· 10 min read

For something which produces 2-5% of global CO2 emissions depending on how you count it and who you ask, you’d think that aviation fuel would be a commodity that every country taxed heavily, especially more rational entities like the EU. However, that’s just not true in most places. Josef Mouris, co-founder and CEO of the EU electric airplane startup I’m on the Advisory Board of, ELECTRON Aviation, pointed out the challenges for the Netherlands to me in 2021. What exists in the Netherlands, however, is just one of a patchwork of aviation fuel pricing adders in the western world.

In the EU, aviation turbine fuels (ATF) including Jet A, Jet A-1, and Jet B were explicitly exempt from taxes until 2003 by EU mandate, and only at that point in time were EU member countries allowed to tax it if they so desired. Since 2008, starting with Germany, about 6 EU countries of the EU27 as well as 3 other European countries have put taxes and levies of various types on the sale of ATF. It’s distinctly not a level playing field, and mostly it’s been a surcharge on ticket prices that’s poorly aligned to emissions. The average cost increase is low as well.

And the EU only allows this tax to be applied to intra-EU flights, not to international destination flights, a major source of global emissions. The EU has historically depended on the International Civil Aviation Organization (ICAO), a UN sub-body, to address international flight emissions, something it has completely failed to do so far.

As a side note, all numbers I’ll use are for ATF, as the avgas often used in smaller private planes, crop dusters and the like has its own significant variances in treatment between jurisdictions, and is a smaller concern.

In the USA, ATF is taxed at an average of $0.28 per US gallon, of which $0.22 is from the federal government, and the remainder from state governments. This applies regardless of whether the flight is domestic or international, a variance from the EU’s approach. There are state-by-state variances, with some states using sales taxes, others using gasoline levies, others explicitly excluding aviation fuels from taxation, others providing refunds, others capping the number of gallons that can be taxed annually, and yet others giving avgas refunds, but not ATF refunds.

In Canada, there are province-by-province taxes, often aligned with gasoline taxes. And Canada in some cases applies them like the EU, with provinces such as Alberta providing tax rebates on ATF purchases for international destinations. Ontario, by comparison, still taxes aviation fuel for international destinations at around $0.08 per US gallon (note: I’m converting everything into USD and US gallons for ease of comparison).

In other words, chief financial officers in airlines likely spend a lot of their year influencing which jurisdictions to support with how many flights of what types, simply because fuel is currently about 19% of an airline’s annual expenses. Picking airports based on fuel surcharges becomes important.

One thing that these various taxes, levies, and surcharges have in common is that they are dirt cheap compared to the negative externalities of burning jet fuel, which in addition to direct CO2 emissions, include nitrous oxides with global warming potentials 265 times that of CO2, other nitrous oxides which cause ground level smog around airports, contrails in the stratosphere which forces more global warming, and of course noise pollution for everyone around the airport, but especially in the landing and take-off paths.

And the other unusual thing about this is that the US actually taxes aviation fuel more than other countries and doesn’t give the money back if the planes are leaving the country. Momentarily, the US’ aviation fuel policies are ahead, even if still completely misaligned with the scale of their negative externalities.

