· 8 min read

This article is part of a seven-piece series on the Global ESGT Megatrends 2025-2026. You can find the previous piece here.

Overview: Stakeholder capitalism metamorphosing

Stakeholder capitalism has existed for a couple of decades, always deeply intertwined with the concepts of sustainability, environmental, social, and governance (ESG), as well as diversity, equity, and inclusion (DEI). Stakeholder capitalism differs most substantially from shareholder capitalism in that it considers not only shareholder and owner requirements but also those of other key stakeholders such as employees, customers, and communities. Accordingly, key ESG issues, risks and opportunities have evolved under the concept of stakeholder capitalism and in many cases been integrated into an entity’s business strategy–including enterprise risk management, R&D, and innovation–as well as governance.

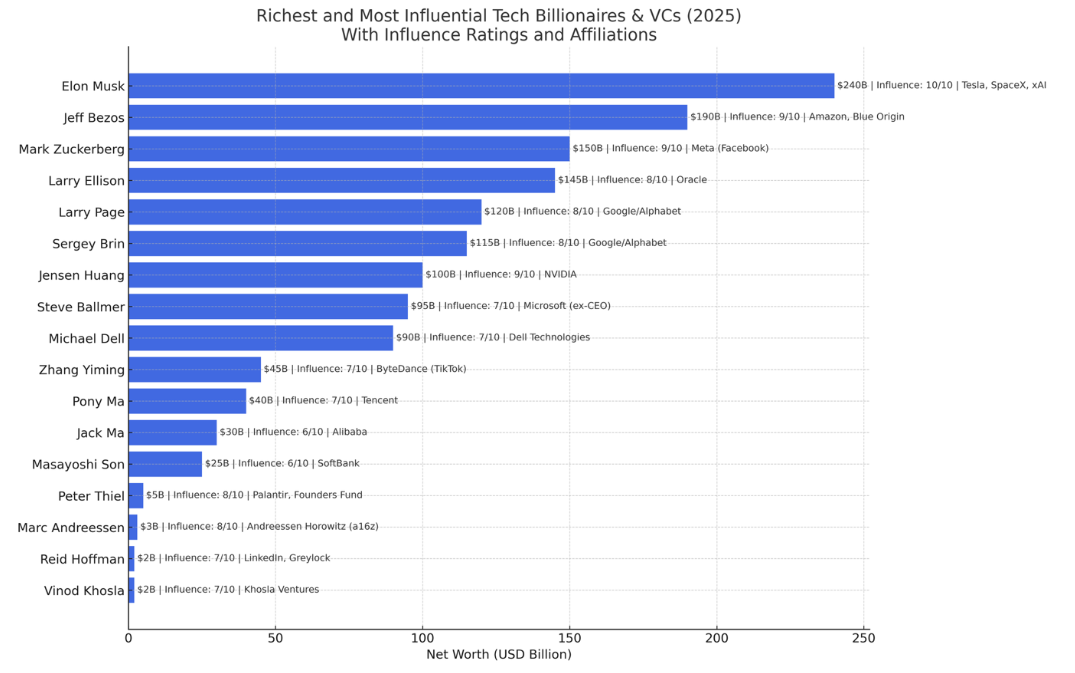

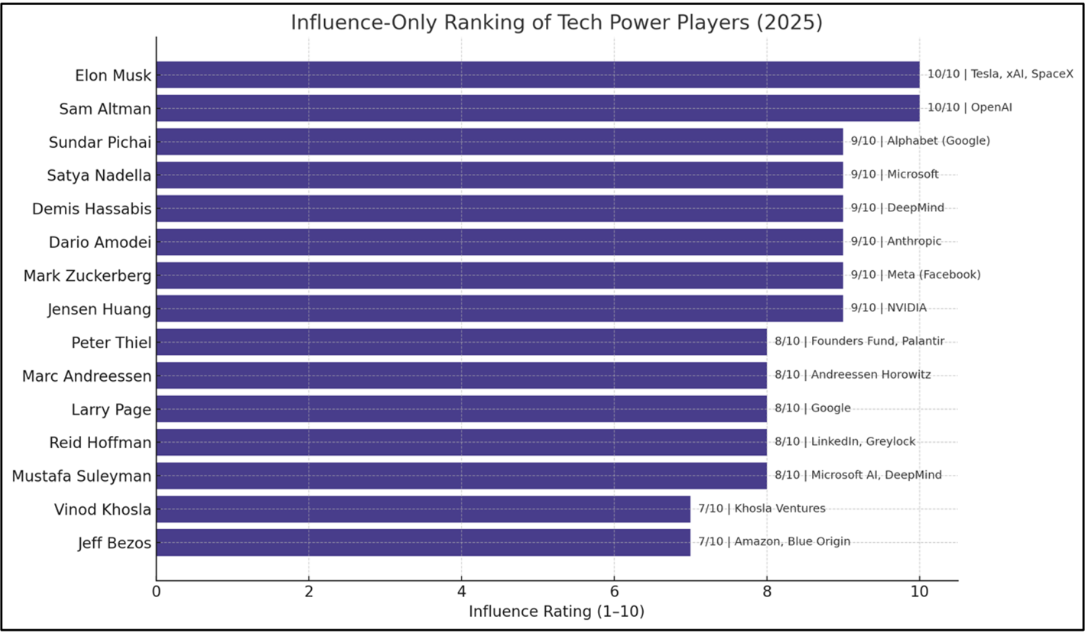

Because ESG has become a deeply polarized topic, especially in the US, stakeholder capitalism faces challenges that require it to adapt and metamorphose. The specific trends that are shaping its evolution include ongoing ESG regulatory skirmishes and wars, responsible businesses continuing to practice ESG/sustainability more quietly or “greenhushing”, a shift toward a more resilient form of sustainability, and a new x-factor in the mix – the rise of a class of technology decision-makers–innovators, financiers, and politicians-riding a new exponential wave of techno-wealth creation. This class of individuals operate across borders almost with impunity, have an outsize influence on sustainability issues (especially environmental and energy-related) and thus on the future of stakeholder capitalism. In addition to all the progress, this tech-infused innovation is also bringing new forms of borderless fraud, grift, graft, kleptocracy and anonymous wealth creation - mainly through crypto, thus giving rise as well to a new form of plutocracy and kleptocracy. The Figure below is a compilation of the most wealthy and influential global technologists based on several sources.

Sources: ChatGPT inquiry and Table creation backed up by the following sources: Bloomberg Billionaires Index, Forbes Real-Time Billionaires List, Hurun Global Rich List 2025, Financial Times, The Economist, CNBC, Crunchbase, a16z Podcast, MIT Tech Review, and Wired.

The big picture: Quo vadis stakeholder capitalism?

In recent times, ESG has become a subject of political polarization particularly in the world’s largest and most influential economy - the US – where state and federal Republicans (closely aligned with Trump) have introduced all manner of bills, measures, executive orders, and regulations to curtail ESG and DEI practices in various sectors. More recently this has included the weaponization of anti-ESG and anti-DEI measures to pressure universities, law firms, and businesses into compliance with Trump Administration demands.

