The Green Deal is Europe’s future

· 5 min read

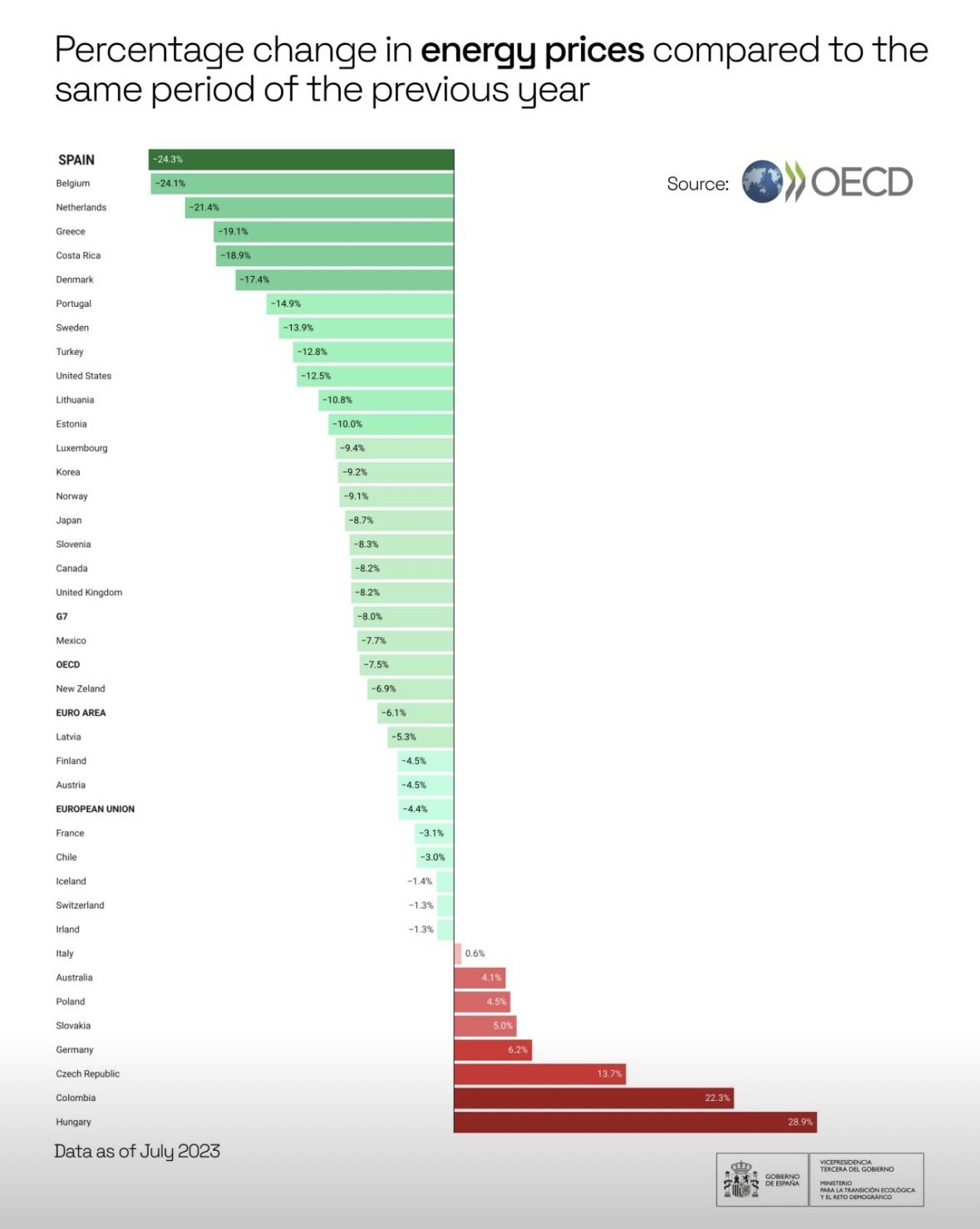

With elections just around the corner, EU climate policy faces headwinds. The Green Deal is blamed for the deindustrialisation of Europe. On the contrary, it is also the key to its competitiveness, according to EU Commission President Ursula von der Leyen. Rather, deindustrialisation depends on the high cost of fossil dependency.

