· 6 min read

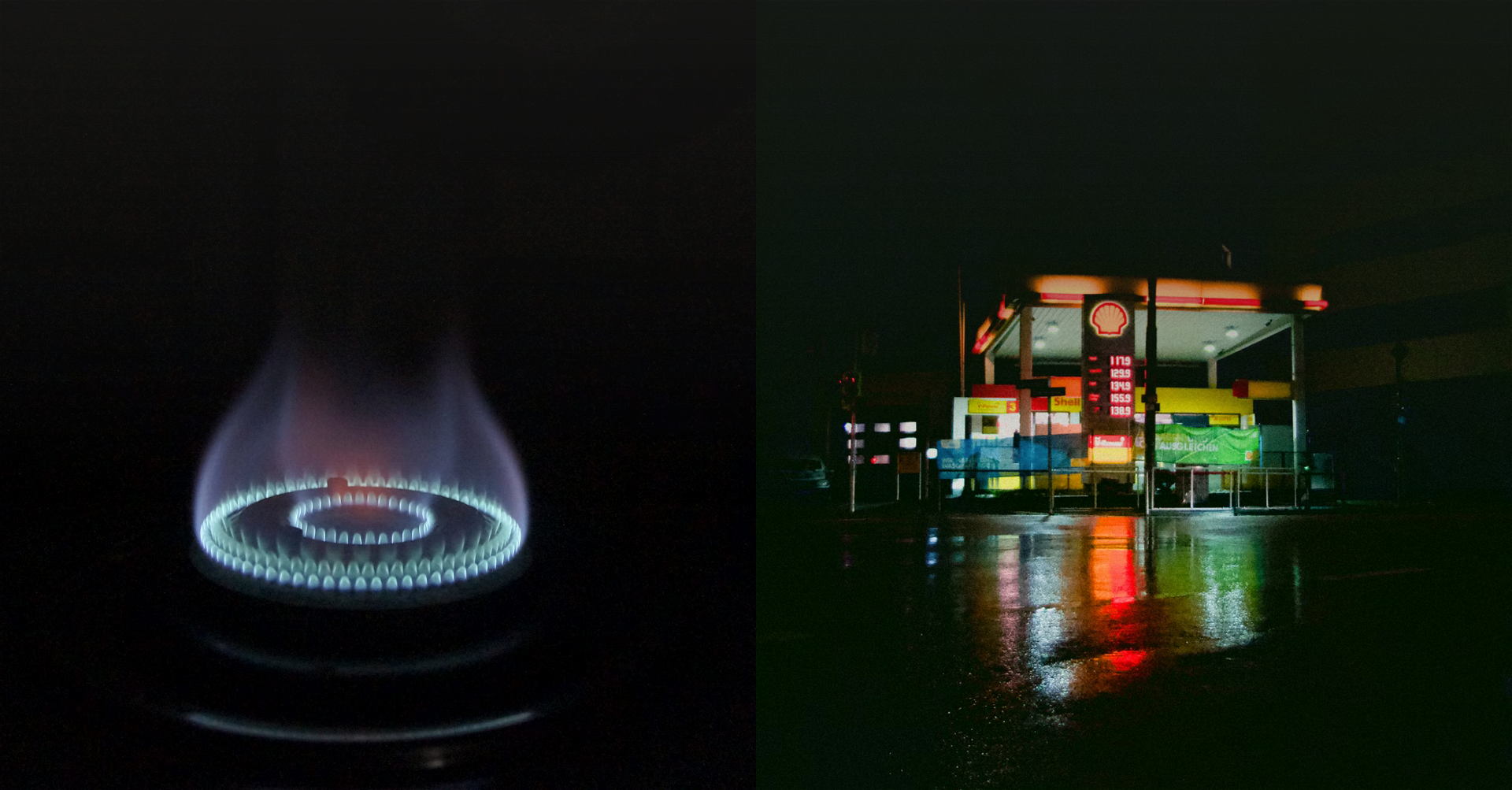

1. What’s Next For Oil And Gas Prices As Sanctions On Russia Intensify

By JPMorgan

- “We assume the current geopolitical risk premium now embedded in our 2022 annual price forecast of 81.25 €/MWh would lend to Northwest Europe importing around 18% more LNG year-over-year”, said Shikha Chaturvedi, Head of Global Natural Gas and Natural Gas Liquids Strategy at J.P. Morgan

- If disruption to Russian volumes were to last throughout the year, the Brent oil price could exit the year at $185/bbl, likely leading to a massive 3 mbd drop in the global oil demand

- Reflecting the higher risk premium across the oil market and wider commodities complex, the J.P. Morgan baseline view calls for the Brent oil price to average $110 /bbl in the second quarter of 2022, $100/bbl in 3Q22 and $90/bbl in 4Q22, with the possibility that prices rise as high as $120/bbl in the interim

2. Carmakers Race to Control Next-Generation Battery Technology

By The New York Times

- Today, batteries can make up a quarter to a third of the cost of electric cars, therefore determining the price of new cars and potentially defining their features