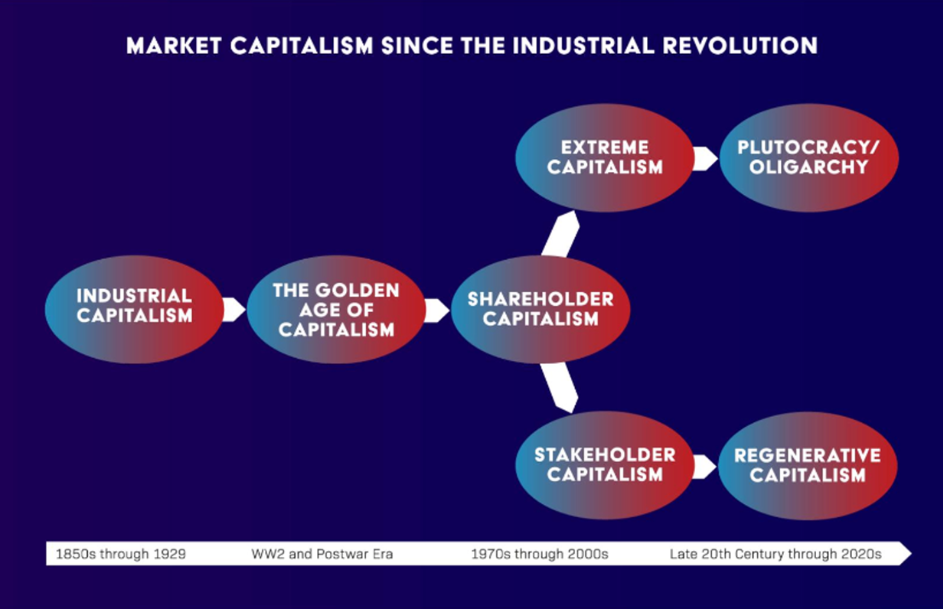

Thus, stakeholder capitalism is undergoing a metamorphosis and a series of challenges. While the overall arc of capitalism continues to move largely in the direction of stakeholder capitalism and in some cases even toward regenerative capitalism, we are also witnessing the development of a more radical, extreme form of shareholder-centric capitalism which, certainly in the U.S. under Trump could even be heading to some form of tech-infused plutocratic or oligarchic capitalism. See Figure below.

Source: A. Bonime-Blanc, ESGT Megatrends 2023-2024. Diplomatic Courier.

Key trends within the “stakeholder capitalism metamorphosing”

Let’s dive into four related trends that are affecting the future of capitalism.

