The prisoner's dilemma – why is Australia (still) backsliding on climate action?

· 14 min read

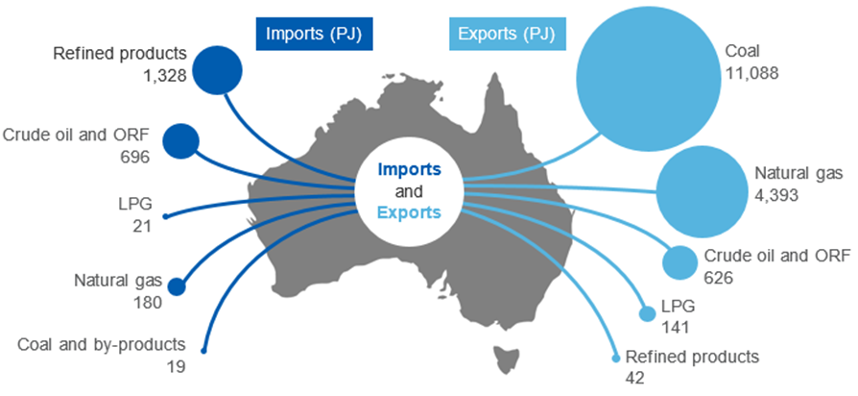

Climate action in Australia has long been a politically charged minefield and it’s no wonder, given that the country is among the top three global exporters of coal and gas [1]. Nevertheless, with the release of the Intergovernmental Panel on Climate Change’s Synthesis report, and its headline statement that even existing fossil fuel infrastructure will exceed the carbon budget for 1.5oC, it is blindingly clear that any new fossil mining project approvals would be grossly negligent [2].

The science is sound, and from a change management perspective, turning off the new projects tap (relying on existing mines and wells to provide finite supplies as we transition to renewable energy sources) would be a masterstroke.

It's a process sometimes known as burning your bridges: ensuring there's an end to the old ways provides a laser focus on accelerating the rollout of a sought-for change. An early example is from ancient Roman mythology: Aeneas was said to have destroyed his armada after conquering territory in Italy, to ensure there was no going back to the homeland.

Why can’t Australia lead the way?

In 2022, the former Australian conservative coalition government was swept aside in a shakeup that included significant support for strong climate action. The Australian Greens party had their best ever showing, and so-called “teal” independent candidates cut a swath through traditional inner-city coalition heartland seats. Both promised authentic climate action, including an end to approvals of new coal and gas extraction projects.

In the end, the Australian Labor Party, whose policies included stronger action on climate, won a one-seat majority in the lower house but needed support in the Senate from either the coalition opposition or the Greens plus at least one independent Senator.

On election night, new Australian Prime Minister Anthony Albanese promised to “end the climate wars.” Nine months and a tokenistic Climate Act later [3], these words are ringing a little hollow, as debate rages over his government’s proposed reforms to a critically important piece of legislation called The Safeguard Mechanism (SGM).

In summary, the SGM covers Australia’s largest emitting industrial facilities of all types (except electricity generation, which is covered by separate policies), from aluminium smelters, steel works, chemical and cement factories to the domestic emissions of its major airlines. It also includes export gas/coal extraction and processing facilities, which collectively make up a whopping 57% of emissions covered by the SGM rules. All up, SGM facilities account for about 30% of Australia's national emissions tally [4]. Introduced by the previous coalition government, the SGM has facilitated an increase in industrial emissions, despite being claimed as an emissions reduction policy.

Many readers will be familiar with national greenhouse gas emissions reporting obligations administered under the UN Framework Convention on Climate Change, which only require emissions generated within a country to be counted by that country.

At one level this makes sense because otherwise emissions could be counted twice.

On the other hand, for countries that are big importers of embedded emissions (i.e., high-consuming countries, including Australia, which offshore manufacturing to countries such as China and South Korea), this approach means they don’t need to consider the upstream emissions impacts of their consumption.

And for countries like Australia that are significant exporters of emissions, it means we don’t have to consider what happens to all our coal and gas when it is burnt.

From a risk perspective, however, excluding traded emissions is a dangerous trap because the impacts of climate change are felt by all countries, regardless of where the emissions are created. Those with the biggest gross impact have the most capability and responsibility to make change.

