$40B 2021 climate venture recap

· 6 min read

Climate tech is notoriously hard to bucket, but we’ve seen 7 major verticals emerge across companies in this space.

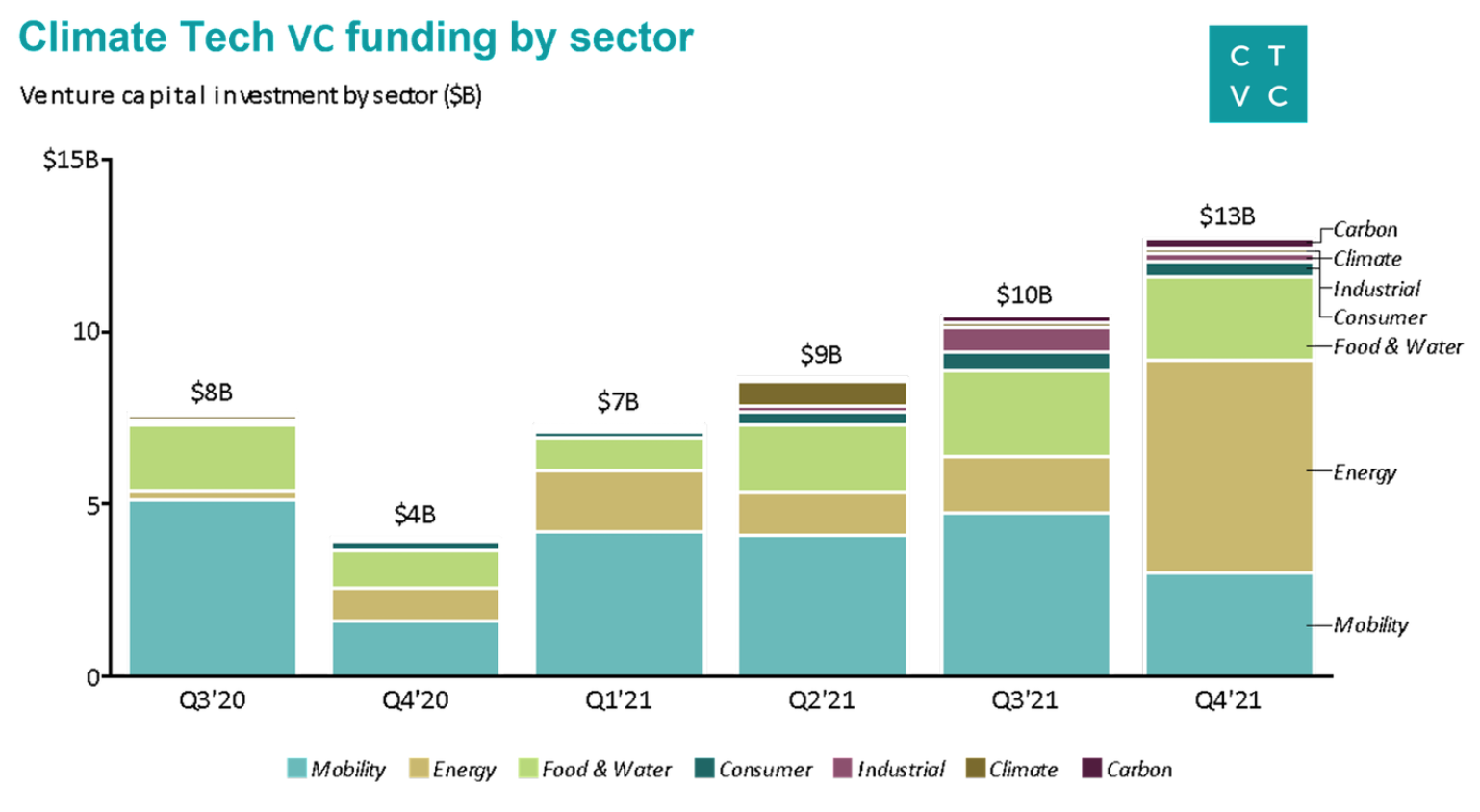

Climate tech startups raised $39.2b across 605 venture deals in 2021. Compared to the same period in 2020, investment in 2H’21 doubled dollars deployed as a whopping $23b+ poured into climate tech cos during the last 6 months of the year. Much of the capital flow volatility observed in topsy-turvy 2020 subsided in 2021. Funding rose ~20% sequentially during each quarter of 2021, likely buoyed by the broader macroeconomic recovery, robust LP engagement with sustainability, and favorable federal policies.

