· 7 min read

Pressure is growing from multiple directions for the shipping industry to decarbonise. Alternative fuels do exist to reduce or remove all emissions from fuel use, but they are not yet competitive with fossil fuels, and face a range of barriers to entry. Calls for policy support for decarbonisation are increasing, but it is not yet clear what such support should entail.

Our analysis looks at the feasibility of applying a policy instrument known as a ‘contract-for-difference’ (CfD), which has seen previous success in driving down the costs of renewable energy generation technologies in the electricity sector. We explore the application of this policy instrument to the decarbonisation of shipping, unpacking the important design and implementation decisions with feedback from a wide range of stakeholders, and provide initial legal documentation based on our findings, drawn up by legal experts Pinsent Masons.

The heavy transport sector is moving to the centre of attention for decarbonisation efforts. Pressure is increasing on governments to decarbonise all forms of transport – road, airborne and waterborne. The International Maritime Organisation (IMO) has agreed to reduce total GHG emissions from shipping by at least 50% by 2050 (from 2008 levels) and consultations are currently under way for the inclusion of shipping in an expansion of the European Union Emissions Trading Scheme. The shipping industry is looking to decarbonise with some major shipping firms, notably, Maersk (the world’s largest container shipping line), announcing zero-carbon targets. Calls for policy support in this effort are increasing.

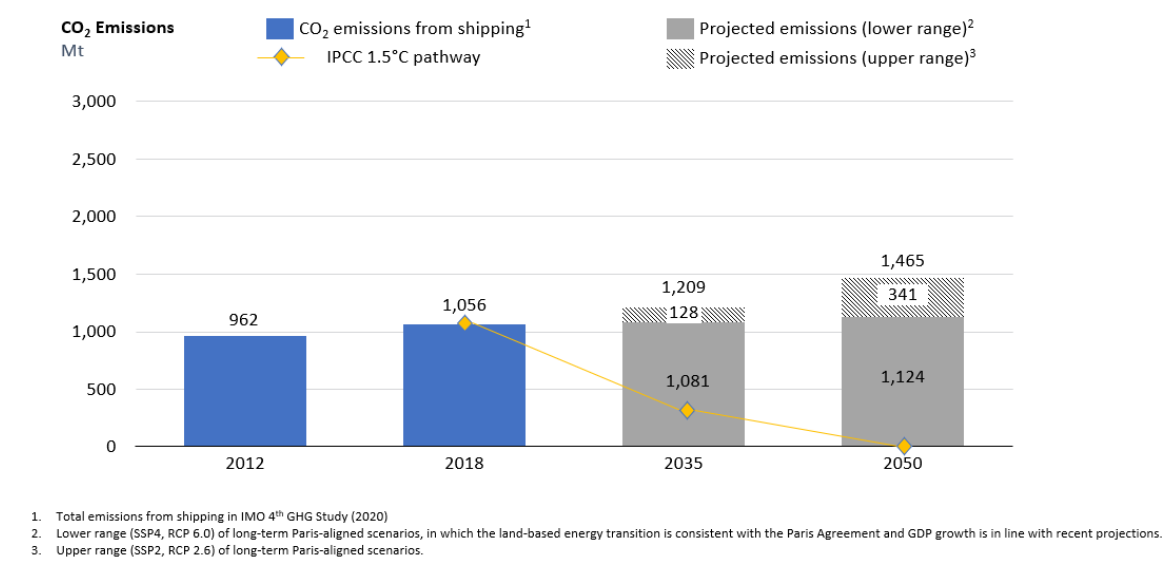

Marine transportation accounts for an estimated 2.9% of global greenhouse gas (GHG) emissions. Even accounting for the COVID-19 pandemic, shipping emissions are expected to stay steady or increase significantly, with the IMO predicting that the sector’s emissions could reflect 90-130% of 2008 levels by 2050 for the most plausible pathways identified in its Fourth GHG study (2020). As shown in ES- 1, the emissions gap between the range of projected shipping emissions and the requirements of the 1.5C pathway under the Paris Agreement are daunting.

