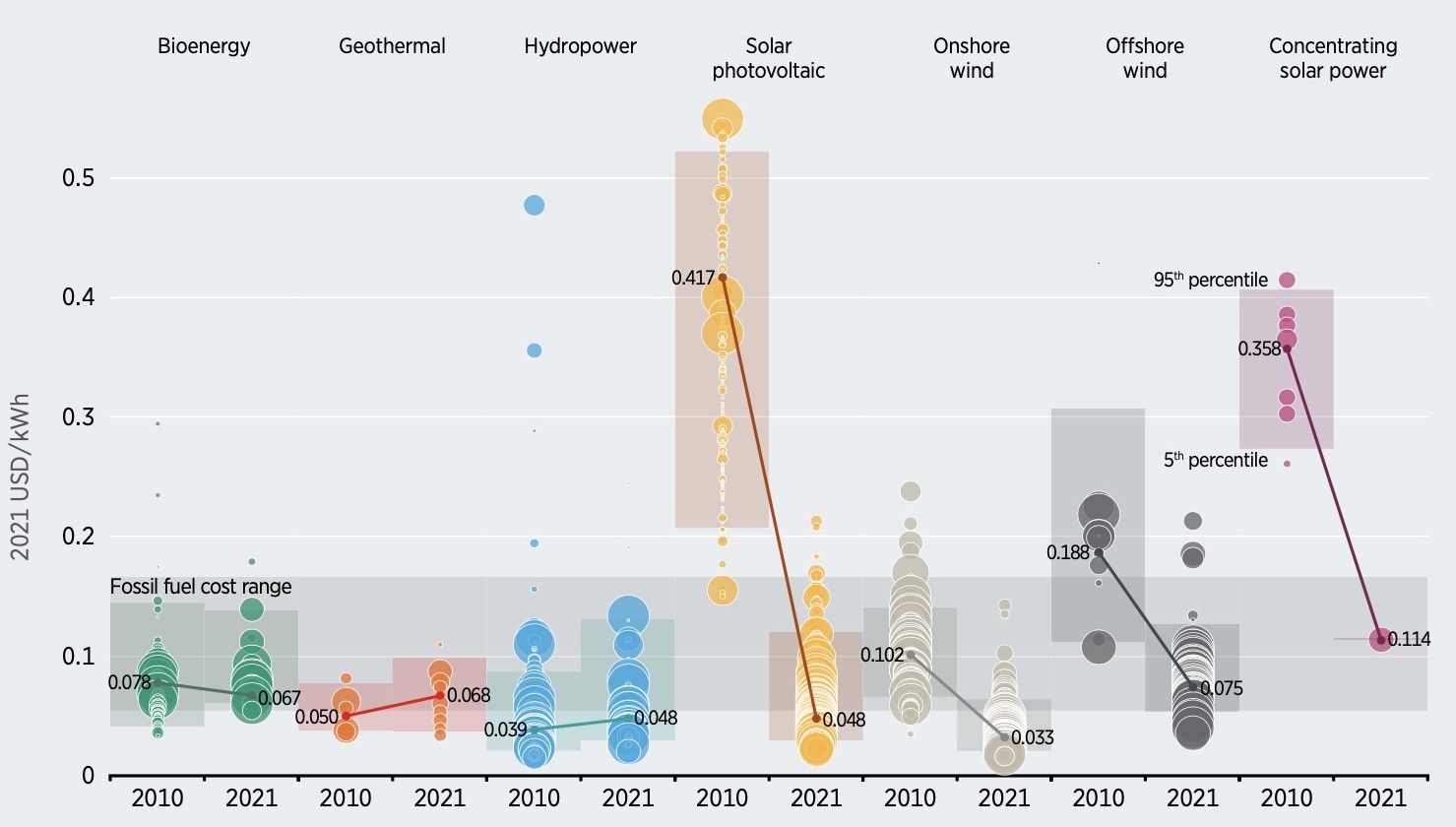

A new report by BloombergNEF finds that 87 countries have now reached clean energy tipping points with accelerated adoption of 10 critical technologies. The U.S. despite political intransigence, managed to go from 5% to 20% renewable power in just 10 years. Solar is now 33% cheaper on average than natural gas, and Xcel just set a record in Colorado — a utility solar project with storage at 4.5 cents per kWh (3 cents with subsidies), far below any form of fossil fuel generation. China single-handedly quadrupled global offshore wind capacity in a single year. And for the naysayers that continue to harp on about the environmental impacts of renewables, detailed analysis has shown that the harmful externalities associated with solar and wind energy are almost imperceptible relative to those of fossil fuels.

