Transition investments: Urban adaptation and climate resiliency

· 8 min read

Which principles should urban societies embrace as they transition to become more resilient against the impacts of climate change? This seemingly simple and key question connected Daniel and Sebastian; professionals who engage with urban developers, investors, de-risking experts and insurance capacity as part of weekly activities across multiple sectors. Early conversations concluded that simple answers to this question are lacking. We recognize that history is replete with “lost civilizations” which were precisely those struggling to adapt to similar types of socio-economic complexities in periods of looming external shocks similar to those that we face today. With rapid progress on technology, sustainability and finance frameworks gearing to unlock our transition, we suggest urban developers and their investors connect on three rapidly evolving dimensions for urban regions; the places where most of humanity is and will be living by 2050:

For Urban Developers and Investors: The time to lean into Sustainable Finance Frameworks is now!

Unlocking complex urban developments with sustainable finance: Deliver jointly on clear and measurable objectives.

Urban Sustainability Hubs: How Urban Progress and Sustainable Investment can align on priorities, with Adaptation and Resilience at their core.

To initiate and stimulate discussions the authors present some thoughts and welcome your engaging feedback.

The European Commission (EC) was mandated to provide a range of building blocks that together form a comprehensive approach to deploying sustainable finance. How does this affect urban developers and investors seeking to play a role in urban transitions? We outline a European thought-process that can be adapted and replicated elsewhere. We believe that sustainable finance is poised to play a major role in the way we invest in and develop our urban centers by introducing more adaptation and resiliency as we respond to climate change. In this context and at its core, sustainable finance aims to achieve a virtuous, just, and green circle across four objectives:

Promoting a consistent language for policy objectives (also referred to as taxonomy),

Establishing consistent disclosure rules,

Providing effective tools for market participants and financial intermediaries that develop sustainable investment solutions, whilst at the same time safeguarding standards,

Guiding the financial market, investors and users alike by providing rules for framing risks or impacts for financial instruments of products

At their core, sustainable finance frameworks, such as the European Sustainable Finance Disclosure (SFDR) regulations and the Corporate Sustainable Finance Directive (CSFD), will shape the financing of our urban transition objectives of amplified sustainability and resiliency at a regional, national and global level. Here urban developers and investors serve to unlock society’s development needs. They embrace new performance metrics, striking a balance between simplicity and decision-ready information. This market identified it requires more than monitoring green asset ratios (the ratio of taxonomy aligned assets to total assets) to tell its full story on transition efforts undertaken. We see the Sustainable Development Goals (SDGs) to continue to act as cornerstones of today’s Sustainable Finance frameworks. They remind us of the importance and benefits of taking urgent action to combat climate change and its impacts (SDG 13), and of making cities and human settlements inclusive, safe, resilient, and sustainable (SDG11). Beyond the components of the EU’s sustainable finance framework it is important to recognize where Transition Plan Disclosure Frameworks also act to strengthen the accountability for firms and sectors. The Transition Plan Taskforce Disclosure Framework (TPT) is one such framework and one we note that the UK has been quick to adopt. (See UK real estate sector adopts the TPT, with its Better Buildings Partnership for guidance towards real estate investors.) These transition disclosure concepts are deemed so central, that the International Sustainability Standards Board (ISSB) has now communicated their intent to include them as part of their sustainability reporting landscape.

Such framework elements, connecting finance with climate and sustainability objectives, support how we progressively shape urban developments. For setting better aligned objectives. Or for using disclosure rules for investors and market stakeholders that internalize their own climate impacts. This is important, as otherwise double materiality becomes single materiality. Urban investors and urban development platforms embracing sustainable finance frameworks can boost the trust placed in them whilst become increasingly transparent on their impact delivery. While many of our global urban centres have many climate perils that need to be insured, the benefits of timely action on adaptation and resilience is clear. The choices of funding mechanism often depending on the climate solution and their local partners and contexts. Financiers such as the EBRD with its Green Cities Program remind us to aim for simplicity, to focus on policies, procurements and permits, whilst structurally connecting the development of urban sustainability plans with conditional finance delivery. Bringing forwards such framework efforts is where we need to focus now.

