Carbon credit sales are booming: It’s time to calibrate, not celebrate

· 12 min read

Climate change is top of mind these days, and more corporations than ever are making big climate pledges. Decarbonizing for real (i.e., deep decarbonization) is very, very hard, though, which means many corporations are relying on carbon offsets to make near-term progress. For example, oil companies are marketing & selling their first tankers of so-called ‘carbon neutral’ liquid natural gas.

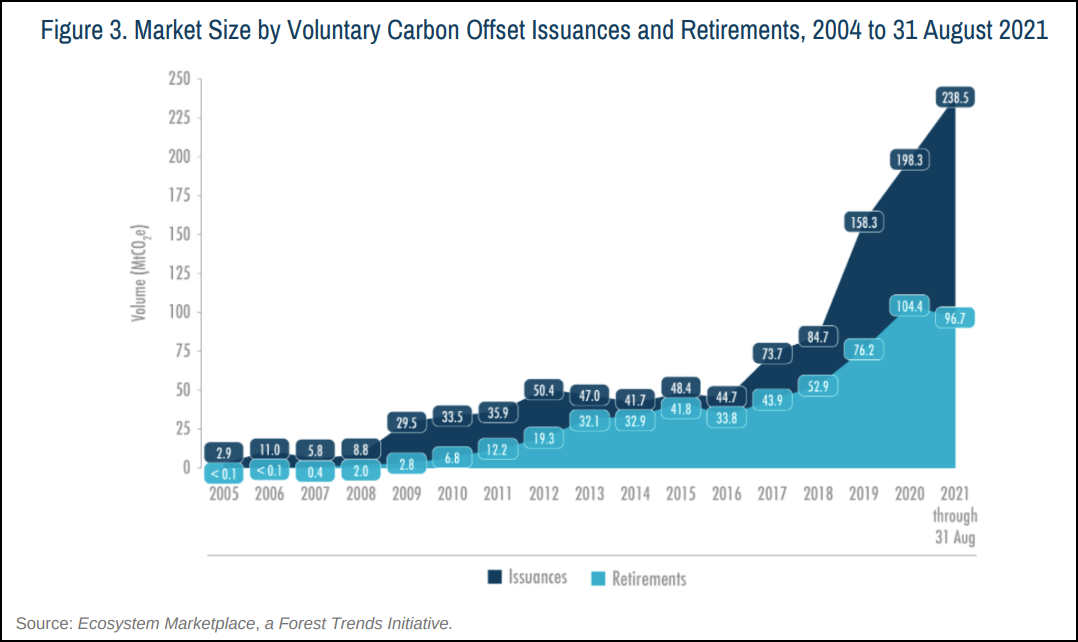

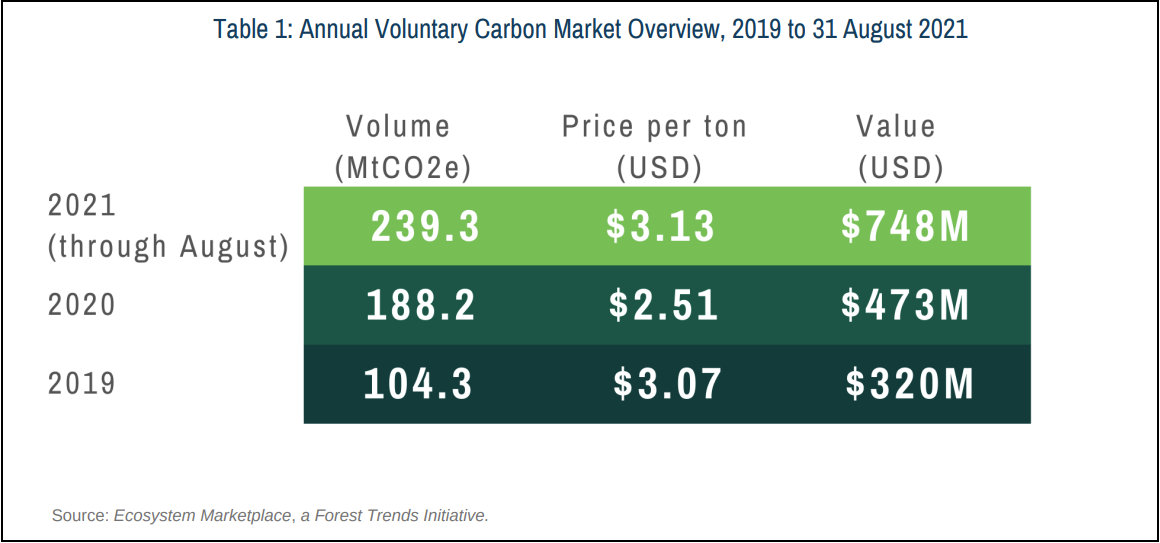

As a result, the voluntary carbon market [1] is hotter than ever, and many are celebrating this growth. On the September webinar unveiling the data that shows the market is on track to be $1B+ this year, Stephen Donofrio, who leads the data gathering effort for Ecosystem Marketplace, kicked it off by saying, “This is a moment of celebration; of excitement. We are watching a market that is growing at an incredible rate.”

But when I saw the report, I was deeply concerned by what I saw in the data.

It’s not because I think ‘offsets are inherently bad, and so a booming offset market is bad.’ We need to pay people to remove carbon from the atmosphere, and carbon credits can be a useful tool for that.

It’s also not because I think ‘buying ~250K credits to make a ‘carbon neutral tanker of liquid natural gas’ is greenwashing.’ It is — but plenty of others are making these points already.