Just three sectors (Mobility, Energy, Food & Water) accounted for ~90% of total 2021 climate funding. Billion dollar giga-rounds for EV OEMs (Northvolt, Rivian) skewed funding towards Mobility in H1’21, while the force was strong in H2’21 for the Energy sector with nuclear fusion (Helion, Commonwealth) giga-rounds.

Though Carbon and Industrial made up a proportionally tiny <5% of the climate tech funding pie, dollars deployed grew ~10X and ~8X respectively from H2’20 to H2’21, significantly outpacing other sectors.

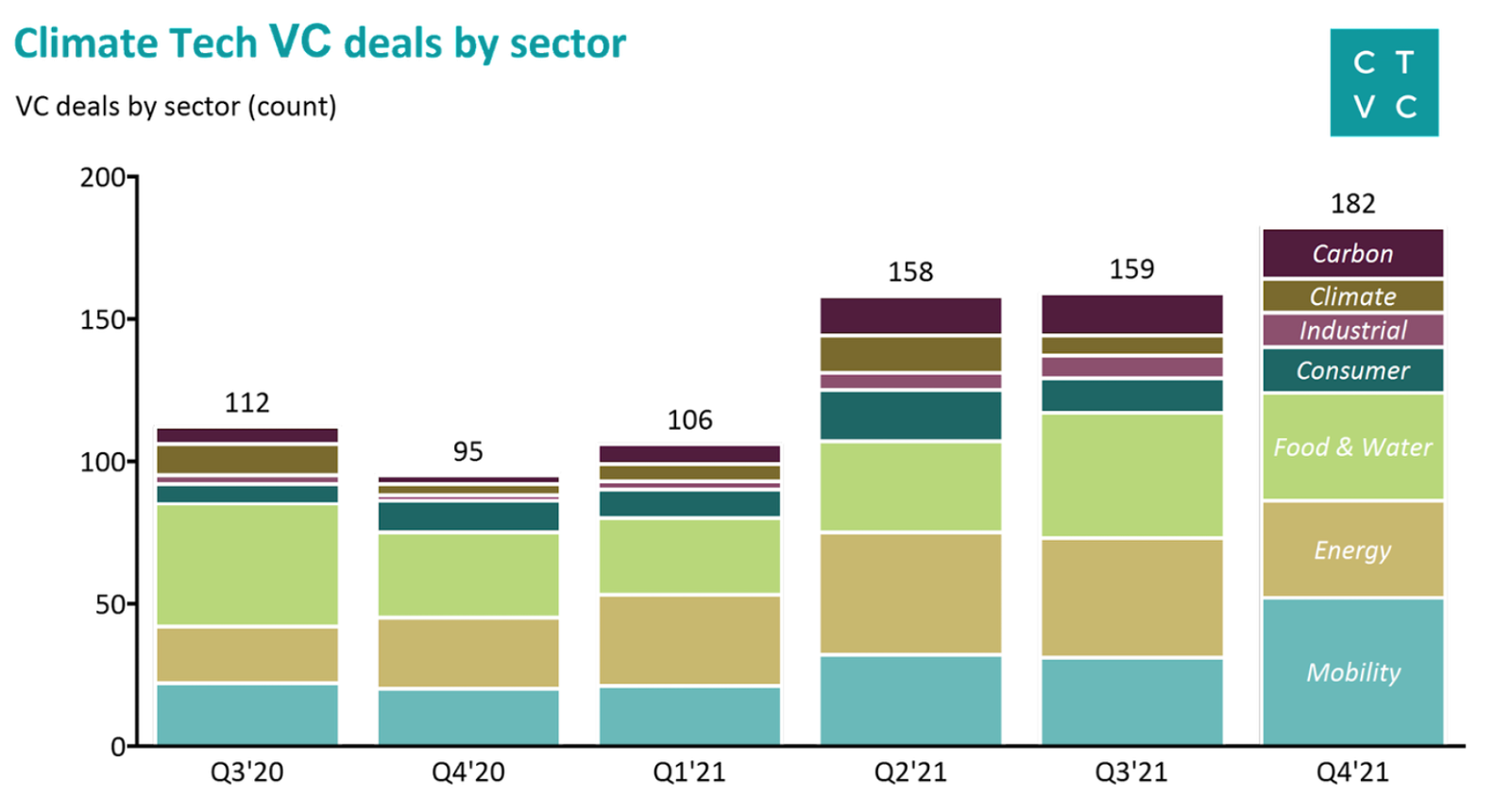

Deal flow boomed alongside deal sizes. 605 climate tech companies got VC funded in 2021. Compared to the same period in 2020, there were ~65% more climate tech deals in H2’21 and ~90% more in Q4’21. Like funding, the count of deals increased sequentially each quarter of 2021.

The sectors that pulled in the largest amount of funding also had the largest median deal sizes; median Energy, Food & Water and Mobility deal sizes were all >$10m. As a result, Mobility accounted for >40% of all funding but only ~20% of all deals. Whereas, though Carbon accounted for <2% of the funding pie, Carbon deals accounted for ~10% of all deals. In fact, the Carbon, Climate, and Industrial sectors all had blockbuster final quarters, with ~5x the number of companies funded compared to Q4’20.

