· 9 min read

The rise of hydrogen

In recent years, the hype around hydrogen for energy has been reaching a fevered pitch in the halls of Brussels and European corporations. Their original intent was to displace natural gas for obvious climate change concerns. This uneconomic and inefficient approach was heavily supported by oil and gas firms and economies dependent on them, with the goal being to create hydrogen from natural gas and bandage over emissions with carbon capture and sequestration.

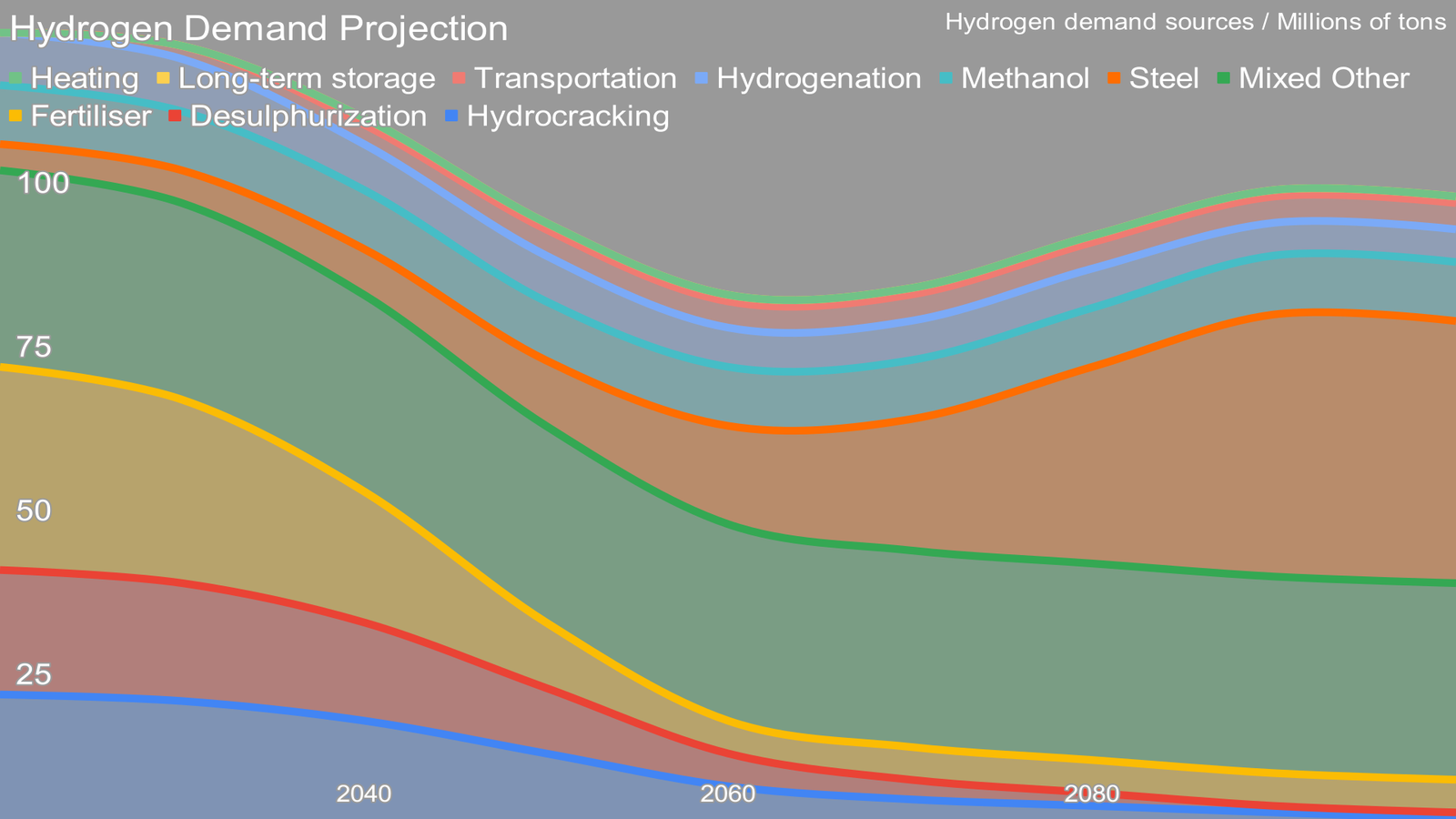

The EU already uses 9.7 million tons of hydrogen annually, with the majority used for oil refining and manufacturing of ammonia and ammonia-based fertilizers, both of which are substantial climate change problems, and both of which have to decline substantially to achieve climate goals. And whatever remains of those 9.7 million tons have to be shifted from current high-carbon hydrogen, with its 10-12 tons of CO2e full lifecycle, to low-carbon hydrogen. Global hydrogen manufacturing is in the same range as all of aviation as a climate problem to give a sense of scale.

