Geography matters (I/II): coastal green hydrogen hub as a key to building a hydrogen economy

· 22 min read

Find Part 2 of the article here

Hydrogen (H2) presents a significant opportunity for modern energy systems. These systems are amid the decarbonization transition due to public concerns about greenhouse gas (GHG) emissions, rapid technical innovation, the availability of specific energy resources, and the growing population from developing nations emerging from energy poverty (Saundry, 2021a). High-carbon energy sources and carriers need to be replaced by low-carbon ones to handle the growing energy demand during the current energy transition (Corbeau et al., 2022). While H2 is not a panacea for this transition, it "uniquely complements and enables other decarbonization pathways such as direct electrification, energy efficiency measures, and biomass-based fuels” (Hydrogen Council, 2021, p.13). In other words, H2 may assist other low-carbon technologies and energy efficiency improvements to achieve favorable decarbonization outcomes.

H2 is the most abundant element available in the universe. On Earth, H2 occurs naturally only in the compound form with other elements in the solid, liquid, or gaseous phases (EIA, 2021). H2 possesses many appealing physical properties. For example, it has a high energy density by mass. 1kg of H2 (33.3 kWh) stores about three times the energy content of 1kg of gasoline (12.2 kWh). Tesla's 4680 lithium-ion batteries may reach 300Wh/kg. A few solid-state batteries may achieve less than 1kWh/kg, a fraction of H2’s density by mass (Neil, 2022; DOE, 2020a). H2 also has environmental and health benefits since it does not generate carbon monoxide or sulfates when burnt in the air. Lastly, when H2 is used in a fuel cell, it emits nothing but water. A fuel cell is a device that uses the chemical reaction between oxygen and hydrogen to produce electricity without combustion (Economist, 2021). H2 is used mainly as 1) a chemical feedstock and catalyst, 2) a chemical in ammonia production, 3) a hydrogenating agent in drug and food production, and 4) in petrochemical and refinery processing. Like electricity, H2 may be utilized as an energy carrier to deliver, move, and store energy from other sources (DOE, 2020a; EIA, 2022).

H2 production is costly and energy-intensive due to its separation from the hydrogen-containing feedstock with an energy source (DOE, 2020a). Standard large-scale production methods include natural gas steam methane reforming (SMR), nuclear high-temperature electrolysis, low-temperature electrolysis, biomass gasification, and coal gasification (Ruth et al., 2020). Electrolysis, a water-splitting H2 production technology, is a “promising option for carbon-free hydrogen production from renewable and nuclear resources” (DOE, 2022a). Based on various technological methods and resources, H2 can be described as black (coal), gray (natural gas), blue (coal/gas with added carbon capture and sequestration), pink (electrolyzers with nuclear power), turquoise (pyrolysis through methane heating), and green or “GH2” (electrolyzers with renewable energy) (Economist, 2021). This study focuses on GH2 as a potential game-changer for modern energy systems.

The enthusiasm surrounding H2 as a low-carbon energy carrier is not new. For instance, in the 1970s, H2 interest was due to oil price shocks, gasoline shortages, acid rain, and air pollution. US federal government introduced the term “hydrogen economy” to define an industrial system running on nuclear and solar-generated H2 (Smith, 2022). The subsequent moderation in oil prices, public resistance against nuclear power, and air-pollution control measures lessened the H2 excitement. In the 1980s, the rise in concern about climate change increased H2 interest, especially with a focus on carbon and capture technology, transportation, and renewable energy. However, global oil prices remained low, lessening support for H2 usage. In the early 2000s, climate change concerns led to renewed policy action, concentrating on peak-oil matters and the transportation sector. By 2010, the H2 momentum decreased due to the peak oil concern’s retreat, uncertainty about climate policy developments, and the rapid progress with battery electric vehicles. None of the waves of interest resulted in sustainable investment in the technology (IEA, 2019). As a result, H2 accounts for less than 1% of the current energy mix, is mainly produced from unabated fossil fuels and is used on-site where it is obtained (Corbeau et al., 2022). In essence, the lack of success in the previous H2 scale-up was due to the dependence on high/rising oil and gas prices and the focus on one sector, transportation.