The opportunities ahead consist of more and better informed investments into adaptive and resilient urban developments. Naturally, those will take on more holistic sustainability perspectives. Here is where sustainable impacts will get more deeply integrated into individual urban investment project. Here, evidencing and accounting for financial impacts becomes a more prominent consideration, in urban investment value chains, from real estate, transportation, urban services or the ecosystem services around our urban centres. This calls for targeted, measurable adjustments as part of project governance and execution. Embedded sustainable finance will happen across various stages of project execution, from appraisal to commissioning, with metrics from concept, planning, to well-targeted value assurance that leverages sustainability monitoring and reporting.

Practically, the list of large urban adaptation projects keeps growing, with many unique solutions. Examples range from New Yorks coastal defences aimed at strengthening this iconic city against today’s new climate risks; to San Francisco’s Digital Twin traffic modelling which uses sensor such as LIDAR to make city streets safer, faster, and cleaner; to Singapore’s Deep Water Sewerage project which uses a city wide gravity collection system to collect and treat wastewater for re-use; to Singapore’s deployment of its Significant Infrastructure Government Loan Act, to the efforts of Paris to improve the quality ahead of and beyond the upcoming Olympic Games 2024.

Whilst many solutions will be local and specific to the needs of urban communities with their local climate and energy transition settings, there will be many lessons learnt which will be worth exchanging, considering that time, resources, and budgets are limited, and competitiveness is paramount.