Several potentially viable technologies for decarbonising shipping exist, with each at different stages of maturity in innovation and implementation. Options include batteries, biofuels, hydrogen-based fuels, carbon-based synfuels, nuclear, and wind power – although not all can meet the fuel energy density requirements of larger deep-sea vessels.

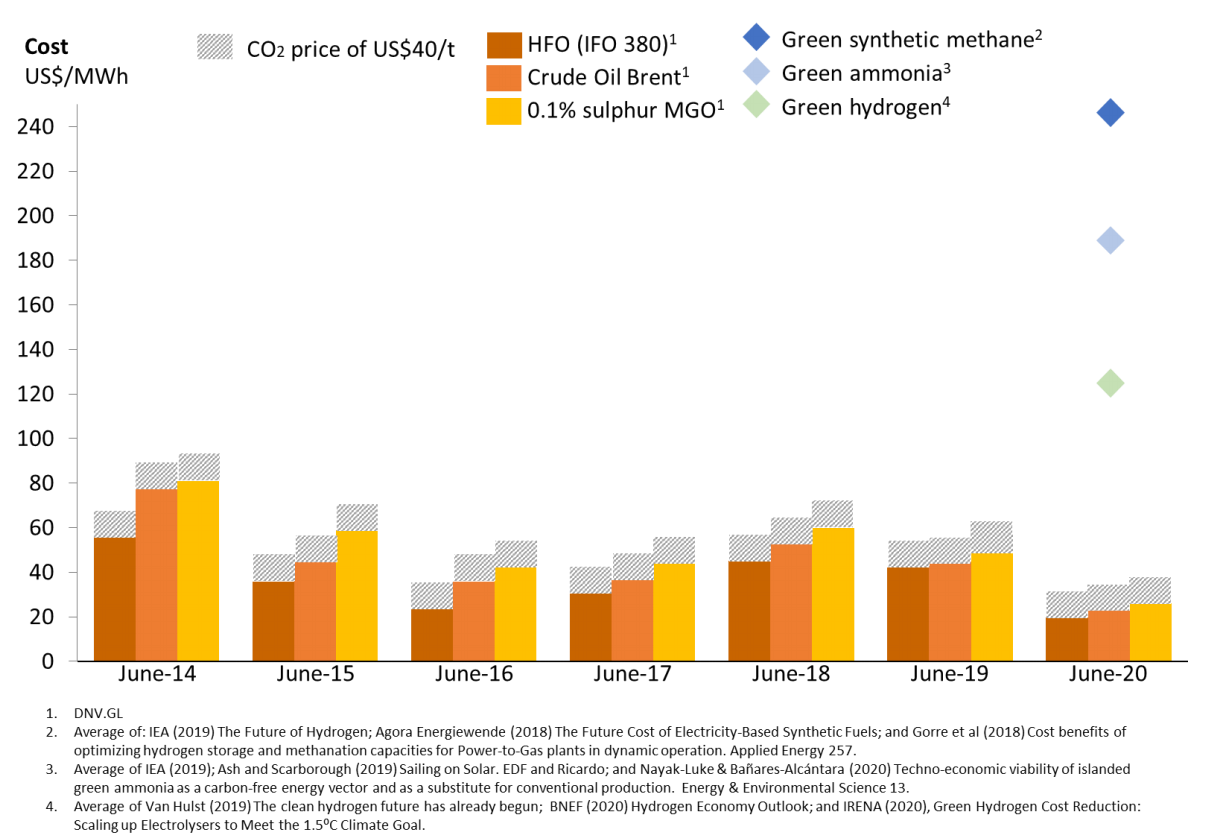

Technological advances have reduced the cost of clean fuels but still more progress will be required for zero-emissions shipping to become economically viable. As shown in ES- 2 the costs of clean fuels, such as green hydrogen and green ammonia are more than double their fossil fuel counterparts, even with a modest carbon price of US$40 per tonne. The key barriers to large-scale private investment and adoption of such clean fuels are well-known and include high perceived technology risks, lack of supporting infrastructure, lack of a project pipeline, lack of stable and scalable fuel supplies, and perhaps most importantly their costs in the absence of carbon pricing (or its equivalent) on existing fuels.