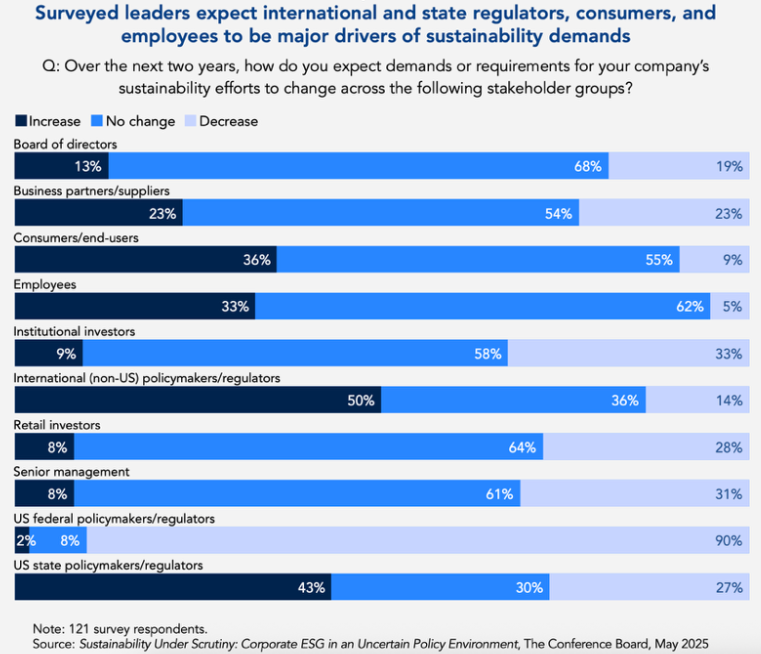

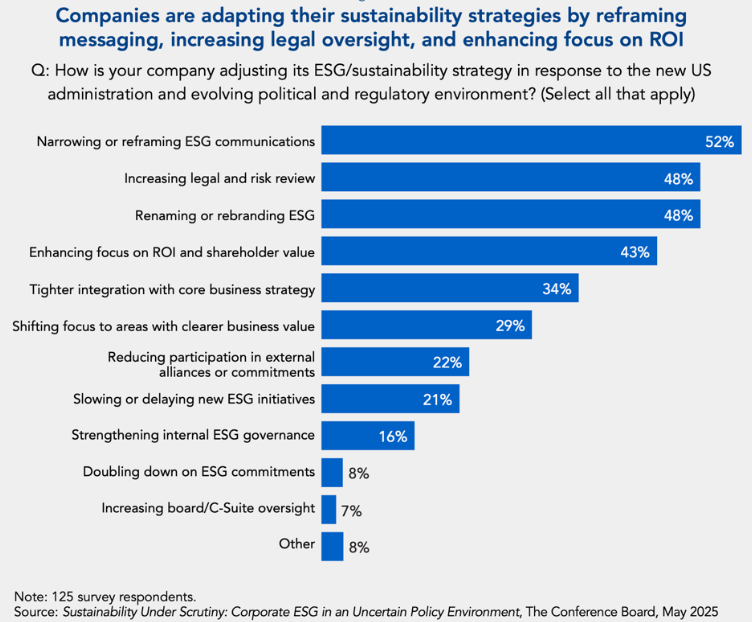

Trend 1 – ESG and DEI skirmishes and wars continue

Regulatory approaches to ESG and sustainability differ greatly between jurisdictions – e.g., the EU and the US - although pro-ESG and sustainability policies and laws continue in several US states like California and New York (respectively the 4th and 8th largest economies in the world). Meanwhile, the rest of the world, especially the EU where the most regulation exists, continues to move forward with a broad array of ESG, energy transition, and technology (EU AI Act) related regulations and reporting requirements. Moreover, stakeholders beyond regulators – customers, employees, and communities – are increasingly demanding ESG and sustainability protections and guardrails. See Figure below showing the results of a recent Conference Board study – Sustainability Under Scrutiny – Corporate ESG in an Uncertain Policy Environment.

Trend 2 - Responsible business going underground or “greenhushing”

Numerous studies demonstrate the deep interconnection between ESG and sustainability practices, on one hand, and a variety of business benefits, on the other. An excellent comprehensive study by NYU and Rockefeller Asset Management reviewing more than 1000 studies from 2015 to 2020 identified six conclusions:

1. There is improved financial performance due to ESG over longer time horizons.

2. ESG integration as an investment strategy increasingly separates the leaders from the improvers.

3. ESG investing appears to provide downside protection especially during social and economic crises.

4. Sustainability initiatives at corporations appear to drive better financial performance due to mediating factors such as improved risk management and greater innovation.

5. Studies indicate that managing for a low-carbon future improves financial performance.

6. ESG disclosure alone does not drive financial performance. It must be a deeper practice.

Source: Tensie Whelan, Ulrich Atz, Tracy Van Holt, and Casey Clark, CFA. ESG and Financial Performance: Uncovering the Relationship by Aggregating Evidence from 1000+ Studies Published Between 2015 and 2020.

