The 10 Financial Actors Who Stand in the Way of Slowing Climate Change

· 3 min read

Who are the key financial actors that can lead the low-carbon transition in the fossil fuel industry? Much like the fossil fuel firms they invest in, actors in capital markets can play a central role in enabling or hindering the transition, by either shifting capital away from carbon-intensive industries, or aligning corporate governance with climate targets. What’s more, these financial actors don’t make up a large, unwieldy group. You can count them on two hands.

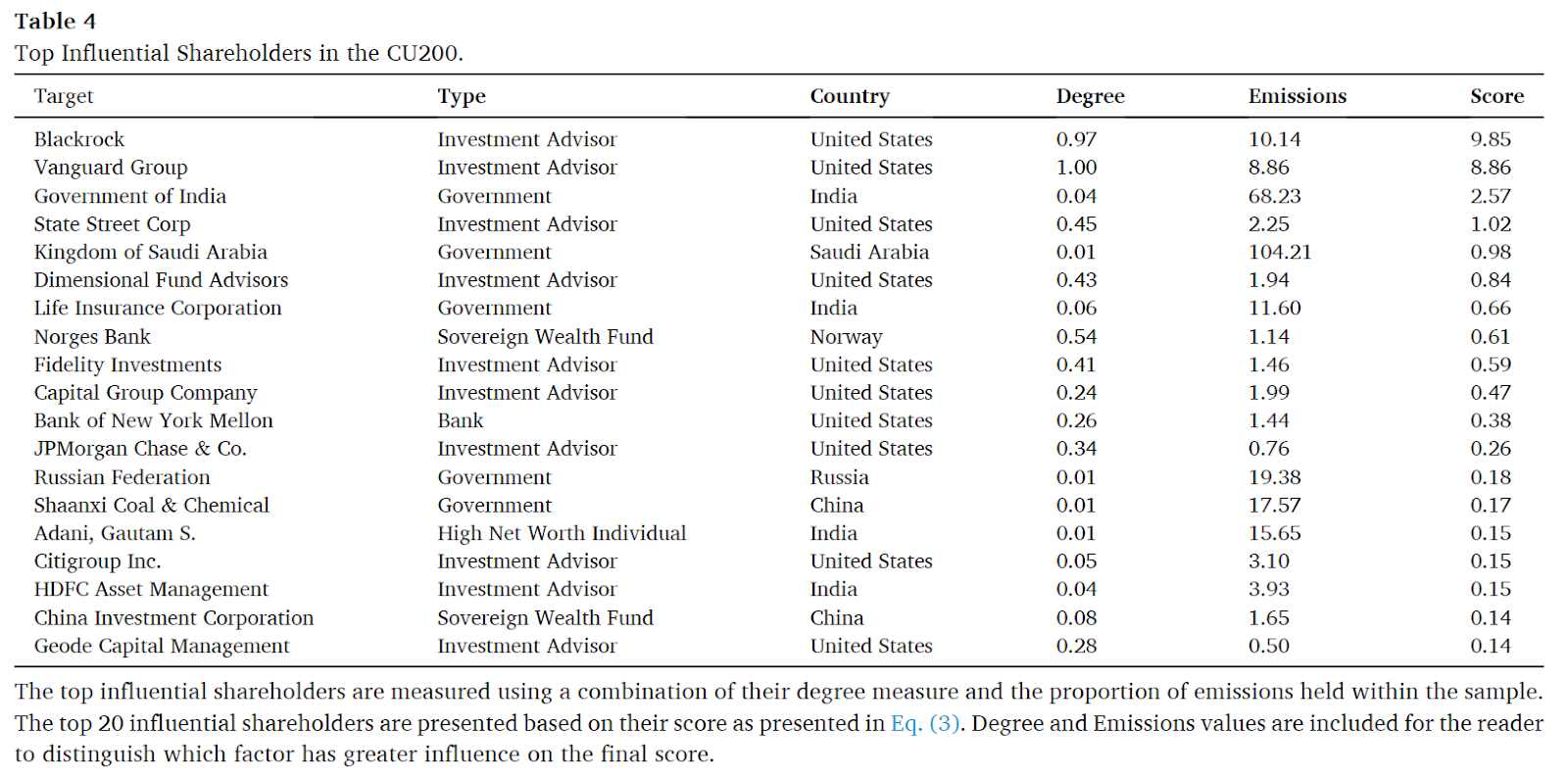

That’s what we found in our recent study, published in Environmental Innovation and Societal Transitions, where we mapped ownership dynamics between the 200 largest fossil fuel firms (colloquially known as the Carbon Underground 200) and their shareholders. Using a novel scoring mechanism, which blends the financial actor’s influence with their emissions exposure, we find that just ten actors—a mix of investment advisors, governments, and sovereign wealth funds—own 49.5 percent of the emissions potential from these 200 firms.

As alarm bells ring, production, emissions, and global temperatures continue a steady path toward climate catastrophe.

These ten actors, which include the likes of Blackrock and the Kingdom of Saudi Arabia, alone have the potential to shift the industry in a more sustainable direction. These actors may have inordinate influence in the industry due to the number of fossil fuel firms they invest in, the size of their holdings, or their exposure to potential emissions from the industry. Thus, engagement efforts by actors with less influence may fall short, without the support of these ten players. The results not only assert that financial markets can influence the trajectory of sustainability transitions but also exemplify that power is concentrated among just a handful of powerful and path-dependent financiers.

There is no question that we will fail to meet our global climate commitments if the fossil fuel industry does not dramatically reduce production. Achieving this, however, is a bit more complicated. Where credit is due, countries around the world have begun taking meaningful steps to taper the demand for fossil fuels through carbon pricing, energy retrofits, and electrification. But these actions alone have failed to constrict the relentless growth of the fossil fuel industry and its contributions to climate instability.

For meaningful climate action, demand-side climate solutions must also be complemented with supply-side interventions that limit the exploration, extraction, and transportation of fossil fuels, analogous to cutting with both arms of the scissors. There is a case to be made for such supply-side interventions—if the existing reserves of the 200 largest oil, gas, and coal are burned, it alone would surpass our global carbon budget three times over. It’s no wonder that climate scientists and policymakers alike have been calling for a rapid decline in greenhouse gas emissions for the better half of a century. Yet, as alarm bells ring, production, emissions, and global temperatures continue a steady path toward climate catastrophe.

Attempting to curtail fossil fuel production through supply-side interventions will likely face formidable political constraints. With immense political power and institutional inertia, the fossil fuel industry is unlikely to restrict emissions alone and, perhaps more insidiously, will lobby to subdue effective climate policies that threaten business as usual. In Canada for example, the federal government maintains a “one eye shut” approach to climate policy, actively propping the industry with public financial support and weakened production targets.

This article was originally published by Ethical Systems. Illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Climate Change · Insurance

illuminem briefings

Labor Rights · Climate Change

Steven W. Pearce

Adaptation · Mitigation

The Jerusalem Post

Biodiversity · Climate Change

earth.com

Climate Change · Effects

rfi

Climate Change · Art