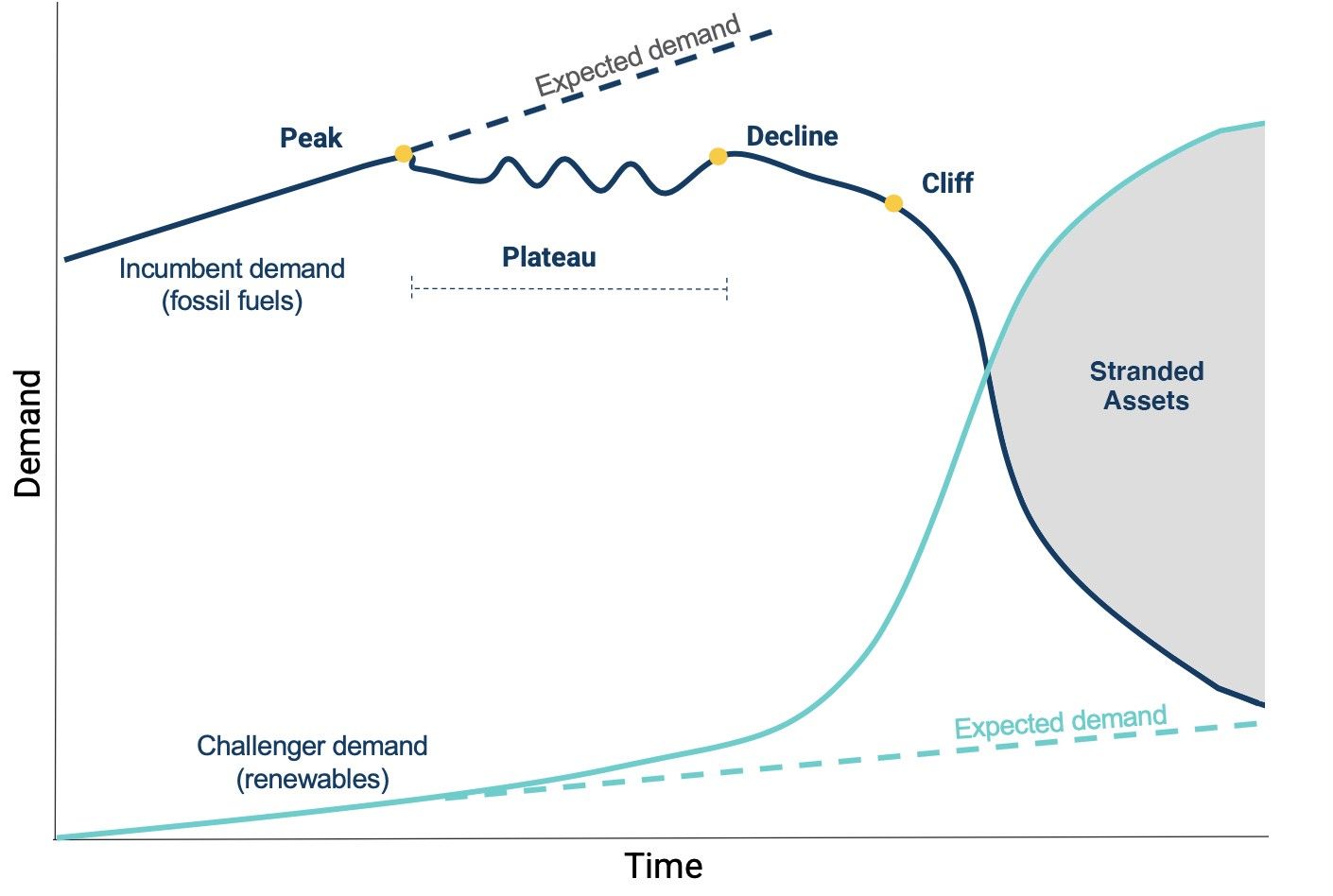

In fact, the University of Oxford in a new study shows that transitioning to 100% renewables would result in $12 trillionin energy savings by 2050 versus our current energy system. So effectively, solving climate change pays for itself many times over. The EU is beginning to experience the clean energy windfall first hand, with $29 billion in savings this past summer due to expanded solar power deployment. Kingsmill Bond at the Rocky Mountain Institute lays out a Theory on Rapid Transition and why it spells a decade of opportunity for some investors and a decade of pain for those wedded to their soon-to-be stranded fossil fuel assets.