Although H2 has not lived up to the hype for decades, there is hope that H2 time as a clean energy solution has finally come. Despite skeptics like Elon Musk, big investors Bill Gates and Andrew Forrest firmly believe in the GH2benefits (Hume; Zilber, 2022). In addition, H2 supporters include the governments of the major economies, automakers, oil and gas companies, industrial gas producers, renewable electricity suppliers, gas/electric utilities, and engineering firms (IEA, 2019). There are four reasons for H2 as hope in the current energy transition. First, H2 can deliver deep emissions reductions, especially in the hard-to-abate sectors: shipping, aviation, heavy-duty and long-distance road transport, steel and iron production, chemicals, high-temperature heat in industry, and building heat. Second, H2 can ensure the continuation of renewable electricity’s growth. Third, technical innovation in other clean energy solutions can also benefit H2 innovation. Fourth, H2 can also contribute to many policy objectives: economic development, energy access, local air pollution, and energy security (IEA, 2019).

Presently, energy security is at the forefront due to the Russian-Ukraine conflict. Europe’s push to decrease its dependence on Russian gas is spearheading the push for GH2. In July 2022, GH2 cost less than natural gas in 8 European countries (Toplensky, 2022). "A nearly 450% jump in European gas prices over the past year has made green fuel of the future cost-competitive about a decade ahead of schedule" (Mattis et al., 2022, p.2). Thus, although gas prices may decline, this conflict solidified the political support and investor interest in scaling up the H2 economy.

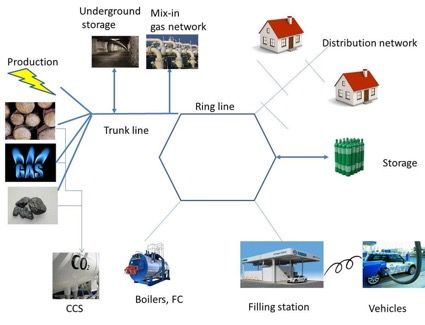

H2 infrastructure comprises production, storage, transmission, and distribution (DOE, 2020a), shown in Figure 1.

H2 producers can use different technologies and energy input sources. A trunk line feeds in a ring line around large demand centers (major cities), which, in turn, disperses in medium (industry, transport filling) and low-pressure distribution lines (households, service buildings) to end-users. The H2 can be consumed in boilers, fuel cells (stationary and mobile), or mixed in the natural gas grid. Several storage options can improve the flexibility of the H2 line, such as sizeable underground storage on the trunk line level and local/regional storage on the ring line level (Joode et al., 2014).

H2 transportation, storage, and distribution represent the main challenges in integrating H2 into the energy system (DOE, 2020a). H2 transportation and storage are difficult due to H2's low-volumetric density at room temperature and capability to permeate metal-based materials. There are four main methods for H2 transportation: tube trailers, pipelines, liquid tankers, and chemical hydrogen carriers. H2 storage options comprise physical-based (compressed gas, cold/cryo-compressed, liquid, and geological) and material-based (metal hydrides, absorbents, and chemical hydrogen carriers). No material-based storage options are ready for widespread commercialization (DOE, 2020c). H2 distribution (dispensing and fueling) is the last vital part of H2 infrastructure. Once the H2 has reached a transmission hub or the import terminal, local distribution is necessary to deliver it to final users. Similar to transmission, the main options for H2 distribution depend on volume, distance, and end-user needs. For example, the absence of H2 fueling network in the transportation sector represents the main obstacle to fuel cell electric vehicle (FCV) adoption since "consumers will only purchase an FCV if the stations exist to refuel it" (Sinha and Brody, 2021, p.7).

This article focuses on the significance of geography in creating an H2 economy. It is organized into six main sections. After the Introduction, Section 2 describes the position and concept of the paper. Section 3 explains the opportunities and challenges for the concept expansion in the US. Section 4 delineates an analysis of the idea through case studies on the US West and Gulf coasts. Section 5 discusses the recommendations for the concept expansion in the US. Section 6 concludes with a call for concept deployment. The following section describes the position and concept of this research paper.

European Union (EU) field visits to German Competence Center for Renewable Energies and Energy Efficiency in Hamburg University of Applied Sciences (CC4E/HAW Hamburg) and Danish power company Ørsted informed the position and concept of this article: a coastal GH2 hub is a key to creating an H2 economy. A GH2 hub is a "regional network consisting of the production, end-use, and connective infrastructure needed to produce, transport, store and use clean hydrogen in a functional regional market" (Kent, 2022, p.1). First, Beba (personal communication, June 24, 2022; NRL, 2022) introduced the Norddeutsches Reallabor project, a consortium of 53 Northern German partners from business, science, and government, attempting the "holistic system integration" through sector coupling with GH2. Coastal states generate vast amounts of offshore/onshore renewable energy with additional potential for GH2 production. Industrial clusters with gas/electricity grids are the backbone of this project, bundled into 4 coastal H2 hubs around urban centers. Second, Ørsted’s (2022) whitepaper also provided the framework for GH2 scale-up: 1) increase renewable energy build-out, 2) supply-side support push through investment and operational support, 3) deliver demand-side pull through carbon pricing and quotas, 4) create H2 hubs, and 5) approve standards and definitions for GH2 hydrogen.

