Aviation is a major climate problem, but electrification and biofuels are solutions

· 12 min read

Aviation is a major source of greenhouse gasses, punching above its weight due to additional forcing factors of contrail- and nitrous oxide-related warming in addition to direct carbon dioxide emissions. It’s in the same range of total greenhouse gas emissions as hydrogen manufacturing as a hard-to-decarbonize segment. It’s going to decarbonize, whether the industry likes it or not, because the climate implications are sufficiently significant that it must.

But how it’s going to decarbonize is a different matter. There are many contenders to be the aviation fuel of the future, and I’ve assessed most of them. Hydrogen would double the cost per passenger or freight mile and introduce very significant safety concerns as -249° Celsius cyrochilled hydrogen will have to be inside the air frame with passengers. The combination makes it infeasible in my opinion.

There are other equally intractable problems with aluminum air fuel cells, another contender being touted by one of the refueling startups. Being non-rechargeable and requiring the depleted batteries be returned to an aluminum smelter to be remanufactured means heavy weights of aluminum will be traveling further than just the air travel, and aluminum smelters are not evenly spread at all. Once again, infeasible.

The contenders for replacement which pass basic tests of viability are sustainable aviation biofuels and the increasingly energy-dense cell batteries that are already fit for 400 km trips. Some SAF biofuel processes are supplemented with hydrogen, and that’s where the demand line for hydrogen fits in.