2. The Climate Economy is about to explode with an influx of public funding.

I don’t think people have fully grasped the magnitude of the passing of the U.S. Inflation Reduction Act (IRA), which has at its center the single largest commitment of public dollars to address climate change to date — well over $800B in potential funding. Robinson Meyer’s excellent piece in The Atlantic entitled “ The Climate Economy is about to explode” breaks down how this will have enormous ripple effects globally, as international supply chains compete for those U.S. clean energy dollars and other governments ramp up their own stimulus packages. California, for example, just signed into law a whopping $54 billion stimulus for climate solutions, which is expected to create 4 million new jobs and cut pollution by 60% by 2030. And at the G20 summit, Indonesia signed a $20 billion deal with the U.S. to accelerate its clean energy transition.

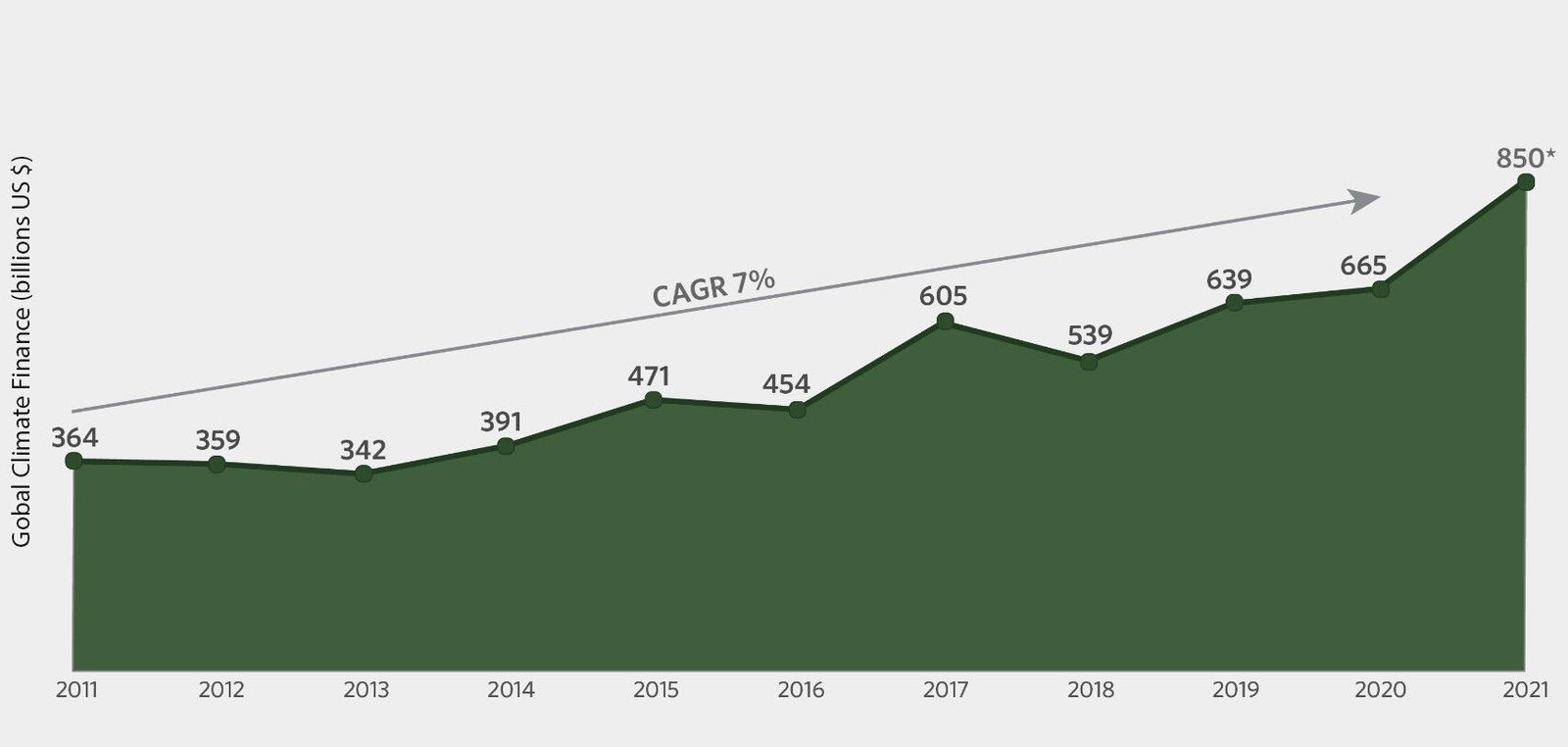

The Climate Policy Institute, which tracks finance flows for mitigation and adaptation efforts globally, is now projecting a record $850 billion in total investments in climate change solutions in 2021, with half coming from public funding sources. This is roughly equivalent to all global fossil fuel investments (which have been steadily declining). When the numbers come in for 2022, we will have officially reached an inflection point with climate investments exceeding fossil investments. And it will rapidly accelerate from here on out as many countries eye windfall taxes to capture and redirect some of the exorbitant inflationary revenue reaped by companies like Exxon and Chevron (both of which recently posted a 280% jump in profits). Green Bonds are also taking off, now representing a total of $1.8 trillion in issuances, and they could climb to $5 trillion by 2025 (PDF).

We’re also seeing Sovereign Wealth Funds (SWFs) and Multilateral Development Banks (MDBs) get in the game. The One Planet Sovereign Wealth Funds Network, launched by President Macron just a few years ago, has now grown to 45+ of the world’s largest institutional investors with more than $37 trillion worth of assets. This is a significant milestone, as SFWs have historically been a major driver in continued fossil fuel expansion. The network includes petrostates like the UAE, which hosted an annual gathering for the network in October, focusing on the clean energy transition. Concurrently, there is a new push for MDBs to open the floodgates of capital through relatively modest shifts in lending policies. An influential G20 report lays out a pathway for the development banks to relax their overly strict risk and capitalization requirements without losing their coveted AAA credit ratings. When implemented, this would unlock trillions to facilitate the clean energy transition in the developing world.

