A strategic storage vision for Europe

Unsplash

Unsplash Unsplash

Unsplash· 17 min read

Energy storage is a crucial element of a functioning energy system and covers three main functions. Firstly, it addresses the mismatch between supply and demand. Secondly, it provides a buffer against energy supply disruption, contributing to energy security. A third driver for storage is commercial. Prices fluctuate and traders and operators buy fossil fuels when prices are low, store, and take advantage of price fluctuations.

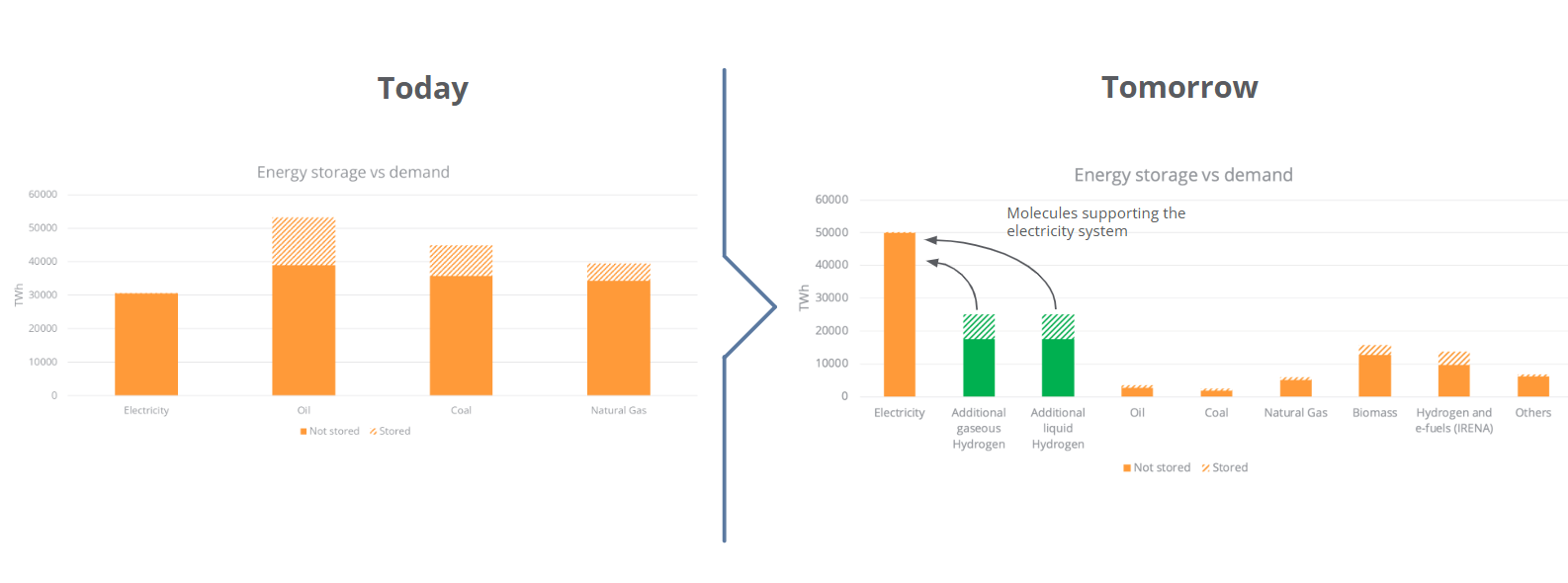

Most energy is stored and transported as a molecule, amounting to 20.8% of all annual molecular energy demand in the world. 26.8% of oil, 20.6% of coal and 13% of annual natural gas demand is being stored, amounting to 28,541 TWh in storage. Electrochemical batteries and pumped hydro storage amount to 9.5TWh, a mere 0.03% of global energy storage.

Europe has strategic reserves of oil and gas to ensure energy security and reduce price shocks. The strategic reserve for oil is linked to the EU’s obligation as part of the IEA membership and amounts to 1,047 TWh. The mandatory gas storage levels are currently 1,025 TWh.