The study also conducted a literature review, which utilized various qualitative and quantitative resources to confirm the concept and perform the analysis. As mentioned in the Introduction, energy security and climate change represent top priorities for EU policymakers. H2 constitutes less than 2% of Europe's industrial energy consumption, and 96% of that H2 is gray, derived from natural gas. In 2020, the EU launched its H2 strategy and the European Clean Hydrogen Alliance, exploring how GH2 may help cost-effectively decarbonize its economy, in line with European Green Deal. Per European Green Deal, the EU block pledged to lower emissions by at least 55% by 2030 (compared to 1990) and strive for the continent's climate neutrality by 2050. In May 2022, the EU announced the REPowerEU plan, which outlined a green "hydrogen accelerator" concept (EU, 2022). The plan targets to produce 10MM H2 tonnes and import 10MM H2 tonnes to the EU by 2030. The combined tonnage would need ~ 600GW of new solar/wind power and 200 GW of electrolyzers (Collins, 2022b). Selected GH2 hub-related initiatives are 1) H2 infrastructure and investment scale-up, 2) proposal for a global European H2 facility to foster business/investment opportunities in H2 production, 3) Important Projects of Common European Interest (IPCEIs) to support innovation in the H2 value chain, and 4) H2 partnerships to facilitate the GH2 import from third countries (EU, 2022).

These dual priorities are also shaping German national energy planning. In July 2022, Germany announced a target for renewable energy to meet 80% of electricity demand by 2030. In June 2020, Germany adopted its National Hydrogen Strategy, favoring GH2 domestic production and import through global partnerships. For example, in 2021, Germany launched the H2Global program to fund foreign GH2 infrastructure to meet domestic demand. The program ($1 billion) seeks to fund up to 500 MW of foreign electrolyzer capacity through competitive auctions to lower H2 costs. In contrast to National Hydrogen Strategy, only the state-level Hydrogen Strategy for North Germany specifically mentions hubs as regional enablers for building a H2 economy. Incidentally, 62 H2 IPCEIs are clustered on the Northern German coast and in the German coal regions (Kerencheva; Huber; HYCAP, 2022).

North Germany attempts to build an H2 economy by 2035. Selected unique regional opportunities for making GH2-infrastructure include: 1) reliable offshore wind power with expansion potential that can be combined with coastal solar power for H2 production, 2) seaports as locations for GH2 import and export of H2-related technologies/components, 3) underground storage formations (caverns) for H2 storage, 4) industrial clusters with a high-skilled workforce already using H2 technology and infrastructure, 5) growing number of potential buyers from various sectors interested in GH2, 6) H2 pipelines and natural gas infrastructure for H2 transport, 7) six government-supported projects testing H2 infrastructure and additional research facilities, and 8) political will to support H2 technology. Selected challenges include 1) lack of economically-viable business models for H2 generation and usage, 2) the lack of compatibility or flexibility in the existing funding landscape with H2 projects, 3) the expansion of renewable energy capacity is capped due to strain on current German power transmission abilities, and 4) existing technical rules for H2 blending in the gas infrastructure need to be adjusted (Ministries, 2022).

Lastly, additional literature confirms the viability of the coastal green H2-hub concept as a solution for creating a GH2 economy. For instance, IEA (2019) believes that coastal industrial clusters can serve as "gateways to building clean hydrogen hubs" (p. 177), as shown in Figure 2.

Corbeau et al. (2022) proclaim that "hubs at ports and industrial clusters will represent the first demand hydrogen centers, offering producers an area on which they can concentrate" (p.20). Alicia Eastman, InterContinental Energy president, believes that coastal sites are keys to GH2 production (Sheppard, 2022).

Based on the field-trip materials and literature review, the position and concept of this study are warranted concerning energy and the environment in the visited sites. A coastal GH2 hub represents a solution for building an H2economy, especially in its early stages. An ideal coastal GH2 hub, which promotes an effective "holistic system integration," has the following characteristics: 1) geographic cluster of facilities for renewable electricity generation with an additional capacity for GH2 production, 2) sea/ocean ports as business and logistics hubs for the GH2 import/export, 3) proximity to H2 storage resources, 4) industrial clusters with a high-skilled workforce already using H2 technology and infrastructure, 5) a large number of potential GH2 off-takers from various sectors, and 6) H2 pipelines, natural gas infrastructure, and other transportation modes for GH2 transport. A supportive political environment is crucial for building a successful GH2 economy. The following section outlines how this concept may be expanded in the USA.

