· 7 min read

If a company buys a carbon dioxide removal (CDR) credit, does it matter how the tonnes are treated by the country where the removal occurs? Very much so. A government can set up policies that negate the positive effect of purchases of carbon removal from any CDR suppliers within their territory.

This discussion has been made topical due to Microsoft's purchase of 2,7 million tonnes of carbon removal from the Danish company Ørstedts planned BECCS facility. The Danish government supports the same project with a subsidy. The deal was criticized in a new white paper on the grounds that both Microsoft and Denmark will be accounting for the tonnes removed, a form of double-counting.

I argue that this deal is an example of a set-up where the sale of tonnes may not directly reduce atmospheric CO₂ - but not because of double counting.

Denmark seems to plan to use the tonnes removed on Danish soil to fulfill their national climate target for 2025 and 2030. That means that removals in Denmark may substitute emission cuts the government otherwise would have made to meet their targets. This means that purchases of removals in Denmark have a high risk of not directly leading to less CO2 in the atmosphere.

In the Ørstedt sale, Microsoft is likely helping Denmark reach a target they would have reached anyway. Arguably purchases of removals only lead to less CO₂ in the atmosphere if 1) the carbon removal leads to increased ambitions in the country where the removal takes place or 2) is not counted against their national emissions at all. This is true regardless if buyers of the tonnes, such as Microsoft, claim them against their own emissions or not.

How the host country accounts for the tonnes is not the only risk a sale of carbon removal tonnes faces when determining the effect on atmospheric CO₂. If a form of state support is involved, such as in the case of Denmark, it must not be reduced due to the sale of CDR tonnes, or else the sale is non-additional.

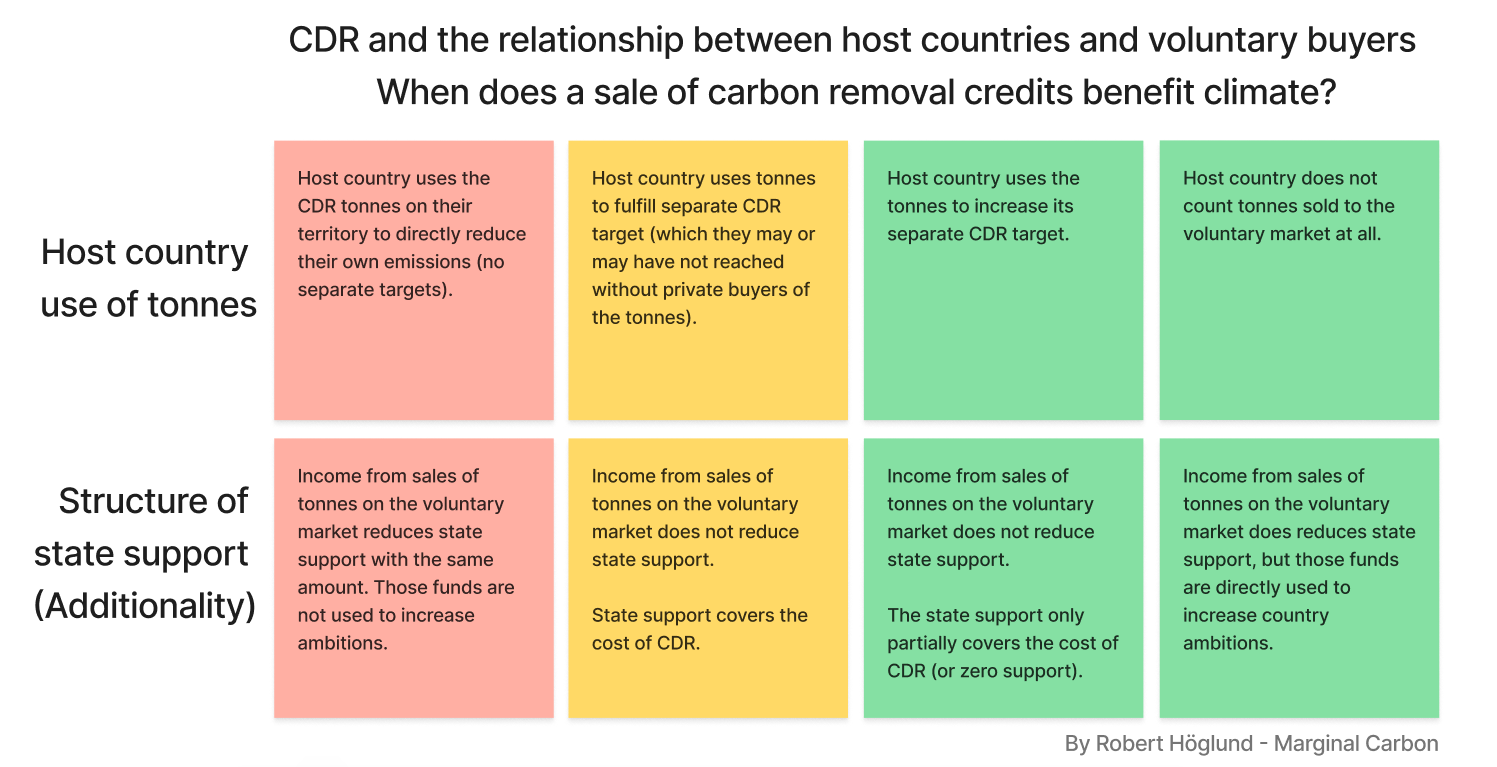

Let’s use these two factors to map out when a sale of carbon removal tonnes to a private company leads to a reduction of CO₂ in the atmosphere:

1. How the country where the removal occurs (host country) uses the removals:

- If the host country uses removals on its territory as a substitute for emissions reduction, the CDR sale has a high risk of not leading to less CO₂ in the atmosphere.