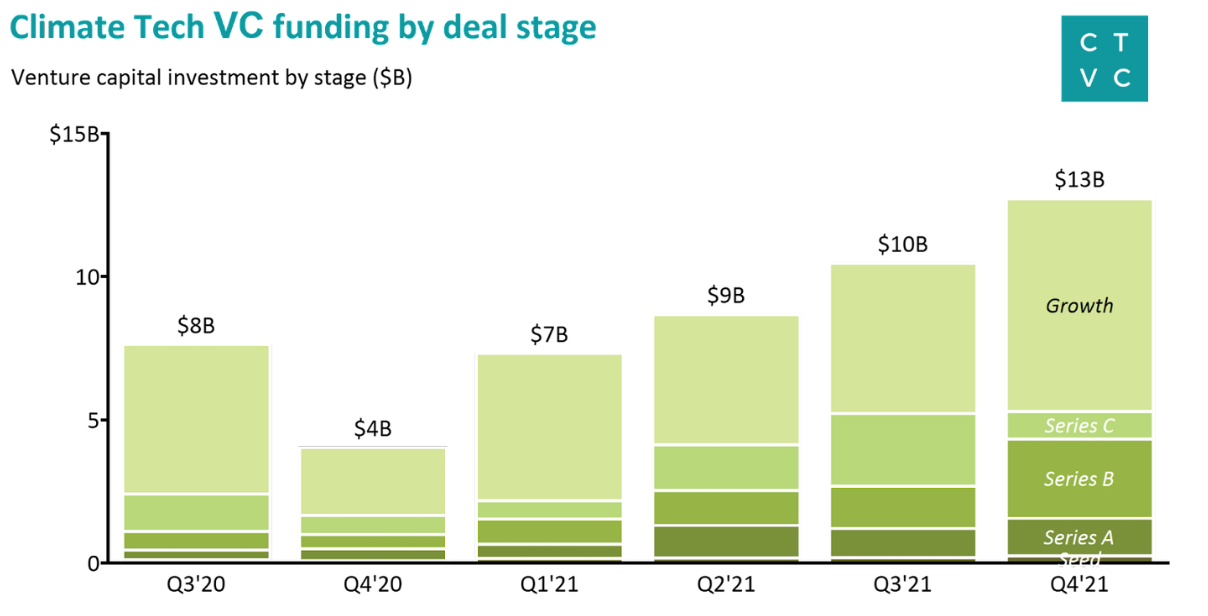

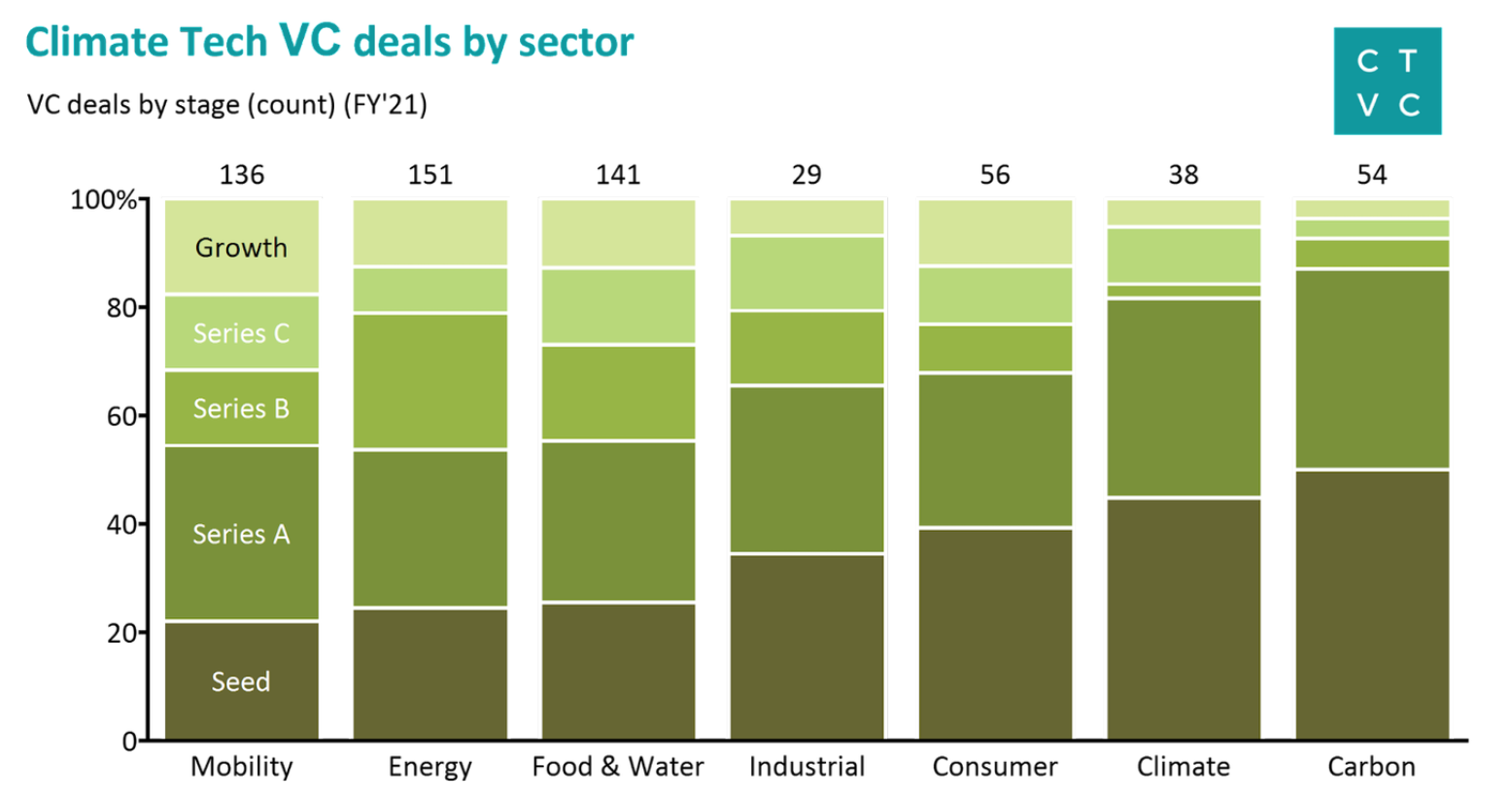

As expected, Growth stage deals continued to account for >50% of all climate dollars in FY’21. In the alphabet soup of pre-Growth venture funding, Series A, B and C rounds each relatively evenly accounted for 10-20% of all climate tech funding. Though, Commonwealth Fusion’s blockbuster $1.8b Series B (putting the $B in Series B!) round boosted Series B’s representation in Q4’21.