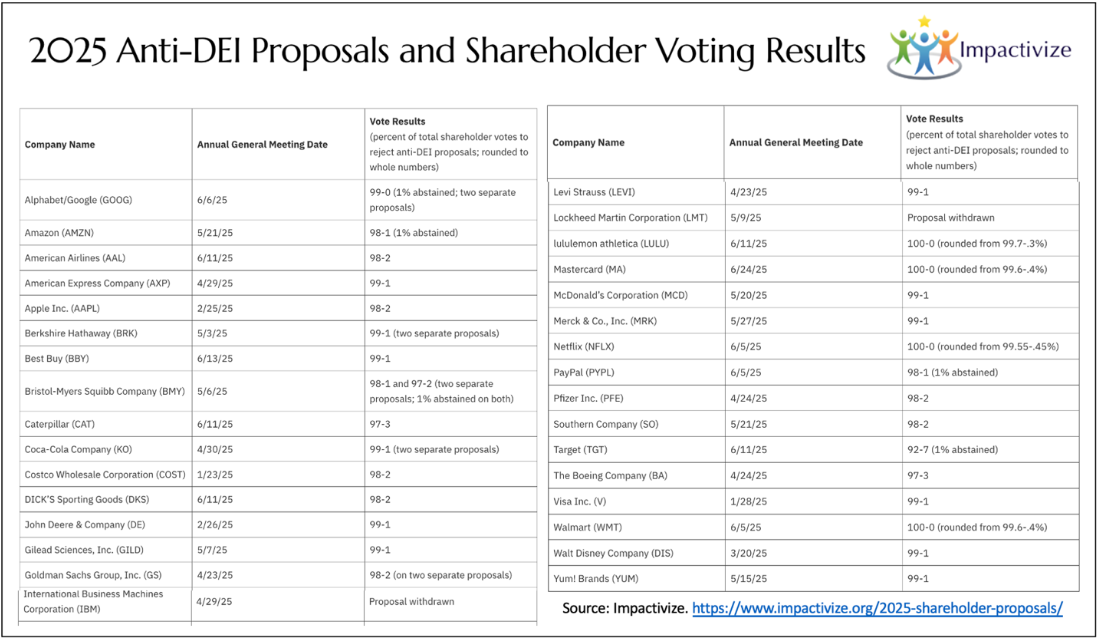

Another key aspect of ESG-DEI–has become a battleground in the “anti-woke” wars invoked by Trump and the Republican Party. However, many major businesses are resisting these tactics, including shareholder proposals to kill DEI programs. See Figure below of information compiled by Impactivize showing many Fortune 500 companies’ shareholders rejecting anti-DEI shareholder proposals from right wing entities rejected at anywhere from 97-100% rejection.

Trend 3 – Smart companies are building “sustainable resilience”

Some companies are beginning to equate the underground or “greenhushing” form of stakeholder capitalism with resilience capitalism: a model that seamlessly integrates sustainability with strategy, risk and opportunity management, and governance. The Figure below from The Conference Board illustrates the various tactics and strategies being deployed by US business to more systematically build a more resilient form of sustainability including morphing and rebranding ESG communications, conducting legal and risk review, and strengthening the shareholder value proposition.

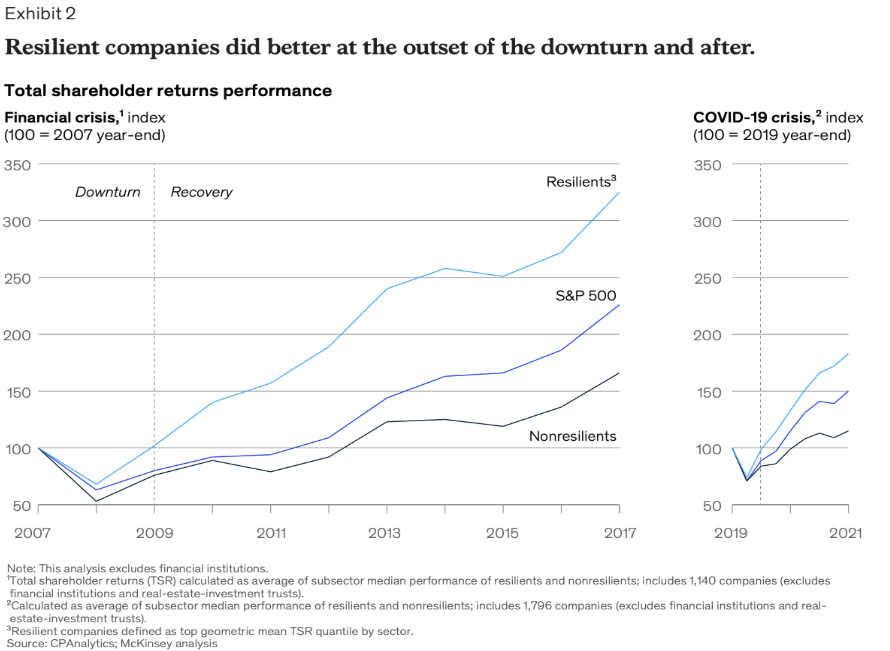

The attacks on ESG, DEI and sustainability seem to have a silver lining in some cases as companies bolster and reinforce their existing programs. Those taking advantage of the current ESG backlash by dropping programs and investments may find that in the long term such moves will deprive their companies of something essential – perhaps even existential: long-term resilience.