- If the host country accounts for the removed tonnes, but uses it for a separate removal target, the sale may benefit the climate, depending on how any financial support is structured.

- If the host country does not count the tonnes at all, there is no issue, and the sale of a CDR credit benefits the climate (as long as it is a high-quality removal in all other aspects such as permanence, etc.).

2. The structure of state support for CDR:

State support refers to any financial assistance a government provides to carbon removal projects, which the sale of carbon removal credits can impact.

- Suppose a country reduces its financial support for carbon removal projects by the same amount as the income generated from carbon credit sales. That would make the purchase non-additional unless the funds from the sale are used to increase the country's climate ambitions.

- If the state support already covers the full cost of the removal, this could also make any private market sales non-additional, but a sale could still benefit the climate if it leads to increased ambitions.

From what I can tell, Denmark's financial support to Ørstedt is not reduced due to sales of tonnes to the private market.

The table below illustrates these conditions. If a red condition is met, there is a high risk of the sale not leading to less CO₂ in the atmosphere. If a yellow condition is combined with a green one, there is likely a benefit, and if two green conditions are met, there is (all else equal) a definite benefit.

Using the table, we can see that a carbon removal purchase can lead to a reduction of CO₂ in the atmosphere even if both a country and a company claim a tonne, as long as the purchase leads to increased national ambitions, both in terms of targets and financial support to CDR if such support is given. In other words, “double counting” by a company and a country is not necessarily a problem.

If a country does not count tonnes sold to the voluntary market in its national accounting or issues a corresponding adjustment (meaning it would have accounted for the removal but chooses not to), a CDR sale automatically represents increased ambitions. Increased ambitions can come from strengthened targets, too, though.

The sale of carbon removal credits only reduces carbon in the atmosphere when it leads to increased national climate ambitions.

When countries trade emission reductions or carbon removal with each other, such corresponding adjustments will always be made according to the Paris Agreement Article 6 rules.

Note that the absence of double counting is not sufficient to ensure a positive climate impact. The claim a corporate buyer of credit makes does not necessarily determine climate benefit. Even if a company does not make an offset claim and count the removal against their own emissions (no double counting), the purchase they make can still lead to no atmospheric CO₂ reduction if the removal would have happened anyway, or a country uses the removal to substitute emission reductions they otherwise would have done. However, if a company wants to make an offset claim, it must be done under a condition that benefits climate (a green-green or yellow-green scenario in the table above).

Also note that a purchase of carbon removal can still have positive effects even if it does not directly lead to less CO₂ in the atmosphere, for example, through aiding innovation and bringing down the cost of CDR, having an indirect positive impact on CO₂ levels further down the line.

Everything above also applies to sales of carbon credits from emission reductions. Increased ambitions in the case of emission reductions could be a strengthened NDC or a net zero target that is fulfilled earlier than planned.

Voluntary buyers want to create a climate benefit, not save the state money.

As a last reflection, voluntary buyers want to create a climate benefit, not save the state money. For example, the Swedish Energy Agency (responsible for CDR) said “The idea behind advocating the sale of negative emissions is that a market is created and that government support should eventually be scaled down. Sweden wants negative emissions but for as little money as possible”. If a sale to private actors does not create an additional climate benefit, there will be very few private buyers, and the tonnes will fail additionality tests in certification schemes (edit: In a comment on LinkedIn, Svante Söderholm at the Energy Agency said that the reduced support likely would be reinvested in new projects and the government budget for CDR unchanged).

A compliance market requiring companies to buy CDR would be completely different however, that is a way of financing CDR through regulation rather than taxes. A version of that will likely be included in the EU ETS post-2030.

Summary

The sale of carbon removal credits, such as those purchased by Microsoft from Danish company Ørstedt, only reduces carbon in the atmosphere when it leads to increased climate ambitions by the host country. This means that the host country should either not count the tonnes of carbon removed against their national emissions or increase their climate ambitions due to the carbon removal. Furthermore, if the host country reduces its financial support for carbon removal projects by the same amount as the income generated from carbon credit sales, the sale does not benefit the climate unless the funds are used to increase the country's climate ambitions. Therefore, the impact of carbon removal sales on the climate depends on how the host country accounts for the carbon removed and how the sale affects the country's climate ambitions. The same logic applies to carbon credits from emission reductions sold to private actors.

This means that countries like Denmark and Sweden may need to change or clarify some of their policies if they want the private sector's purchases of removals to help reduce the amount of CO₂ in the atmosphere. For example, by having CDR targets separate from emission reductions, and making sure that the total state support is not reduced when tonnes are sold to the private market.