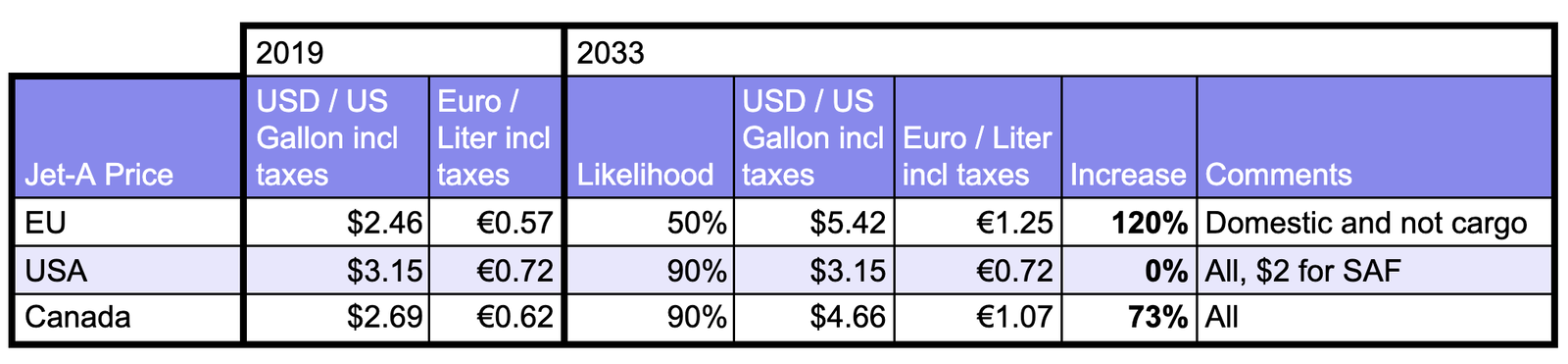

But that’s changing. Among other things, explicit carbon pricing is being applied to fuels in jurisdictions that have a carbon price. Let’s start with Canada, which has introduced a carbon price that’s rising from about $16 USD per ton of CO2 in 2019 to a current target of about $133 in 2030. It applies to aviation fuel, at least for the provinces that don’t have their own carbon pricing mechanism, with British Columbia and Quebec being the major exceptions as they are in California’s carbon trading plan. That turned into about $0.27 per US gallon initially, and will be about $2.20 per US gallon by 2030. That’s hefty, about 8 times US aviation fuel taxation. There’s also no indication that it’s going to be subject to a rebate if the planes leave the country.

There’s another good news story about Canada’s carbon price. The Liberal Party has now fought three elections on climate change and a carbon tax, and won them with majority and minority governments. Further, the center and center left parties — the NDP, BQ, and Greens — also support the carbon tax, and, with the Liberals, represent two-thirds of the popular vote and a large majority of seats in Parliament. The federal Conservative Party is in turmoil, having replaced its leader three times in the past eight years, and has no path to potentially gaining power until 2025. Further, they are internally split on climate change and carbon pricing, while the country isn’t, so if they don’t have a reasonable climate policy and maintain the carbon price, they are unlikely to be electable. While the Liberals currently hold a minority, in other words, the carbon price is very unlikely to be overturned in the coming years, unlike the fate of a similar carbon price introduced by the Australian Labor Party, who were ousted in large part due to attacks on it.

The EU has had a movement for years to normalize aviation fuel taxes across the EU countries, and also to stop giving them EU emissions trading scheme (ETS) allowances. Currently, the EU gives large ETS allowances to aviation, enabling them to avoid paying for EU carbon permits which were as high as $114 USD per ton within the past year. As part of the EU’s plan to reduce carbon emissions by 55% by 2030, they have proposed reducing the allowances starting in 2024 down to zero allowances in 2027. A carbon permit price at the peak of $114 would add about $1.50 per US gallon to the cost of ATF. Like Canada’s carbon price, that’s significant, and if the carbon permit value increases, it may match Canada’s with that measure alone.

However, the EU has another lever it’s also hoping to pull, an actual aviation fuel tax of about $1.40 USD per gallon designed to promote sustainable aviation fuels. The combination would mean that the EU goes from remarkably backward to leading the world, with an increase in the cost of ATF by 2033 of almost $3.00 per US gallon.

There are loopholes in the EU increases. They still only apply to intra-EU air travel, with most international destinations being exempt. The EU continues to rely on the ICAO addressing international flight carbon emissions, which is not something the ICAO has been doing or appears to be serious about. ICAO communications at best reference aspirational measures for addressing aviation emissions.

The EU proposals also exclude cargo planes, a significant portion of aviation. Despite these exclusions European aviation firms and organizations are lobbying hard to water these initiatives down further, or block them entirely. It’s not yet guaranteed that the EU will appropriately tax and carbon price aviation fuel, but if they do it will still exclude international destinations and all intra-EU cargo, which is a deeply compromised plan.

In the US, there’s a different measure under way. The Biden Administration’s Build Back Better bill included as of late 2021 a target of increasing sustainable aviation fuels from the current 1% to 14% of total fuels used by 2030 with a $1.75 to $2.00 per US gallon tax credit to sellers of sustainable aviation fuels. Naturally, there is lobbying by various biofuel sectors to make sure that their sector is included, as there are grease and fat vs corn pathways. Of course, the Build Back Better plan has been carved down and down and may not pass even as a shadow of its original self. However, American politicians have a bipartisan love of giving farmers subsidies, so there is some hope that this carrot will remain.

For context, the January 2022 average price of ATF was $2.46 per US gallon. Canada’s carbon price in 2030 will be a 73% increase in the price. The EU’s will be a 120% increase, while the US is unlikely to be able to get a carbon price or increase fuel prices through Congress with the structural and cultural problems they have in that country. If we take doubling the price of jet fuel as the basis for a calculation, that turns the annual airliner expense for fuel from 19% to 32% — a massive business disruption.