In fact, that's why – under the GHG Protocol guidelines covering sub-national measurement of emissions – companies are encouraged to measure so-called Scope 3 emissions from their upstream and downstream supply chains, because understanding the full environmental impact of their activities can help firms assess strategic opportunities for pollution reduction (a vehicle manufacturer transitioning towards electrified mobility services, for example). What gets measured might actually get managed.

In Australia, we have a cultural tradition of “lifters” who go above and beyond in their contribution to society, versus “leaners” who expect the world to provide for them.

Some local commentators are fond of pointing out that our national emissions are a mere 1.2% of the global total, so anything we do will have no impact. This is easily refuted when you consider that the aggregate emissions from countries each with between 1-2% of the global total, add up to a very material 40%. By their logic, Australia should be a leaner of the worst order, relying on other countries to clean up their mess before we are willing to lift a finger. Notwithstanding that Australia’s population is only 0.3% of the global total, making our per capita emissions amongst the highest in the world [5].

And when the emissions from the burning of Australia’s fossil fuel exports are added, our influence on global emissions increases to a material 4.5%. Add in emissions associated with turning its iron ore (and other metal and mineral exports) into steel (and other products) in mills across Asia, and Australia’s emissions influence exceeds 9% of the global total, more than Russia and India’s domestic figures, and approaching two-thirds of the US [6]. That’s massive for a country of only 26 million.

Earlier, I mentioned that the domestic emissions associated with extracting and processing coal and gas – around 80% of which is exported – account for the lion’s share (57%) of Australia’s largest industrial emitters.

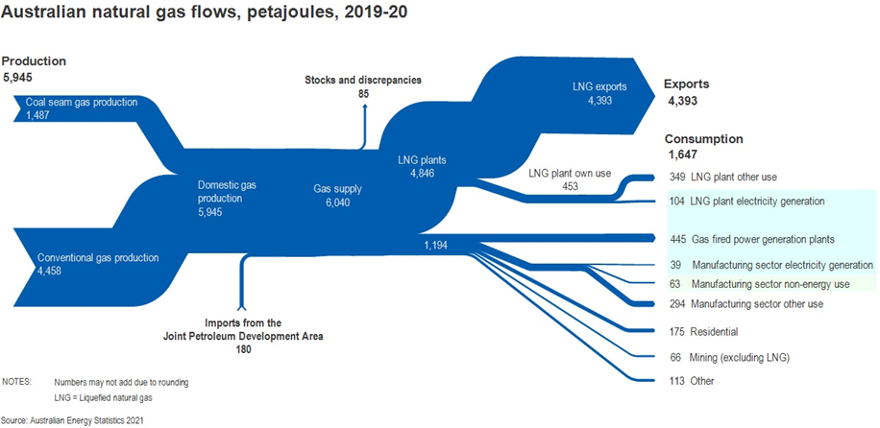

Indeed, a look at Australia’s energy flows highlights that the gas export industry uses domestically an additional 10% of gas (denoted "LNG plant own use") – over and above what is exported – for extraction and processing purposes (amongst other uses, compressing gas into liquid form for export takes a lot of energy) [7]. In fact, the Australian gas export industry is the single largest domestic user of gas in Australia, even exceeding gas used for grid electricity generation.

Meanwhile, Australia's coal industry often involves significant atmospheric releases of methane that was once trapped in the coal seams, as well as large amounts of liquid fuels for the equipment used to mine, wash and transport the coal to export ports. In short, fossil fuel extraction is a dirty business.

Gas and coal exports generate tens of billions of dollars in export receipts, helping to give Australia a good-looking trade surplus on paper. But so what?

Sure, economists generally claim that a trade surplus is a good thing for the stability of the currency and so on. But in terms of the real economy, Australia’s fossil mining sector has built a myth of its importance that just doesn’t stack up.

The sector is increasingly automated and employs a mere 1% of the Australian workforce; about the same as McDonalds does in this country [8]. Australian state governments have virtually given away their mineral wealth, imposing low royalties compared with the value received by the mining companies, particularly when compared to countries such as Norway and Qatar, which have amassed massive sovereign wealth funds from their respective oil and gas [9].