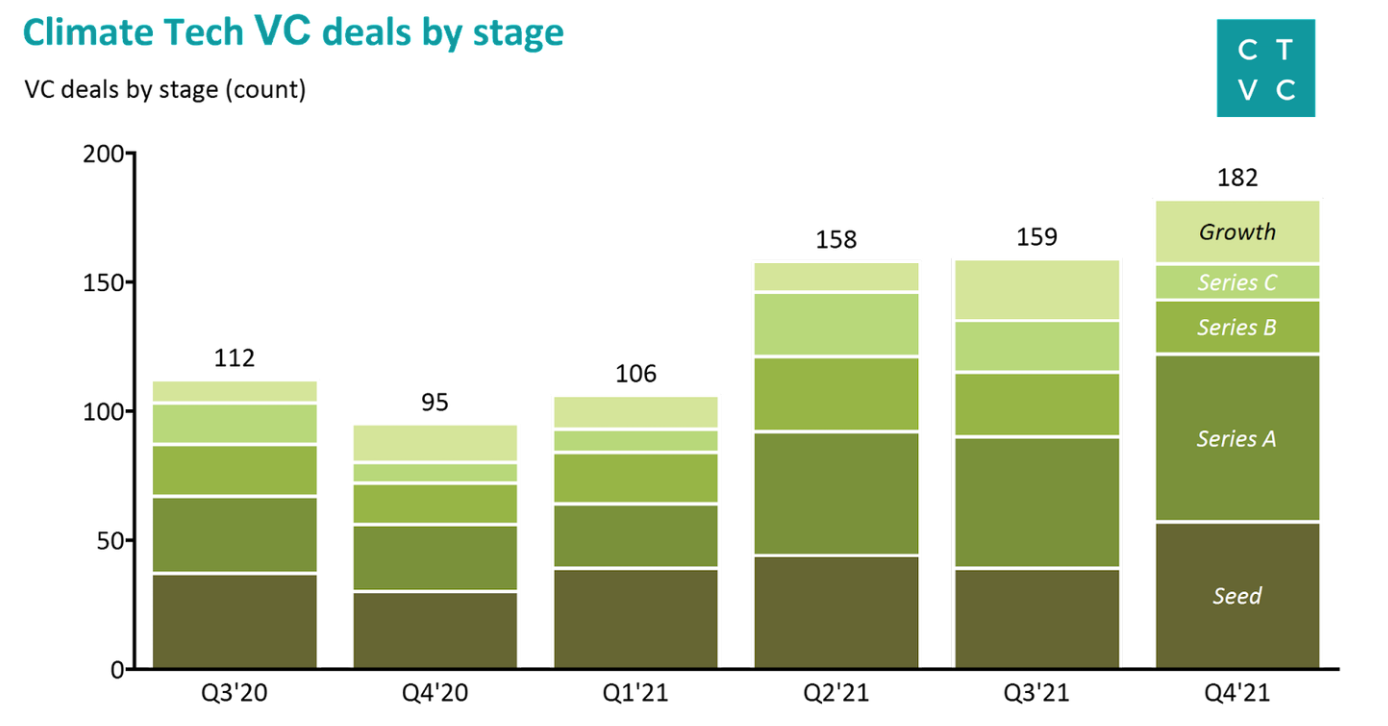

Early stage deal activity boomed in 2021 with a Cambrian explosion of climate technology startups. New climate companies were minted faster than ever before as Seed and Series A deals accounted for >60% of all activity. As expected, Seed-stage rounds accounted for <2% of all funding but recorded ~30% of all deals.