According to the International Energy Agency, fossil consumption will peak in this decade. Chinese energy giant Sinopec has announced that peak gasoline demand has already passed. From next year demand will start to decline. It is a historic step that marks the “beginning of the end of the fossil era”, wrote the IEA director in the Financial Times this week. In 2020, I came to the same conclusion.

And indeed, President von der Leyen had no reason to back down from her green plan for Europe in her State of the Union address. The Green Deal was born out of a “necessity to protect our planet”, she said, looking at the wildfires and catastrophic floods ravaging Southern Europe. “But it was also designed as an opportunity to preserve our future prosperity,”, she adds, referring to clean hydrogen investments in Europe, which are higher than in the US and China combined. It’s a policy of industrial competitiveness, she reminds naysayers and political opportunists.

The new world is emerging, but the old one is not yet dead. Above all, market rules survive that slow down and make the investment choices necessary for global industrial competition unnecessarily more expensive.

The US, with its package of subsidies for green technologies, under the Inflation Reduction Act, has put the EU on the spot. In China, renewables and green innovation are galloping. At the Munich motor show this year, Chinese car brands dominated the scene. The situation worries European automakers that are lagging far behind on electrics. The responsibility, to a large extent, lies with them. For years, the Commission has been urging them to look to the future and invest in electron-power. The European automakers preferred to keep their money in their pockets.

Now von der Leyen announces that the EU would open an anti-subsidy investigation into electric vehicles from China. That’s good. We have to hurry, and we need a 'competitive race' for the eco-industry. It is a wake-up call for European automakers. What if it turns out that they can (and should) do better, as it is rumored in the corridors of the Commission?

The EU needs sustainable growth, social equity and cheap energy. None of these goals can be guaranteed by fossils. In lean times, Italy still spends almost 100 billion a year on fossil imports and 20 billion in subsidies. Ambitious plans for the green economy would offer important incentives for development and a possible path to negotiate a new green 'stability pact' for Europe. Another way, after all, of declining Mario Draghi's call not to fall back into the logic of old budgetary policies. And it is precisely the former Italian prime minister and former banker who will be tasked – as we learn from von der Leyen's SOTEU – with preparing “a report on the future of European competitiveness”.

New ideas come from innovative businesses. The first field of action is land use and the functioning of agricultural systems. It is a question of coming to grips with new rules for a new ecological economy. This can be done by creating new business – and profit – opportunities with companies paid to eliminate CO2 by capturing it in the soil. According to entrepreneur Andrea Illy, the key is the “scalability of 'ecosystem services'. To this end, a (captured) carbon market is needed. Italy could take the lead in this field.

So far, regulations and financial incentives for the extraction and natural storage of CO2 are lacking. A system of soil carbon auctions, regulated by a 'European carbon central bank' would guarantee the proper functioning of credits, rewarding suppliers who extract CO2 at the lowest cost, and ensuring quality and permanence of removals. Because if, as soon as CO2 is removed, it escapes again, the benefit is nil.

Nature still offers the best solutions, but innovation is leading to new commercially viable extraction methods, such as direct extraction through air filtration systems and underground storage – by, for example, storing CO2 in old, depleted natural gas fields.

Market demand for these credits would come from companies that need rights to offset unavoidable residual emissions, as happens in the industrial emissions market (ETS). In this framework, European agriculture should be protected from 'unfair' climate competition from outside the EU by extending the EU border carbon duty already introduced for energy-intensive industries to the sector.

Climate policies are global. The choices of the EU, US and China are pushing markets towards common mechanisms; the only way to avoid conflicts. If the market needs an agreement on the price of carbon, a carbon tax can quickly generate the huge financing required for decarbonisation and address its social costs. Thus, the EU has endowed itself with a Social Climate Fund. Now it is a matter of using its resources well.

With the end of the Fossil Age, the price of CO2 is the main instrument of control for reducing the stock of 'black' capital, destined to become ballast that is capable of sinking banks and financial portfolios. The alternative is trade wars and inflation for all.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Wind · Renewables

illuminem briefings

Public Governance · Sustainable Mobility

illuminem briefings

Public Governance · Corporate Governance

Politico

Public Governance · Climate Change

Politico

Public Governance · Corporate Sustainability

Global Environment Fund

Sustainable Finance · Public Governance