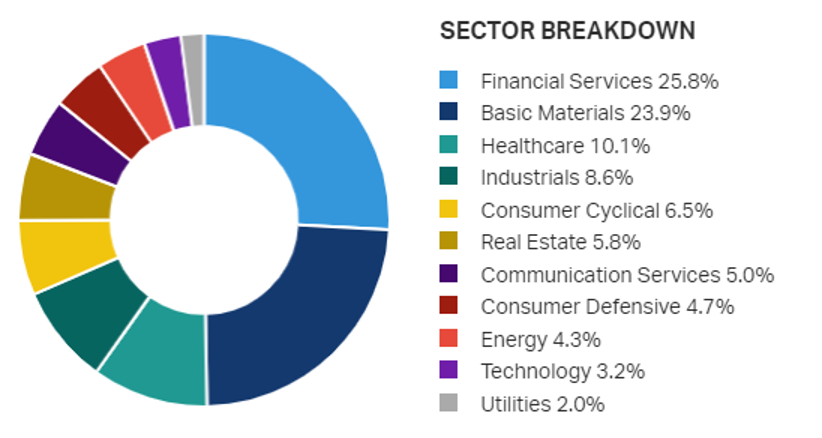

Local fossil miners account for only 4.3% of the Australian stock market [10], with many companies operating here domiciled abroad and paying little, if any, corporate tax in this country. Indeed, Australia’s mining sector was found to be 90% foreign-owned. [11]

To add insult to injury, it is estimated that Australian governments subsidize the sector to the tune of around $12 billion per annum [12]. Is a trade surplus worth it, given the massive externalities?

Given the lack of value Australian governments and citizens receive for our fossil mineral wealth, it seems odd and galling that a government that claims to be committed to climate action would have much hesitation in starting to turn down the spigot by halting approvals of new extraction projects, particularly those focused on export markets. For context, there are currently 116 fossil projects seeking government approvals [13], with a gas processing plant green-lit this month to operate out to 2063 [14].

Currently, we’re claiming to be trying to put out a fire in our house while simultaneously pouring gasoline on it. Ignoring Australia’s exported emissions is an example of blinkered risk-taking, where material opportunities to reduce harm are ignored.

It’s worth pointing out that Australia is the developed country with the most at stake from climate impacts [15]. Over the last four years, it’s been hard to go a month without news of “unprecedented” extreme weather somewhere in the country, not to mention the decline of the Great Barrier Reef from repeated coral bleaching episodes. (Reef-based tourism in Australia employs a similar number of people to fossil mining). We also face grave risks in terms of food and water security and exposure to deadly heat.

Even putting exported emissions to one side, the fact that a single new gas hub project can add domestic emissions equivalent to 1-2% of Australia’s national total annually – more than any other single industrial activity in this country – means every such approval (and there are dozens in the pipeline) makes it that much harder to achieve our domestic targets.

Why is Australia's government literally shooting the country in both feet, supporting projects that both materially increase domestic emissions, whose vast exported emissions contribute to already devastating levels of climate harm, yet yield little economic benefit to its people?

This is where it gets even weirder because since coming to office last year, Prime Minister Albanese and other senior ministers have repeated the previous government’s use of the immoral drug dealer’s defense: if we don’t supply our fossil fuels to the world someone else will, so it may as well be us [16].

As a top three exporter, if Australia announced it was exiting the market as existing projects wind down, its major markets would worry about a supply gap. Sure, other fossil-rich countries might announce expansion plans to try to fill that gap. But demand-side countries would perceive it as yet another energy security challenge, stimulating accelerated investments in renewables and electrification. In short, like the impacts Russia’s invasion of Ukraine has had in accelerating the transition to renewables in Europe (notwithstanding short-term increases in coal use), it is likely that we would see a similar response from Australia’s Asian trading partners.

New coal and gas extraction takes – in many cases – at least a decade to plan, permit and develop. If key infrastructure such as rail and port links are missing, that needs to be built too. It requires multi-billion-dollar investments, at a time when an ever-growing number of major financial institutions have announced exits from some or all types of fossil fuel lending and investment [17].

Albeit that in saying no to new approvals, little would happen in the short term, because many existing approvals extend for decades (some into the 2070s). Australia would remain a large fossil exporter for the foreseeable future. Yes, it would cause fossil mining stocks to slump, but remember that’s only 4.3% of the Australian market. On the other hand, if the market perceives a looming supply shortage, it could maintain high energy prices, which would help prop up fossil stocks. Sure, there might also be knock-on impacts for the banks that currently finance Australian fossil fuel projects and firms that supply miners with equipment.

