A vibrant moment for Sustainable Finance in Italy

· 3 min read

Since the beginning of the new year, economic analysts have been starting to drive their thoughts towards the aftermath SARS COV-2 pandemic. The first country in Europe to end all restrictions is the UK, whose government has just announced a feasible “freedom day” to forgive and forget the pandemic restrictions. But, in a way, these thoughts of “regaining” our previous lives are everywhere. Now, looking at the European economy, if ever there has been a specialty whose long-term strategies had been already put in place before the pandemic commenced, it was certainly Sustainable Finance. Active in the world of Sustainable Finance since 2004, the Sustainability Rating Agency Standard Ethics released its latest “Big Picture” of 2021 in February [1]. Thus analysing the efforts made by worldwide companies to comply with international standards on Sustainability defined by the EU, the UN, and the OECD. The report traces the main trends underlying the Agency’s rated companies, solicited and unsolicited. In the section entitled “Country In-Depth Analysis”, the Standard Ethics Research Office has described analytically the five biggest European Markets: the UK, France, Germany, Spain and Italy. [2] The subsequent picture made of Italy was shown as promising.

Now, if ever there were a pattern of correlation between the Bel Paese’ economics and sustainability outlooks, Italy would have been selected as a case study: after having been positively praised by the European Commission for its management of the pandemic. Italy’s sustainability rating was upgraded by Standard Ethics on March 13th, 2020 [3]. Before the rating upgrade, Italy successfully issued its first Green Bond Framework [4]. It implemented the first installments of the Next Generation EU Plan [5], and then it presented the National Resilience and Recovery Plan [6]. The perspectives for growth are somehow underway. Overall, not only did the Country show its awareness of the pandemic but it also found a feasible way to recover after it. Perhaps, driven by the major wager for future generations and growth that the Italian PM Mario Draghi has underlined recently [7].

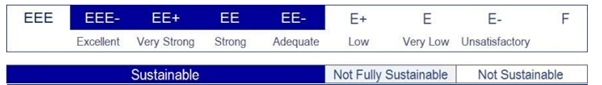

If we then wanted to delve into the Italian companies, the SE Big Picture still serves such a purpose. Looking over at Italian companies, Standard Ethics analysts portrayed a positive picture; since the majority (i.e. 55%) of the Standard Ethics Italian Index components currently have a Sustainable Grade. Such trend seems to have been drawn in by the Italian Banking industry, representing more than 35% of the Index components, whose trend is prominent: in fact, analysts state that “(…) Today, the industry presents a very advanced level of alignment on Sustainability” and thus that numbers at hand, while considering the Standard Ethics Rating scale (i.e. EEE-; EE+; EE; EE-; E+; E; E-; F), 61% of Italian Banks have a Sustainable Grade. [8]

Considering all of the above, we can easily hypothesize that this is truly a vibrant moment for Sustainable Finance in Italy. The pathway undertaken by Italy cannot go back now.

Future Thought Leaders is a democratic space presenting the thoughts and opinions of rising Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

[3],Standard Ethics – Press Release (2020) “Standard Ethics stabilizes Italy’s Rating”. London, 13 March 2020. URL: Microsoft Word - PressRelease_Italia_eng_12.03.2020_final (standardethics.eu).

John Leo Algo

Ethical Governance · Environmental Sustainability

Steven W. Pearce

Adaptation · Mitigation

illuminem briefings

Carbon · Environmental Sustainability

Politico

Climate Change · Agriculture

UN News

Effects · Climate Change

Financial Times

Carbon Market · Public Governance