WEF 2023 risk report: climate disasters are coming if we don't act now

· 5 min read

In the World Economic Forum's 2023 annual risk report, released earlier this month, the seminal message was unmistakable: Watch out for climate-related disasters over the next decade, particularly in the context of the multi-headed hydra of "polycrisis". The WEF report, based upon a global survey, “see[s] the path to 2025 dominated by social and environmental risks,” and the 10-year time frame is even worse: “the longer-term global risks landscape is also dominated by deteriorating environmental risks”, particularly those related to climate change. In case you aren’t sweating bullets yet, WEF notes that these crises are likely to feed on each other and cascade, confounding expectations of a slow, gradual slide towards climate impacts in the decades ahead.

For a certain constituency, this is old news. The Intergovernmental Panel on Climate Change has been sounding the alarm on climate change impacts for decades, punctuated by a particularly alarming Working Group II report from AR6 (the sixth assessment report) in February 2022. Youth movements, green political parties, and advocacy groups the world over have made climate change a mainstream political and business issue. UN Secretary-General António Guterres, to his credit, has been imploring the world to take more urgent action in increasingly stark terms, recently asserting that we are on the "highway to climate hell". And the Task Force on Climate-Related Financial Disclosures (TCFD), an industry-led group building consensus on communicating how climate change impacts business, has now firmly embedded climate risk in widely-adopted voluntary and compulsory financial disclosure regimes, reinforcing that it is a material risk to investors.

But most of the world is not acting as if we are on the brink of calamitous climate impacts. For one, there are hardly any countries where governments have committed to decarbonization at the rate and scale necessary even to meet the Paris Agreement targets of 2025, let alone 2030 or 2050. Many corporates and financial institutions have committed to Net Zero greenhouse gas emissions, but some are backpedaling, many are still robustly funding fossil fuels, and few have put forward credible transition plans – leading to the creation of a high-level UN expert group to fix the problem. And according to calculations by many experts, investment in climate adaptation is at miniscule levels.

Also concerning are the influential voices questioning whether a focus on climate risk is well-placed. In the aftermath of the Russian invasion of Ukraine and extreme market turbulence last spring, Stuart Kirk, then-head of sustainable investing for HSBC, memorably questioned the urgency and importance of addressing climate risk. Today, Republican elected officials across the U.S. are seeking to rein in and reverse efforts to embed ESG principles in investing and business practices, much of which is centered around climate action. Whether these efforts and arguments are advanced in good faith is widely debated, but the dismissal of urgent warnings of catastrophe is full-throated and sincere.