What troubles me most about the recent market data is that it looks like we are repeating the mistakes others have already made in the past with carbon markets. Big industrial buyers have an incentive to make offsets as cheap and plentiful as possible. They put their finger on the scale and drive the market towards quantity at the expense of quality. The appearance of progress can delay real progress — a fig leaf hiding the fact that the emperor has no clothes — and thereby do more harm than good. We can get out of this vicious cycle, but it will require targeted, conscious interventions from a variety of market participants, which I’ll outline.

Carbon markets aren’t new. They’ve been around for 30+ years. Danny Cullenward and David Victor identified a repeated failure mode: cheap offsets win while rigorous climate impact loses. [2] They mount a compelling, multi-faceted argument, which I’ll over-simplify down to two points that are particularly relevant to what we’re seeing in the voluntary carbon market today.

The first relevant point is that “the most powerful stakeholders — [big polluting] industries — care first and foremost about lowering overall compliance costs. That is, they demand high volumes of low-cost offsets to keep carbon prices low.” If you’re a hydrocarbon energy company, and you want to be ‘carbon neutral’, the fastest way to get there is by purchasing offsets.[3] The lower the average price of your offsets, the cheaper it is to achieve your goal. Straightforward.

Their second point is that “there is no constituency for quality.” And if there is, then it is “weaker politically, less well organized, and less informed” than their large industrial rivals. Further, the case the quality constituency needs to make — what ‘quality’ is and why it matters — is terribly complicated, since it hinges on counterfactuals, called ‘additionality’ and ‘leakage’, that can never be observed.[4]