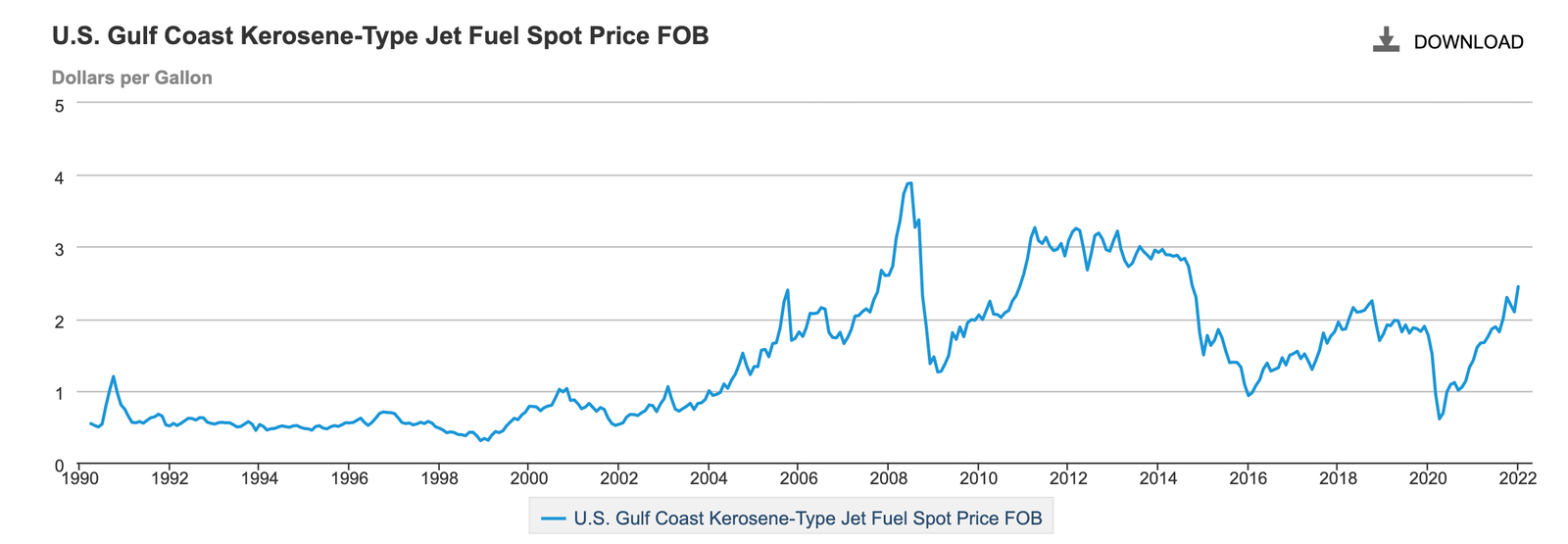

Of course, ATF has significant price volatility, and that’s only increased in the past 15 years. The 2019-2020 dip was due to a significant drop in demand as COVID curtailed aviation globally, of course. But as the energy transition plays out, volatility in fossil fuel prices will only increase, as was the case with natural gas price spikes in late 2021 and further spikes with the Ukraine invasion by Russia. Airlines will have to hedge potential fuel volatility more and more, and the stability of electricity prices will start to become more attractive.