The study’s concept can be expanded in the US with possible locations with suitable components for an ideal coastal GH2 hub. H2 deployment is crucial for the US. Since the US has the world's largest economy, its decarbonization is essential for obtaining global GHG emissions reductions of the magnitude required to fight climate change. This section describes opportunities and challenges for expanding this concept in the US.

In recent years, the US has started to create a solid groundwork for national H2 solutions, despite the absence of an official H2 strategy. In 2020, the US Department of Energy (DOE) published the Hydrogen Strategy and Hydrogen Program Plan, which describes the strategic framework for nationwide H2 deployment, H2@Scale (DOE, 2020a; 2020c). In 2021, DOE launched the Hydrogen Earthshot initiative to reduce clean H2 costs by 80% to $1/kg by 2031 (DOE, 2022b). In 2022, the US announced $9.5 billion in clean H2 funding as part of the US Infrastructure Investments and Jobs Act (IIJA) (Goldman Sachs, 2022, p. 17) and DOE's access to the $545MM Defense Production Act's emergency fund, which will also support domestic electrolyzer manufacturing (Parkes, 2022b). The proposed Inflation Reduction Act (IRA-2022) is also poised to make US GH2 the world’s cheapest form of GH2 under the tax-credit plan (Collins, 2022c).

The H2 hub concept is already well-recognized in the US since $8 billion of IIJA's federal investment is allocated towards the Regional Clean Hydrogen Hubs program (H2Hubs). On June 6, 2022, DOE released a Notice of Intent to fund the program, whose eligible applicants include technology developers, state/local/tribal governments, industry, utilities, etc. In addition, DOE’s H2-Matchmaker program seeks to connect H2 consumers, producers, and other stakeholders. In the early fall of 2022, DOE plans to publish the H2Hubs funding announcement. Presently, DOE anticipates awarding funding from 6 to 10 H2 hubs across the country, which are expected to be carried out over 8-12 years. DOE's program hopes to provide an award with a minimum range of $0.4-$0.5 billion, the maximum range of $1-$1.25 billion, with a 50% minimum non-federal cost share. In choosing the projects, DOE will look for projects with geographic, feedstock, and end-use diversity. Further, DOE will prioritize projects that create employment and focus on environmental and energy justice, consent-based siting, labor and community engagement, and workforce development (Gimont, 2022). H2 supporters view DOE funding for hubs as “deposits” that will fuel H2 innovation and further private investment (Smith, 2022).

The US has suitable locations with six components for an ideal coastal GH2 hub, allowing the deployment of large-scale decarbonization solutions.

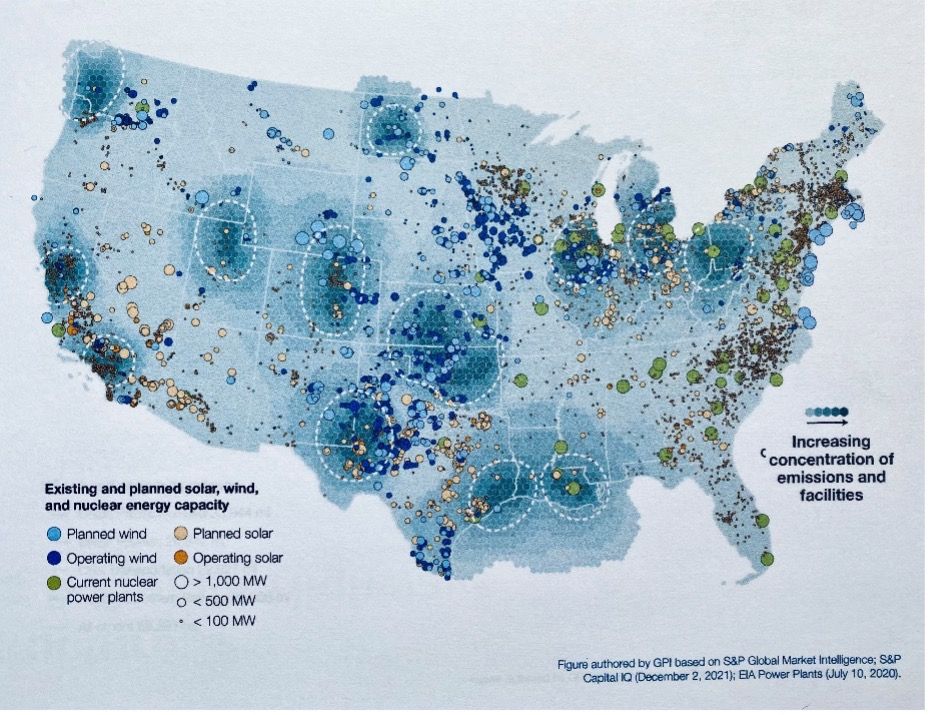

First, the country holds abundant renewable electricity sources (additional to existing and planned generation) required for GH2 production, as shown in Figure 3 (FCHEA, 2020; GPI, 2022). Given the electric intensity of water electrolysis, the capacity of electric generation dispatch markets and regional balancing authorities to take on additional load must be considered (GPI, 2022).

