What new strategic imperatives in the oil and gas sector mean for the energy transition

· 6 min read

Businesses, industries and countries increasingly find themselves in recovery mode after the multifaceted disruption caused by the COVID-19 pandemic. Yet, the health crisis is not over, and uncertainty looms large over the recovery prospects.

Against this backdrop, various forces are reshaping the future of many industries – and the oil and gas sector is no exception. There are growing demands to increase productivity, to build a more resilient industry ecosystem, and to continue contributing to socioeconomic development and wellbeing, while at the same time there is increasing pressure to deliver on long-term commitments to fulfil stakeholder expectations through low-carbon economy transition pathways.

Some of these trends gained significant momentum in the past year, particularly in relation to the energy transition. How does this new context redefine the strategic imperatives that will shape the future of the oil and gas industry? This article brings together these different imperatives. And in subsequent pieces we will deep dive into each of them, one by one.

According to the International Energy Agency, countries that pledged to achieve net-zero emissions cover around 70% of global emissions of CO2. It is likely that policies and measures in this respect will have a profound impact on the oil and gas industry, both in relation to its operations as well as in demand for its products.

First, the industry needs to minimise its own emissions, so-called Scope 1 and 2. These constitute emissions from production, processing and logistics. An even greater challenge, however, is related to Scope 3 emissions. These include those from when fuel is burnt by users and consumers. It’s important to know that Scope 1 and 2 comprise only approximately 20% of emissions in the life cycle, while Scope 3 are responsible for the remaining approximately 80%.

Second, there is an urgent need to address emissions that are released eventually. One way to do that is through carbon offsets, where one party pays a price for other parties to remove a portion of emissions through activities such as reforestation or carbon capture. But offsets come with their own challenges and question marks – from fragmentation, lack of global markets to a need for greater transparency. As demand for oil and gas erodes, the cost of capital increases and carbon taxes kick in, decarbonisation will be essential in retaining the support of consumers, investors and regulators.

The trend to decarbonise the global economy is likely to accelerate peak demand for oil and possibly natural gas as well. Some analysts believe that peak oil will happen in the next few years, others that it has already happened, while some would argue that demand will continue growing for some time yet. Nevertheless, peak demand is on the way.

Interestingly, no analyst that we are aware of expects demand to fall close to zero in the foreseeable future under any scenario; oil and gas will retain a large share of the energy mix and will continue to grow for non-energy use. From personal protective equipment, plastics, chemicals and fertilisers through to aspirin, clothing, bubble gum and … yes, solar panels, oil and gas are used as feedstocks to produce many, many things.

Hence, future of demand will also be decided by consumer preferences and expectations. And here we mean not only consumers of energy, but those of all other goods and services as well. As consumers play an increasingly active role in reducing emissions and addressing climate change by making more environmentally conscious purchases, better knowledge of the consumption side and consumers is a key emerging strategic imperative for the industry.

Decarbonisation and evolving demand call for industry players to consider and, in some cases, reinvent their business models and future portfolio strategies.

According to Accenture, three different portfolio strategies could emerge:

1. The Oil & Gas Specialist, where companies double down on cost and operational excellence, while reducing carbon intensity. This path is likely to be chosen by national oil companies and some exploration and production independents.

2. The Energy Major, where companies broaden their focus on hydrocarbons to electrons or hydrogen. It is likely to be followed by major international oil companies.

3. The Low-Carbon Leader, where companies will make a full pivot towards a carbon-neutral future. It is likely to be followed by service companies and those with small, declining or no oil and gas producing assets.

Incumbents must understand their role in the energy transition and decide what to offload, where to diversify, what to optimise and which new market opportunities to target.

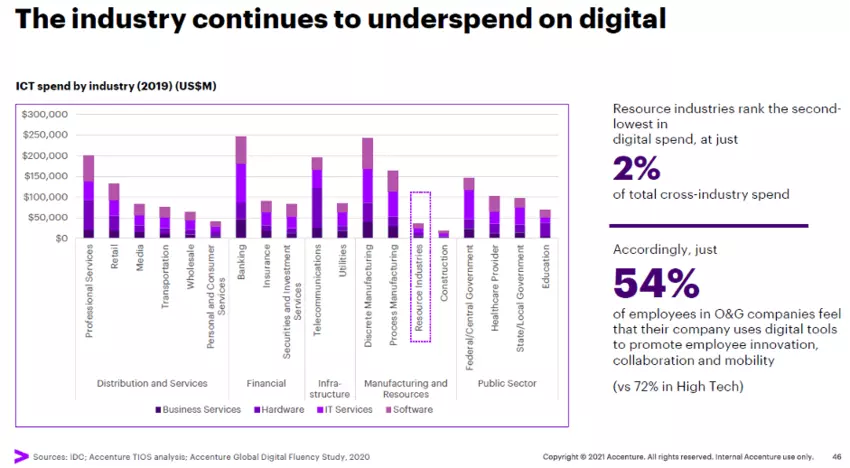

Leveraging digitalisation and data-driven decision making is another key imperative for the industry. It could help minimise its carbon footprint, increase productivity and decrease costs, as well as support new business models.

Companies in the oil and gas industry have used automation and data processing for decades. For example, two of the top 10 world’s most powerful supercomputers are owned and used by oil and gas companies. Some analysts suggest that because of these experiences, many oil and gas companies believe they are already up to speed with digital technologies and almost consider themselves digital natives.

Yet when compared with other industries, the oil and gas sector lags significantly behind. The prevailing industry culture is often suggested as a key roadblock to advancing digitalisation. Another structural reason is data silos and fragmentation – this prevents communication between different pieces, functions, operators and the supply chain, greatly limiting opportunity to fully embrace digitalisation.

Developing a highly skilled yet nimble workforce will be critical to support organizations and the wider industry. The changing marketplace, needs of customers, requirements of digitalisation and organisational business model transformation will require companies to acquire new skills.

The industry will need to address the challenge of attracting fresh talent. Thousands of data scientists will be needed in the energy workforce in the new digital net-zero world. Today, it will be difficult to achieve that, particularly in relation to graduates due to shifting preferences of the workforce as well as persisting perceptions of the industry.

Moreover, the industry needs to find a way to retain talent that it already has. At the same time, in line with upcoming changes, some talent could require reskilling or upskilling to fit future needs.

Strategic imperatives of the oil and gas industry are shifting. In the coming weeks, we will look into different aspects of these shifts in greater detail. Stay tuned!

This article was co-authored by Pedro Caruso, David Elizondo and Maciej Kolaczkowski.

This article is also published by the World Economic Forum. Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

Olaoluwa John Adeleke

Power Grid · Power & Utilities

Alex Hong

Energy Transition · Energy

illuminem briefings

Hydrogen · Energy

Financial Times

LNG · Oil & Gas

Oil Price

Renewables · Energy

Forbes

Energy Transition · Energy Management & Efficiency