· 6 min read

If you haven’t heard it before here’s a saying you will soon come across “A carbon credit, is not a carbon credit”. In fact, a carbon credit embodies many attributes that make them anything but equal. This variance in attributes results in carbon credits having a wide price discrepancy. In the following article, we are going to break down some of these attributes and explain why carbon prices vary so much.

If I am a buyer of carbon credits today I am able to choose from a variety of projects that range from

- Renewable energy projects trading anywhere from $1-$10MT/CO2e

Through to

- Tree planting projects trading anywhere from $5-$25MT/CO2e

And

- Direct Air Capture which sucks carbon out of the air through large vacuums which are being sold nearer to $1000MT/CO2e

But what makes these projects such different prices? It comes down to a few different factors

- Additionality

- Permanence

- Co-Benefits

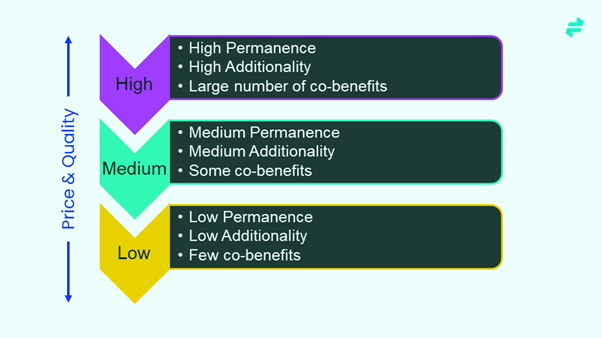

These factors tend to decide a projects “quality”. In simple terms, the higher the additionality and permanence and the larger the number of co-benefits a project provides, the higher the price. As with everything its never quite this simple but let’s dive into some of these terms to undestand them better.

Additionality

Additionality is the ability of a project to deliver reductions in CO2 that are additional to a baseline i.e. if the project had not been developed the carbon would not have been reduced. Projects need to prove additionality to demonstrate that they are making an impact. It also helps if the project would not have been economically feasible without the added bonus of a carbon credit to spur its development. This shows the revenue earned from a carbon credit is helping to drive investment in “additional” carbon removal or avoidance.

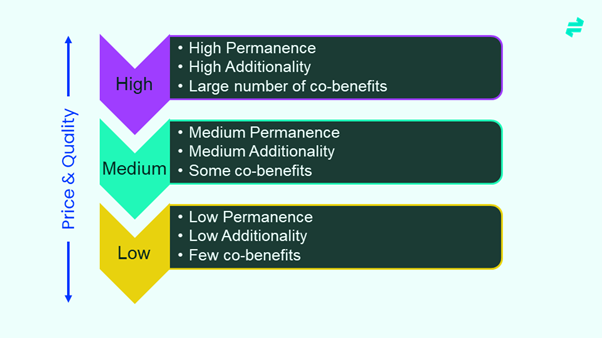

Let’s take the renewable energy project above. Even just a few years ago solar and wind projects were not economically rational decisions (excluding a global cost on carbon). They tended to be more expensive than thermal generation from fossil fuels such as coal and gas. As such, any renewable project that got built was additional and was rightly supported by carbon credits or other incentive mechanisms.

However, as the cost of wind and solar have continued to dramatically decline the additionality of these projects as a source of carbon credits becomes increasingly misaligned. It is now cheaper to build new solar and wind than it is to continue running old existing coal plants. The economic rationale of building out renewable energy is firmly confirmed as an economically rational decision and therefore the requirement of a carbon credit to incentivise this investment is largely ignored.

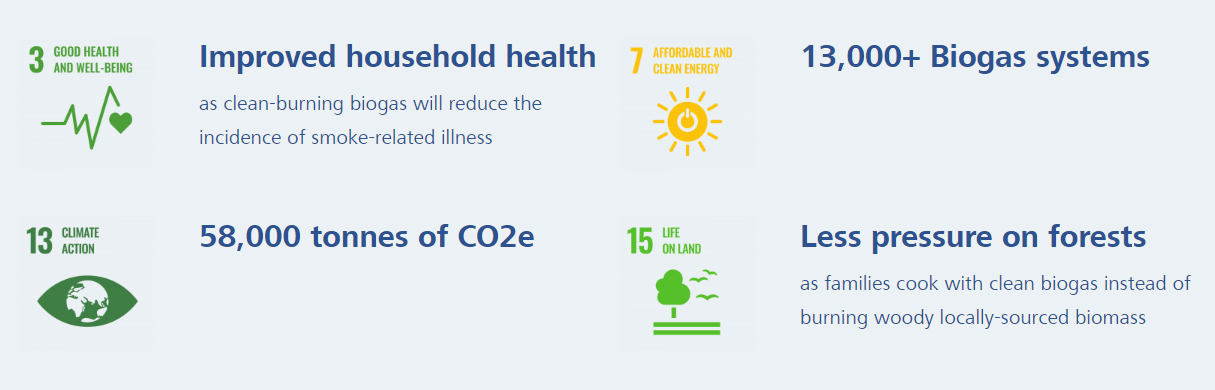

Renewable energy projects also support a lower number of co-benefits, specifically the development of the UN’s Sustainable Development Goal number 7 — affordable and clean energy access.