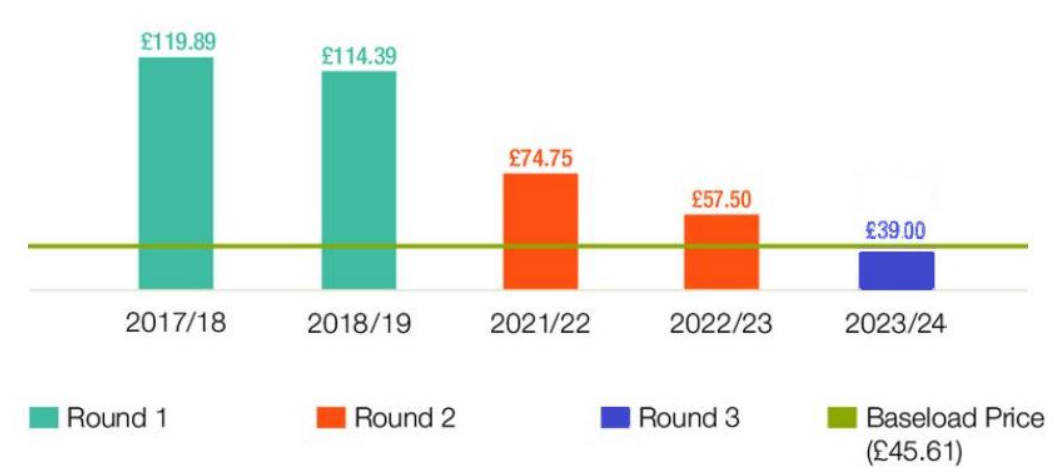

Cost obstacles have been dealt with successfully in other sectors in recent years. Most notably, in the UK offshore wind industry, a renewable obligations scheme, followed by three rounds of contract-for-difference (CfD) auctions has seen the ‘strike’ price of wind-derived electricity reduced to a third of its pre-CfD value and to a price below current base-load electricity prices (ES- 3). This remarkable result has been achieved at least partly by using CfDs to promote private sector investment and thereby stimulate technological progress and accelerate learning rates.

This report investigates the design and implementation of CfD mechanisms for international shipping to support the sector’s decarbonisation. The purpose of such schemes is to incentivise investment in emerging technologies, to accelerate deployment and reduce costs to the point where they become economically competitive without support.

Incentivising private investment is key to the necessary scaling and adoption of clean shipping fuels. In its basic form, a CfD can help achieve this by allowing a public sector entity to meet the difference between the market price for a fuel or technology (the ‘reference price’), and the ‘strike price’ required for its financial returns to be sufficiently attractive to developers and private investors. When the strike price is higher than the reference price, the scheme in effect subsidises the producer of the fuel or technology the difference. When the reverse is true, the producer repays the subsidy.

The viability of any incentive mechanism depends on both legal and economic feasibility as well as appetite for uptake by relevant stakeholders. Any CfD solution must be sensitive to the needs of the shipping community and providers of supporting infrastructure. Consequently, a key focus of the project was a stakeholder engagement process aimed at understanding the myriad viewpoints from shipping and energy industries, government and regulatory bodies, financial institutions, researchers, and civil society. In designing the CfD we strove to strike the right balance between stakeholder needs, political and practical feasibility, the need for technology neutrality and a level playing field, and the need for specificity in the policy mechanism.