Our future electricity system, which is expected to cover half of all future energy use, requires additional consideration for flexibility provided by storage and transport of molecular energy, something that is overlooked by most models aiming to construct a future clean energy system. We have used IRENA’s NetZero 1.5°C Pathway of their World Energy Transition Outlook 2023 but added additional hydrogen storage to create a functioning electricity system. We estimate that 50% of all future clean electricity is derived from hydrogen and derivatives, down from the current 60% molecules used in the electricity system. More quantitative analysis is required, but the role of hydrogen is much more important than most models predict. It is expected that in a future clean energy system, the same drivers behind today’s storage needs will determine the role of storage to create a secure and functional energy system. We assume that also in the future, 20.8% of all annual demand for molecules will be stored. (1)

Figure 1 . Energy storage vs. demand today and in 2050. The stored additional gaseous and liquid hydrogen are

systemically important for a functional future electricity system

Europe has strategic reserves for oil and gas and will in the future require strategic reserves for hydrogen and derivatives to cushion price shocks and guarantee energy security. In the short term a strategic reserve could also accelerate the clean hydrogen economy by disconnecting supply from demand. In line with current practice, we propose a strategic reserve of 25% of annual demand, implying 1.7 million tonnes of hydrogen and derivatives by 2030.

In addition to the EU strategic hydrogen reserve, which will be kept for war-like situations, an additional EU hydrogen balancing reserve will be mandated, much like the current EU natural gas storage mandate. We propose adding 15% of annual demand, or 1 million tonne by 2030.

In addition to the investment in the molecules that constitute the strategic and balancing reserves, investments in physical infrastructure such as salt caverns are required. This investment could be done by private infrastructure investors, backed by 10- or 20-year service agreements for the storage of the strategic and balancing reserves.

Since the declared policy goals of the European Union are to replace fossil fuels with renewable energy over time, we propose reducing the strategic reserves of fossil fuels in sync with the ramping up of strategic hydrogen reserves, based on replaced and equivalent energy value. The current price gap between fossil fuels and more expensive green hydrogen requires additional money. However, one should also consider that the value of fossil fuels will reduce drastically over the next decades.

The following are recommended steps:

Develop the European Hydrogen Backbone as formulated in the REPowerEU strategy and supported by European Gas TSO’s. (2)

Develop storage volume for clean hydrogen and derivatives for a strategic reserve of 1.7 Mt and for a balancing reserve of 1 Mt by 2030.

Realize a hydrogen storage capacity of 1.7 + 1 Mt by 2030 owned by public bodies, TSO’s or infrastructure investors backed by the EU or Member States.

Realize a strategic hydrogen reserve of 1.7 Mt and for a balancing reserve of 1 Mt by 2030, whereby the EU and member states buy green hydrogen over a defined period and finance it by selling fossil fuel strategic reserves plus additional funding from EU and member state sources.

The European Union’s energy system incorporates systemic storage, a substantial part of which are strategic reserves to cushion price shocks and guarantee energy security. The European Union’s energy security strategy is multifaceted, but storage of molecules is central. Strategic energy reserves currently consist of oil and natural gas.

The EU’s oil stock is governed by the IEA. Ensuring energy security has been at the centre of the IEA’s mission since its creation in 1974, following the oil price crisis in 1973. In accordance with the Agreement on an International Energy Programme (I.E.P.), each IEA country has an obligation to hold oil stocks equivalent to at least 90 days of net oil imports and to be ready to collectively respond to severe supply disruptions affecting the global oil market.

Member countries have substantial flexibility in how they meet the stockholding obligation. That can include stocks held exclusively for emergencies and stocks held for commercial purposes (both in the form of crude oil and as refined products), as well as holding stocks in other countries under bilateral agreements. Each IEA member country is thus able to determine how to meet their IEA stockholding commitment in the manner most appropriate to their domestic circumstances. In case of a severe oil supply disruption, IEA members may decide to release these stocks to the market as part of a collective action.

There are three approaches to emergency oil stockholding that countries can use to guarantee overall stock levels to meet a country’s 90 days’ requirement: industry stocks, government stocks and agency stocks. Several countries use only one category of stocks while most use a combination of the three. Along with other emergency policies, IEA members’ stockholding structure is assessed every 5 years as part of a peer-to-peer review process.

Government stocks are owned directly by the state, typically financed through the central government budget and held exclusively for emergency purposes.

Agency stocks are held by a separate agency, either on behalf of the government or domestic industry.

Obligated industry stocks are held by industry to meet minimum stockholding requirements set by governments. Typically, these are requirements set on certain companies (e.g. importers, refiners, wholesalers) to hold a minimum level of stocks based on their share of imports or sales in the domestic market.

