The potential of payment service banks (PSB) in bridging the energy access gap in Nigeria

· 4 min read

The Nigerian adult population (18 years and above) is 106 million and about two-thirds of this population live in rural areas (70 million people). According to the 2020 EFInA, access to financial services in Nigeria survey, about 35.9% of the adult population is financially excluded. (EFInA, 2021)

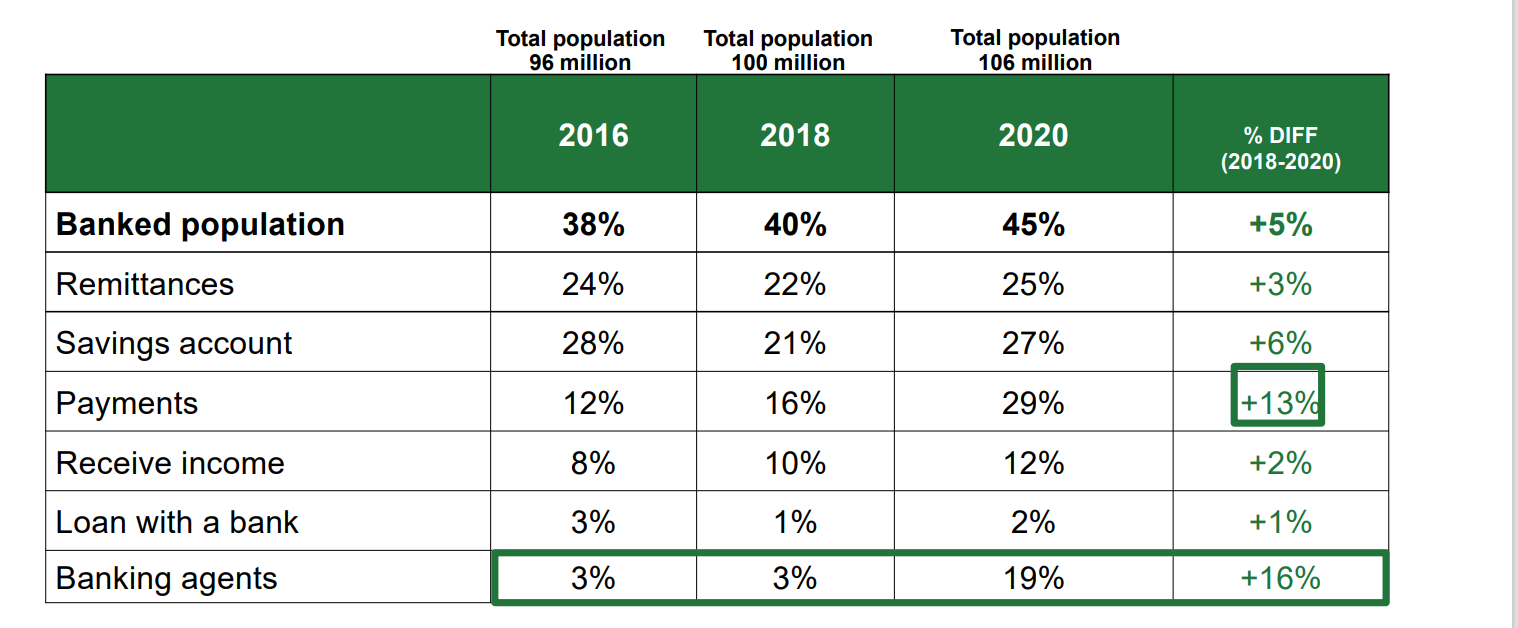

Table 1: Bank growth is driven by the use of digital financial services, savings, remittances and agents

Nigeria ranks top among countries with low access to electricity and the majority of the unelectrified population is found in the rural areas, with the rural areas having a population of 99,033,580 as of 2020. This shows that efforts need to be increased in rural areas if Nigeria is to come out of energy poverty in the near future.

“In Nigeria, the electricity access rate was nearly 60% in 2015 (according to the World Bank), with 86% of urban areas and 41% of rural areas with access, while access to non-solid fuels reached only 4%”.

According to a report from Sustainable Energy for All. (Sustainable Energy for All, 2021)

The huge gap in energy access in Nigeria provides a huge opportunity for "discos" (distribution companies), including PV Mini-grid Operators but then electrifying these rural communities have been faced with so many challenges with the pronounced one being Customers’ ability to pay can be associated with the following:

Solving these constraints will increase the rate of electrification in rural communities, Could the answer be a payment service bank?

A payments bank is similar to a regular bank, except it operates on a smaller scale and does not take on any credit risk. In simple words, it can perform most banking functions but cannot advance loans or issue credit cards. It can accept demand deposits, remit funds, accept mobile payments/transfers/purchases, and provide additional banking services such as ATM/debit cards, net banking, and third-party fund transfers.

The Central Bank of Nigeria (CBN) has issued laws and guidelines for the licensing and operation of payment service banks (PSB) in Nigeria. This is in line with the central bank's initiatives to use technology to promote financial inclusion and improve access to financial services for the unbanked and underserved. The CBN's goal is for 80% of Nigerian adults to have access to financial services by 2020. According to the CBN, one of the main goals of the PSBs is to use mobile and digital platforms to improve financial inclusion in rural areas, particularly in underserved communities. Small/micro-companies and low-income households are likely to benefit from increased access to deposit products, payments, and remittance services (KPMG Nigeria, 2018).

The rural electrification rate will increase if discos and mini-grids operators are certain of collecting their revenue which will be fastened by the emergence of Payment Service Banks (PSB). This will be a win-win for all stakeholders.

Future Thought Leaders is a democratic space presenting the thoughts and opinions of rising Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

EFInA. (2021). EFInA Access to Financial Services in Nigeria.

Jack, T. S. (2016). The long-run poverty and gender impacts of Mobile Money. New York: sciencemag.org.doi:10.1126/science.aah5309

KPMG Nigeria. (2018). Payment Service Banks: The ‘Challenger’ Banks in Nigeria.

Sustainable energy for all. (2021). Country Data Nigeria.

Glen Jordan

Sustainable Lifestyle · Sustainable Living

illuminem briefings

Architecture · Carbon Capture & Storage

illuminem briefings

Labor Rights · Climate Change

Financial Times

Carbon Market · Public Governance

GB News

Carbon · Sustainable Mobility

The Independent

Effects · Climate Change