The EU's use of hydrogen

Instead, the EU thinks it is appropriate to substantially extend hydrogen as a source of energy, with heavy vehicles, trains, ships, airplanes, building heat, industrial heat all considered suitable targets for hydrogen use. Their stated goal is to increase hydrogen use by 10 million tons a year, mostly through import from neighboring countries in eastern Europe and northern Africa. Heavy lobbying by firms and countries with major natural gas resources is suppressing the reality that most of these uses are terrible ideas, with direct electrification being much better options. After all, hydrogen in the best possible case returns a fraction of the energy used to manufacture it, while directly using renewable electricity is very high efficiency, and hence much lower cost. Heat pumps are an especially effective direct use of electricity, as they provide 3-5 times the heat per unit of energy by moving it from place to place.

Into this 2021 hydrogen bubble came first the massive increase in natural gas prices in Europe’s winter, something I’d predicted in early 2020. The Saudi Arabian and Russian oil price war was aimed at high-cost producers globally, with the intent of ensuring that the last barrels pumped for energy were from those countries’ wells. That had significant implications for unconventional extraction of oil, where hydrofracturing of shale formations brought up both oil and natural gas, but not cheaply. And it was on the heels of the USA’s debt-mired oil and gas industry seeing 2019 foreclosures and drying up of cheap debt financing as it became clear that the industry was overextended and unprofitable.

It was clear to me and analysts such as McKinsey that this would lead to a significant reduction in natural gas on the market, and hence an increase in both the base cost of natural gas over inflation and an increase in volatility.

And then Russia invaded Ukraine.

The aftermath of the invasion

The two long decades of natural gas being a cheap and stable commodity were over. Natural gas prices shot up further as the taps from Russia were closed. Blue hydrogen dreams for energy evaporated. Who would consider it reasonable to pay multiples of the price of energy today when blue hydrogen still has upstream methane emissions and a maximum of 85% of its CO2 emissions captured and stored? What strategic economic planner or policy maker would subject their countries and economies to that degree of volatility in energy prices for so little climate benefit?

Ukraine had been considered a major country for manufacturing hydrogen for Europe’s needs, whether green from renewables splitting water or blue from Russia’s natural gas. Obviously that option was off the table, or at least deferred by potentially years.

The role of North Africa

Enter northern Africa. Europe has long looked south to the massive continent across the Mediterranean for resources. Countries were occupied, became ‘veiled protectorates’, overt protectorates or simply colonies. Their resources were stripped and shipped back to Europe.

And now hydrogen is the new resource. The sun, wind and empty spaces, not to mention the natural gas reserves, are being considered for European hydrogen demand illusions.

Against this backdrop, Corporate Europe Observatory (CEO) and the Transnational Institute (TNI) reached out and asked me to assess European-initiated hydrogen plans in Morocco, Algeria and Egypt. Each of these countries has different situations, risks and opportunities with this latest wave of European resource extraction. The resulting report, Morocco, Algeria, Egypt: Assessing EU plans to import hydrogen from North Africa, is now published.

Morocco is likely best positioned to find a useful path through Europe’s efforts. It is a green leader in Africa, with wind and solar farms and 323 km of high-speed, electrified passenger rail. It’s not a fossil fuel economy, although its limited natural gas reserves are being considered for exploitation now. And as an economy that’s already spent a considerable amount of time and effort considering decarbonization, it knows where most of the carbon bodies are actually buried, and has seen through more of the greenwashing. As a result, the strategy first targets decarbonizing their own fertilizer manufacturing, and then considering hydrogen for other uses.

But there are risks. Morocco’s published documents make it clear that they are still considering hydrogen for transportation and as an energy source themselves. Further, they are considering shipping it to Europe, either on very costly hydrogen tankers or via the decommissioned portion of the Mahgreb-Europe natural gas pipeline that is in their country. None of these portions of their thinking make sense.