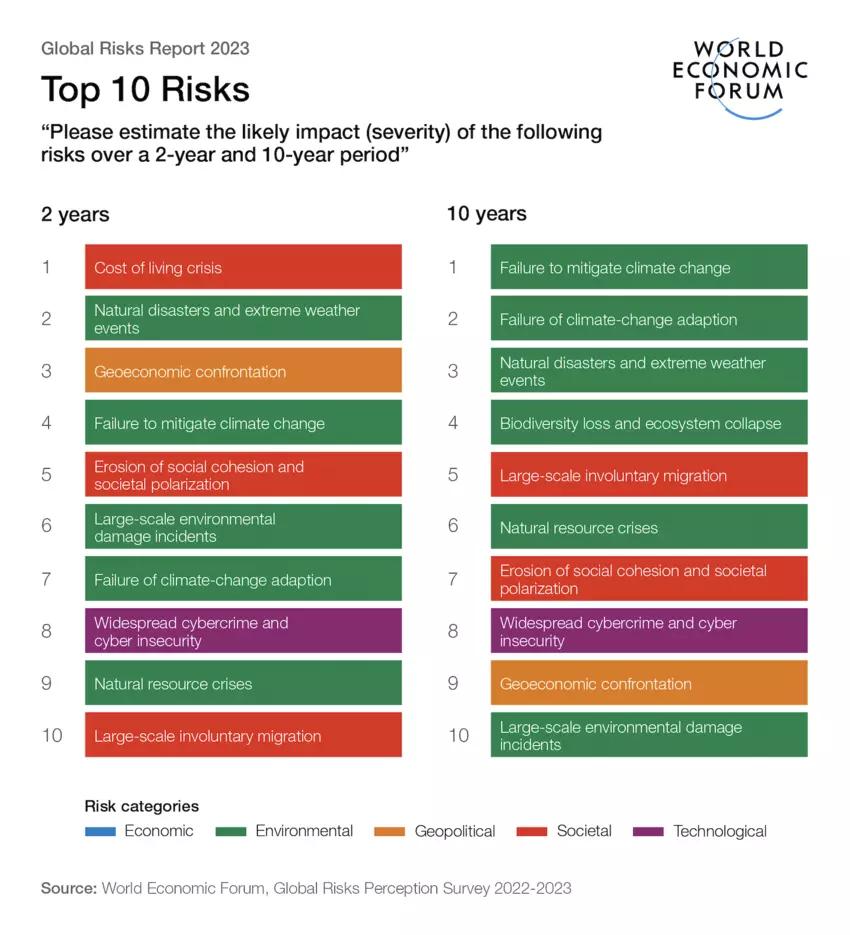

In this context of inaction and insouciance, it is clarifying to see that the World Economic Forum's survey of 12,000 public and private sector leaders across the globe clearly ranks climate- and environment-linked crises as among their primary concerns for the two-year time horizon to 2025. And these "green" risks sweep the top four ranked places for the ten-year time horizon to 2033 and take six of the top ten [see graphic below].

These risks, which splash green across the infographics in the report, are rightfully catalogued together, as they are all reflective of related causes and consequences of our poor stewardship of the natural world and its resources. WEF notes that even those without ‘climate’ in the name are part of the same complex: to wit, “Nature loss and climate change are intrinsically interlinked – a failure in one sphere will cascade into the other”.

Even the ‘non-green’ risks bear the fingerprints of climate change: “Large-scale involuntary migration”, “Erosion of social cohesion and societal polarization”, and “Geoeconomic confrontation” nearly round out the top 10 decade-scale risks… and all represent predicted consequences of climate stress and collapse.

Compounding the perceived risk of the onset of environmental disasters is a lack of preparedness. WEF experts surveyed “assessed existing measures to prevent or prepare for” these environmental calamities to be “ineffective or highly ineffective.”

Perhaps even more edifying than the top-line messages in the WEF report is the analysis on managing these environmental risks that's buried deep in the document. The “Resource Rivalries” section and conclusion sections emphasize the need for readiness, resilience, and adaptability in the face of uncertain but possible and even likely cascading crises. Mapped across dimensions of geoeconomic confrontation/cooperation and slow/fast climate action, the report emphasizes the range of future outcomes that climate change may help precipitate. WEF concludes, "Lack of preparedness for longer-term risks will destabilize the global risks landscape further.... A rigorous approach to foresight and preparedness is called for."

After the seemingly unending recent series of "black swan" events and "unforeseeable" crises – the Great Recession, the Trump/Brexit populist backlash, COVID-19, global megadrought, and the Russian invasion of Ukraine, to name the most prominent – as a species, we remain woefully unready for acute, near-term climate-related crises. This short-termism and myopia permeate society deep and wide. Even the experts running scenario analysis at the Network of Central Banks and Supervisors for Greening the Financial System (NGFS) are focused squarely on long-term physical and transition risks circa 2050 and beyond, not near-term acute crises right in front of our noses.

Let's hope the latest WEF report, though itself only the latest installment in an annual drumbeat, helps jar the world out of its complacency and into recognition of, and action on, the urgent imperative of climate crisis readiness.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Steven W. Pearce

Adaptation · Mitigation

illuminem briefings

Climate Change · Environmental Sustainability

illuminem briefings

Climate Change · AI

France24

Public Governance · Climate Change

Euronews

Mitigation · Climate Change

Mongabay

Climate Change · Effects