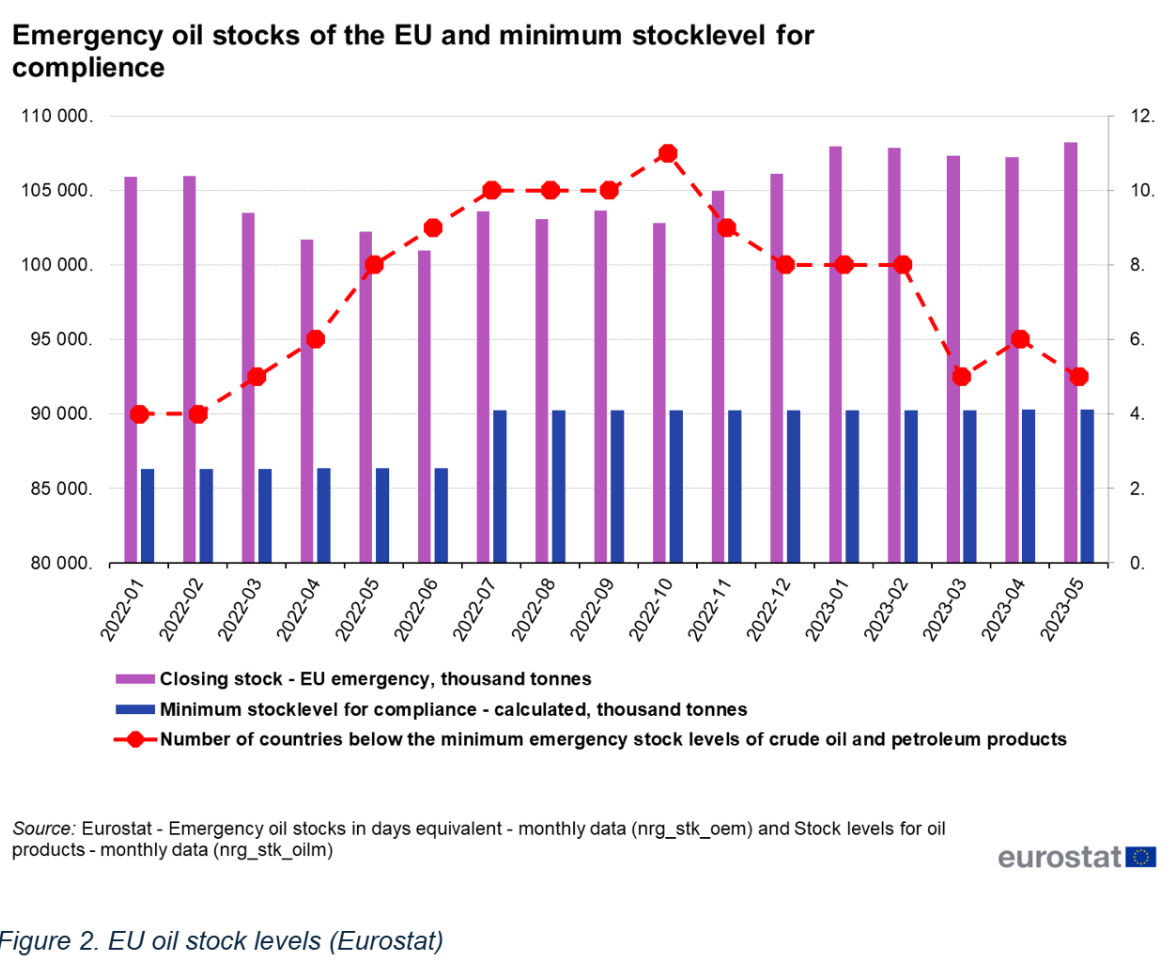

An overview for the strategic oil reserve of the EU is given in Figure 2 below. The required stock level in 2023 was 90 million tonnes of oil equivalent or 1,047 TWh (1 toe = 11.63 MWh).

Figure 2. EU oil stock levels (Eurostat)

In response to the global energy supply and market disruptions caused by Russia’s invasion of Ukraine, the Covid-19 pandemic, inflation and cyber security threats, the EU has implemented new energy security measures, especially regarding gas supply, storage and markets.