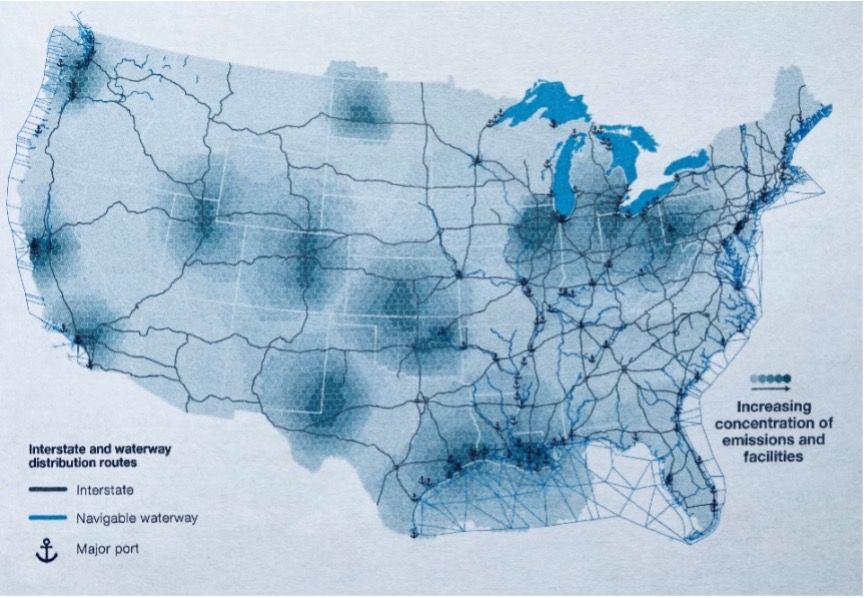

Second, the country has large ports, similar to the ones in North Germany. Such ports are on the Pacific, Atlantic, and Gulf of Mexico coasts, as shown in Figure 4 (GPI, 2022).

The ports hold potential for dual purposes: 1) support the H2 for truck/fleet vehicles and inland/marine shipping fuel, and 2) international H2 trade by ship (IEA, 2019). For example, IRENA (2022) estimates that by 2050, in an optimistic scenario, the US and Saudi Arabia would be able to achieve GH2-Levelized costs of about $0.75-0.80/kg. China will be the cheapest place for GH2 production, followed by Chile, Morocco, Colombia, and Australia (Parkes, 2022a). As soon as infrastructure, technology, and economics can support H2 trade through shipping, the H2 market might resemble the liquified natural gas (LNG) market from the early 2000s, such as point-to-point shipments based on long-term contracts. However, in contrast to the LNG, the H2 market will not be unified since H2 will be traded in many forms, such as liquified hydrogen, ammonia, organic hydrogen carriers, etc. (Corbeau et al., 2022).

Third, in terms of H2 storage, the US possesses three caverns, which can be used to store H2 on a massive scale (DOE, 2020c). In June 2020, DOE closed a $504.4 million loan to Advanced Clean Energy Storage. During its first phase, the hub is expected to produce up to 100 GH2-tonnes/day stored in two salt caverns (each with 150 GWh capacity), resulting in the global single largest H2 storage site (MP, 2022).