On the flip side, more capital would switch to the clean energy transition (which still requires mining). As well as fossil fuels and iron ore, Australia happens to be very well endowed with many of the critical metals and minerals required for renewables and electrification [18]. Minerally speaking – if no longer climatically – we truly are the "lucky country."

If anything, the market impacts would simply represent an acceleration of the now inevitable slow reduction in coal demand and a slower trajectory for gas, given the inexorable rise of cheap renewables. Indeed, the Australian Stock Exchange's energy sector index, comprising of coal and gas stocks, has shown a long-term decline since peaking in mid-2008 [19].

Australia could join at least nine other countries that have announced bans on new fossil fuel approvals, along with a growing number of sub-national regions and municipalities [20]. While at this stage – understandably – most are minnows when it comes to fossil fuel extraction, the list includes large nations such as France and Greenland, which has chosen to forego vast oil reserves even as a rapidly melting Arctic brings down the cost of exploitation.

However, Australia is trapped in a tragic game of Prisoner's Dilemma where everyone loses [21]. Where no other fossil giant is willing to make the first move, none of them will, despite the payoff associated with mutual action (avoiding the enormous impacts of runaway climate change) overwhelming the cost of action (foregoing export receipts, most of which – in Australia's case – wind up in offshore tax havens anyway, and preserving a handful of jobs).

It's not like weaning Australia off its domestic fossil fuel consumption is even that hard. As well as having abundant transitional mineral resources, Australia also has the best renewable resources in the world, with ample sunshine, wind and vacant land, making our electricity grid one of the cheapest to decarbonize [22]. Plus, it has the opportunity to replace fossil export receipts with renewably-produced energy and manufactured goods – others have written about the country’s potential as a clean energy export superpower.

It should come as no surprise that some of the largest donors to Australia's major political parties are fossil fuel miners, nor that there is a veritable revolving door between fossil firms, their lobbyists, and political party offices [23]. Change will not come without substantial measures to overhaul donation laws, transparency of political appointments, and fossil fuel firms' ability to lobby, advertise, and take out sponsorships to buy a social licence.

On the other hand, the success of the Greens and climate-focused independents in the last election should not be underestimated. With the new government failing to respect the mandate it was given for genuine and urgent climate action, it's a case of "watch this space" when Australians return to the ballot in 2025.

Meanwhile, the government has proposed a convoluted series of reforms to the Safeguard Mechanism as a smokescreen for action, so far resisting attempts to fulfil its duty to protect the people of Australia.

The proposed reforms [24] require large emitting facilities to achieve a 4.9% annual decrease in emissions intensity. That’s not a decrease in emissions overall. If a facility produces a tonne of coal, gas, steel, aluminium (or whatever) with 4.9% fewer emissions compared with a tonne produced the year before, their emissions reduce. However, within the rules, they could also increase their production year on year, and if they do so by more than 4.9%, their overall emissions rise!

It gets worse. To “achieve” emissions reductions, the reforms allow unlimited use of Australia's government-regulated carbon credits (which have been roundly criticised by experts despite a recent greenwashed review [25]), and a lowball cap on the price of those offsets to polluters, with Australian taxpayers making up any shortfall given whatever the cost price rises to (for comparison, the price of the EU’s regulated carbon credits recently hit more than twice the Australian government’s proposed cap).

Following fierce pressure from the Greens and independent members of Parliament, an emissions cap for the scheme was announced on March 27 – previously there had been no means of limiting aggregate emissions from the scheme. New gas projects will be required to be “net zero” from commencement (using those subsidised offsets, and only for the facility’s direct emissions). However, the Climate and Energy Minister hastened to qualify that “if for whatever reason that cap is being approached, the obligation on me is then to publicly consult, to amend the rules if I regard that… as the best approach or to take other policy actions” [26].

With that sort of nonsense on the table, the climate wars will only end if the Australian government can escape the prison in which it has entrapped itself. It must use its electoral mandate to break the shackles of its fossil donors and apply its unique leverage as a major world energy power (both fossil and renewable). Australia’s fossil resources must stay in the ground, something that seems unlikely in the current parliamentary term.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Public Governance · Carbon Regulations

illuminem briefings

Carbon Market · Carbon

Marco Hirsbrunner

Carbon Market · Carbon Removal

Carbon Herald

Carbon Market · Carbon Regulations

Politico

Carbon Regulations · Carbon Market

Sustainable Views

Carbon Regulations · Carbon Market