The EU implemented new gas storage regulation in June 2022. (3) The main obligatory target in the new gas storage regulation is that gas storage fillings need to be at least 90% as of 1 November of each year. In 2024, the target was reached well over 2 months ahead of the 1 November deadline. Gas storage levels reached 1,025 TWh or 90.02% of storage capacity (equivalent to just under 92 billion cubic metres (bcm) of natural gas) on 19 August. (4)

It should be noted that these mandated storage levels are not equivalent to the strategic oil reserves, in the sense that the stored volumes can and will be used. Their main purpose is to have sufficient gas for the European winter demand and

avoid price shocks, whereas the strategic oil reserves are really meant for war-like situations.

The EU Commission launched the EU Energy Platform in April 2022. (5) It aims at coordinating EU action on global gas markets to prevent EU countries from outbidding each other, whilst leveraging EU’s political and market weight to effectively diversify supplies, introduce direct competition between the world’s largest suppliers and achieve better conditions for all EU consumers. It covers a range of actions regarding natural gas and LNG (and in the future hydrogen) to support the EU’s security of supply and access to affordable energy, including international outreach, demand aggregation, and efficient use of EU gas infrastructures.

The EU Energy Platform include the AggregateEU mechanism that was launched in 2023. It plays a key role in pooling gas demand, coordinating infrastructure use, negotiating with international partners and preparing for joint gas and hydrogen purchases. AggregateEU pools gas demand from EU and Energy Community companies and matches this demand with competitive supply offers. Following the matching of demand with supply, companies can voluntarily conclude purchasing contracts with gas suppliers, either individually or jointly. AggregateEU is operated by the service provider, Prisma European Capacity Platform GmbH.

Whilst purchasing contracts between companies and gas suppliers remain voluntary, and can be done outside AggregateEU, EU countries must aggregate gas demand equivalent to 15% of their storage filling obligations, representing around 13.5 billion cubic metres of gas per year. Beyond the 15% storage volume threshold, the aggregation is voluntary but based on the same mechanism.

The European hydrogen market is characterized by big ambitions, but actual development is lagging. In December 2023 the Hydrogen Council estimated a total of more than 1,400 announced projects across all regions, with the largest number in Europe (540), but only 7% of the total announced investments progressed past final investment decision (FID). (6) There are many factors contributing to this: complex or inconclusive regulations, mismatch between supply and demand, insufficient political or financial support, lack of infrastructure, etc. A major issue seems to be that upstream investments are capital intensive and require certainty on long-term offtake to become bankable. On the offtake side, potential customers are now typically purchasing conventional energy on much shorter timeframes than required for upstream bankability. Currently companies buy cargoes of LNG or ships of crude, which is the norm in a liquid marketplace. For renewable hydrogen and ammonia such a marketplace does not exist yet, and until a liquid marketplace has developed, creative solutions are required. Enabling infrastructure in terms of pipelines, storage facilities, ports etc. is required, and in the short term a decoupling of supply and demand is necessary to fix the current conundrum. To kickstart the European hydrogen economy, it seems imperative that much of the risk and stimulus will have to be born and managed by the public sector for a limited period, which is a role that governments also take in other public infrastructure or nascent sectors.

A case in point is a strategic hydrogen reserve. Since hydrogen will eventually replace fossil fuels, a European strategic hydrogen reserve should at least match Europe’s strategic oil and natural gas reserves, which are currently 25% of annual demand. Such reserve could be equally split between gaseous hydrogen and liquids (liquid hydrogen, ammonia, biofuels), and could be developed right away. Gaseous hydrogen would be stored underground and connected to the high-pressure hydrogen backbone. Liquids would be stored in tanks (onshore and/or offshore floating storage) or also in underground storage.

There are many European communications concerning hydrogen ambitions, notably the EU hydrogen Strategy (July 2020) and RePowerEU (March 2022), containing aspirational targets and ambitions. However, the Revised Renewable Energy Directive (REDIII) is the only legislative proposal containing legally binding targets, i.e. that in industry a minimum of 42% of the hydrogen used shall be green and a minimum of 1% of the energy content of all transport fuels shall be Renewable Fuel of Non-Biological Origin (RFNBO). Although it is not possible to determine the exact amounts because there are some exemptions and multiplication factors, the estimated upper limit amounts to 6.8 million tonne in 2030. If we assume that 50% is imported, the import volume amounts to 3.4 million tonnes.

It should be noted that strategic reserves mainly apply to imports. However, since the proposed mechanism would favour imports over domestic production, which is undesirable, we include domestic production of hydrogen in the strategic reserve consideration.

