· 8 min read

The European Union's Emissions Trading System (EU ETS) constitutes a cornerstone of the EU's strategy to combat climate change since its establishment in 2005. The new EU ETS 2, implemented from 2024 covers emissions from buildings, road transport, and additional sectors such as fuel use in small industrial installations. The EU ETS 2 is founded upon the objectives of the EU Climate Law and the Fit-for-55 package and requires the fuel suppliers to monitor and report emissions in their fuels. From 2027 when the EU ETS 2 is fully operational, emission allowances need to be purchased and surrendered based on the emissions in the fuels sold. This new emission trading system adds a further layer of complexity to the regulatory compliance landscape.

Key facts about the EU ETS 2

The EU ETS 2 will be running in parallel to the EU ETS 1 and encompasses areas that were previously excluded, such as the buildings and road transport sectors. The operational principle of the EU ETS 2 is based on a cap-and-trade system, where an annually decreasing cap is set on total emissions and a corresponding number of allowances is auctioned to regulated entities. One allowance needs to be surrendered per ton of CO2 emitted. The EU ETS 2 is designed to reduce emissions by 42% by 2030 in comparison to 2005 levels. In contrast to the EU ETS 1, which regulates emissions at the point of origin, the EU ETS 2 places the compliance burden upstream at the release for consumption of fuels and not at the point where fuels are combusted. Estimates of the EU Commission expect up to 11.400 fuel suppliers, distributers and resellers to be regulated (regulated entities). This new system harmonises national and EU responsibilities, targets and emissions pricing.

To determine emissions under the scope of the EU ETS 2, a comprehensive monitoring, reporting, and verification (MRV) system is implemented at the company-level. To avoid double counting, emissions from fuel combustion under the EU ETS 1 should not be counted in the EU ETS 2. This requires fuel suppliers and their clients to provide proof and documentation in such cases. The EU ETS 2 permits the coexistence of national carbon taxes with the EU ETS 2, allowing EU Member States to exempt companies from EU ETS 2 requirements until 2030 if national measures are more stringent. In Germany the national ETS is only fully integrated into the EU ETS 2 from 2027 onwards, which makes a double reporting of emissions necessary for 2024 - 2026.

First compliance deadlines in 2024

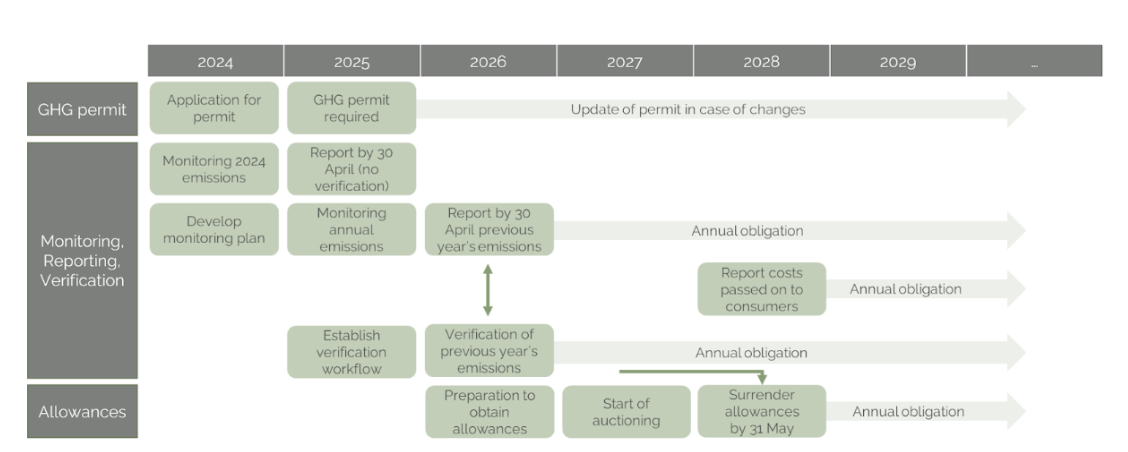

For companies subject to the EU ETS 2, key compliance activities should already be ongoing, and deadlines are approaching soon. Companies must commence monitoring emissions by January 2024 and report those emissions by 30 April 2025. The timeline for compliance is stringent, as Figure 1 indicates.

Figure 1: Timeline of EU ETS 2 compliance obligations. Source: carboneer

To monitor emissions in accordance with the rules of the EU ETS 2, by 31 August 2024 a monitoring plan should be submitted to the competent national authority. Full compliance, especially procuring and surrendering allowances under the EU ETS 2 is required from 2027, and failure to meet these deadlines can result in significant penalties and legal repercussions, making it imperative for companies to commence preparations without delay. The potential consequences of non-compliance include financial penalties and loss of competitiveness.