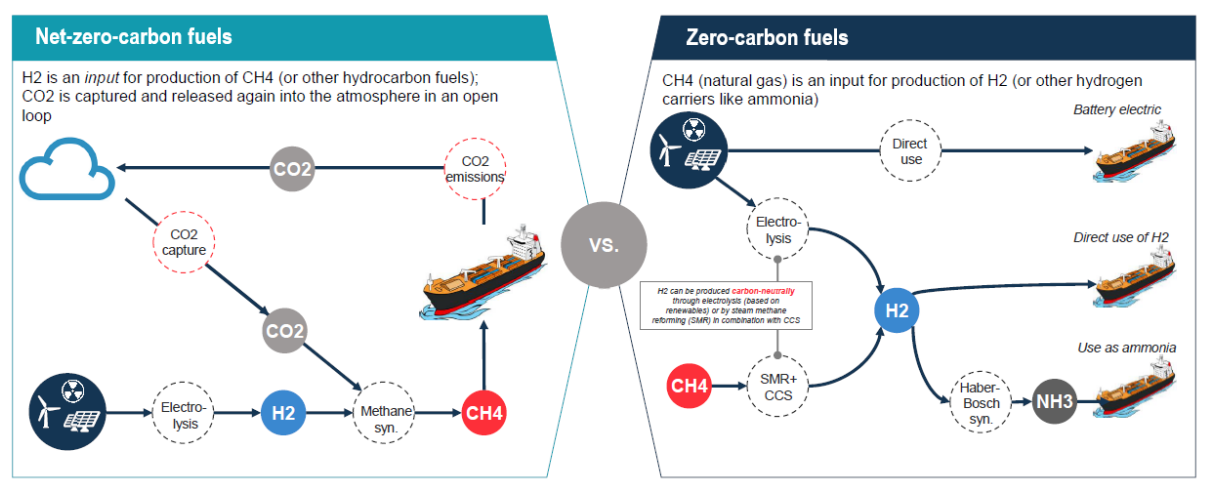

The different technology options for shipping can be characterised as being either zero-carbon or net-zero-carbon fuels (ES- 4). These solutions each need very different, and potentially expensive infrastructure, which means it is potentially undesirable for all to exist at scale simultaneously. Certain technologies have a clear advantage for international shipping, but technology-neutrality is important to ensure the best long-term solution succeeds. There is however a trade-off between technology neutrality and the complexity of the CfDs, given the need to cater for the many and varied segments of the shipping industry.

We develop a framework for designing CfDs for international shipping, based on implementation of this instrument in other sectors, the specific features of the shipping industry, and stakeholder views. We explore two CfD options in detail:

- A “Fuel-only” CfD, which is the simplest and most popular solution among stakeholders, providing shippers with zero-carbon emission fuels at the same price as Marine Gas Oil (MGO) but may not cover 100% of the costs of switching from to zero-emission shipping or necessarily provide support for infrastructure and retrofitting costs. This CfD can be applied equally to all shipping segments but does not help promote ‘nonfuel’, highly capital-intensive options like nuclear-powered or wind-assisted ships.

- A “Total Cost of Ownership” TCO-based CfD, which covers all costs associated with building and running a zero-carbon emission ship. This option is administratively much more difficult to manage and would likely require many variants to cover all shipping segments but is more technology-neutral, and potentially better for fostering competition, and for making progress on the cost of non-fuel components required to build and operate zero-emissions ships.

- To provide industry stakeholders with a tangible legal product for use in taking the concept forward, the report concludes with draft “Heads of Agreement” for each of the two CfD options. These documents were drawn up by experienced law firm Pinsent Masons, based on the findings of the report. They are concise framework documents that can be used to outline an agreement in principle between parties and counterparties, laying out how each CfD would work and under what terms it would operate. They are intended to provide readers with an understanding of how the CfD might work in practice and enable industry stakeholders to see the concrete details of a basic CfD contract, locate points of agreement, and uncover issues that may require further negotiation.

In summary, this report provides readers with an in-depth understanding of the difficulties facing a shipping industry looking to decarbonise as well as a potentially powerful solution to enable it to do so. It is our hope that readers take from this analysis the belief that a zero-emissions shipping future is an economically viable possibility.

This article is a summary of the "Zero-Emissions Shipping: Contracts-for-difference as incentives for the decarbonisation of international shipping" report of the Smith School of Enterprise and the Environment, the University of Oxford, co-authored by:

Alex Clark, Matthew Ives, Byron Fay, Ronan Lambe, Johanna Schiele, Lukas Larsson, Jessica Krejcie, Leah Tillmann-Morris, Peter Barbrook-Johnson, and Cameron Hepburn

To read the full report please click here.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.