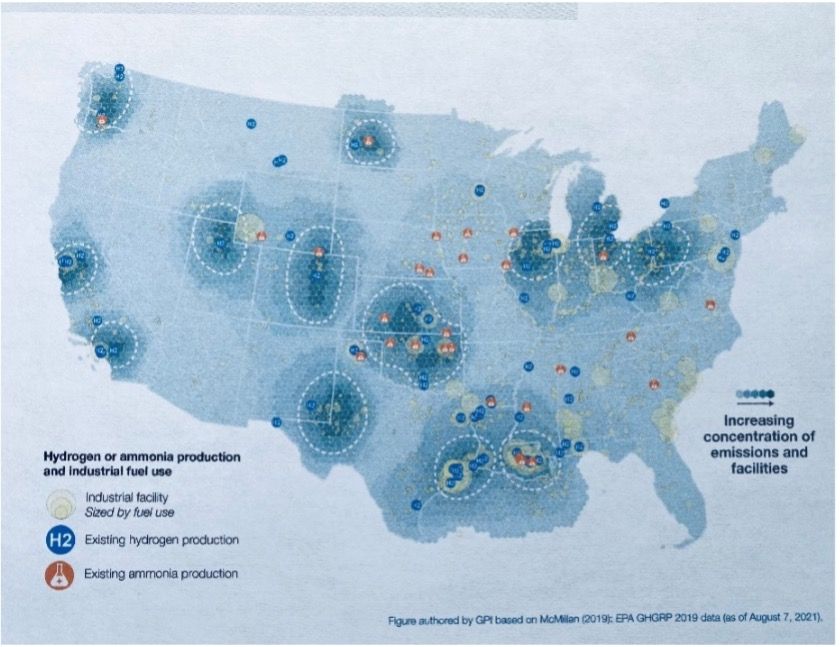

Fourth, US coastal industrial clusters with a high-skilled workforce are already using H2 technology and infrastructure, as shown in Figure 5 (GPI, 2022).

Such clusters provide an essential opportunity for scaling up (and cleaning up) H2 demand and supply. Since the GH2 demand and supply can be co-located, they reduce the need for significant investment in transmission and distribution infrastructure. The US industrial clusters already have large established H2 users for chemicals, ammonia, methanol, and steelmaking, offering an extensive and rising volume of GH2 demand (IEA, 2019).

Fifth, the US coastal industrial clusters represent promising locations for expanding H2 use in other sectors, as shown in Figure 6 (GPI, 2022).

Besides heavy industries, an effective coastal GH2 hub needs to have many off-takers from other vital end-use sectors, which require H2 as a decarbonization solution. Such sectors include long-haul, heavy-duty trucking, marine shipping, aviation, dispatchable power generation, and residential heating. The potential sources of H2 demand co-located with industrial clusters may offer potential synergies. For example, a 500MW power plant might generate H2 demand equal to 650,000 FCVs or heat demand from 2 million residential facilities (IEA, 2019; Kent, 2022).