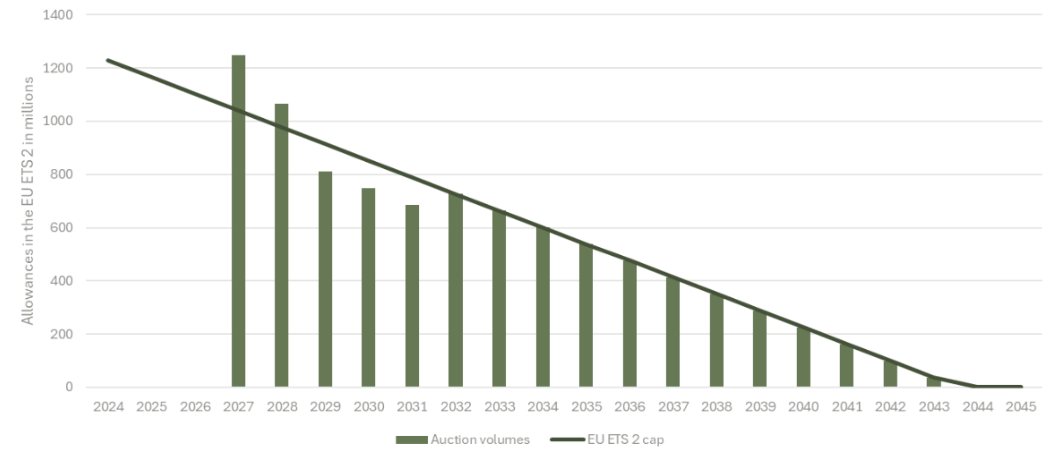

From 2027 onwards allowances under the EU ETS 2 will be auctioned. An allocation of free allowances such as during the start of the EU ETS 1 and currently still applied to EU industry will not exist. To regulate the supply of allowances and maintain price stability, a market stability reserve will be implemented. The initial allowance cap in 2027 will be determined by applying a 5.1% annual reduction to the 2024 emission level. From 2025 onwards, this linear reduction factor increases to 5.38%. This implies that the total supply of allowances in 2027 will be approximately 1.25 billion, declining to below 800 million by 2030. Figure 2 illustrates the decline in the allowance auction volumes over time, aligned with the EU’s long-term sectoral climate targets.

Figure 2: Approximate EU ETS 2 allowance supply. Source: carboneer

Challenges and complexity

The EU ETS 2 presents a significant challenge for companies as they need to develop comprehensive emission monitoring plans, detailing their activities, fuel types, and emission calculation methodologies to comply with their obligations. Especially the calculation of the emissions can be a complex undertaking. First, a scope factor needs to be established to determine the portion of a company's fuel sales that lie within the regulated activities, such as buildings and road transport. The scope factor ranges from 0 (no fuel in scope) to 1 (all fuel in scope). This ensures only relevant emissions are counted. Using the correct emission factor for different fuels along with the quantity of fuels, the total CO2-emissions can be calculated.

To ensure data quality, the MRV follows a tier system that categorises data accuracy from Tier 1 (least accurate) to Tier 4 (most accurate). Higher tiers, used for companies with more larger fuel streams and thus higher emissions, require more precise data, ensuring reliable results. Importantly, emissions from fuels based on biomass can be zero-rated if they fulfil the criteria on biomass under the Renewable Energy Directive (RED) II and the upcoming RED III.

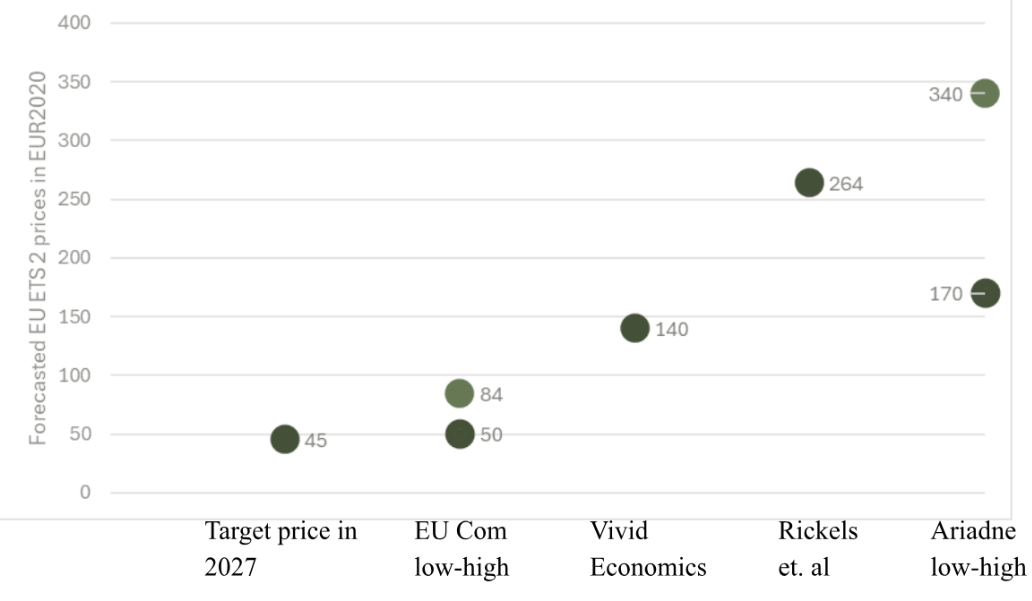

Monitoring plans must gain approval from the competent national authority, underscoring the importance of early and thorough preparation. The emission reporting for 2024 is due 30 April 2025, with third-party verification becoming mandatory from the 2025 emission report on. The introduction of the EU ETS 2 pricing can result in significant cost increases, which will have an impact on both operational expenses and consumer prices. Figure 3 displays price forecasts for the allowances in the EU ETS from different sources. As prices are determined through demand and supply, they can be expected to exhibit significant volatility, with forecasts ranging from €48 to €340 per tCO2 by 2030. Companies ought to manage cost risk via tailored procurement strategies for EU ETS 2 allowances.