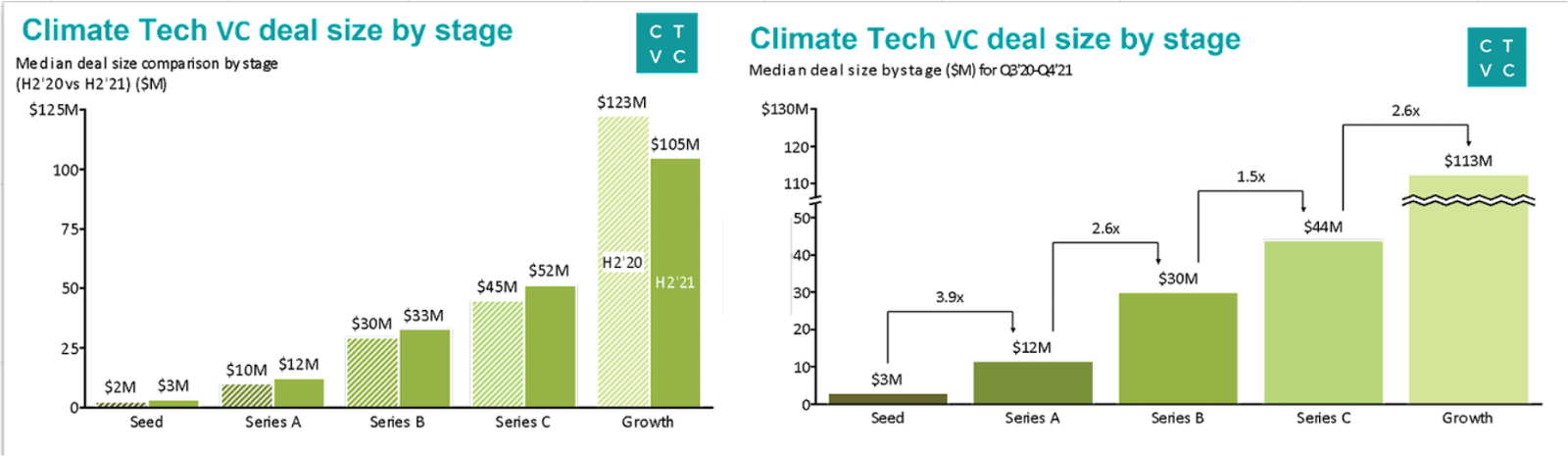

Rounds got bigger across the board as median pre-Growth deal sizes in H2’21 were all larger versus the same period the year before. The ‘graduation rate’ between stages was healthy, indicating that companies are validating investors’ expectations between rounds and can attract additional capital needed to mature.

Deal stage distributions reveal the relative maturity of various climate tech sectors. Within Mobility, Energy, Food & Water, late stage deals (Series B+) make up 40% of deal count activity. These 3 sectors have a prior cohort of businesses founded in the early 2010s that are now maturing. Meanwhile, in the emerging sectors of Carbon and Climate, early stage activity (Seed and Series A) made up 80% of deal count as new businesses were christened. As the new cohort of climate startups established over the past <5 years matures, we expect to see more late stage activity. This cohort of successful climate companies will likely be incentivized to raise at a faster velocity, pulled by demand from many new large growth-oriented climate investment funds.