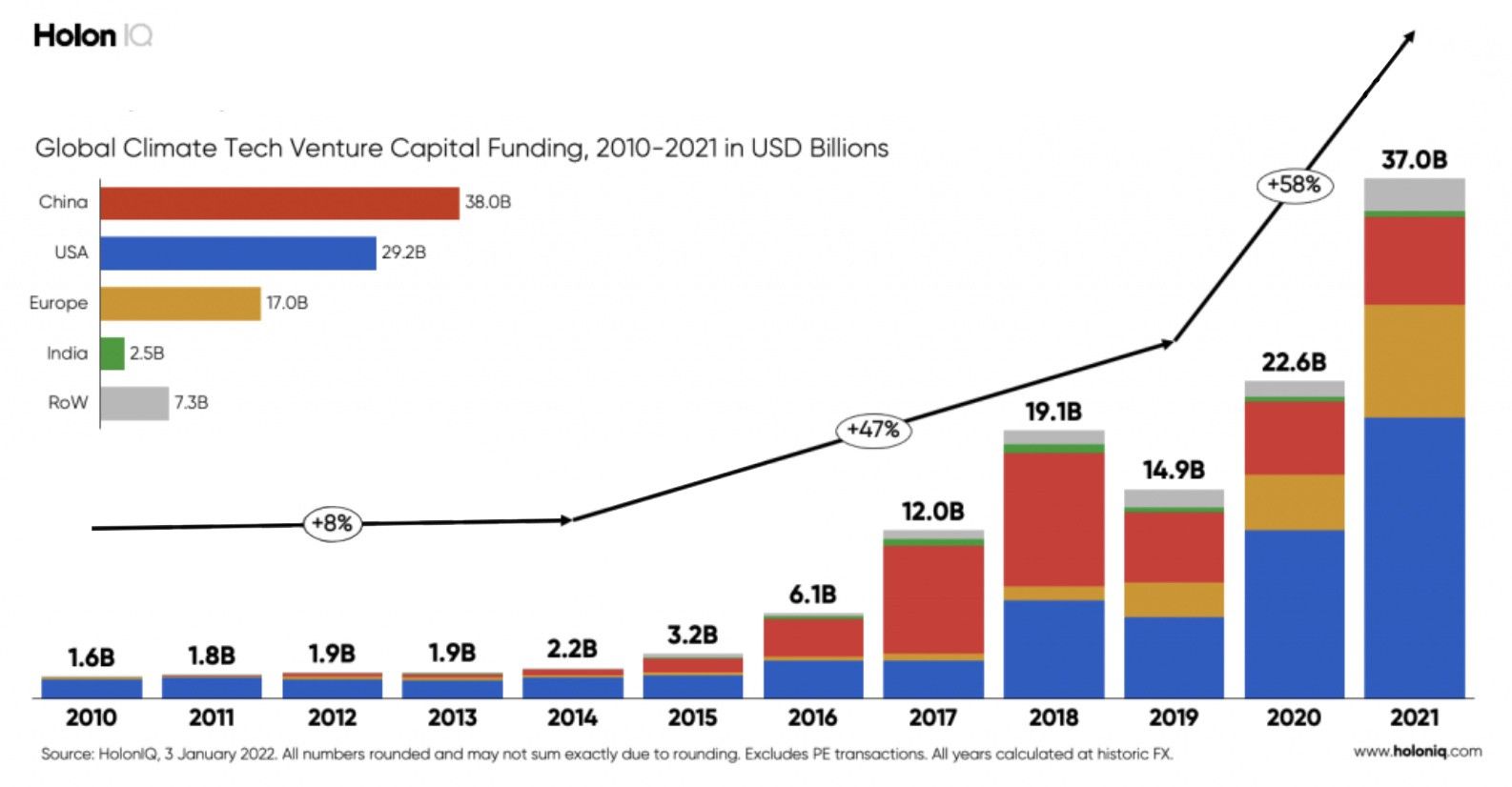

3. Private capital is flooding in, as climate becomes a major focus for investors.

For traditional digital tech companies, we’ve seen massive layoffs and capital constriction. But the climate tech sector is absolutely booming. Overall, climate tech venture capital reached 2.5x pre-pandemic investment levels in 2021 and it shows no signs of slowing down as the traditional tech sector declines. A new analysis by CB Insights found that in Q3 of this year, 50% of the biggest VC deals were in climate tech. These companies span the gamut of solutions — from renewable power and green fuels, to “nature tech” companies that advance forest conservation, to water processing technologies and climate-friendly agricultural solutions. The recently launched Climate Finance Tracker led by Vibrant Data Labs (housed at One Earth), tracks the new influx of private capital into climate investments, and ImpactAlpha is indexing an growing collection of stories on the new universe of investible opportunities in the climate space.

You might be thinking to yourself that this is all well and good, but what about the hard-to-abate industrial sectors like steel, jet fuel, and chemicals? The recently released One Earth Climate Model, a 2-year collaboration with leading climate and energy experts commissioned by the UN’s Net Zero Asset Owners Alliance, provides for the first time pathways to decarbonize even the most challenging nooks and crannies of the global economy. Some of the most exciting opportunities from an investor’s perspective may lie specifically in these industrial sectors. A Swedish green steel firmjust got the green light to build its first plant. Universal Hydrogen was just backed by major investors and aviation companies to deliver plug-and-play hydrogen fuel containers for domestic aircraft. Solugen just closed another $200 million for its highly lucrative “bioforges” that produce specialty chemicals without any carbon emissions.