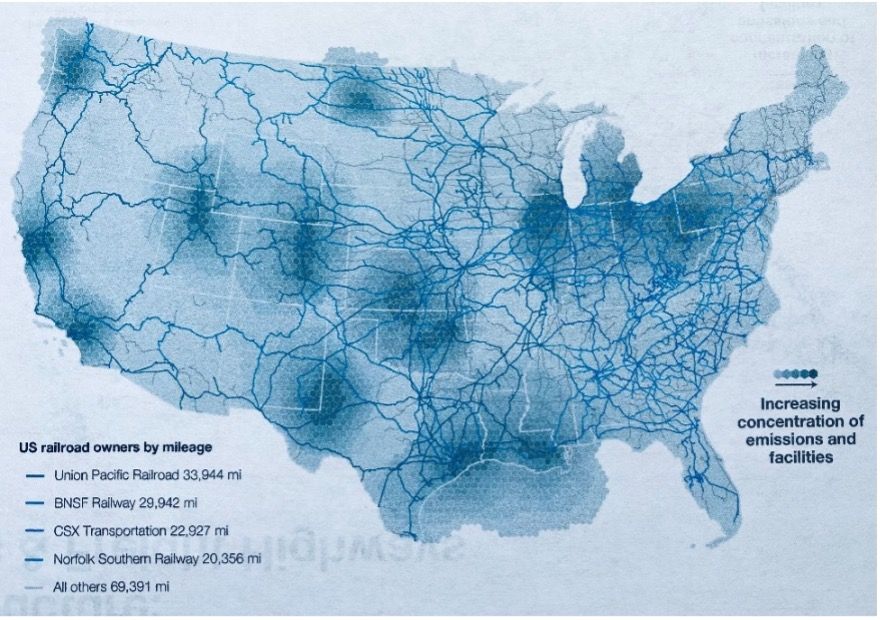

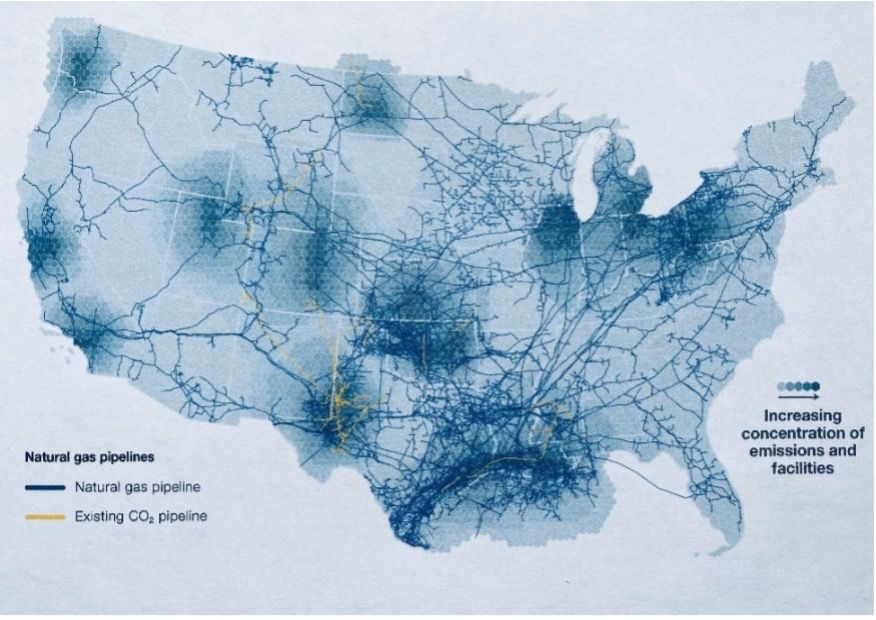

Sixth, similar to North Germany, the US extensive transportation network can be used for H2 transport. For example, the country already possesses more than 1600 miles of H2 pipelines (DOE, 2020c). Additionally, the country has railroads, barge waterways, and freight highways that can transport GH2 to places of utilization or storage, as shown in Figure 4 and Figure 7 (GPI, 2022). The US also has a well-developed natural gas infrastructure, allowing H2 transport, as shown in Figure 8 (GPI, 2022). Using existing natural gas pipeline networks in H2 transmission may benefit hydrogen supply technologies without incurring the significant investment costs and risks of developing a new H2 transmission and distribution infrastructure (IEA, 2019). Thus, the presented data and analysis prove that the US has the political will and all the components for ideal coastal GH2 hubs. The following section addresses the challenges of the US concept expansion.

There are two significant challenges to successful US coastal GH2 hub’s concept expansion: 1) the costs of electrolyzers and H2 infrastructure, and 2) competition with electrification in end-use sectors due to technology-neutral policies.

The economic issue with this study's concept expansion is connected to the costs of electrolyzers and H2infrastructure. Annually, the US produces ~10 MMT of H2 from fossil fuels: (99%), SMR (95%), and coal gasification (4%). The US uses electrolysis only in 1% of its H2 production. The current US H2 costs are GH2 ($10-$15/kg), gray H2($2/kg), and blue H2 ($5-$7/kg) (SGH2 Energy, 2022).

First, the competitive GH2 Levelized cost mainly depends on the cost of electrolyzers since renewable energy prices for solar/wind energy have decreased and become cost-competitive with natural gas (Krause, 2021). The largest electrolyzers proposed today are around 100MW, equal to only 10% of a steel plant's H2 demand. (DOE, 2020a; IEA, 2019). The current electrolysis technology is expensive, with approximately $1000/kW capacity and a conversion efficiency loss of about 10-30% (Krause, 2021). Raw materials used in electrolyzer manufacturing will also be in tight supply near-term (Parkes, 2022b). In 2020, the DOE analyzed that the US can generate GH2 from polymer electrolyte membranes (PEM) at nearly $5-$6/kg. This calculation assumes existing technology, electrolyzer costs at $1500/kW, and grid electricity prices between $0.05-0.07/kWh (Vickers et al., 2020). However, significant H2 off-takers would consider H2 economically viable only if it is made at $1/kg in the US and $2/kg in the EU (Hellstern et al., 2021). Therefore, building a GH2 economy through coastal GH2 hubs requires a drastic reduction in the cost of electrolyzers.

Fortunately, according to IRENA’s World Energy Transitions Outlooks 2022, the cost of H2 electrolyzers will decline at comparable rates to solar PV and onshore wind’s decrease in the past decade (Collins, 2022a). Such reduction will be realized by scaling manufacturing processes, utilizing learning-by-doing effects in electrolyzer utilization, and advances in system materials and design (Badgett et al., 2021). For example, Hysata, an Australian start-up, has recently developed a “capillary-fed” electrolyzer technology for alkaline electrolysis, representing a drastic improvement over the existing designs. The company claims its electrolyzer requires only 41.5 KWh/ kgGH2, whereas the industry efficiency benchmark is 50kWh// kgGH2. The electrolyzer's high efficiency, low supply chain risks, and straightforward approach to mass manufacturing – all help position Hysata as a valuable player in delivering the world’s cheapest GH2 (Collins, 2022d). Thus, such promising global developments indicate that the electrolyzer costs will eventually not challenge US coastal GH2 hub expansion.