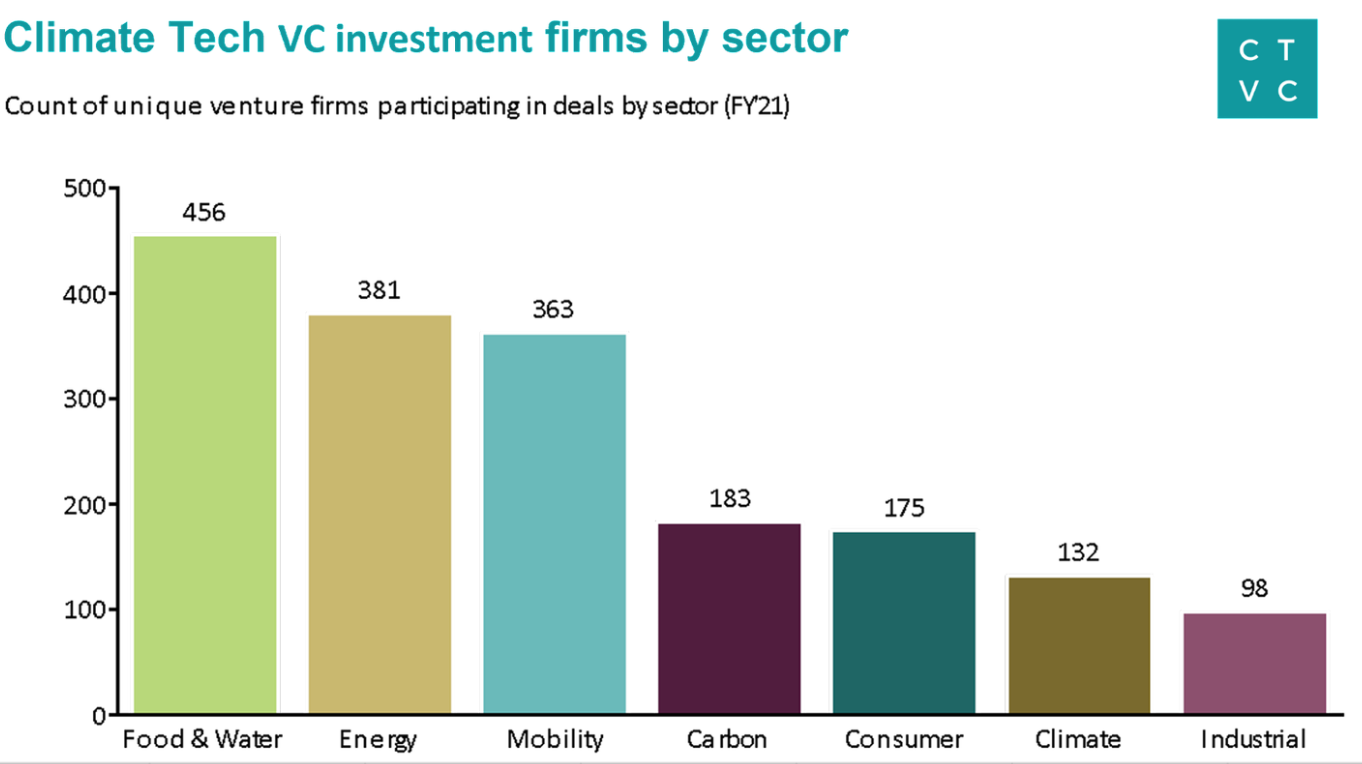

~1,400 investment firms joined at least 1 climate tech deal in 2021. Food & Water climate deals attracted the greatest diversity of unique participating investment firms. Climate-curious firms participated in many more Energy and Mobility deals compared to the year before, signaling an overall willingness to support B2B and hardtech models. In total, these three sectors accounted for over two-thirds of unique investors’ climate activity. Most notably, more investment firms jumped into the white-hot Carbon sector. 100 additional unique investors backed Carbon deals in just H2’21 for a total of 183 firms participating in carbon removal, offsets, and markets in 2021.