The influx of money and opportunity for investors is matched by an influx of talent. There has been a mass exodus of top management and engineering talent out of the fossil fuel industry. Employees are fed up with the toxic work culture of legacy oil & gas companies (and their toxic products), and they’re heading for brighter opportunities in the clean energy sector. In parallel, there has been a mass exodus from traditional tech. Even before the big layoffs of November, top engineers were quitting in droves to join climate tech startups. Perhaps this trend is due to the sudden realization by people with high IQs that climate-friendly companies are going to fare much better over the coming decade and will likely become the dominant driver of economic growth.

4. Investors and governments are waking up to the massive risk associated with fossil fuel equities.

A stunning report by Finance Watch estimates that the world’s 60 largest banks are currently exposed to $1.35 trillion in fossil fuel assets whose value will drop dramatically in the transition to net zero emissions. Digging into annual shareholder reports, they found that the risk level associated with stranded assets is comparable to that seen just before the subprime mortgage crisis in 2008. AXA in its ninth global survey of 4500 top risk experts established, for the first time, climate change as the #1 global risk. People are finally waking up to the huge economic threats stemming from continued fossil fuel investment, and both governments and banking institutions are getting ready to crack down through incoming regulations. The European Union is now considering a ban on new fossil fuel investments, and the first major UK bank, Lloyds, just announced it will cease direct financing for new oil and gas fields.