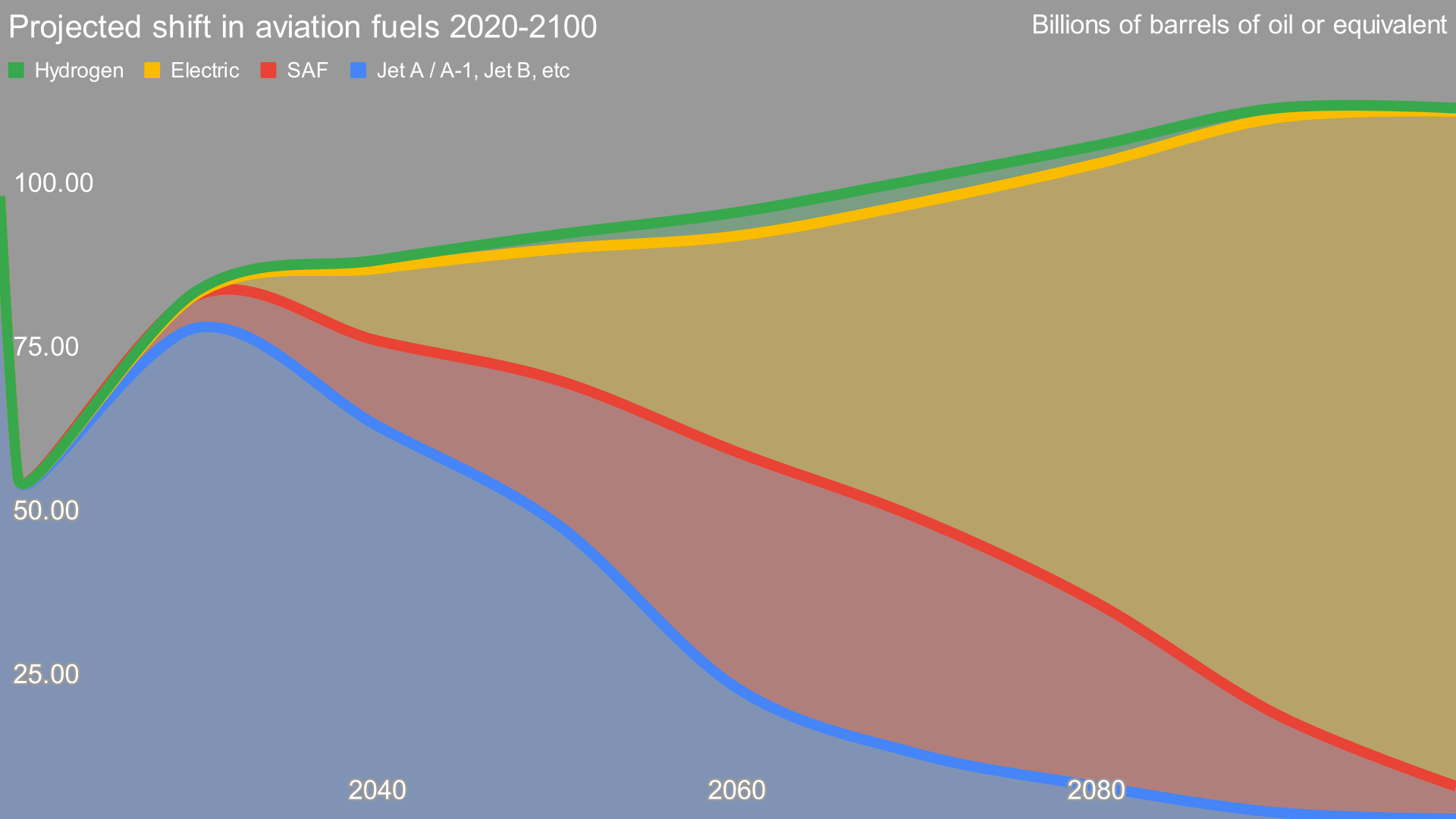

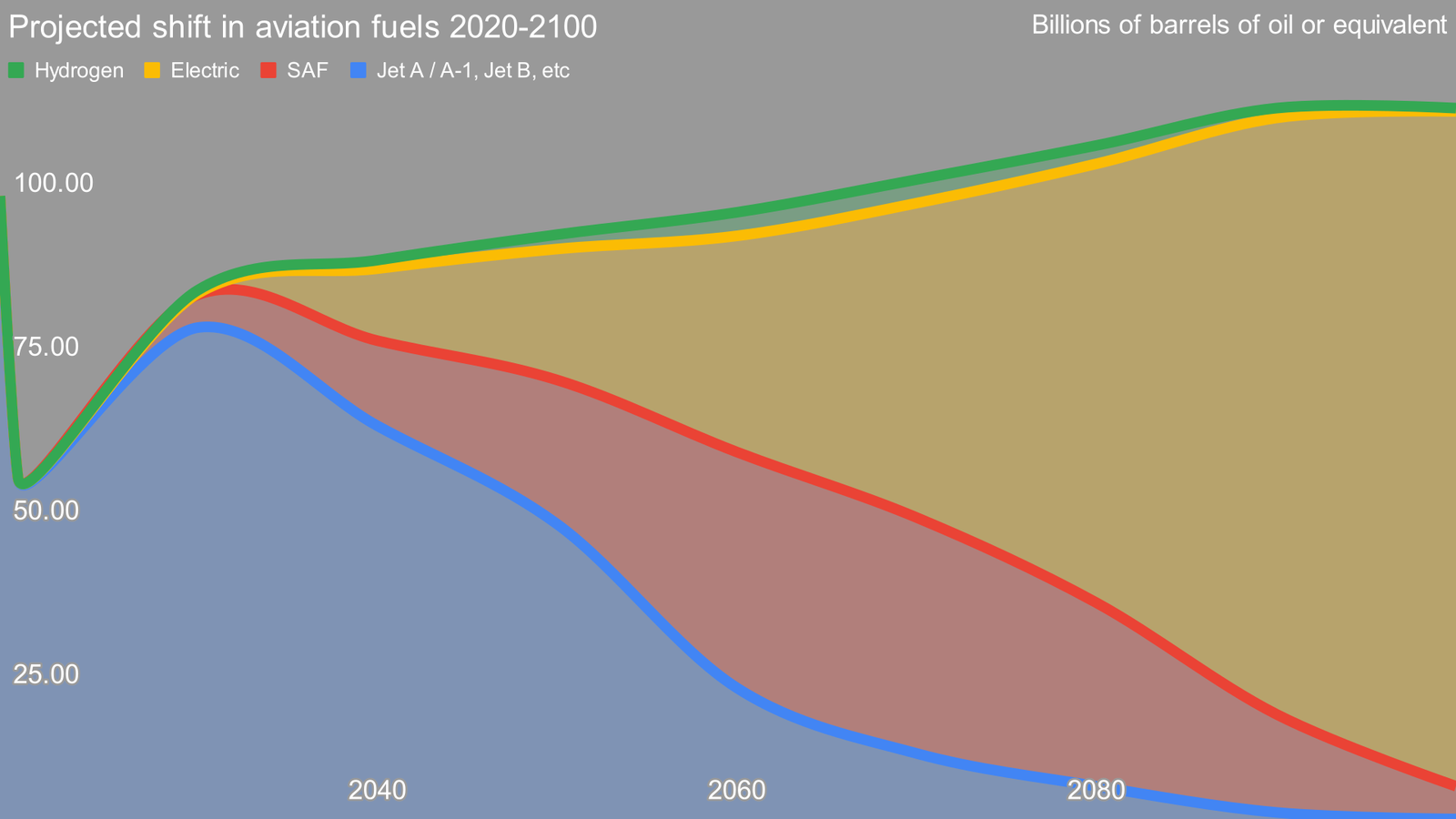

I’ve been projecting out various aspects of electrifying aviation, with a refueling scenario through 2100 and an electrified regional air mobility maturity model projected through 2040. Electrified aviation takes its fuel from rapidly decarbonizing grids, so it will pay less and less carbon tax over time. Global aviation and fossil fuel industries haven’t been lobbying for decades to keep their tax breaks or incredibly low taxes, so electric aviation is currently paying normal taxes on electricity. In the Netherlands, where ELECTRON is based, electricity costs from $0.12-$0.18 per kWh and has a 19% VAT applied, but ATF isn’t taxed at present, a clearly problematic state of affairs.

What this means is that Canada and the EU are appropriately applying market mechanisms to the fuel with negative externalities and allowing competition between replacements such as electricity, SAF biofuels, hydrogen, and synthetic fuels — a competition that I believe electricity and SAF biofuels will win –, while the US appears set on picking a single winner and not using market mechanisms. One assumes that rational decision-making will resurface in the US at some point, per Churchill’s observation on the country. At some point, the US will have to tax aviation fuels and price carbon, but at present it’s unlikely that it will even manage to subsidize better alternatives.

Which leads to the next interesting point. A thread I’ve been pulling at recently, and will return to in future aviation-oriented articles, is that airports are amazing places for behind-the-meter solar and storage. Aviation regulations require that large amounts of open space are everywhere around runways so that planes can actually land and take off safely. Ground-mounted solar has lots of room, with Groningen in the Netherlands having a 21.9 MW solar array and Edmonton International in Canada developing a 120 MW solar farm.

Electric aviation and behind-the-meter solar become a virtuous pairing, and combined with the potential for electric fleet vehicle and freight vehicle behind-the-meter charging, turns airports into energy powerhouses, giving them a valuable new revenue stream and role in decarbonization. I suspect that like the Texas Gigafactory, they’ll have to formally become an electricity utility to sell it to plane and ground operators, but regardless, there’s a strong climate win between cheaper behind-the-meter electricity and electric aviation that’s going to change flight economics.

All of this to say that the emissions of aviation will be priced so the price of aviation for passengers and cargo will go up significantly, and that’s part of why my projection of aviation demand is relatively flat through 2100. The actual opportunity market is a displacement of current business models and airframes with electrified regional air mobility, electric drivetrains on increasingly large planes, and SAF biofuels.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.