Sustainability and resilience go hand in hand - one egging the other on - and together developing the organizational muscle to power through the tough times – survive – and the brains and acumen to seize opportunities and create value through thick and thin times – i.e., thrive. The McKinsey figure below, which shows resilient companies substantially outperforming both the S&P 500 and non-resilient companies over time and through crises, strongly underscores this point.

Trend 4 – A new ESG X-Factor: The rise of a tech turbocharged uber class

Finally, a critical crosscurrent influencing the direction of stakeholder capitalism relates to the influence and interconnection of various forms of technology – especially exponential ones like generative AI, synthetic bio, edge computing and so many more – with sustainability and ESG topics. I coined the term ESGT six years ago in my book Gloom to Boom: How Leaders Transform Risk into Resilience and Value and summarized in this World Economic Forum Agenda article in which I made the case that technology must be considered part and parcel of any and all ESG and sustainability work.

In recent years, a new and powerful tech-infused phenomenon has arrived – the rise of a techno-uber class of extremely wealthy, influential and largely untouchable global business leaders – most of them from Silicon Valley but also from China and increasingly oil-rich Middle Eastern countries and beyond. See the Chart below.

Sources: ChatGPT inquiry and Table creation supported by the following sources: Bloomberg Billionaires Index, Forbes Real-Time Billionaires List, Hurun Global Rich List 2025, Financial Times, The Economist, CNBC, Crunchbase, a16z Podcast, MIT Tech Review, and Wired.

The significance of this rising class of borderless, powerful technologists? They are turbocharging the era of exponential tech change with an outsize series of effects on ESG and sustainability issues – starting with the insatiable hunger of GenAI data centers for energy. Many are seeking to build sustainable energy – nuclear, renewable, solar, and more. Others don’t care or will follow whichever way the policy winds blow. Either way, technology and ESG issues are joined at the hip and this powerful techno-class will have a huge impact on the future of stakeholder capitalism and possibly a more plutocratic capitalism.

Leadership to-dos to futureproof “stakeholder capitalism metamorphosing”

Below are four suggested leadership to-dos related to this Megatrend.

1. ESG Polemics are Noise—Sustainability is Signal – Focus on the Latter. Treat the ESG polemics as noise, and sustainability as the signal—equip your organization accordingly with the talent, tools, and culture your organization needs to survive and thrive through the next few years. This means having the right CEO, management team, and a board that understands sustainability governance intimately. Don’t let temporary political policies distract you from the long term resilient sustainability strategy that can power your business.

2. Put Stakeholders and their Key Issues at the Core. This includes critical environmental and social risks and opportunities such as mental and physical health and safety, human rights, mass involuntary migration and privacy—add them to your risk register and strategy. In other words, care about your stakeholders.

3. Acknowledge the Central Role of Tech in ESG/Sustainability. Technology has a central and crucial role to play in advancing sustainability and resilience—make sure you understand and leverage what is required technologically.

4. Despite the ESG Headwinds, Stick to Values and Resilience Building. For every force, there is a counterforce – for every pendulum swing there is a counter swing. Change will happen faster than we expect. Staying true to values, practices and long-term resilience will define the winners. Speak out consistently in line with your organization’s values—even when it risks jeopardizing actual or potential business. Successful stakeholder capitalism is a long-term play not a day-trader’s game.

Look out for the concluding Part 7 of this Series in which we will offer a leadership blueprint of to-dos to futureproof organizational strategy, risk, and opportunity, soon.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.