Figure 3: Forecast of EU ETS 2 allowances prices in 2030. Data Source: UBA, 2024, Source: carboneer

The Social Climate Fund plays a crucial role in mitigating the financial impact on vulnerable consumers in the EU. Its objective is to support vulnerable households and micro-enterprises that are impacted by the transition to a low-carbon economy. The fund, financed by revenues from the auctioning of allowances, provides financial assistance for measures that reduce emissions and energy costs. One example is the provision of subsidies to enhance the energy efficiency of residential properties such as improvements to insulation and the installation of more efficient heating systems. This dual focus on households and businesses ensures a broader impact, promoting social equity and economic resilience, and helps to offset some of the financial burdens and operational challenges posed by the EU ETS 2.

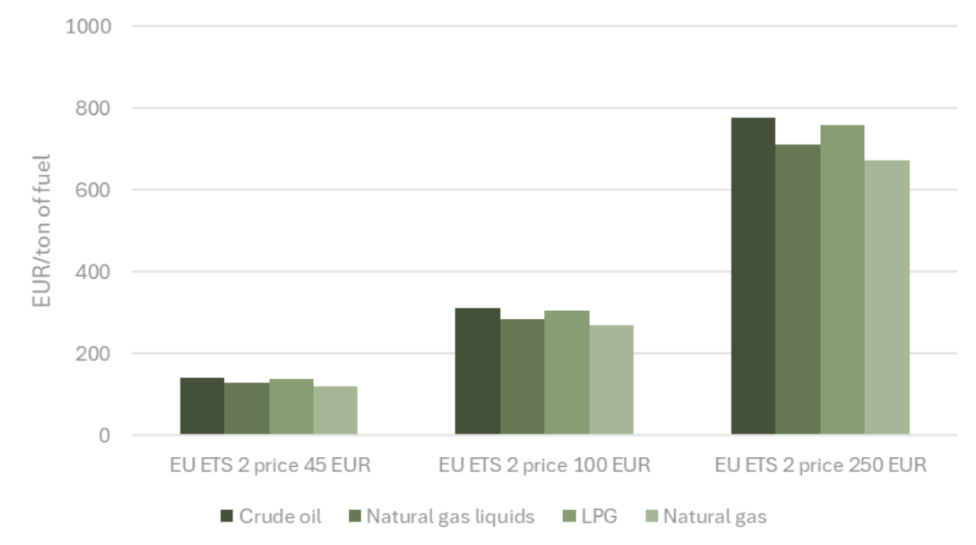

To understand the potential impact of the rising allowance prices, Figure 4 illustrates how different fuel types are being impacted by different allowance prices.

Figure 4: Price impact on different fuels under varying EU ETS 2 allowance prices. Source: carboneer

What should an EU ETS strategy entail?

Due to the complexity of the EU ETS 2 and its stringent timeline, a sound EU ETS 2 strategy is essential. But what does a company need to prepare for?

MRV details and compliance cycle

-

Development of comprehensive monitoring plans that cover all relevant activities, fuel types, and emission calculation methodologies

-

Monitoring plans must be approved by national authorities

-

Verification of emissions

Compliance obligations:

-

Detailed understanding of the EU ETS 2 rules and associated regulation

-

Build capacity, assign responsibilities, internal and external communication

-

Access to registries and EU ETS 2 allowances

Financial impact assessment:

-

Assessment of EU ETS 2 exposure and cost forecasts

-

Implementation of strategies to manage costs and pass on costs to consumers

-

Risk management and allowance procurement strategies to reduce financial exposure

Conclusion

The EU ETS 2 is a crucial tool in the European Union’s strategy to combat climate change by establishing a new cap-and-trade system for fuels in sectors such as buildings and road transport. It aims to reduce emissions by 42% by 2030 compared to 2005 levels. The system introduces complex obligation for companies that require planning and a compliance strategy, including stringent monitoring, reporting, and verification processes starting from 2024. With allowance prices expected to rise significantly, the financial implications are substantial and necessitate robust risk management and hedging strategies. Companies should act now to understand and navigate these new regulations, ensuring compliance and maintaining competitiveness.

Sources: UBA, 2024, Supply and Demand in the ETS 2, URL: https://www.umweltbundesamt.de/publikationen/supply-demand-in-the-ets-2

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.