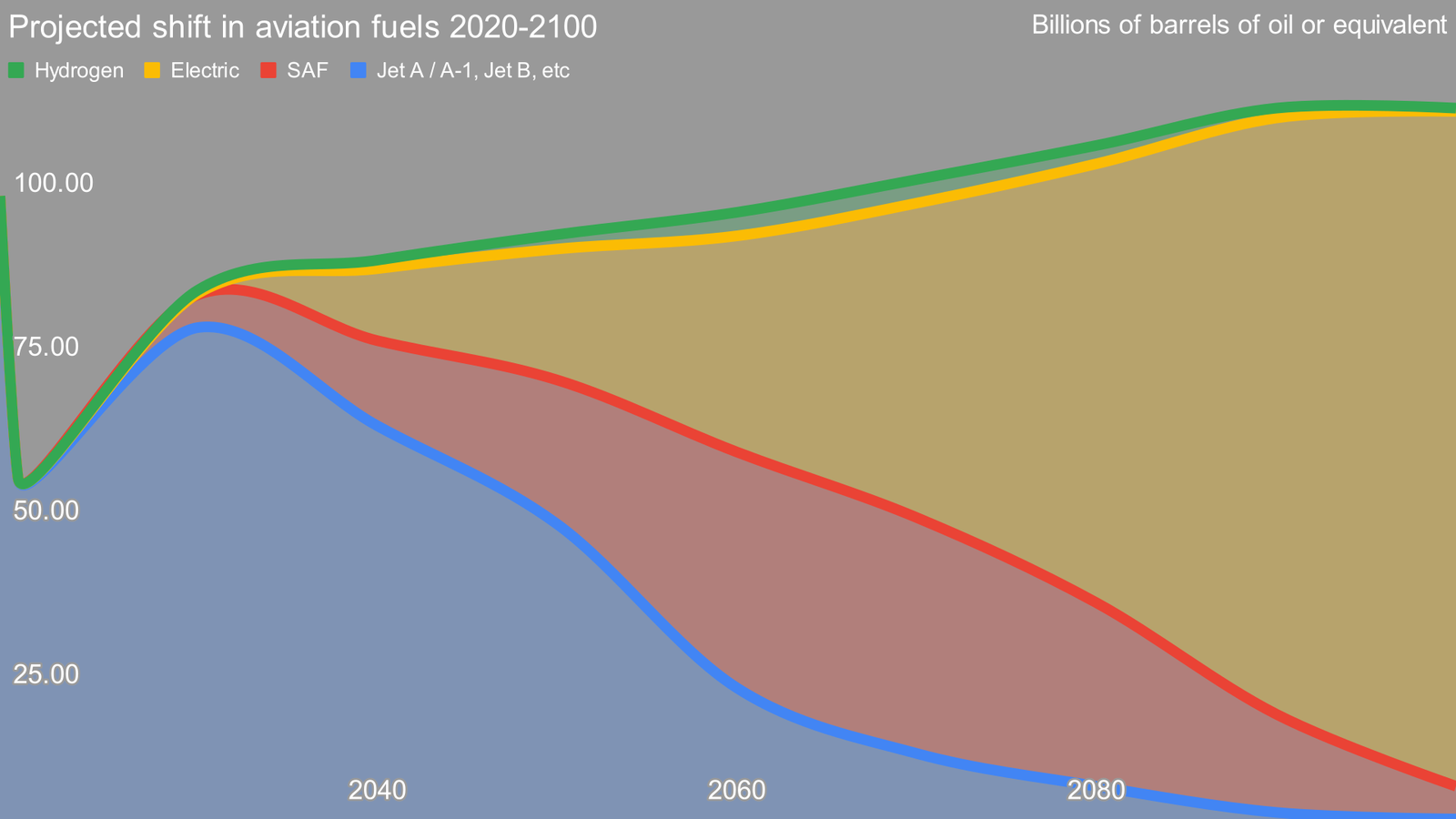

Late in 2021, I published version 1.0 of my projection of aviation refueling through 2100 based on my analyses, discussions with aerospace startups and engineers, and assessment of the impacts of multiple strongly impactful trends. Subsequently, I engaged in discussions with more experts and analysts to consider how I would refine the next iterations.

The most substantive discussion was with Wilma Suen, PhD in strategic alliances and most recently the global Vice President of Portfolio Strategy & Forecasting for GE’s airplane leasing business, until very recently the largest such organization in the world. She and her timezone-distributed team spent their days analyzing the best data that a multibillion dollar organization could buy to project flights per person per year for every material country in the world for 5, 10, and 20 years, with decreasing reliability with each increase in duration of course. Her insights led me to increase growth slightly.

There are several things to call out in this projection.

First, aviation is unlikely to return to pre-COVID-19 levels quickly. The efficiency and effectiveness of video conferencing and remote work has been proven across the economy, but especially in those sectors that used to be heavy fliers, and I say that as someone who used to fly weekly for business. We’ve moved a decade into the future and broken the habit of getting on planes, and corporations will no longer pay for rafts of consultants to show up Monday and fly away Thursday. Client-facing now means over video links for the vast majority of the information, sales, and consulting workforces.

Among many other data points, this was reinforced by my discussion yesterday with a former colleague who now runs the national ESG practice for Canada for one of the major consultancies. While their junior staff are itching to get back to client sites, that’s just not going to happen. Only the most important and critical deals will involve flying from now on, and then only a subset of them.

Similarly, in-country travel is going to be much more favored than international travel by many more people for vacations, and that will persist. COVID-19 was the fourth epidemic in the past 20 years, following SARS, H1N1 and Ebola, and now everyone knows the consequences. COVID-19 wasn’t the last epidemic, it was just the worst epidemic since the Spanish Flu.

That said, both IATA and Boeing project in the range of 4% growth year over year for the next twenty years. I consider this deeply unlikely after the post-COVID bounce. Population growth is slowing and will end between 2070 and 2100, depending on which demographic projections you prefer, with the UN being on the conservative side. That means fewer new potential passengers. Alternatives to flying are increasing as well, specifically high-speed rail, with China alone having built 38,000 kilometers of electrified passenger service since 2007, California’s high-speed rail having started construction, and Morocco planning to expand its current 323 km service to 1,500 km in the coming years. Shorter distance travel will be subsumed somewhat by autonomous electric ground transportation as well, as people sleep their way to their destinations. Finally, aviation refueling will come with increased aviation costs through the second half of the century, putting a strong economic inhibitor on increases in demand. However, global affluence continues to grow, and with that, new customers.

The combination means that I’ve added a slow rise per decade to demand through 2090, where it flattens out, instead of being flat after the post-COVID bounce. This is a global perspective, with significant geographic variance.