Algeria is likely the most deeply challenged of the three countries, with the greatest likelihood of wasted energy, time and money with hydrogen initiatives that don’t have merit. It’s the most dependent on fossil fuel revenues, with 14.39% of its GDP directly from them. Its electricity is virtually all from natural gas generation. It has virtually no renewable generation at all. It ships its natural gas to Europe through the 1,600 kilometers of the Mahgreb-Europe pipeline.

As such, it’s susceptible to the idea that green and blue hydrogen could flow through that pipeline, replacing the revenues from natural gas that will inevitably be lost in coming years. Initially they are considering mixing up to 20% by volume of hydrogen with natural gas. However, that would challenge the pipeline itself requiring investment, the mixed gas would be much more expensive per unit of energy than the natural gas, and the resultant mixture when used would only reduce CO2 emissions by 6-7%.

Their hopes of sending green and blue hydrogen through the pipeline in its pure form are even less likely. Manufacturing green or blue hydrogen with new infrastructure custom built for it would result in energy costs 5-11 times what Europe was used to paying in the summer of 2021 for natural gas. And that’s before the cost of distribution through the pipeline triples. These costs are well above the unsustainable peak costs for natural gas during the Ukraine invasion by Russia, and won’t be viable compared to electrification.

Egypt is yet again different. Its oil rent is lower, around 4% of its GDP. It has the Aswan Dam, although its contribution of electricity has been a steeply declining percentage of its grid mix as natural gas and oil generation have been built.