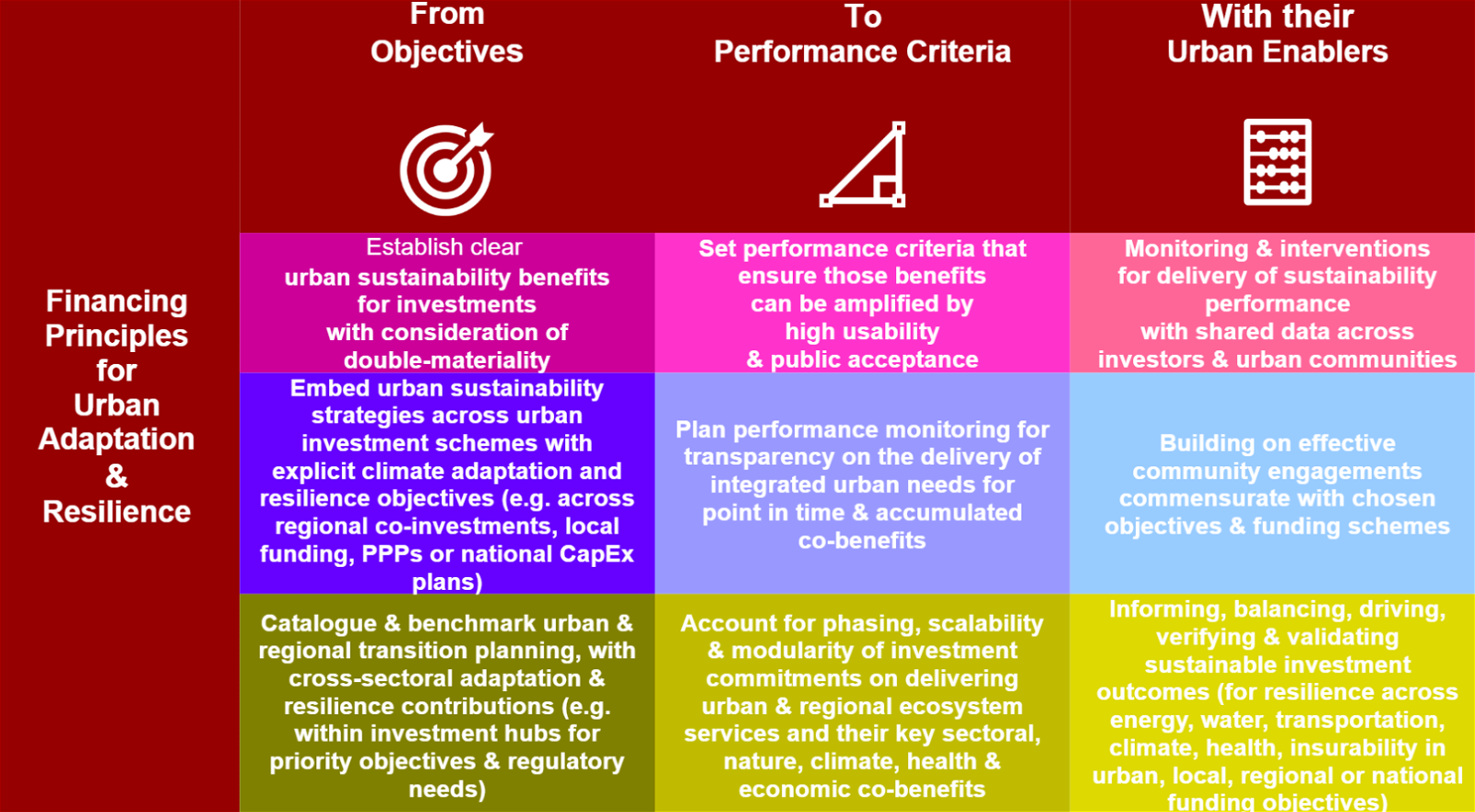

For establishing clear, attractive and convincing climate pathways in financing climate adaptation and resilience for urban regions, we highlight three principles below.

The need to support the transition of urban areas sits squarely in the spotlight. Climate change and the energy transition accelerate the need for more investment and accordingly for more impact measurement and greater accountability to safeguard a sustainable transition.

Economic analysis puts the scale of climate action needed into context. In Europe, the EC has called for earmarking additional green transition investment of €620 billion annually between 2023 and 2030, or 3.7% of the EU’s 2023 GDP. It is in our urban areas, where most of humanity will be exposed to increasing climate shocks, where meeting our environmental, net zero, energy and green transition objectives is playing out.

Piero Cipollone, Member of the Executive Board of the European Central Bank, reminded us: “We find ourselves at a critical juncture. Faced with the severe negative effects of climate change, we have to act swiftly while seizing the economic opportunities that the green transition offers.” It’s time for sustainable finance practitioners, with those developing private public partnerships (PPP), or the EU Capital Market Union, to come together with urban developers and their investors, to prioritize funding priorities. Priority themes can spur local hubs into action, which in turn can catalyse PPP investments, convene cross-sector stakeholders and accelerate integrated sustainable finance support with leadership and sound regulatory alignment. What most nations require in the coming decades, is progress well beyond the global C40 mayor’s network that is already taking action; for broad municipal and social development together with our urban and infrastructure developments. Here is where we authors anticipate seeing urban transition hubs unlocking planning for the coming decades, with a strong focus on urban priority needs to integrate sustainable financing. Here is where trusted urban platforms can convene sectors and stakeholder groups, for example around the right incentives and results from embedding adaptation measures and resilience solutions.

It’s on us to carefully listen and lead now.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

From illuminem: Join us at Terra Tuscany from September 2-4 for a transformative three-day event with world-class sustainability experts. This event empowers your business through practical strategies and collaborative opportunities in an immersive, barrier-free environment. Act fast to secure your spot—tickets are limited! Request your ticket at Terra Tuscany.

illuminem briefings

Climate Change · Insurance

Glen Jordan

Sustainable Lifestyle · Sustainable Living

illuminem briefings

Social Responsibility · Public Governance

Forbes

Sustainable Living · Climate Change

World Cement

Circularity · Architecture

The Guardian

Climate Change · Architecture