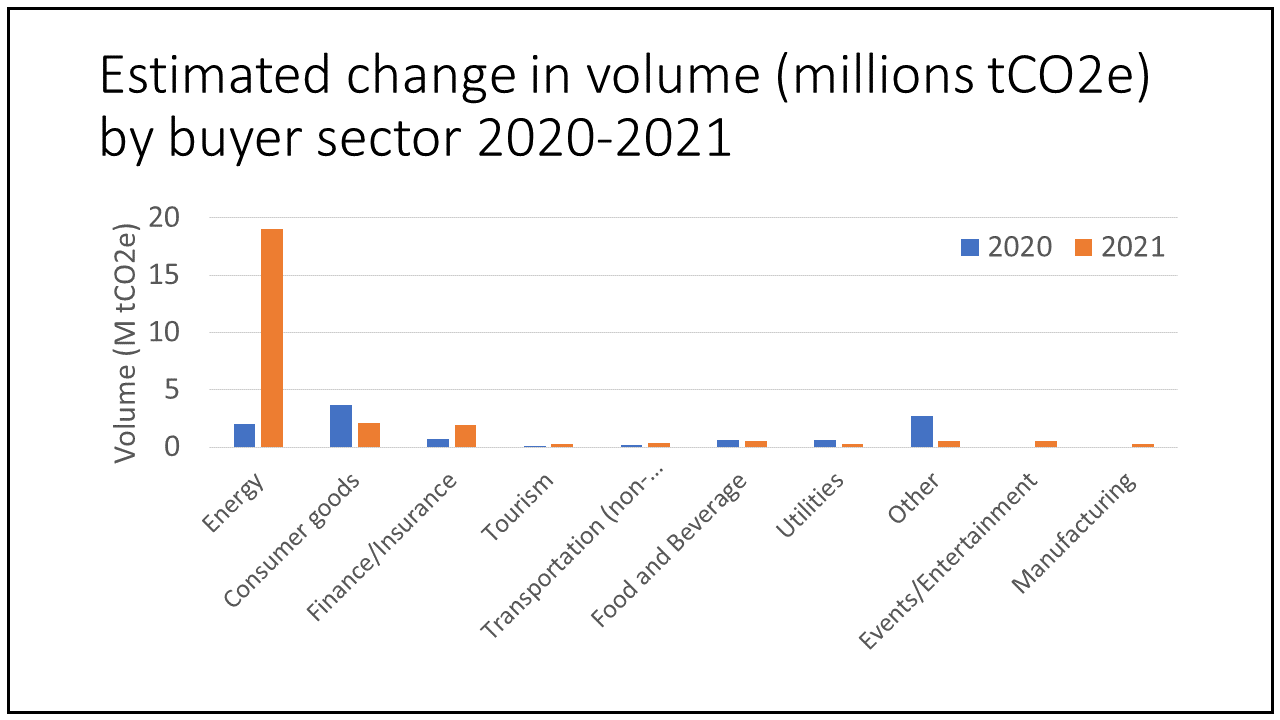

In the recent data on the voluntary carbon market, this tug of war between quantity and quality is alive and well, and quantity appears to be winning, driven primarily by the skyrocketing participation of energy companies. Consider three data points:

It’s head-scratching because to have a demonstrable, lasting impact on the climate, the approaches we have today are orders of magnitude more expensive than $3.[5]

In 2020, they were only 20% of the market, and in 2021 YTD they are 75% of the market. Their total volume is up ~850%, and they are now ~9x the size of the next largest buyer segment.

This sure looks like the same old dynamics are playing out.

Microsoft, EDF, and Carbon Direct said the same thing (but more articulately) in their recent article in Nature, asserting that the carbon market needs to provide “economic incentives to promote the most effective forms of CO2 removal… Today’s pricing on a per-tonne basis encourages companies to buy the lowest-quality carbon offsets.”

In light of how the market is growing, we should not be celebrating its growth. We should recognize there is a thumb on the scale, pushing the market to ramp rapidly with low price, low quality credits. And in the past, those low quality offsets have delayed more impactful climate action — a fig leaf hiding the real work of decarbonization we have yet to do.[7]

That was the bad news. Here’s the good news: we may finally have a vocal, well-funded, well-organized ‘constituency for quality’.

A few pieces of evidence:

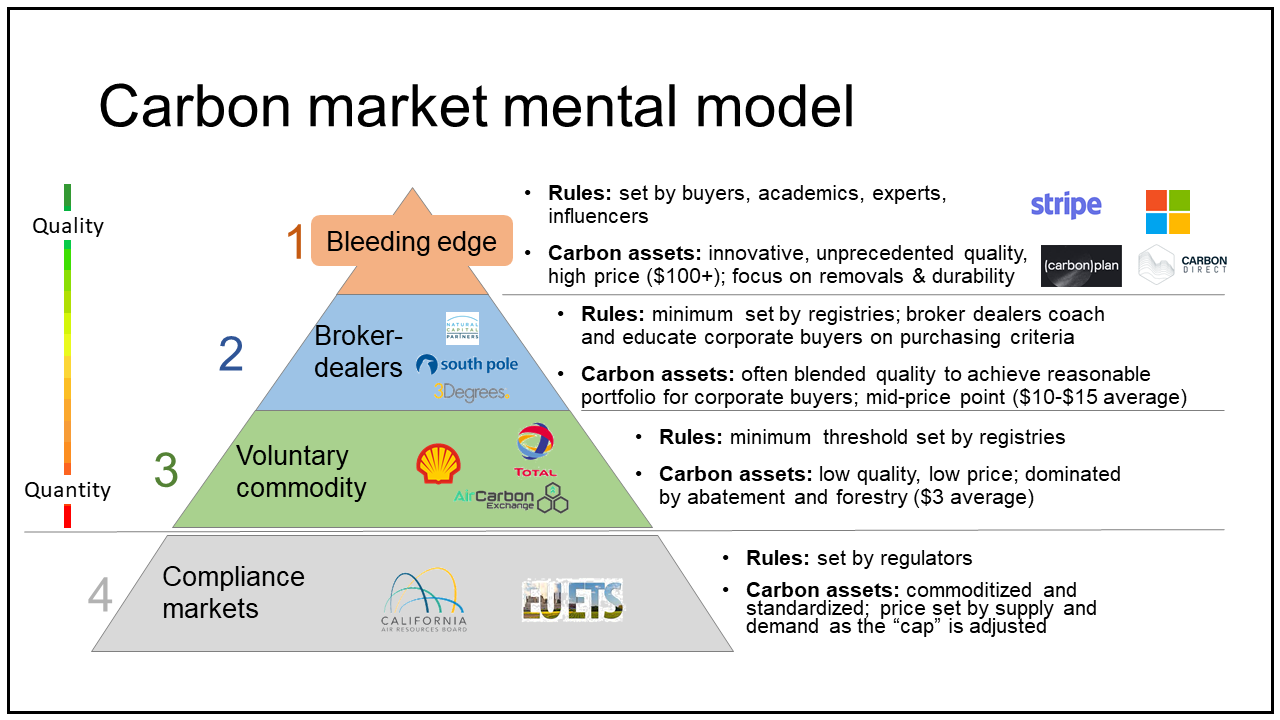

These examples and more paint a very different picture than the data in Ecosystem Marketplace’s report. That is because we essentially have different markets complete with different buyers, different sellers, and very different rules. Here’s my mental model for thinking about this market:

The quality tug of war is happening in the voluntary carbon markets, largely between #1 the bleeding edge and #3 the voluntary commodity market.[9] (We’ll set aside #4 the compliance markets since they are a separate beast entirely)

#1 the bleeding edge is the quality contingency. This is where Stripe, Microsoft, Climeworks, Breakthrough Energy Ventures, and other climate tech VCs and startups are playing. It’s a hotbed of innovation. They’re partnering with world-renowned experts to write new rules for what high-quality climate action looks like.[10]

On the other hand is #3 the voluntary commodity market. It’s the largest voluntary segment, and as a result of its size, it’s basically what we see in the Ecosystem Marketplace report.

In the commodity segment, almost any offset that meets the rules set by a carbon registry (e.g., American Carbon Registry, Gold Standard, Verra) is eligible for purchase and trade. In spite of the best intentions of these standard-setting organizations, with that as the bar, this segment tends to be a race to the cheapest: “The simplest and least costly project that generates readily the largest volumes of credits crowd out more worthy, complex, costly ventures.”[11]

And then in the middle, we have #2 the over-the-counter market where broker-dealers play a critical role advising corporate customers and constructing carbon portfolios for them (e.g., South Pole, Natural Capital Partners, 3 Degrees, etc). Here accreditation by a carbon registry is necessary but not sufficient because buyers are more sensitive and broker-dealers are discerning.

The cynical view of this segment is that corporations want to construct portfolios that are just good enough to avoid accusations of greenwashing, while keeping a moderate weighted average price per offset (say $10-$15).

The optimistic view is that corporate customers want to know what they are investing in, and they have a good sense that not all credits are created equal. Broker-dealers act as experts, guiding customers on their journey.[12] In the tug of war over quality, this segment of broker-dealers could be decisive.

This mental model of the voluntary carbon market helps me (a) make sense of the conflicting data and (b) envision a path to a better outcome where the market is a major catalyst for real climate impact.

