You can't change what you can't price: pricing climate risk and opportunity

· 6 min read

Recently, several companies have capitalized on the growing demand for physical risks, accumulating over $500m in investment over the past two years. With asset managers across the globe grappling with an evolving economy leaning towards sustainable solutions, the spotlight is now on "transition risks".

But what does this term even mean? How does one measure the size and potential of such a nascent market? And how can its impact be gauged? Let's delve in.

Transition risks refer to the challenges arising from societal and economic adjustments in response to climate change and the corresponding mitigation and adaptation strategies. These risks include multiple dimensions, including:

To illustrate the difference between transition risk and other environmental scorings such as ESG and carbon accounting, take the example given by Dovetail — the developer of one of the first dedicated transition risk software. They compare two companies: one in satellite data for gas and oil, the other in nickel mining. Carbon accounting would find that mining is environmentally taxing due to heavy direct and supply chain greenhouse gas emissions. The satellite firm, however, has negligible scope one and two emissions, making it far greener on the surface.

However, this is not so clear when taking a transition risk perspective, as emissions and transition risk do not necessarily correlate. Climate economics hinge on the inevitable need to decarbonize, transforming many industries and propelling others. As the shift to a net-zero economy accelerates, the data company's revenue base in oil and gas will decline, forcing it to pivot or go out of business—whereas demand will grow for nickel to supply the renewables industry. An investor who only paid attention to carbon emissions would have missed the severity of the climate transition risks on the satellite company.

Accurately determining the impacts of transition risks requires detailed data, yet current asset manager models for climate transition risks are limited, leaning heavily on scope 1 and 2 emissions proxies. As per the ECB 2021 report, the first challenge is to accurately size the risks. This task calls for intricate measurements to discern the varying physical and transition risk impacts across different sectors, regions, and companies.

To grasp the magnitude of this opportunity, it is useful to examine the market size. Transition risk solutions aren't limited to data and software but also include new investment funds, complex valuation frameworks, and specialized consulting. However, for clarity, this article narrows its focus on the cutting-edge software technology used for quantifying transition risk.

While it's challenging to place a figure on such a budding market, looking at related markets provides some insight. By 2027, TCFD compliance total addressable market (TAM) is projected to reach over $36 billion, ESG data & analytics at $4 billion, and ESG assets managed as reaching approximately $53 billion by 2025.