A strategic reserve that amounts to 25% of demand of hydrogen and derivatives adds up to 1.7 million tonnes in 2030, assuming a hydrogen demand of 6.8 million tonnes. In addition to the EU strategic hydrogen reserve, which will be kept for war-like situations, an additional EU hydrogen balancing reserve will be mandated, much like the current EU natural gas storage mandate. We propose adding 15% of annual demand, or 1 million tonne.

The Teesside hydrogen salt cavern complex in the UK, one of the few operational hydrogen bulk storage facilities in Europe, has a capacity of 30GWh, which is very small and wouldn’t support a national or regional hydrogen storage strategy. (7) Nonetheless, 2.7 million tonnes imply many new salt caverns, with numbers in the hundreds. Developing a salt cavern takes 5-8 years, so Europe must start immediately given the low number of hydrogen storage projects currently being developed. However, there are many unused salt caverns that are immediately available, and priority should be given to operationalize those.

Next to hydrogen storage in salt caverns, a strategy needs to be developed for storage of hydrogen derivatives such as ammonia, which is being considered a major share of the 3.4 million tonnes projected imports.

The potential for salt caverns in Europe is very large, but not equally available throughout the continent. Overall, the storage potential considering offshore and onshore salt caverns constitutes 84,800 TWh, 42% of which belongs to Germany. This is followed by the Netherlands and the United Kingdom, with 10,400 and 9,000 TWh, respectively. Most of the countries have both onshore and offshore salt caverns options, the exception being Norway, which only has offshore salt cavern potential. (8) Countries such as Sweden have good potential for hydrogen production but do not have salt caverns. It is therefore imperative to develop a hydrogen backbone linking production, storage and demand locations to create a cost-effective and secure European hydrogen system.

It should be noted that most if not all gas reserves are privately developed on a commercial basis. However, we suggest including the strategic reserves as part of the regulated TSO business to accelerate their development.

The strategic reserve could immediately provide an offtake opportunity for producers and could disconnect the current conundrum between offtakers and suppliers.

Energy storage is a crucial element of Europe’s future clean, functional and secure energy system. Clean molecules will be indispensable energy carriers and will remain dominant in the storage ecosystem. Europe’s hydrogen market is nascent and requires a push to achieve the short-term target of 6.8 million tonnes of hydrogen by 2030. This push consists of the development and execution of a hydrogen storage roadmap and the development of a strategic reserve.

Like for oil and natural gas, hydrogen and its derivatives require a strategic reserve in Europe, and we propose to develop this reserve as a priority. A government mandated hydrogen reserve of 25% would be in line with current strategic reserves of oil and natural gas. For 2030 this would amount to 1.7 million tonnes of hydrogen and derivatives and would provide an immediate offtake opportunity for suppliers to sell into.

In addition to the EU strategic hydrogen reserve, which will be kept for war-like situations, an additional EU hydrogen balancing reserve will be mandated, much like the current EU natural gas storage mandate. We propose adding 15% of annual demand, or 1 million tonne.

The EU strategic hydrogen reserve shall be administered by a public body from a financial and governance perspective whilst the actual management can be done by an agent, a commercial market player. The way current strategic reserves for oil and gas are being managed could be the starting point of a management framework, and we propose the involvement of AggregateEU, the European Hydrogen Bank (EHB) and H2Global. In terms of price finding, auctions will be used. The reserve shall be a mixture of gaseous hydrogen and liquids.

Upstream market players can sell into the reserve via auctions until the reserve is adequate. The strategic reserve shall be financed by the EU and member states. This mechanism can be organised by H2Global, providing ten-year offtake agreements to producers.

Since the declared policy goals of the European Union are to replace fossil fuels with renewable energy over time, we propose reducing the strategic reserves of fossil fuels in sync with the ramping up of strategic hydrogen reserves, based on replaced and equivalent energy value. The current price gap between fossil fuels and more expensive green hydrogen requires additional money. However, one should also consider that the value of fossil fuels will reduce drastically over the next decades.

The EU has recently implemented new gas storage regulation, with the main obligatory target that the gas storage is at least 90% filled on 1 November. For hydrogen a similar regulation needs to be designed, but the filling targets will be more diversified geographically in Europe and shall consist of a mixture of hydrogen and liquid derivatives. The recent auction results of the European Hydrogen Bank have shown the potential for competitive hydrogen production in the Iberian Peninsula and Northern Europe, (9) so we propose to focus on these areas for storage in the short term, whereby we must consider the different potential for salt caverns across Europe.