I hope to someday write about incredible, rigorous $3/ton carbon removal credits. That will mean we had a market rally for quality, and those high impact solutions had a chance to scale up and drop down the cost curve. But we’re not there yet.

To get there, we need to reroute the ~$1B we’re spending on mostly low quality offsets in the voluntary market and invest it in the real stuff.

To that end, I see implications for key market participants. At the risk of being preachy, I want to end with recommendations for what voluntary carbon market participants can do to make sure that quality wins this time around:

There are more market constituents worth mentioning, but without being exhaustive, the short answer is that all of us should be fighting for quality climate solutions and fighting against low quality ones. Sure, we should avoid ‘green on green’ crime and not let the perfect be the enemy of the good. But today, ‘good enough’ costs more than $3.13.

This article is published on both illuminem and Carbonware. Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

[1] ‘Voluntary’ as opposed to ‘compliance’. Compliance markets are government run and mandated, whereas voluntary markets are those where people / companies / organizations participate voluntarily.

[2] In Making Climate Policy Work, Cullenward and Victor focus their analysis on compliance markets, like the EU’s and California’s cap and trade programs. The learnings from their work are applicable to what we’re seeing in the voluntary carbon market today.

[3] There is a lot of dialogue around terms and claims companies can make. For example ‘carbon neutral’ vs. ‘net zero’ vs. ‘carbon responsible’. I dodge that can of worms here, but see this Bloomberg article if you’re interested in that discussion: Offsets Can Play a Role to Make Companies "Carbon Responsible".

[4] The topics of additionality and leakage are big topics on their own, so I won’t cover them here. If you’re interested, this previous Carbonware article discusses why these concepts are an impediment to real, rigorous carbon offsets, and why they should be surmountable with the right effort, investment, and innovation.

5 Consider this thought experiment: if the average American’s footprint is ~20 tonnes per year, could we solve this for $60 per person per year? Climate change is arguably the hardest problem we face as a species. This doesn’t seem plausible.

[6] Specific data points in the chart are estimated from reading Figure 5 and Figure 6 in the State of the Voluntary Carbon Market 2021 report.

[7] From Victor and Cullenward: “Our darkest observation is that the offsets create perverse incentives for firms to oppose the expansion of legally binding climate policy — and thus rather than offer a path to policy proliferation, offsets end up supporting incumbent firms’ entrenchment.”

[8] Microsoft: of 154 megatonnes of CO2 submitted, 2 MtCO2 met their criteria (1.2%). Stripe: of 16 MtCO2 proposed, 0.024 MtCO2 met their criteria (0.15%). Microsoft's million-tonne CO2-removal purchase — lessons for net zero.

[9] You could certainly argue there are more than four, but in my experience, adding nuance beyond these four actually makes my mental model more unwieldy and less useful.

Compliance markets are worth noting for completeness. They are government run markets that are true commodities, since the regulations make a tonne = a tonne = a tonne. I think of the voluntary carbon market as the skunkworks innovation lab for compliance markets, which is why the dynamic happening there is where I want to focus.

[10] The Microsoft Criteria for High-Quality Carbon Dioxide Removal that they co-authored with Carbon Direct is a perfect example.

[11] Making Climate Policy Work, Cullenward and Victor

[12] Steph Harris, Director of Carbon Markets at 3 Degrees, described this segment as: “Buyers want to know what they are getting. They want to understand the types of projects they are supporting. They want to know what the co-benefits are, who are the folks on the ground working with the project. How is revenue flowing back to the project. That information is really hard to disclose in a commoditized, standardized way.” State of the Voluntary Carbon Markets 2021 video.

[13] Joining coalitions, like this announcement from Breakthrough Energy Catalyst about 7 major corporate partners, is what we need more of.

[14] The Taskforce on Scaling Voluntary Carbon Markets is a particularly high-profile effort on this exact topic, and I sincerely hope they land in the right place.

Aaron Bruckbauer

Pollution · Greenwashing

Jesse Scott

Carbon Market · Carbon Regulations

Glen Jordan

Sustainable Lifestyle · Sustainable Living

Inside Climate News

Pollution · Nature

The Jerusalem Post

Biodiversity · Climate Change

earth.com

Climate Change · Effects