Second, electric means battery-electric, but is not limited to lithium-ion chemistries. Lithium-ion is fit for purpose for up to 19-passenger turboprops with 400 km ranges today, and the intersection of density, cost, and weight will continue to improve every year. The fast-charging technology for cars and trucks is fit for purpose for rapid recharging of small electric airplanes today. The amount of manufacturing, research, and innovation underway in battery technology means that battery technologies have their own Moore’s Law equivalent, Wright’s Law. Lithium-ion is improving roughly 28% for every doubling of manufacturing capacity. But new chemistries are coming which will see significant improvements beyond that. Lithium-ion will likely prove suitable up to 100-passenger planes for 1000 kilometers, but other chemistries will take over. Only in the second half of the century will a mixture of aviation advances including greater battery density, better power management, novel electric engines currently on the drawing board and improved airframe aerodynamics enable cross-Pacific aviation.

Third, battery-electric and biofuels are only going to start making a noticeable dent in aviation fuel toward the middle of the 2030s. This is a hard sector to decarbonize, and significant transformation and development is required to achieve these targets. For example, in my piece articulating the case for biofuels one of the transformations that will occur is the elimination of wasteful use of biofuels in easier to electrify sectors. The two million barrels a day currently going into cars and trucks today needs to be repurposed as all ground transportation is electrified.

The economic intersection of battery energy density, weight, and cost is sufficient for 400-600 km range planes with 4-19 passengers today, and that will grow substantially with each passing decade, but it’s insufficient for the majority of current flights right now. And, of course, battery-electric passenger planes need to be manufactured and certified, something companies like Heart Aerospace and ELECTRON Aviation are working hard at.

Fourth, I’ve put a line in for it, but sharp eyes will note that hydrogen is going to be providing very little energy for aviation. I see no future for it as a directly used fuel based on the assessment of massive increases of cost and the need to use hydrogen for much more useful decarbonization purposes. However, hydrogen is used in some biofuel processes to supplement the hydrogen bound up in the cellulose, and there will be a window for some economically viable use of green hydrogen for that purpose.

Fifth, SAF biofuels will only grow as a source through 2060, when I project that energy densities of batteries will be sufficient for 80% of flights, and a sufficient number of battery electric airplanes will be replacing the current fleets. After 2070, it starts diminishing rapidly as fuel-burning turboprops and turbofans retire. Biofuels for aviation are only a 40-year growth market and after that they will diminish. Of course, agricultural lobbies will work to extend this, and may very well pervert or at least defer rational decision making.

Sixth, battery electric barrels of oil equivalent is arrived at by using a blended efficiency factor for current aviation between the remarkable 55% of high-altitude turbofans at cruise, and the much lower efficiency of internal combustion turboprops operating at lower levels. I use that to determine the gigajoules required, then use the very high efficiency factory for electric motors to gross it up to the MWh required for similar distances. In other words, it’s the normalized energy used per distance flown that becomes the electricity figure. This seems defensible to me, and conservative.

Of course, many deep analysts have issues with this perspective. People seemingly close to current SAF results have disagreed with my earlier analysis. Others deeper into batteries have disagreed with my perspectives on aluminum air fuel cells, albeit on what appear to be technicalities and some lack of a systems engineering perspective. People invested in hydrogen for their various reasons disagree with this analysis of course. Professor Mark Z. Jacobson disagrees with the earlier biofuels portion of the analysis, although the time perspective and CO2e perspective still might shift his opinion. So do consider this to be one of many potential scenarios. It is necessarily imperfect.