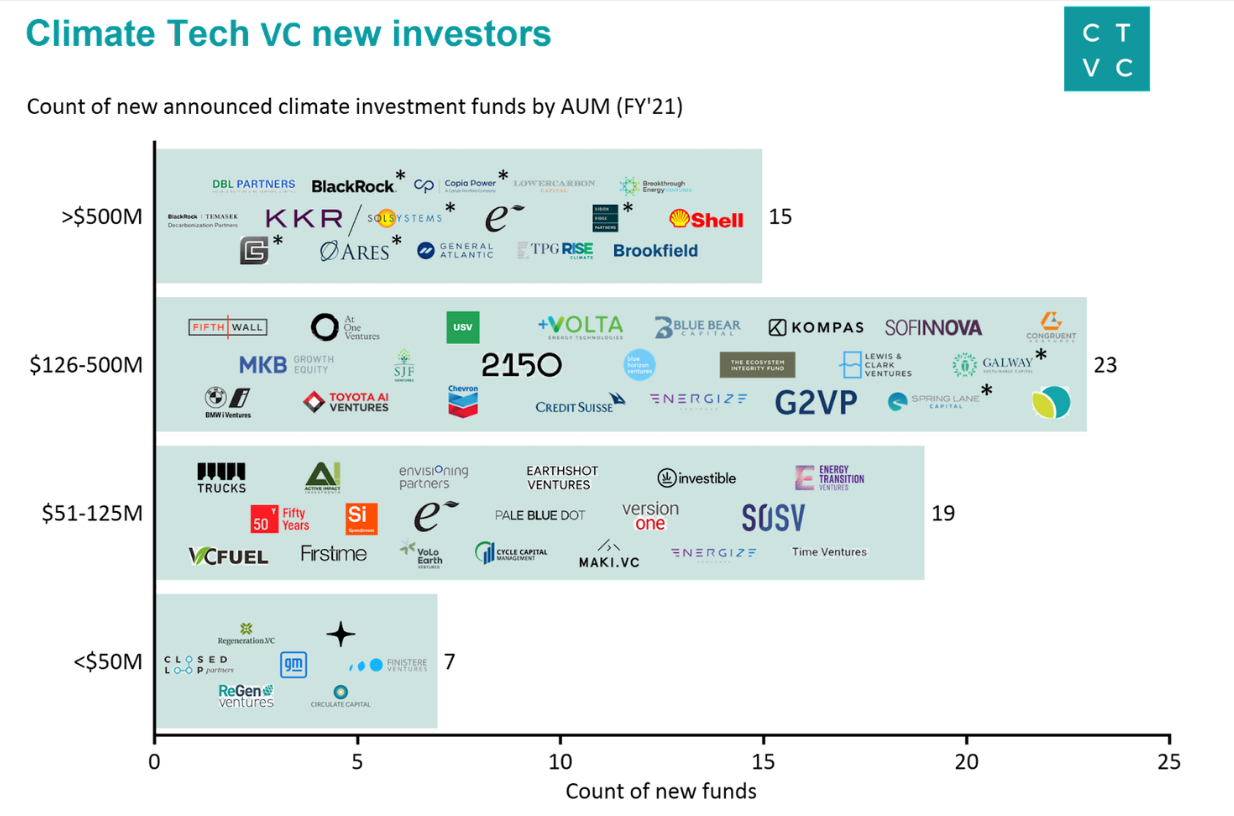

When tracking announcements of new climate funds, we looked at the full stack of financing options, including both VC/ PE as well as infra funds (marked with an * in the chart above). 64 new climate funds launched in 2021 with $37b of fresh dry powder ready to plow into climate tech. 2/3rds of new entrants are mid-to-large funds with $51-500m AUM. But the lion’s share of new climate cash ($30b) comes from the 15 new megafunds, each with $500m+ AUM.

Of the megafunds, 40% are deployment-ready infra funds with deep pockets to build and scale mature climate technologies. While infra finance has historically skewed away from risk, there’s hope that new climate infra funds will fund newer climate technologies like hydrogen fuel cells and anaerobic digesters to allow them to achieve scale faster than renewables did.

This article also appeared on Climate Tech VC. Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

Glen Jordan

Sustainable Lifestyle · Sustainable Living

illuminem briefings

Architecture · Carbon Capture & Storage

illuminem briefings

Labor Rights · Climate Change

Financial Times

Carbon Market · Public Governance

GB News

Carbon · Sustainable Mobility

The Independent

Effects · Climate Change