Understanding carbon credits: how blockchain technology can change the rules of the game

· 7 min read

A carbon credit represents the reduction or removal of one ton of CO2 equivalent from the atmosphere. Carbon credits are an important tool for offsetting the environmental impact and CO2 emissions of companies that want to pursue a path of ecological transition and decarbonization. They are a financial instrument used in corporate strategies to mitigate climate change, to compensate for residual emissions of greenhouse gases, in a path of carbon neutrality.

There are generally two types of carbon offsets:

The trade in carbon credits was formalized as part of the 1997 UN Kyoto Protocol, the first international agreement to reduce CO2 emissions. Its Clean Development Mechanism (“CDM”) allowed industrialized countries to reduce emissions abroad where it might be cheaper than at home.

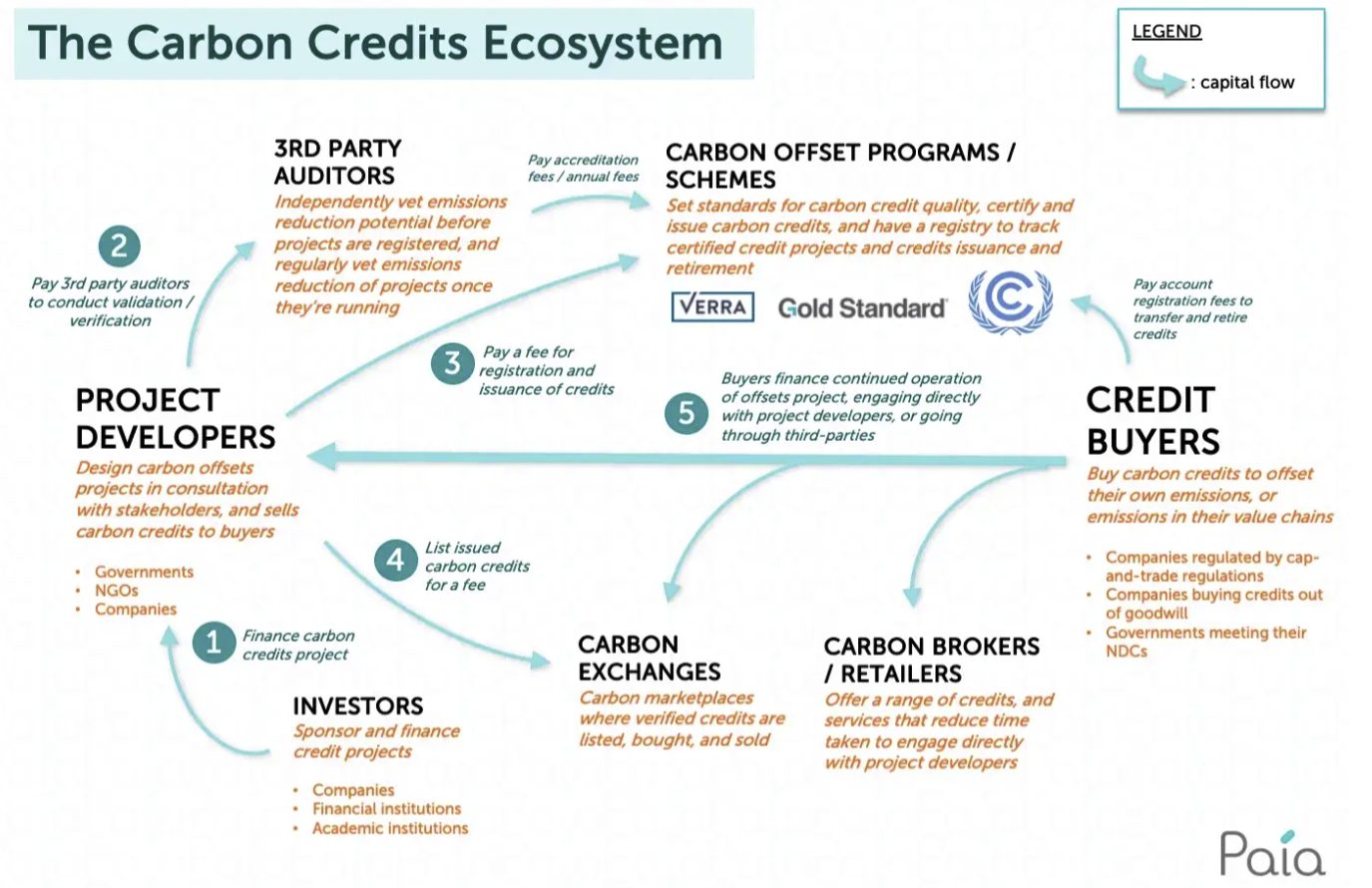

Carbon credits can be created through a variety of methods, including agricultural and forestry practices, as well as any project that reduces, avoids, destroys, or captures emissions.

Companies or individuals looking to offset their own greenhouse gas emissions can purchase these credits from those who are directly capturing carbon or through a middleman (i.e. a farmer who plants trees can receive money, while a corporation can offset their emissions and a middleman can potentially profit from the transaction).

The Kyoto mechanism is the only internationally agreed system for regulating carbon credits and includes checks for additionality and overall effectiveness. The UNFCCC, its supporting organization, is the only organization with a global mandate on the overall effectiveness of emission control systems, although enforcement relies on national cooperation.