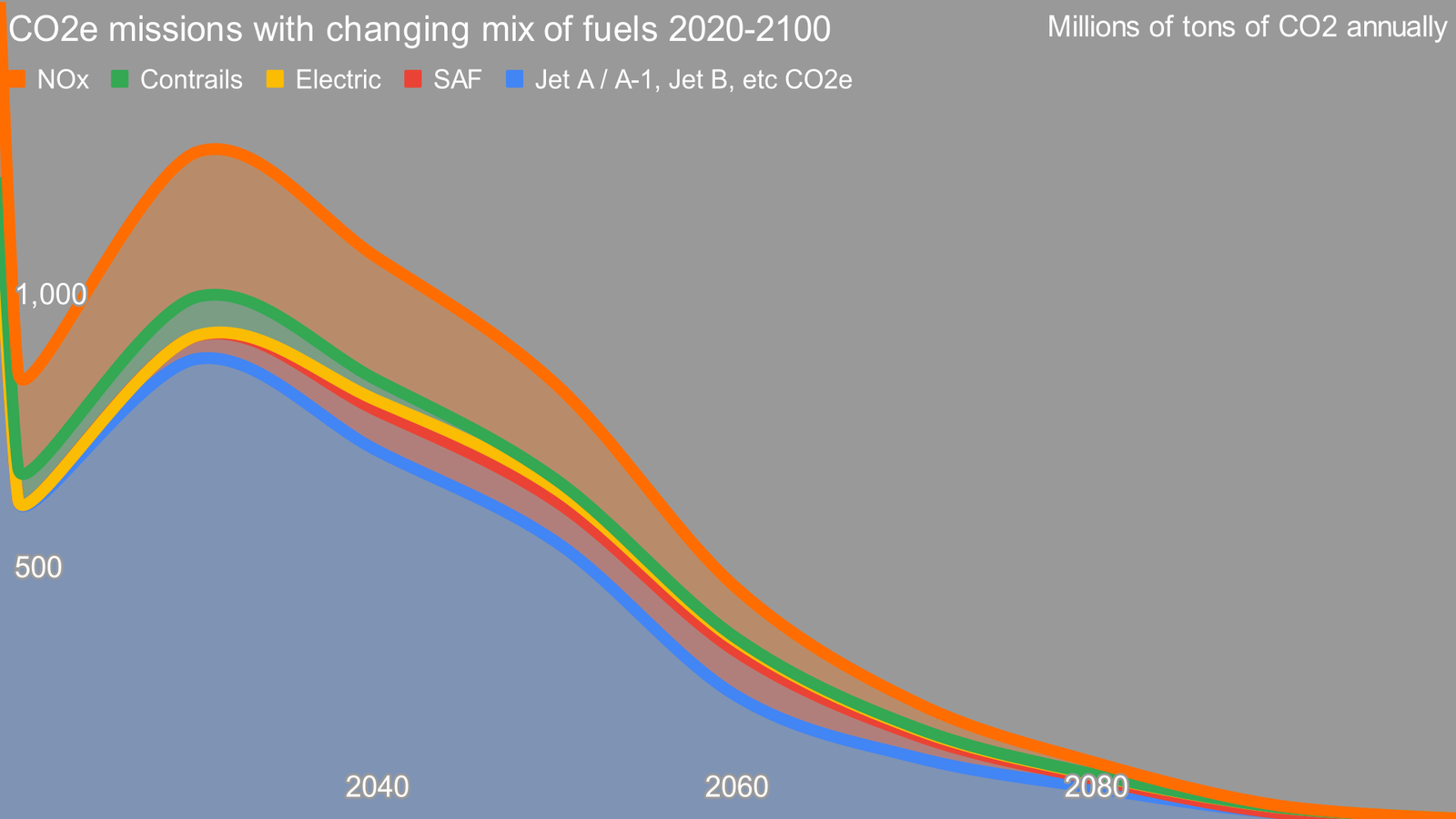

What is important with this analysis are the implications for greenhouse gas emissions.

Similarly to the projection of fuel usage, I’ll call out a set of obvious observations and some not so obvious ones.

First, aviation-related global warming emissions plummeted during COVID-19. Regardless of the measure, whether direct CO2, NOx or contrails, enormous numbers of flights didn’t occur for the past two years. It’s relatively insignificant compared to the history of CO2e emissions that will drive warming for the next century regardless of what else we do, but it’s still there.

Second, while aviation energy requirements will not return to 2019 levels until mid-century, it will still rebound a fair amount over the next eight years, and emissions will rise as a result.

Third, it will likely take three decades before net emissions for aviation are back below 2020 levels. That’s a problem, but they’ll still be well below 2019 levels. That said, this projection suggests that while aviation is a hard target, more attention needs to be paid to it. Aviation emissions rising substantially this decade is not a climate solution.

Fourth, contrails and NOx CO2e ratios make it clear that biofuels are not a long-term solution. Both are significant warming side effects of burning fuels. The model assumes operational changes that substantially reduce contrail formation and impacts, something that can be substantially done by just 500-meter changes in operating altitude. But burning any fuel in our atmosphere produces NOx with 265 times the global warming potential of CO2. Biofuels substantially reduce CO2 from the fuel and operational changes reduce CO2e from contrails, but NOx persists. They are much better than fossil fuels however. That said, electric drive trains would emit no NOx and create no contrails, and so is obviously the best case scenario. I project, without a specific chemistry or technology set, that fully electric long-haul aviation will be viable after 2050.