- “This is going to be the new brand differentiation going forward - the battery in electric vehicles,” said Hau Thai-Tang, Chief product platform and operations officer at Ford

- Tesla said in February that it had already built one million cells for its next-generation “4680” battery and the CEO Elon Musk, claimed that the battery will have 16% more range because of its distinctive honeycomb design

3. What does IPCC report II tell energy businesses about their future?

By Energy Monitor

- One of the key risks identified in the latest released IPCC report II comes from changes to water availability as the Earth heats up, because hydroelectric power generation could be affected drastically by it

- Furthermore, higher global temperatures will increase the effectiveness of thermal plants but decrease the efficiency of photovoltaic solar panels with a global decrease of solar power effectiveness of 1% per decade between 2005 and 2049, according to a paper

- Similarly, structural damage to power transmission systems will increase in areas expecting more wintery weather in future: “In the EU, the expected annual damages to energy infrastructure, currently €500m per year, are projected to increase 1,612% by the 2080s,” the report states

4. Climate goals and the collateral damage from Putin’s war

By GreenBiz

- Putin’s war is leading to the loss of valuable time in addressing the growing climate crisis, with green electricity generation and transportation systems transitions being just two examples that will likely require some additional years.

- Four factors explain why, for the foreseeable future, climate change will be significantly sidetracked and these are: the global scramble to secure oil and gas supplies; inflation; the international system’s increasing fracture; political leaders in the western democracies’ limited bandwidth

- With the overall objective being one of finding ways to progress towards net-zero, several steps are recommended: strengthening coalitions; implementing regulations; accelerating partnerships

5. Rising leaders on social and environmental sustainability

By Yale CBEY

- 2035 students from 32 business schools all over the world were surveyed on 4 main points: the perceived knowledge of business leaders on climate issues, how business schools are integrating sustainability topics, the importance of sustainability when choosing a job and levels of concern about the environment

- Main findings include that 51% would accept a lower salary to work for an environmentally responsible company and only 20% believe businesses are taking sufficient climate actions

- 94% agree that climate change is happening and 52% consider themselves very or extremely worried about its impacts. Overall, they demand more action both from their own schools and from global actors in general

6. The EU’s plan to cure its Russian gas addiction

By Politico

- The war in Ukraine has added urgency to EU efforts to wean itself off imports from Russia, prompting Brussels to delay its long-awaited communication on tackling sky-high power prices and turn it into a plan for improving the Continent’s energy security

- As part of the retooled text, the Commission is mulling setting mandatory gas storage levels for member countries, saying that to prepare for next winter, the EU needs an “average level of storage filling of at least 80% by 30 September”

- The draft text, also features several measures aimed at scaling up the EU’s renewable energy capacity, dubbed a “New Energy Compact”

7. Shell sorry and pledges to stop buying Russian oil

By BBC

- Shell came under huge criticism at the weekend after it purchased a cargo of Russian crude at a discounted price

- When the energy giant was forced to defend its purchase of Russian crude over the weekend, it insisted that it had "no alternative" in order to maintain timely supplies of fuel to Europe

- The company has now pledged to stop buying oil from Russia as it apologised for its purchase of cheap Russian crude at the weekend. It also said it would close all its service stations in the country and stop all current work there

8. This startup uses an ancient microbe to turn CO2 into ingredients for food

By Fast Company

- The startup Arkeon Biotechnologies is using a single-step process of fermentation, turning captured CO2 into ingredients for food in a Vienna-based lab

- “The unique feature of the microorganism we’re using is that it’s producing all of the amino acids that we need in human nutrition,” says Gregor Tegl, the CEO of Arkeon, which just raised a seed round of $7 million from investors

- In a few weeks, the company will expand to a pilot facility to begin producing its ingredients at a larger scale, following its partnerships with breweries to use CO2 captured in the brewing process

9. Here’s How Biden’s Historic Ban On Russian Oil Will Hit The Economy

By Forbes

- In a widely anticipated move Tuesday, President Biden announced a new, unilateral ban on Russian oil imports—the latest punitive actions from the West against Putin’s regime for the ongoing invasion of Ukraine

- Experts now predict that in a worst-case scenario, where further restrictions are placed on Russian energy markets essentially isolating them from global markets, oil prices could surge to more than $150 per barrel—even as high as $200 per barrel—for a sustained period of time

- Several major economists now predict that the U.S. ban on Russian oil imports—though widely supported by the domestic public—will likely exacerbate decades-high inflation and lead to slower economic growth

10. Oil and gas prices are surging — Here’s what that means for renewable energy stocks

By CNBC

- Oil shot above $100 per barrel for the first time in years the day Russia invaded Ukraine, and has climbed sharply higher since, while on Thursday, Brent crude hit $119.84 per barrel

- “The move higher in global natural gas and power prices is potentially a longer-term catalyst for acceleration of development of renewable energy capacity”, said Ameet Thakkar, energy transition and infrastructure analyst at BMO