One of the main problems regards the countries responsible for a large proportion of global emissions, such as the US, India, and China, which have avoided mandatory caps, leading businesses in capped countries to feel at a competitive disadvantage as they now pay for carbon costs directly.

A key concept behind the cap and trade system is that: national quotas should represent genuine and meaningful reductions in national emissions. This ensures overall emissions are reduced and the costs of emissions trading are fairly distributed.

However, governments of capped countries may attempt to weaken their commitments, as seen in the 2006 and 2007 National Allocation Plans for several EU ETS countries, which were initially rejected by the European Commission for being too lax. There have also been concerns about the grandfathering of allowances, where incumbent businesses in EU ETS countries are given most or all of their allowances for free, which may be perceived as a protectionist barrier for new market entrants. There have also been accusations of power generators profiting from passing on these emissions “charges” to customers. As the EU ETS moves into its second phase and joins the Kyoto system, it is likely that these issues will be reduced as more allowances will be auctioned.

While the carbon credit system can be an effective way to regulate carbon offsets by large institutions in large developed countries, it does not do enough to fight climate change in developing countries.

What this capped system has created is the emergence of a voluntary, unregulated market, dedicated to trading these credits. The voluntary market for carbon credits, which allows companies to purchase credits in addition to any mandatory emissions reductions, has seen about a billion tons of CO2 put up for sale. However, there has been low demand for these credits, with a report from the Oko-Institut in Germany finding that only 2% of previous Clean Development Mechanism (CDM) projects had a “high likelihood” of achieving their intended benefits.

In recent months, some tech companies have increased their purchases of carbon credits, with Microsoft buying 1.3 million tons worth from 26 projects. These credits may come from new projects, such as an Australian cattle ranch that claims its grazing practices have added 40,000 tons of carbon to soil in the past three years. While some companies see the purchase of carbon credits as a temporary solution while they work to eliminate their own emissions, others, like Italian oil company Eni, plan to continue buying credits in the long term. Eni aims to increase its carbon credit portfolio to 10 million tons of CO2 per year by 2025 and 30 million annually by 2050, with the goal of achieving “an 80% reduction in net emissions.”

However, the effectiveness of carbon credits has been called into question by environmentalists and others, who argue that they are often used as a cover for business-as-usual rather than resulting in real benefits for the atmosphere. In particular, the main concerns regards a market for outdated credits that offer no carbon reduction benefits because the projects they were intended to fund have already been completed.

In addition, there are fears of fraud and the existence of poor-quality credits that do not provide meaningful environmental benefits.

To address these issues, some have called for the reform of carbon credit markets to ensure they are effective in reducing carbon emissions. Others believe that companies should focus on reducing their own emissions rather than relying on credits.

The VCM (“Voluntary Carbon Market”) is a decentralized market where private actors buy and sell carbon credits, which are intended to offset greenhouse gas emissions and help mitigate climate change.

However, the market has faced the credibility issues seen above, due to a lack of a unifying standard for quality and mutually agreed upon accounting principles. This has resulted in a market flooded with multiple certifying options, making it difficult for buyers to differentiate genuine carbon credits from unreliable ones. This lack of transparency also undermines the credibility of climate benefit claims.

As the world seeks to accelerate efforts to address climate change and expand markets for carbon products, it is crucial that the VCM establishes trust and transparency. Some experts believe that blockchain technology may be able to help address these issues. Blockchain is a decentralized and secure digital ledger that can be used to record and verify transactions. It has the potential to increase transparency and trust in the VCM by providing a tamper-proof record of carbon credit transactions and making it easier to track and verify the authenticity and effectiveness of these credits.

One way in which blockchain technology may be able to improve the VCM is through the use of digital tokens, including non-fungible tokens (NFTs). These tokens can facilitate the trade of carbon credits on the blockchain and make it easier for buyers to access and trade these credits. NFTs, in particular, have garnered attention for their potential to differentiate avoidance and removal credits, which can help direct capital towards high-quality credits.

In addition to facilitating the trade of carbon credits, blockchain technology can also be used to improve the tracking and verification of these credits. This can increase transparency in the market and help build trust among buyers and sellers. For example, a meta-registry, or a publicly visible and trackable record of carbon credit information compiled from various siloed data systems, could be created using blockchain technology. This could provide a single source of truth for carbon credit information and make it easier for buyers to verify the authenticity and effectiveness of the credits they are purchasing.

There are also a number of other potential applications of blockchain technology in the VCM. For instance, it could be used to create smart contracts that automatically execute and enforce the terms of carbon credit transactions, reducing the risk of fraud and streamlining the trading process. It could also be used to improve the monitoring, reporting, and verification (MRV) of carbon credits, providing a more transparent and reliable way to track and verify the emission reductions associated with these credits.

Overall, while it is still an open question whether blockchain technology can fully address the trust and transparency issues plaguing the VCM, it has the potential to significantly improve the tracking and verification of carbon credits and increase transparency in the market. This, in turn, could help build trust among buyers and sellers and improve the overall credibility of the VCM.

In conclusion, what blockchain can do?

Future Thought Leaders is a democratic space presenting the thoughts and opinions of rising Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Carbon Regulations · Carbon Market

illuminem briefings

Carbon Market · Public Governance

illuminem briefings

Carbon Regulations · Public Governance

Financial Times

Carbon Market · Public Governance

Inside Climate News

Carbon Market · Biodiversity

Euractiv

Carbon Market · Public Governance