Like the EU strategic hydrogen reserve, upstream market players can sell into the EU hydrogen balancing reserve via auctions until the reserve is adequate. The strategic reserve shall also be financed by the EU and member states. This mechanism can be organised by H2Global, providing ten-year offtake agreements to producers. In parallel, H2Global shall pool demand and sell any excess hydrogen from the balancing reserve. Offtakers shall be incentivized by a combination of quotas and pricing based on alternative fuels they are currently using. A European distribution system shall be designed, with national offtake quotas for a fair distribution of the produced hydrogen.

The playbook currently used for the storage obligation for natural gas can provide a template to be used for the balancing reserve.

In addition to the investment in the molecules that constitute the strategic and balancing reserves, investments in physical infrastructure such as salt caverns are required. This investment could be done by private infrastructure investors, backed by 10- or 20-year service agreements for the storage of the strategic and balancing reserves.

To accelerate the development of a hydrogen system from scratch we need to decouple the production from the demand, both in time and place. The enabling infrastructure for that are a hydrogen backbone and comprehensive storage. The following steps are proposed. Firstly, develop the transport and distribution infrastructure and storage facilities and operationalize them. Secondly, develop hydrogen production and initially store the total production. Thirdly, develop the demand and secure hydrogen supply from production and storage.

The following procedure could offer a solution for a cost-effective and speedy realization of this sequence:

Develop the European Hydrogen Backbone as formulated in the REPowerEU strategy and supported by European Gas TSO’s. (10)

Develop storage volume for clean hydrogen and derivatives for a strategic reserve of 1.7 Mt and for a balancing reserve of 1 Mt by 2030 as proposed in this paper.

Realize a hydrogen storage capacity of 1.7 + 1 Mt by 2030 owned by public bodies, TSO’s or infrastructure investors backed by the EU or Member States.

Realize a strategic hydrogen reserve of 1.7 Mt and for a balancing reserve of

1 Mt by 2030, whereby the EU and member states buy green hydrogen over a defined period and finance it by selling fossil fuel strategic reserves plus additional funding from EU and member state sources.

Develop storage regulations and support for 1 Mt hydrogen by 2030 for balancing, using the same mechanism used for natural gas today.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

1 https://frank-wouters.com/2024/11/14/energystorage/ - Accessed 19 Nov. 24

2 https://gasforclimate2050.eu/wp-content/uploads/2023/12/Gas-for-Climate-Action-Plan-for-implementing-REPowerEU-1.pdf - Accessed 28 August 2024

3 https://energy.ec.europa.eu/topics/energy-security/gas-storage_en - Accessed 27 August 2024

4 https://energy.ec.europa.eu/news/eu-reaches-90-gas-storage-target-10-weeks-ahead-deadline-

2024-08-21_en, Accessed 28 October 2024

5 https://energy.ec.europa.eu/topics/energy-security/eu-energy-platform_en - Accessed 27 August

2024

6 https://hydrogencouncil.com/wp-content/uploads/2023/12/Hydrogen-Insights-Dec-2023-Update.pdf -

Accessed 27 August 2024

7 https://www.sciencedirect.com/science/article/pii/S1364032123008596 - Accessed 27 August 2024

8 F. Crotogino, S. Donadei, U. Bünger, H. Landinger, “Large-Scale Hydrogen Underground Storage for Securing Future Energy Supplies”. Proceedings of the WHEC, May 16.-21. 2010, Essen, Schriften des Forschungszentrums Jülich / Energy & Environment, Vol. 78-4 - Institute of Energy Research - Fuel Cells (IEF-3) - Forschungszentrum Jülich GmbH, Zentralbibliothek, Verlag, 2010 (ISBN: 978-3-89336-654-5)

9 https://climate.ec.europa.eu/eu-action/eu-funding-climate-action/innovation-fund/competitive-

bidding_en - Accessed 28 August 2024

10 https://gasforclimate2050.eu/wp-content/uploads/2023/12/Gas-for-Climate-Action-Plan-for-

implementing-REPowerEU-1.pdf - Accessed 28 August 2024

illuminem briefings

Oil & Gas · Ethical Governance

Jonathan Lishawa

AI · Energy Transition

Olaoluwa John Adeleke

Power Grid · Power & Utilities

Financial Times

Oil & Gas · Upstream

Forbes

Nuclear · Power & Utilities

Eco Business

Oil & Gas · Public Governance