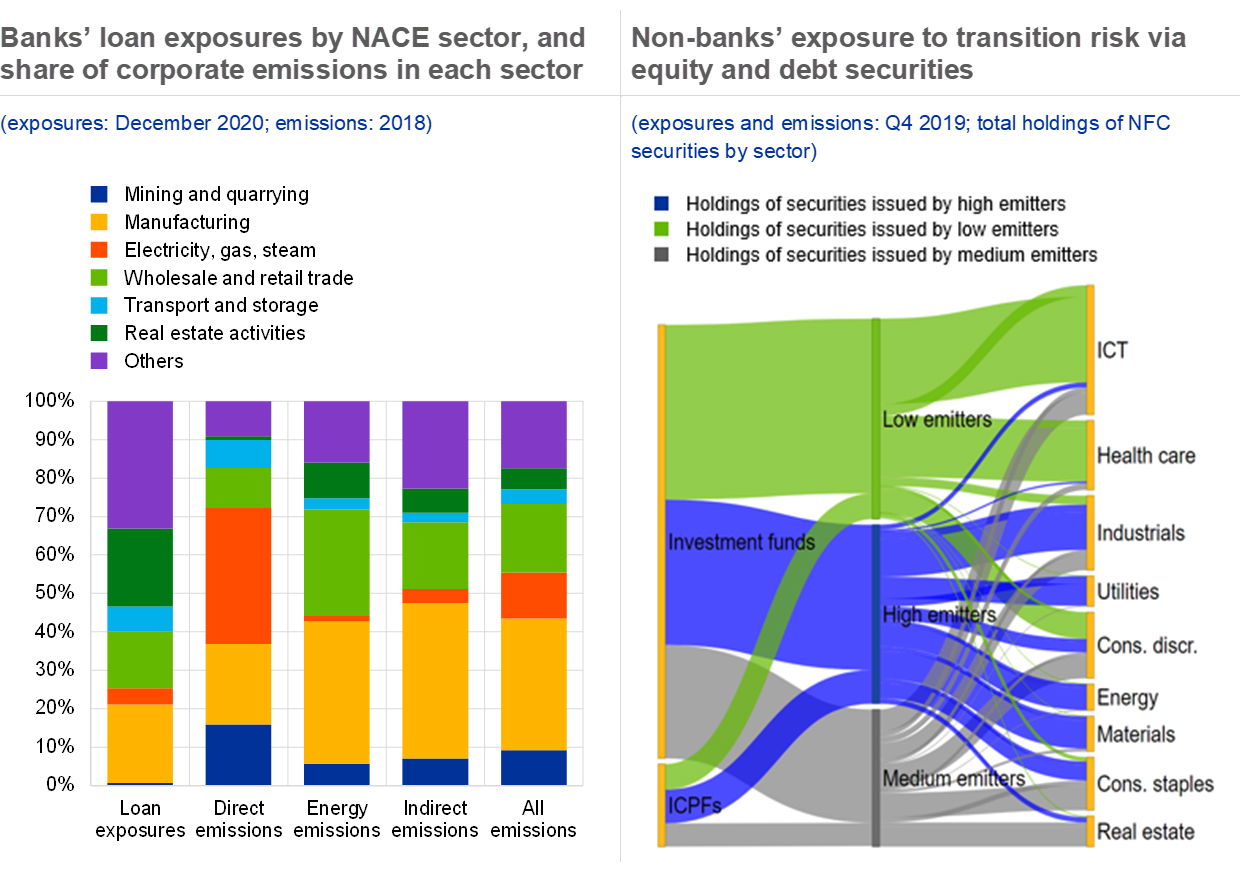

Another indicator of the market size is the sheer magnitude of the problem. Approximately 30% of banks' equity and corporate bond portfolios are dominated by high-emitting non-financial corporations, as found by Alogoskoufis et al. 2021. This translates into approximately €1.6 trillion invested by investment funds, insurance corporations, and pension funds in securities issued by high emitters operating mainly in the industrial, energy, and materials sectors.

Indeed, nearly 100% of asset managers' portfolios can be viewed as exposed, not just the segment invested in high-emission corporations: "In truth, every financial asset faces transition risks — for example, there isn't a single firm globally without at least indirect exposure to the energy market," states Amos Wittenberg, CEO and Founder of Dovetail.

Source: ECB

Global financial giants are now increasingly tracking climate risk and adjusting their portfolios. For example, GIC, one of the world's most substantial sovereign wealth funds, is employing climate scenarios for risk assessment, noting the potential in climate-exposed portfolios for increased volatility and diminished returns. As a more tangible example, Aviva's pension excludes coal, while the Church of England, overseeing £10.1 billion, has divested from fossil fuels, highlighting ethical and risk motives.

With the projections for adjacent markets, global financial giants adjusting portfolios, and the ever-increasing emphasis on sustainability, it's evident that the transition risk market is poised for exponential growth. The current figures might just be the tip of the iceberg. As more industries and sectors begin to integrate transition risk evaluations into their operations, the market's significance in the financial landscape is likely to see a rapid upward trajectory.

Though the precise impact of transition risks cannot be directly quantified, there's a consensus on its substantial influence in financial and economic decisions. Recognizing transition risk offers three significant advantages:

If firms and investors think about transition risk they can stay ahead of the curve, turn it into opportunities, and deliver returns to their investors and the planet. Financial stability isn't just a nice-to-have – it's a prerequisite for efficient climate risk mitigation and adaptation. Recognizing and appropriately managing these risks is our pathway forward.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Gokul Shekar

Corporate Sustainability · Sustainable Business

Barnabé Colin

Biodiversity · Nature

Michael Wright

Agriculture · Environmental Sustainability

World Economic Forum

Carbon Removal · Sustainable Investment

UNEP FI

Circularity · Sustainable Investment

Financial Times

Oil & Gas · Sustainable Investment