U.S. Bank regulators are also joining in. The Federal Deposit Insurance Corporation and the Federal Reserve are moving a political mountain by organizing a joint exercise in 2023 to stress test six of the nation’s largest banks, examining the economic ramifications of climate change and energy decarbonization scenarios. According to a recent analysis by BloombergNEF the world is currently spending $838 billion per year on fossil fuel investments. This will have to get cut by half or more by 2030 (PDF) in order to solve the climate crisis, and with regulators suddenly interested in climate risk we could see an accelerated phase-down of fossil fuel investing within the next 5 years.

In a recent talk I gave at the 2022 ICE Climate & Capital conference, I laid out three distinct types of risk associated with climate change which asset owners and managers need to be thinking about. The first is physical risk, for example the increased flooding of roads, ports, or other key infrastructure assets that are essential for doing business. The second type are “stranded assets” — sunk capital in developing new fossil fuel reserves that will not be able to be sold due to shifts in government policy and markets more broadly. The third is social or brand risk, where a company is seen as a laggard (or worse) because of its association with the fossil fuel industry. Managing these risks in the coming decade will be tricky, but economists have proposed several brilliant strategies to support investors in gracefully transitioning out of fossil fuels and into climate solutions.

5. Investors are also getting very serious about their own transitions to net zero financed emissions.

It’s clear the pressure is on to reduce risk, but as investors move out of toxic legacy enterprises, where will they put all that money? How specifically, should they engineer their own financial transitions in order to support climate solutions that will deliver net zero emissions globally by 2050? These critical questions pertaining to financed emissions are being worked on by 7 distinct alliances underneath the Glasgow Financial Alliance for Net Zero (GFANZ), which includes 550+ member institutions with more than $100 trillion in assets — from asset owners and managers, to insurers and banks, to service providers and consultants. As Mahmoud Mohieldin, Egypt’s climate action champion, said at COP27, “Every company, bank, insurer and investor will have to adjust their business models, develop credible plans for the transition and implement them.” That hard work is now underway.