Second, the cost of building H2 infrastructure for its end-use sectors, such as transportation, might be prohibitive. In 2019, the US transportation sector (28%) was responsible for the most significant source of US emissions vs. the power sector (25% of US emissions) (Saundry, 2021b). Emissions reduction from the US transportation sector, with potential GH2 assistance, is vital to meeting IPCC reduction mandates (IPCC, 2022). However, the costs of presently available H2-fueling stations are higher than those of traditional gas stations. Such costs include on-site natural gas re-formers and more stringent compliance costs connected to federal, state, and local regulations (Neil, 2022; CFCP, 2022). Thus, the delay in building H2 transportation infrastructure might hurt the generation of customer demand to buy GH2 at a price needed to cover production costs and a profit, regardless of potential subsidies provided by the US H2Hubs program.

Opportunely, the provisions under the recently introduced Inflation Reduction Act of 2022 might help solve the challenge of the cost of H2 infrastructure:

Therefore, the new US historical policy supporting the H2 industry would simplify the challenge of the cost of H2 infrastructure for its coastal GH2 hub deployment. The following section discusses the competition with electrification in end-use sectors as another obstacle for US GH2 hub developers.

The competition with electrification in coastal GH2 hub's end-use sectors (i.e., transportation) due to technology-neutral policies is another challenge for expanding the study's concept in the U.S. Papadis and Tsatsoronis (2020) believe that electrification of cars and trucks may serve as the best approach for the transportation sector. However, applying electrification to the entire transportation sector may be problematic (IRENA, 2018). Therefore, as mentioned in the Introduction, H2 deployment can complement electrification in the transportation sector during the US energy transition. Recently, the US has adopted technology-neutral policies for its transportation sector. For instance, 50% of all new light trucks and passenger cars sold in 2030 need to be zero-emissions vehicles, including electric, plug-in hybrid electric, or FCVs (Saundry, 2021c). However, due to ambitious state decarbonization targets, accurate technology winners might not be discovered rapidly enough to justify H2 infrastructure build-out.

Gross (2020) claims that a technology-neutral policy can increase infrastructure development and vehicle uptake but hinder fair technological competition. In other words, the technology-neutral policies that encourage the turn to a low-carbon vehicle fleet may prevent establishing an accurate technology winner for the transportation segments. For example, in June 2020, the California Air Resources Board (CARB) passed a ruling that requires the broad adoption of zero-emissions trucks from 2024, with all zero-emissions heavy-duty vehicle sales by 2045. Although the CARB policy is technology-neutral, this ruling will significantly benefit California's electric trucks which are currently ahead of H2 in research and development efforts (Gross, 2020). Thus, such policies may encourage the electrification of medium-heavy-duty trucks, which are more suited for decarbonization through the deployment of GH2 technology. Consequently, the policies might leave the deployment of H2 infrastructure and FCVs significantly behind, reducing the GH2 demand needed for the success of a US coastal GH2 hub.

As discussed in the previous section, the newly introduced Inflation Reduction Act of 2022 might establish a level-playing field for the potential US coastal GH2 hub developers. Besides the vast support for H2 infrastructure, this monumental policy introduces the Clean Hydrogen Production Tax Credit, offering nearly $13 billion in value across the H2 industry during the next 10 years. This credit provides up to $ 3/kg H2, depending on the carbon intensity of production, or a comparatively scaled investment tax credit for up to 30% for new facilities. Based on this policy, the GH2 producers might emerge as the main winners in the new H2 economy. Thus, the federal subsidies provided for H2 infrastructure and production might lessen the severity of the competition with electrification in end-use sectors, where GH2 is more beneficial for US decarbonization.

Regardless of the current challenges, the study's concept extension opportunities are more compelling in building the US H2 economy. The following section offers examples of the concept's upcoming use.

Continue reading Part 2 and find a full list of references here

This article is also published (in English and Arabic) in the "Climate Prospects Journal" of the Egyptian Cabinet Information and Decision Support Center (IDSC). Illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Hydrogen · Energy

illuminem briefings

Hydrogen · Green Hydrogen

illuminem briefings

Sustainable Finance · Biomass

H2-View

Hydrogen · Energy

Forbes

Green Hydrogen · Ethical Governance

Hydrogen Council

Hydrogen · Corporate Governance