· 4 min read

Almost a year ago, I was in a boat off Juneau, Alaska, looking at a pod of magnificent whales. I’d been invited by scientists to observe the effects of climate change and other degradation of the local marine environment. There, as elsewhere, rising sea temperatures and increasing ocean acidification are threatening multiple species.

Things haven’t got any easier for ocean dwellers since then. Further rises in sea temperatures have had increasingly obvious effects (e.g. wide-spread coral bleaching). Solutions are still elusive, as is the money that would be needed to enact them: We face a major problem in both environmental and economic terms.

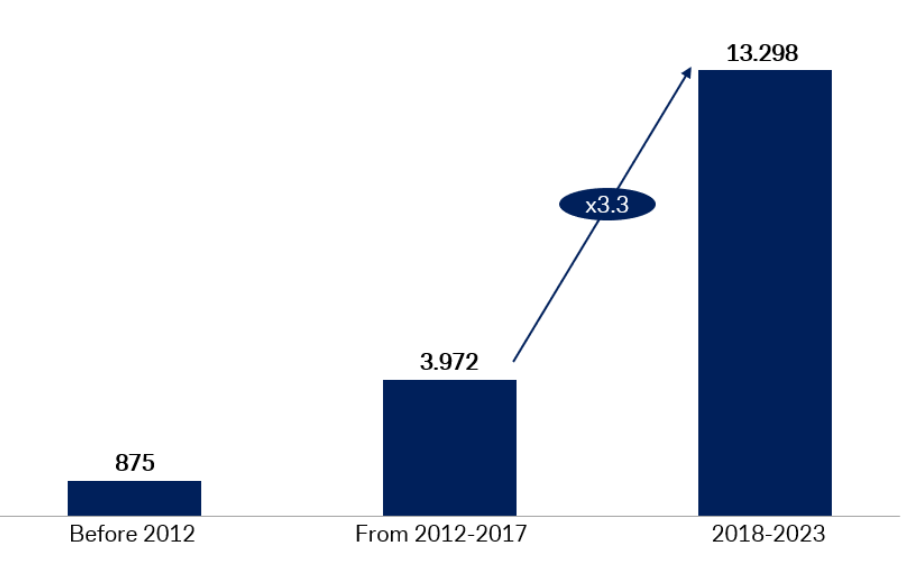

There have been some positive developments, including some rather uneven progress on blue economy financing, both in terms of volumes of investment and the number of funds existing. BlueInvest provides a useful recent summary from an official European Union perspective (see the chart below), but we should be careful not to extrapolate these trends on a global basis.

Total disclosed investments in the EU Blue Economy, EUR mn

Even so, blue economy investment still appears to be the poor sister of green, in terms of both values invested and public awareness.

How do we change this?

Ultimately, I think, achieving a truly sustainable blue economy will require us to think differently about our economic relationship with the ocean. Companies will need to look deeper at their value chains and their ultimate dependency on nature – the impact goes well beyond directly ocean-related projects. Major sector incumbents will have to drive this process, not just start-ups. Investors need, for their part, to understand which activities are positive for the ocean and which will never be compliant with a sustainable blue economy.

The challenge is therefore not just to increase the volume of investment, but also to make sure it goes to productive areas. To do this, better and standardized data is needed — about the state of the ocean and the human activities that affect it — to allow investors to make informed decisions. Much current ocean/biodiversity data is poorly structured, depends on proprietary methodologies, or is not easily accessible by policymakers or investors. Financial data is already starting to improve, with the Taskforce on Nature-related Financial Disclosures helping to highlight opportunities as well as risks. More convincing data on outcomes for individual projects will demonstrate that investment is working.

Governments and supranationals have a big role to play in mobilizing capital for many blue economy projects. But financial innovation and commercial investors will also help scale-up investments in the blue economy, through sustainable funds or new financing structures (e.g. around bundling revenue streams, biodiversity credits or payments-for-ecosystem services schemes). Financial innovation will increasingly be underpinned by its own supportive “ecosystem”, e.g. science-based financial modelling.

Accept too that this is a process of transition as companies transform their business models. Regulatory ambiguity will persist during this transition, but as it evolves, it can help develop well-functioning markets in different stages of the value chain, with regulatory “sandboxes” to test out emerging approaches. Regulation also should incorporate local input into blue economy projects.

We can boost blue economy investment if we follow this approach: think differently, focus on value chains, improve data, encourage financial innovation and accept that this is a process of transition – all of which shouldn’t stop us identifying opportunities. Increasing blue economy investment will also need transparency and building better links between science, finance and policy. The marine life off Juneau, and elsewhere around the world, just might depend on it.

This article is also published on the author's blog. illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.