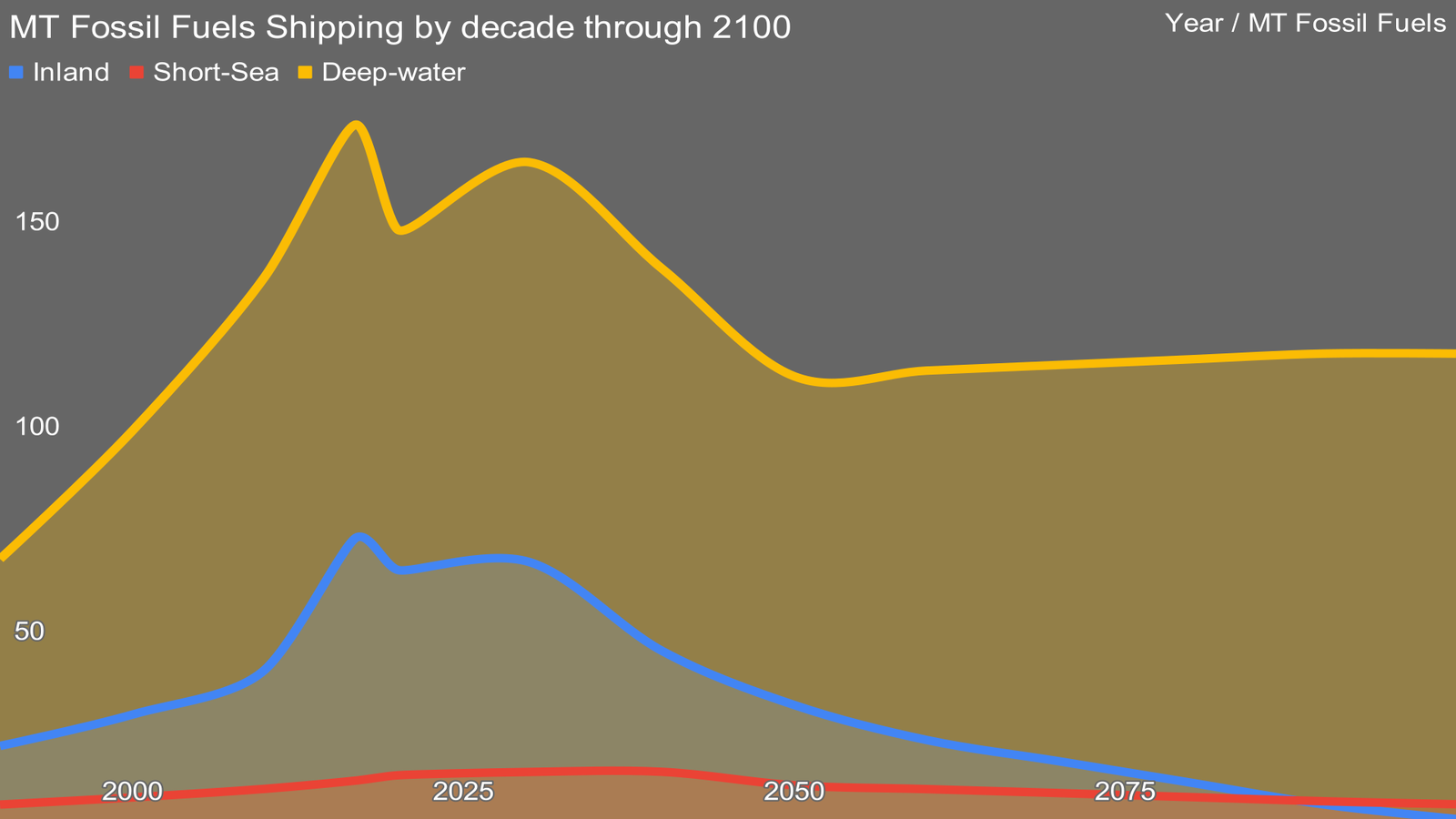

And it’s on the Suez Canal. That last is important as major initiatives are underway to make synthetic ammonia and methanol to be used as marine shipping fuels. Green and blue hydrogen would, in theory, be combined with CO2 or nitrogen to manufacture alternatives to bunker fuel. However, these substances are both deeply problematic from a human health perspective, and in ammonia’s case, deadly in its primary form, reacting with water to make a dangerous caustic solution and finally decomposing into something merely bad for human health. Battery electrification of shipping will cover all inland and most short-sea shipping, but these two fuels are being considered as replacements for deep-sea shipping. The jury is out, but biofuels are likely to be a more economic option.

The perils of Europe's hydrogen policy for North Africa

But any electricity used to manufacture green hydrogen for Europe and its economy will not be available to decarbonize these countries. They all have significant CO2e emissions from electrical generation using coal, natural gas and oil. They all have significant CO2e emissions from fertilizer for their agricultural sectors, sectors which export up to 60% of their produce to Europe. They all have other industries which require hydrogen.

Manufacturing hydrogen for Europe’s decarbonization at great expense, deep inefficiency and in the case of blue hydrogen, more CO2e emissions, makes little sense compared to electrifying and decarbonizing their own economies. It’s exactly the type of European extractive economic actions that left a bad taste in countries around the world in previous decades and centuries. And it’s antithetical to the Paris Agreement pledge to assist developing countries to decarbonize.

If only there were an alternative to hydrogen for Europe’s energy needs. And, of course, there is.

Currently, transmission of electricity occurs between Morocco and Spain and across the Bosphorus Strait through Turkey. MEDGRID proposes to substantially increase these transmission interconnects with high-capacity HVDC lines.

HVDC loses a mere 3.0% to 3.5% of energy for every 1,000 kilometers traveled, meaning that energy can flow very long distances without significant efficiency burdens. North African wind and solar could flow northward to assist Europe, while Scandinavian hydroelectric and North Sea wind could flow south to those countries. One of the best ways to manage the intermittency of renewable generation is to connect them across broader geographical expanses, enabling it to flow from where it is generated to where it is needed with few barriers.

This would assist all European and North African countries to decarbonize. Instead of manufacturing and shipping molecules at great expense in Africa and shipping them north, decarbonized electricity from the grid would manufacture green hydrogen more cheaply at the places it is consumed.

With careful efforts, the leaders of the northern African countries will be able to take advantage of this period of hydrogen for energy hype to gain renewables, transmission and green hydrogen infrastructure for their own needs. With more careful efforts, they should be able to avoid wasting much of their own time, energy and money on shipping, pipelines and the like for European export. When the European hydrogen for energy bubble inevitably collapses, these countries could be left in much better shape, a desire much to be hoped for.

And so, Europe’s primary strategy, to create a hydrogen energy economy, is fatally flawed. It would be uneconomic. It would be inefficient. It would be ineffective. And it would be outdistanced rapidly by electrification. With luck and strategic care, good will come of it in northern Africa despite Europe’s efforts to the contrary.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.