Fifth, the initial CO2e of electricity is relatively high, but diminishes substantially through 2040 with grid decarbonization. As a result, CO2e savings from electrification grow per billion barrels of fuel equivalent with time.

Sixth, biofuels are also high in CO2e initially, but diminish through time. Agrigenetics related to nitrogen fixing at the roots of plants as per Pivot Bio, resultant reductions in fossil-fuel sourced ammonia fertilizers, precision agriculture lowering fertilizer use further, and low-tillage agriculture are going to radically reduce agriculture warming emissions in the coming decades. Every ton of fertilizer used today is equivalent to 9 or more tons of CO2e between direct fossil fuel use and nitrous oxide formation after application. Diminishing fertilizer applied very precisely by electrified farming equipment brings agriculture close to zero emissions. I have conservatively not assumed soil carbon sequestration from farming in this analysis, but many studies project the potential for agriculture of all types to become carbon negative. This wouldn’t change the need to eliminate biofuels due to contrails and NOx by the way, so those who think biofuels have a future past 2100 should think again.

Seventh, emissions take until 2100 to approach zero. There will be a long tail of both fossil-fuel sourced kerosene and SAF biofuels into 2090 and 2100. Direct and indirect emissions are still substantial. Electricity is similarly going to have a long tail of lowering emissions. This is to be expected, and if not embraced, at least acknowledged. It’s going to take a long time to get rid of the long-tail CO2e emissions.

Eighth, hydrogen doesn’t show up on this chart because the small amount of it that will be used to increase the yield of biofuel processes is assumed to be manufactured from green hydrogen with very low CO2e per ton.

Finally, I’ll remind readers who have made it this far that while my opinion is professional, informed, broad, and fairly deep, it is still merely an opinion, and hence at the bottom of the ladder of evidence. And further, while I have a history with aviation and the transportation sector, and have been reviewing transportation related emissions and alternatives for a decade, my professional life is not solely devoted to this subject. The error bars on these projections are broad.

That said, the general outlines I think are correct. As I said in my assessment of hydrogen as an aviation fuel and the assessments of those who like it, they require an assumption of truly extraordinary advances that do not appear to be viable per the laws of physics. The economics of alternatives and operational requirements appear to make them so non-viable as to be easily dismissed.

To summarize, battery-electric aviation will be over 50% of flights by 2070, and approaching 100% by 2100. Biofuels will rise through 2060 and then start to fall again. This is an imperfect solution, but perfection is the enemy of good enough. This projection sees total aviation-related warming at under a third of 2019 levels by 2060, and continuing to drop to approach zero by 2100. In 80 years, flygskam will be a thing of the past.

As a note, one of the things I looked at while preparing this scenario was a set of market analyses projecting aviation fuel growth. To say I found them remarkably lacking in reality, context and usefulness would be to deeply understate how unlikely I thought they were. There was no recognition of the state change that COVID-19 had brought, the projections were clearly based on projecting history in a straight line into the radically altered future, they ignored the requirement for aviation to deal with climate change, and they ignored the battery-electric and biofuel revolutions sweeping up to replace petroleum-sourced kerosene fuels.

For commodities traders, businesses, strategists, and policy makers, I would recommend being very leery of most of the market analyses currently in the space. Anyone invested in hydrogen aviation startups such as ZeroAvia and Wright Electric should be considering their exit very carefully, as there is still hype to ride, but no upside due to the laws of thermodynamics and economics. Obviously anyone considering investing in aviation fuel alternatives should avoid hydrogen pathways as well, beyond hype-oriented speculative investments lasting at most 5-6 years.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Public Governance · Climate Change

Olaoluwa John Adeleke

Human Rights · Environmental Rights

illuminem briefings

Biomass · Carbon

CBC News

Carbon Capture & Storage · Public Governance

Africa News Agency

Circularity · Public Governance

The Wall Street Journal

Climate Change · Effects