The static risk trap: how ESG classifications are driving the next banking crisis

Unsplash

Unsplash Unsplash

Unsplash· 5 min read

Despite growing consensus on the systemic financial risks posed by climate change, current regulatory frameworks are actively amplifying these risks. Static ESG classifications and backward looking taxonomies—such as those embedded in the EU Taxonomy and voluntary sustainability disclosures—are creating false confidence in the resilience of assets, discouraging proactive mitigation, and misallocating capital. A dynamic, options-based approach to climate risk is urgently needed to replace outdated classification models and avert a predictable, preventable financial crisis.

Financial institutions, regulators, and central banks are increasingly focused on climate risk—but most are relying on frameworks that fail to anticipate dynamic realities. Static classifications assume that assets retain fixed sustainability characteristics over time, ignoring how climate policy shifts, technology disruption, and nonlinear physical risks can transform low-risk assets into liabilities. Unless this blind spot is corrected, it could trigger a cascade of asset write-downs, defaults, and systemic contagion.

Static ESG classifications—grouping assets into “green,” “amber,” or “red” categories—are ill equipped to track evolving climate risks. These categories:

• Create false security: Investors assume "green" means low risk, even as policy or market shifts rapidly alter fundamentals.

• Cause regulatory lag: Classifications change too slowly to match real-time repricing. • Ignore nonlinear tipping points: Gradual warming or policy drift can suddenly render entire asset classes stranded.

A static gas facility rated as “transitional” may become uneconomical overnight with changes to carbon pricing. Meanwhile, genuine climate-aligned investments can become liabilities due to rigid regulatory definitions.

INEOS invested £30 million in a hydrogen fuel switch at its Hull chemicals plant, reducing emissions by 75%. Instead of being rewarded, the company faced potential reclassification under the UK Emissions Trading Scheme as a "new installation"—losing access to £23 million in carbon allowances. The result: regulatory punishment for decarbonisation. This shows how static classification frameworks can transform transition risk into governance risk.

Stranded asset risk is best understood using real options theory, which treats investments as embedded options. Assets have a right—but not obligation—to continue, expand, or abandon operations. This framework captures:

• Dynamic volatility: Climate risk is not static. Asset value and risk shift with regulation, technology, and physical impacts.

• Time-varying uncertainty: Delayed regulatory clarity increases variance, raising short-term option value but long-term fragility.

• Correlated collapse: When regulatory uncertainty resolves—e.g., clear carbon rules— embedded option values collapse across portfolios simultaneously.

Understanding stranded asset risk requires recognizing that each vulnerable asset functions as a natural “abandonment option”—the right to cease operations and realize salvage value when conditions deteriorate.

Building on London Business School’s pioneering real options research by Lenos Trigeorgis and Michael Brennan, recent studies show these embedded options exhibit time-varying volatility that evolves with climate policy, technological progress, and environmental conditions.

Research by Ma et al. (2023) demonstrates this dynamic in shipping: a fossil-fuel-powered bulk carrier faces approximately $26.5 million in stranded asset risk under carbon pricing scenarios. But crucially, option values can remain paradoxically elevated due to regulatory uncertainty—then collapse rapidly when that uncertainty resolves.

This is especially dangerous in sectors where global regulatory signals remain weak or misaligned. The International Maritime Organization’s (IMO) April 2025 Net-Zero Framework—a historic move to introduce global maritime carbon pricing—has been criticized for pricing only ~10% of shipping emissions, over-relying on offsets, and failing to align with the Paris Agreement or the IMO’s own 2030 targets. The scheme’s deferred enforcement, weak compliance tracks, and loopholes for first generation biofuels have created a façade of regulatory action without credible emission pathways.

As a result, carbon-intensive vessels continue to trade as if their operational lifespans remain secure— despite mounting legal, technological, and investor pressures. If, as expected, courts begin enforcing UNCLOS-based pollution duties post-ITLOS 2024, or if carbon pricing becomes more stringent and widespread, these option values could vanish abruptly—forcing a synchronized devaluation across shipping portfolios, including bonds, insurance exposures, and asset-backed securities.

Static classification systems cannot model this collapse. They treat regulatory frameworks as stable and compliant assets as safe, masking how fragile these assumptions really are. This mispricing is not an accident—it’s a product of the system's architecture.

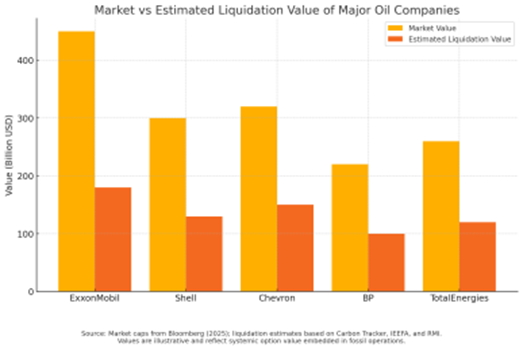

This same logic applies to oil majors, which continue to trade at valuations far above their liquidation value. Investors implicitly assume long operational lifespans and strong returns, despite mounting regulatory pressure, technological disruption, and climate-driven litigation. As long as global frameworks fail to mandate true decarbonisation or penalise lifecycle emissions effectively, the embedded option to continue operating remains priced in. But once regulatory certainty strengthens—through binding carbon budgets, asset-level disclosure, or successful liability claims—these inflated option values may evaporate quickly. The result would be a dramatic repricing of fossil-linked equities across global portfolios, echoing the systemic collapse dynamics observed in shipping and housing before it.

1. Abandon static taxonomies*: Regulators must treat classification systems as dynamic and updateable in real-time.*

2. Integrate real options thinking*: Climate financial models should embed abandonment, salvage value, and adaptive deferral as core metrics.*

3. Mandate dynamic scenario analysis*: ESG disclosures must reflect evolving policy, physical, and technology risk scenarios.*

4. Reward adaptive resilience*: Create incentives for investments that build flexibility, not just meet current compliance labels.*

5. Align Just Transition metrics*: Climate frameworks must include political, equity, and social impact measures to prevent conflict-driven risk.*

Climate change will not trigger a financial crisis on its own—our current risk frameworks will. Static classifications lull markets into underestimating risk, concentrating exposures, and punishing proactive climate action. The tools to shift toward dynamic intelligence—scenario modelling, real options, adaptive regulatory schemes—already exist. The next crisis is predictable. Whether it becomes catastrophic depends on whether we replace static thinking with systems designed for a volatile, transitioning world.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Sources

• INEOS Hull Hydrogen Case, H2 View & Yorkshire Post (2025)

• Carbon Tracker Initiative: Unburnable Carbon Reports (2024)

• Trigeorgis, Brennan, Dixit & Pindyck: Real Options Literature (LBS/UCLA/Princeton) • Ma et al. (2023), Stranded Asset Risk in Shipping

• IMO Net-Zero Framework Critique from Global Climate Litigation Update (2025) • World Bank Climate Risk Screening & Fiscal Reports (2024)

• IPCC AR6 & Jim Skea Leadership Statements (2023–2024)

Charlene Norman

Sustainable Business · Sustainable Finance

illuminem briefings

ESG · AI

Glen Jordan

Sustainable Lifestyle · Sustainable Living

Morningstar

Sustainable Investment · Public Governance

Responsible Investor

Sustainable Finance · Sustainable Investment

Devex

Sustainable Finance · Public Governance