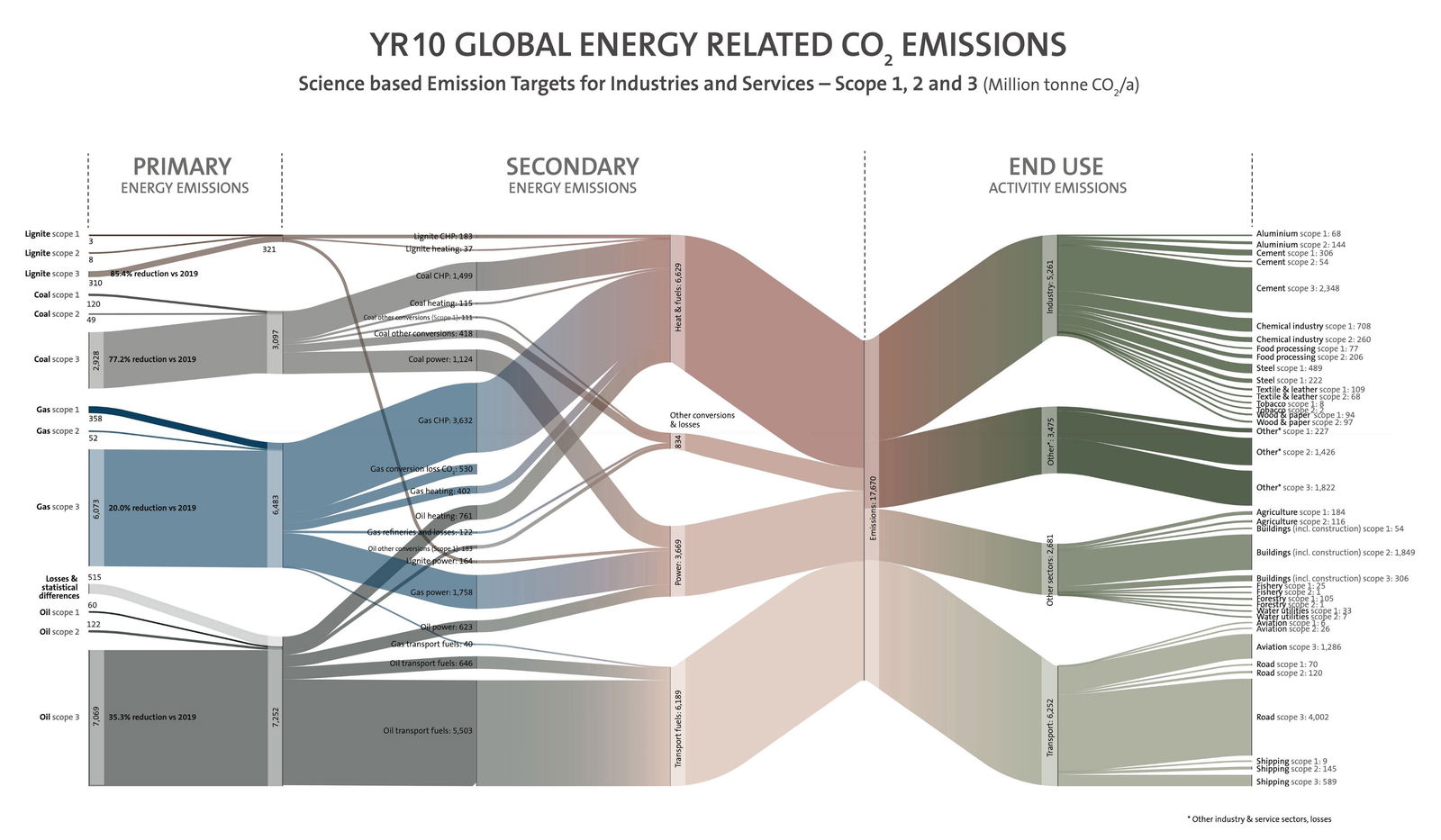

The Science Based Targets Initiative (SBTi), after years of haggling, was able to release fairly aggressive standards for corporate entities seeking to achieve net zero emissions. For most sectors this means a 50% reduction of actual emissions within a decade, and 95% or more reduction by 2050, with the small ‘net’ component achieved though carbon dioxide removals (aka neutralizations). Hard-to-abate sectors are given a little more leeway room, which has been criticized by some, but SBTi did succeed in creating a common baseline for the entire financial sector. A fossil fuel company, for example, can no longer claim neutrality simply by planting trees to offset gasoline emissions. Now that we know what net zero means for enterprises, institutional investors have a clear starting point. The UN-convened Net Zero Asset Owners Alliance (NZAOA), which commissioned a major update of the One Earth Climate Model mentioned above, offers a detailed transition scenario for all industrial sub-sectors, supporting asset owners and managers in advancinv internal decarbonization targets. The Net Zero Banking Alliance (NZBA) is also making progress, with more than half of members now setting 2030 targets.

This acceleration of activity is certainly due, in part, to external pressures and increasing visibility into Scope 1–3 emissions of every company and financial institution. Climate Action 100+ just put out their new stocktake and found that most companies pledging net zero do not have credible decarbonization strategies in place and are arguably guilty of greenwashing. A new UN high-level panel report entitled “Integrity Matters” lays out 10 recommendations for non-state actors to establish clear, science-based net zero claims, and warns of coming regulations. The Carbon Disclosure Project (CDP), with 18,700 companies representing half of global market cap, has now adopted a rigorous climate-related disclosure standard developed by the International Sustainability Standard Board (ISSB). It includes a new requirementto use climate-related scenarios to inform resilience analysis, a move that has been embraced by the G20, G7, and the global Financial Stability Board. This means no more wiggle room for greenwashing. In a sign of things to come, the Biden administration just announced a requirement for all U.S. government suppliers to disclose their net emissions per the new CDP standard.

For the 5 reasons listed above, I believe we will soon be seeing a mass exodus of dollars out of fossil fuels and into clean, renewable energy solutions. If we cut fossil finance in half and double investments in climate solutions by 2030 we can get on track for a 1.5°C. But there is a sixth reason that makes me think we might achieve this milestone even sooner — The greenwashing gig is up and people will abandon companies responsible for climate change.

This article is also published on the author's blog. Illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.