As such, renewable energy projects are seen as “lower quality” and demand a lower premium for the associated carbon credits. On the other hand, projects that offer high additionality and extra co-benefits tend to be higher priced.

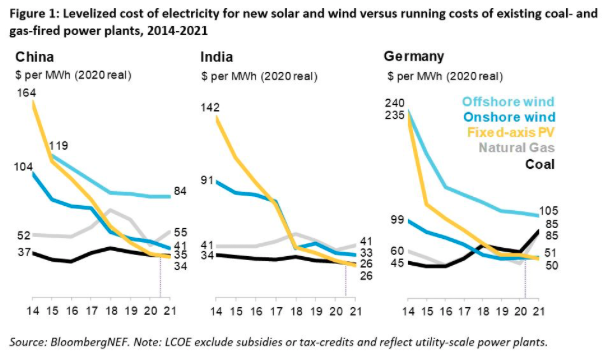

Such an example would be clean cookstoves programs which can address the pollution from burning wood or biomass in traditional stoves. Around 3 billion people cook over open fires or on rudimentary stoves which produce between 2 to 5 per cent of annual greenhouse gas emissions worldwide. Unsustainable harvesting of fuel drives deforestation and forest degradation whilst burning fuels during the cooking process emits pollution.

Cleaner cooking methods not only prevent the release of carbon but the co-benefits include

- Improved health by reducing the 4.3 million premature deaths caused each year by soot and particulates from open fires

- The protecting life on land by diverting sourcing of fuel for fires

Permanence

Permanence refers to the length of time any greenhouse gas emissions will remain removed from the atmosphere. A lower level of permanence signifies a higher risk that a GHG reduction or removal may be reversed. This higher risk leads to a lower price as the quality of the credit used to offset is deemed to be less.

Let’s use a classic example that is often referred to — trees. Tree planting and the protection of existing forest ecosystems are fantastic examples of environmental stewardship. They not only remove carbon but support various other co-benefits including biodiversity. However, they do burn … but perhaps not as much as you think.

A 2015 study showed that over the period from 2003 to 2012, an average of about 67 million ha (or 1.7 % of forest land) was burned yearly. The largest average area burned was in South America (35 million ha per year), followed by Africa (17 million) and Oceania (7 million). It also showed that fire activity in the Amazon, Central America, and south-east Asia is almost exclusively associated with deforestation and shifting cultivation.

Thus, the risk of forest burning is around 2%, of which a large proportion of those forest fires are human-induced. Tree plantings are an important part of regeneration, particularly as a need to replace those lost by human actions, but cannot be considered “permanent”.

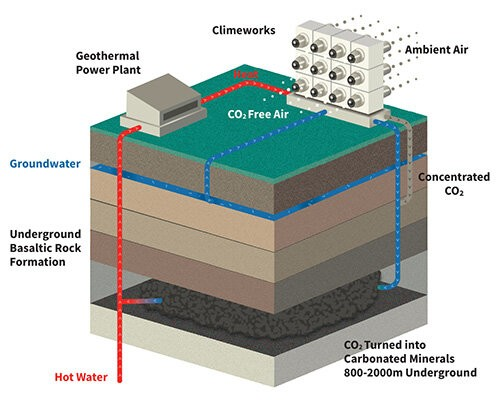

Highly permanent projects currently command some of the highest costs for credits. This is because there are bottom-up costs associated with the various methods of removing or reducing carbon. Direct Air Carbon Capture and Storage (DAC) is an example of technological innovation to remove GHG directly from the atmosphere and store it permanently.

Think of it as a giant vacuum cleaner sucking carbon from the atmosphere and storing it underground. This type of technology requires an abundant amount of clean energy and an underground area nearby where the carbonated minerals can be stored. Whilst costs are expected to decrease significantly the cost of permanence is expected to require a significant premium to other methods for quite some time.

Co-Benefits

Co-benefits have been somewhat already described in this article so we will only touch on them briefly. In addition to carbon abatement, projects may achieve a range of other environmental, economic, social and cultural benefits, called co-benefits. Examples of co-benefits include:

- increasing biodiversity from the protection and regeneration of native vegetation

- providing new income streams for Indigenous communities, and

- improved soil health and resilience in the land sector.

Many of these co-benefits are aligned with the United Nation’s Sustainable Development Goals (UN SDGs). Projects which are able to show co-benefits aligned with these goals can command a higher premium. This is because they often cost more to produce but also because large multi-national corporations are willing to pay a higher price for such credits in order to achieve their ESG priorities.

Carbon prices vary for a number of reasons, as highlighted above. It is a complex and opaque market which we believe requires more transparency and fungibility to achieve scale. At katalyst.earth we are building trust into carbon markets through the use of blockchain technology. We are partnering with project developers who have the expertise to deliver on the ground impact and helping them get their projects off the ground faster and cheaper.

This article is also published by The Katalyst. Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.